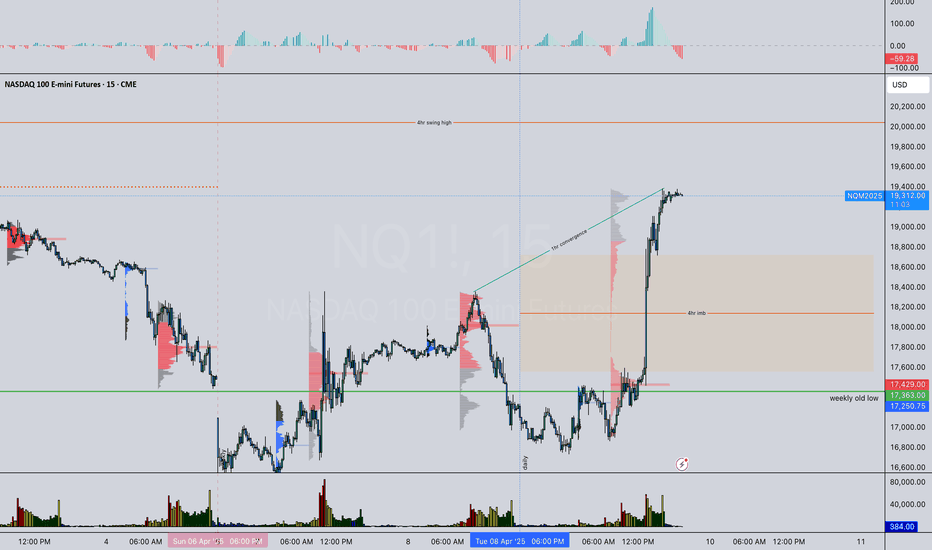

✅ Summary of Top-Down Analysis: 🟢 Daily (Macro Bias): Bias: Neutral → Leaning Bullish Context: MACD and price both made lower lows (convergence = no divergence, but momentum weakening). Price hit strong support at 16,457. Bullish close post-FOMC + macro catalyst (Trump’s tariff changes) = positive sentiment. Key note: China-specific tariff at 125% could...

Weekly: Price took out old swing low after a lower low was printed — confirming bearish intent. However, price is now inside a new HTF support zone. MACD remains bearish, signaling potential continuation lower, but watch for possible slowdown or divergence signs in this zone. Daily: Structure is firmly bearish — lower low confirmed. MACD bearish and showing...

daily hidden divergence, price might want to continue seeking sell side liquidity 4hr is making a new low and taking out old lows (sell side liquidity) to the left MACD is not converging as of yet 1hr hbrsh-div price is dropping ahead of red news this Friday, could head to 1hr old low or weekly low, waiting to see how price reacts to news m15 price is below...

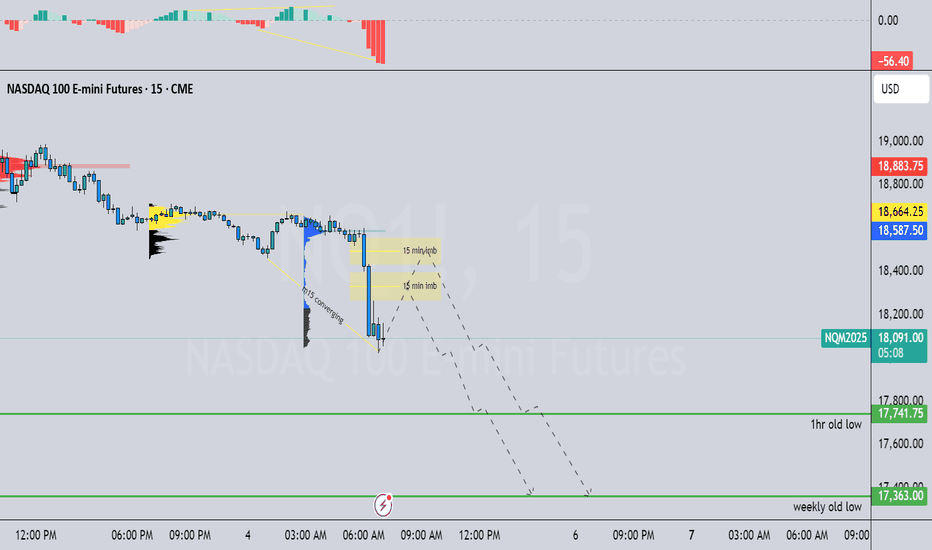

Bias: Bearish (Pending Confirmation Post-News) Higher Timeframe Context (Daily) Wednesday closed bearish – 4H made a lower high, and a bearish engulfing candle after sweeping the previous day high, and MACD turned from bullish momentum after making a higher high showing hidden bearish divergence Lower Timeframe Breakdown 1hr made a market structure shift...

Daily: Tuesday trading was bearish pushing into the weekly low. Wednesday's price failed to take out Tuesday's daily low creating indecision. For me, that's giving the idea that Thursday can go either way 4hr: RTH shows that the NY session had mostly bullish volume but still a bearish presence at the highs. Longs will be favored if we can get above...

