With the big God Candles ended be reminded the Monero KRAKEN:XMRUSD has pulled back to the 50% Retracement of the move at 292. Monero is still up 53% YTD and in the past has shown signs of great resiliency and a "safe haven asset" within crypto itself. Monero outperforms all others crypto during bear market cycles as it holds its value better. ...

Bitcoin's Volume Profile Support at 103,900 is holding. Hold here (again) and likely another test for new ATH. Breaking it means retrace down to the 94k-93k 50% Retracement + Volume Profile region. Then, time comes into play with the tried and tested Bitcoin Daily Ichimoku Cloud Strategy. If Chikou (used as momentum) does not clear the cloud at the same...

Just a meme I made this morning. The Weekly All Time High Breakout has failed, twice, just like 2021...

TL;DR: Monero is used as a currency giving it a relatively stable value during all seasons There has been and will continue to be large transfers of Bitcoin to Monero creating supply shocks and XMRUSD RIPs I have been heavily focused on sharing my bull case for Monero for over two years now. That made for a very disturbing morning on February 4th, 2024 when...

I have been watching COINBASE:ETHUSD flirt with 2750 for the better part of May as all crypto has gone "risk on" with Bitcoin's All-Time-High push. This level is the 50% Retracement of the last major high in December 2024 to the low of April 2025. There is also significant Volume Profile Resistance from February matching this price action level. This level is...

I've been a bag holder of NASDAQ:PLTR from $9. Don't give me too much credit; I bagheld down to $6. I still have the shares but as it makes an attempt to break the prior All Time High this week will close in failure = bearish. When price makes a shot to a new major high or especially new ATH its of utmost importance that it follow through. You need that...

Never betting against the man is a pretty solid strategy. Nevertheless, considering I am long shares I want to take this textbook trade to hedge (again). This morning on my spike alerts list was $NASDAQ:TSLA. With an opening high of 354.56 which swiftly closed back inside the range a 30m spike was created. The ATR Clearance fits my criteria to consider this a...

News today that NYSE:UNH suspended 2025 guidance and CEO stepped down led to a massive route... right down to the 50% Retracement from the 2008 bottom to the former All Time High. This is potentially a big opportunity for a long term position at this level: 322. I would have preferred the level to be matched by a Volume Profile level but the nearest one below...

The "reason" KRAKEN:XMRUSD RIPPED to $339 overnight was because of a hack: Nine hours ago a suspicious transfer was made from a potential victim for 3520 BTC ($330.7M) Theft address bc1qcrypchnrdx87jnal5e5m849fw460t4gk7vz55g Shortly after the funds began to be laundered via 6+ instant exchanges and was swapped for XMR causing the XMR price to spike 50%....

I thought I read that NASDAQ:TSLA was going down and Elon was going broke. Earnings were going to assure it. Looks like it came and went and instead went bullish. Oh well, you can't rely on narratives: Only Technicals! The 218.65 Volume Profile Level has been holding TSLA up for weeks now. Great long by the way. And as long as it holds the next major VP...

The general sentiment coming into this week is that the bear trend is over and "things are fine." Maybe. This morning there was a 30m opening spike on NASDAQ:QQQ I cannot ignore. It is happening right at the big Daily 50% Retracement of the leg down: The level is even more prominent on Nasdaq futures and one can add the Volume Profile Point of Control to...

Am I crazy to be looking at a manufacturing play right now considering the tariff trade wars going on? The stock right now has a forward dividend yield of 8.65% at the current price with a technical setup. There are fundamentals around tariffs to consider but that could only be the "reason" the price has come to a great buy. I set an alert almost a year ago in...

All over the media eyes are on yields but what exactly do the different potential rates of the 10-year yield mean in terms of debt servicing for the United States? I made this chart to visualize the danger points. I am not saying I think we will get there I just wanted to know myself and help others to understand what each pain point can mean to the United...

...like a middle schooler, why Monero over the last year with delistings, without ETFs, and without Strategic Reserves has outperformed Bitcoin?

My plan will be to look to trade major Supports on Bitcoin: 67k: Major volume profile node of prior range, 50% Retracement of the pre-ETF low > ATH, 89EMA) 63k: Secondary volume profile node of prior range, 50% Retracement of the whole bull cycle.

This last week was interesting to say the least but the most interesting thing to watch was the incredibly influx of volume into INDEX:BTCUSD As the week progressed into Thursday and Friday and equity markets sold off big the volume of trading in Bitcoin more than doubled... yet the price remained stagnant. A month ago I did a study of correlation and...

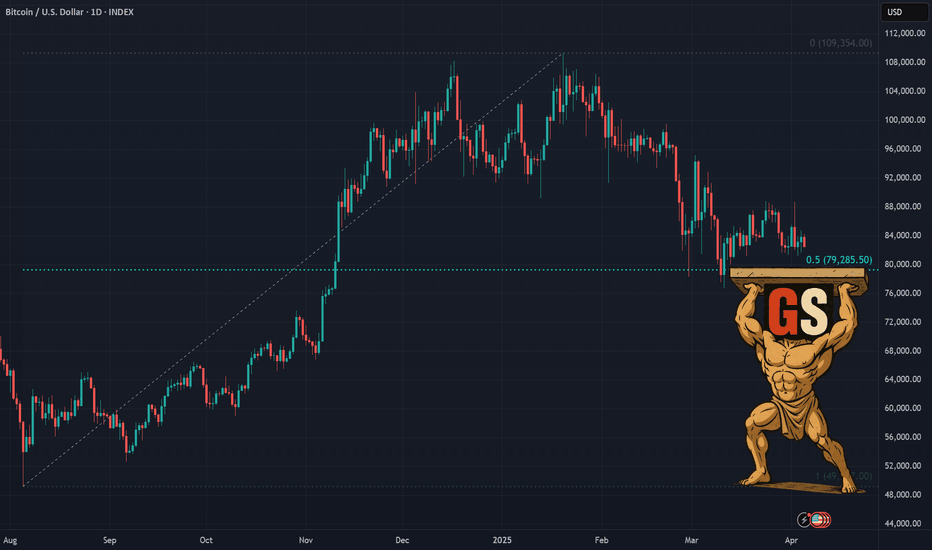

Bitcoin volume is exploding today. The Maxi's are trying to close it green on the day to advertise it as a "Safe Haven Asset." We are watching an All-In to keep it above 79k Support. Will they win?

Reddit NYSE:RDDT has entered my textbook "Valley of Risk" period where the stock has a chance to hold its 50% Retracement of a major trend, fails, and even now has the added confirmation of retesting said 50% Support as overhead Resistance. There is now only the gap level at 104.90 which if broken will probably fill. Then it will be on to test the post-IPO...