mommymiles

PremiumAfter that crazy April 2025 crash, it feels like we should not be this high so fast... that's how I felt before too. But the rising channel is holding up right now. We are approaching the top. In previous times, the market grinded even higher (COVID pandemic was the last example). Today we squeezed out new ATHs. The month ends next week and a new one begins....

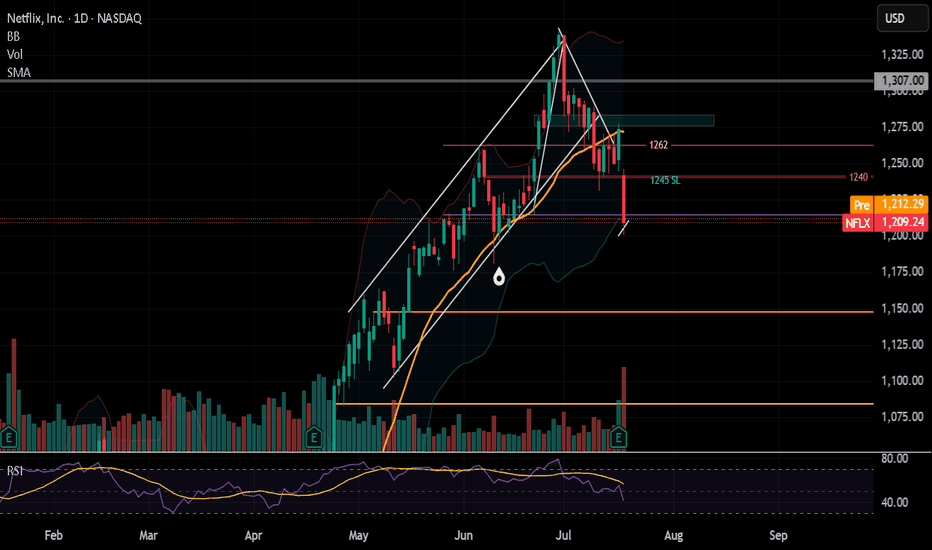

Watching Monday... looking for continuation to downside. This week into next week. 1245 zone is where the post earnings gap down and go started. Using this as my stop loss. Targets 1200 down to 1180.

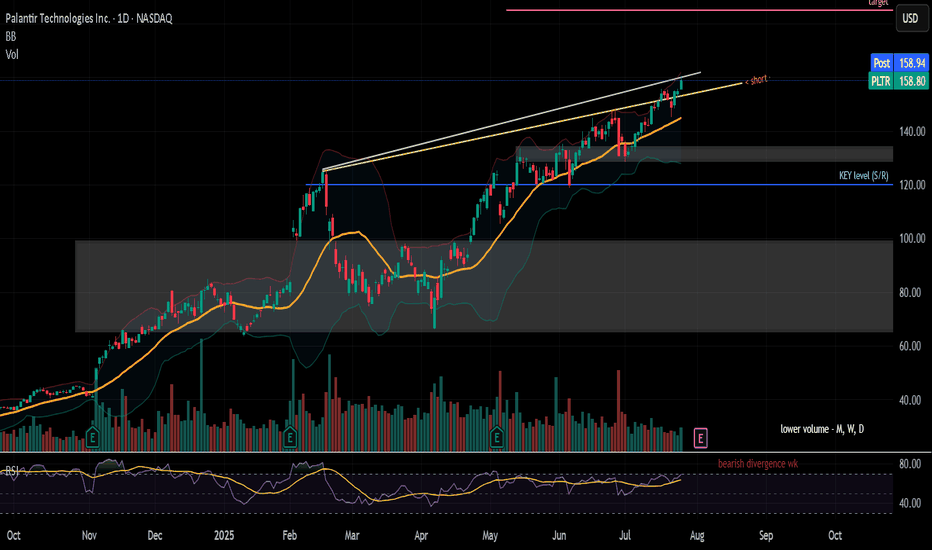

This video has my thoughts about PLTR and a trading view tip... the data window!!! Who knew? Hope the talk inspires you as you decide on future investments; especially when it's stalling or pulling back. My short term bias is bearish for a pullback on PLTR. Not sure when it will happen, but <155 is my trigger to see what I see. What do you see? **>162... slow...