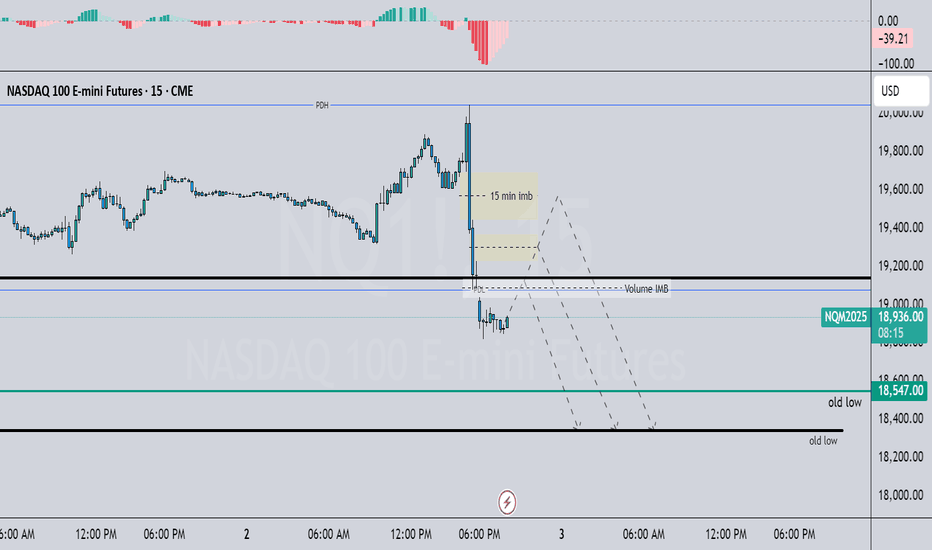

Daily: Monday's candle swept below Friday's low and closed bullish. Price is still extended at a higher high in the daily bullish trading range. Price can potentially move higher into the previous day's high. 4hr: The 4hr trading range is still bullish in the corrective phase back into the 4hr volume profile POC, but we can see a potential reversal for longs...

Daily: Last week, the price extended higher until Thursday staying in the daily higher high range Friday's price closed lower potentially starting a corrective phase this week 4hr: The 4hr trading range is still bullish but has now started the corrective phase back into the 4hr volume profile POC, There is a bullish imbalance sitting around the 20,138.00 area...

Thursday's candle closed above the prior day's high, reaching the weekly SIBI, overnight in the Asian session the price rallied, consolidated in London, and Reversed In the NY Session 4hr market structure is still bullish but at the top of the range creating a bearish reversal with high volume that created a bearish SIBI retesting value area high or the 4hr...

Wednesday's candle closed above the prior day's high, reaching the weekly high as well as the previous month's high, we could potentially see the price continue to rally into weekly sibi 4hr market structure is still bullish but after the rally, the price has now closed above 4hr swing-high 4hr Fixed Volume profile shows the POC is at the high of a price and...

Tuesday's candle closed above prior day high, as well as reaching weekly high 4hr market structure is still bullish but after rally price failed to close above 4hr swing high 4hr Fixed Volume profile shows the POC is at the highs on the 4hr price attempted to move away from POC in a bullish fashion but could be a weak move due to the failed closure I want to...

previous day indecision candle shows that we have some uncertainty at the highs 4hr market structure is still bullish but we acre consolidating 4hr Fixed Volume profile shows the POC is at the highs meaning fair value for price I will not be considering buys just yet unless price breaks 20107.25 on the 4hr or we have a market structure shift on the m15...

last week closed price closed bullish after Fed rate cut news, therefore possible draw on liquidity could be towards previous weeks high 4hr price action is bullish respecting bullish imbalances, created an area of resistance 4hr Fixed Volume profile shows the two highest volume nodes and buyers could still be in control but we are waiting 4hr bullish close to...

price is now at my first AOI with possibilities to go to 1hr ob want to see a bsl sweep and a candle close below the candle that made the sweep preferably price taking Asian buy side at the right time of day, price did everything I wanted to see in the asian session and ran to the pdl sell side in the London session then the price reversed creating a bullish...

Monthly: Price is still above PMH with 3d and 19Hrs left and we are at all time highs therefore price can either continue or start to pull back. Weekly: price took out previous weeks high and low failed to close above PWH or below PWL, however the candle closed bullish. Daily: Friday candle swept buy side liquidity or PDH and failed to make a swing high...

after price took out weekly-low/ sell side liquidity we had a reversal from positive reports from big tech companies on NQ followed by a huge rally today, therefore I am anticipating price continuing to previous day high and maybe even previous weeks high. The 1hr time frame could have a shallow pull back and we run to that level in london , I am looking for a...

MMBM expecting price to draw to weekly highs of 17793.00 Anticipating price to come into 4hr/1hr FVG

after price traded high friday i am anticipating a re-tracement back to some sort of imbalance or bullish order block and look for longs, I will look at how price setups Monday and Tuesday to re access if long bias is still valid

daily sibi has been creating resistance for the last 11 days, the dealing range is in bullish and price is in a premium, the volume has been weakening on the rally up, however supply has not stepped in the market to bring prices lower, so we can be in a manipulation/consolidation of the market 4hr and lower is making bearish structure so I'm anticipating price...