markethunter888

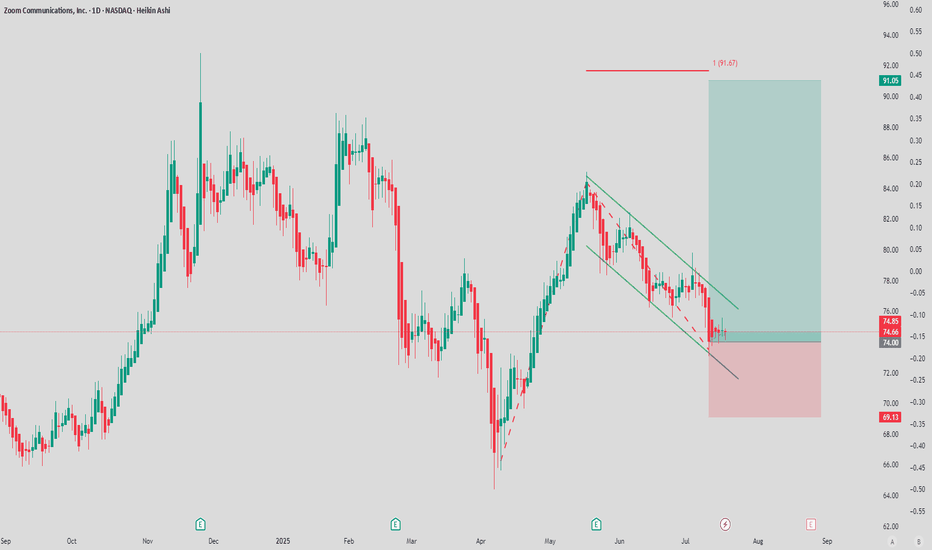

PlusZoom has formed a bull flag over the past 2 months, which has a strong bias to breaking out higher. Zoom is the textbook example of a "stay at home" stock, if this is going to do well, what should we expect in the near future ? LOL

After forming a bullish wedge for a few months, the price went sideways for another 3 months which is a very good sign that the bottom is in.

I have used the put call ratio to identify some very extreme readings in market sentiment.

Getting 2 major news failures is a strong indication the bottom is already in for Pfizer and maybe the vaccine space as a whole.

1. Over the past year moderna is down 85% and from its pandemic highs, down 90%+ so simply that alone tells you the stock is quite cheap and beaten down. It is currently trading at 2020 levels as if a world changing pandemic never happened. 2. Moderna is currently trading around its book value once again highlighting how cheap it is. 3. From a trading...

I have done an analysis on ETHBTC vs BTCUSD which has consistently predicted the phases when altcoins do well. This is only when there's liquidity in the system and thus, even the broader stock market does very well.

I've reviewed a recent trade I was in and a useful lesson we can learn from it.

Zoom who was a big beneficiary of the pandemic but unlike other stay at home stocks, this one actually makes money. I think a markup phase has begun and I am currently long, UNLESS there's a break of recent lows and the 200d SMA.

I've used 3 forms of technical analysis to make a case for a major top forming in the European markets. If this turns around, it could lead to a 10% selloff very quickly and if this transforms into a bear market then 20% drop is totally on the cards. Nothing goes up forever.

This analysis shows warning signs of gold's uptrend could potentially see a solid correction over the coming weeks.

There is some very bullish price action being observed in Biontech. This could mean a catalyst for all the vaccine stocks could be coming soon.

It seems like a massive accumulation phase has been completed in paypal and potentially a markup phase has begun. If an impulsive move has begun, then its a good trade to go long on a correction.

Moderna has gone through panic selling which tells me a generational bottom has probably formed.

I've analyzed the putcall ratio in this video to show how valuable the sentiment is in determining the direction of the market.

For the past couple months, it seems like bitcoin has made a typical head and shoulders top. If this plays out, we can see a sizable drop in the near future.

It is quite apparent that PFE and the vaccine space as a whole is witnessing capitulation. Details are explained in the video as to why a major bottom is forming.

Once again, Tesla has gone vertical which leads to a short squeeze and buying climax. Based off today's reversal price action, it seems like the top is behind us.

Pfizer is showing signs of accumulation past few months which means a markup phase is coming very soon. I am assuming the market already knows some major catalyst is in the pipeline.