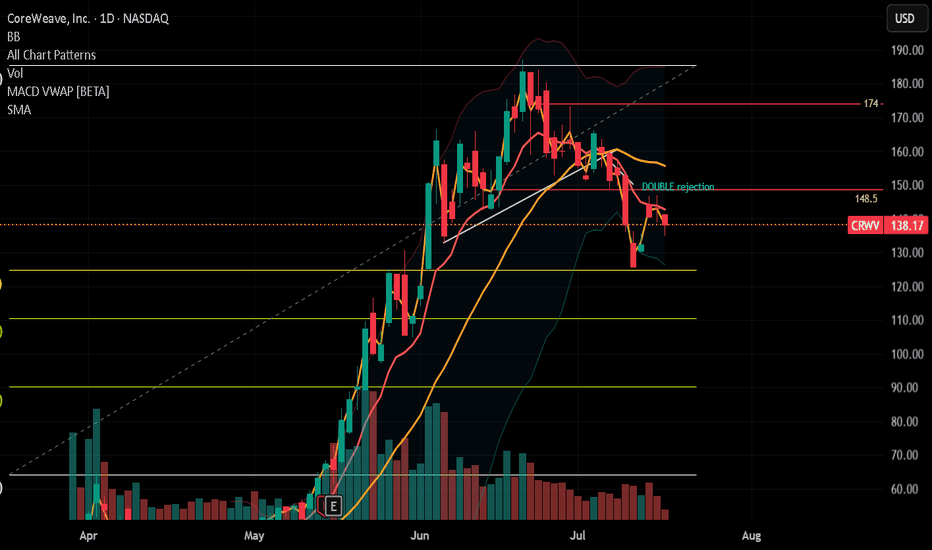

will we retest 130? That's my bet. I'm sure that Fri 7/18 will be wild as it is the monthly contract. Staying below 140, I'll hold my runners. After this bottom, I think we will reverse back upward to 145+

area 1: 340 area 2: 360 will be tuned into earnings to see if the jig is jiggin July 23rd. Elon is busy. so let's see what's the dealio. ****280 is a key level **300 needs to hold for these attempts

so it doesn't have to happen, but I would love to see a double bottom around 245-250. it's just a technical idea that would give "ok we are ready to head back to 400." neckline would be 320-325. watching and puts below 295. or rejects against 300.

below 1262 i'm puttin' it down friday. 1250p staying focused for now.

last 3 days closed below 21 ema. under 50 on daily RSI. head/shoulders below 145 may breach 140 this week? looks like it. i'm gonna make the play. 148 SL

I had a whole video that I created but couldn't manage to post. Nonetheless... I figured it out and will just share my points in this picture. *below the 21 ema (1220), I believe we can target 1200 down to 1180. I'll be on the lookout for this trade until it happens. That's it... that's the post. Enjoy Juneteenth.

Heard about Trump's lil phone. Chile... Well AAPL i aiming for 195 - 193. With this trump phone news, I am thinking it can go lower... toward my blue line. Not all in one day, but not regaining 201 and holding it is not good. Hoping this posts as I have been having issues publicly posting over the last 2 weeks.

Which way will it squeeze? I share my thoughts if AAPL can hold above 200. *technically showing caution signs (bearish, but can flip) *news is affecting the market greatly (esp AAPL re: tarriffs) *RSI & MACD need a positive signal *204, 205, 208 immediate targets to be focused on imo Have a great weekend!

I know Tesla lovers hate to see a short post on the stock. Okay... it's cooling off... lol. *another news report states he's leaving gov't; trump holding on tight... we shall see *alleged new growth story incoming... check news and see what you see *TA (technical analysis) look like a pullback in order... 330-325 Do you see what I see? Or you are feeling like...

I think so. Weekly chart updates. Enjoy your weekend.

Intrigued by today as we closed the month and week. The charts appear bullish until something changes that. Key points I noticed... *Monthly morning star pattern *RSI above 50 on month and week chart *MACD over zero line and signal up on month and week chart *Key levels holding up (21 ema, FVGs) We are still in volatile times and narratives are being thrown all...

Friday 5/23, Tues 5/27, Wed 5/28 - bullish Targets up to 225-230 maybe... not all this week (summer) *looks like AAPL has already moved toward the 207-208 level overnight. *hope we are blessed with a pullback to buy back up. 202-203 *NVDA earnings propping market = good *Catalyst conversations mounting: finance.yahoo.com

I happened to see someone ask "when will ETH run?" So I just wanted to take a stab at the chart. I have never played this, but I noticed cycles. During it's IPO you can clearly see a head & shoulder. After the next bull cycle, a larger head and shoulder pattern. Currently we appear to be on the downside of a triple top; we are below the neck line. If price rallies...

1st rejection of last week's close. I say mark the zone and be cautious. Key levels will be targets (daily hi & lo minimum). If your hit targets, take profit. when aiming above, take the trade from a support level or specific candle shift. Again... FOMC Wed 5/7. Will update my thoughts daily this week.

295 is seemingly the tough level. I was just praising TSLA for turning slightly bullish too. We rejected pretty hard Fri 5/2. <285, 280, 275, 270... may even take out 265. I definitely think that TSLA is trying to hold the range and not breakdown. Stay conscious of each level if you are playing it and take profit. FOMC Wed 5/7. I think that may determine a lot...