nothingchangehere

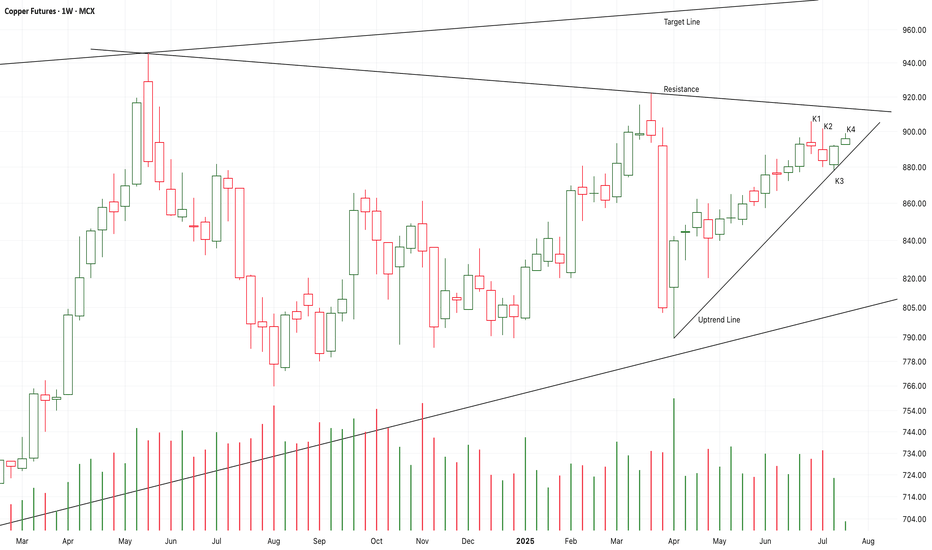

EssentialK2 and K3 is a strong bullish up engulfing pattent. K4 started with a bull gap to verify it. It seems that K5 or K6 will break up the resistance to test the target line in the near future. If I didn’t buy it earlier,I will try to buy it here. I still hold the idea that the expensive metals such as Gold/Silver/Copper are in the long-term bull...

From K1 to K5, It is a small scale consolidation or a bullish triangle pattern. The supply pressure is decreasing too. It seems that K6 or K7 will break up or fall down. If the following candles close upon K3 or K4, It is likely that another bull run will start here to test 77USD area. On the other hand, If the following candles close below the neck line, The...

From K1 to K6, It is a strong bullish three methods pattern, It close upon the neck line of a potential bullish triangle. It seems that the market will keep accelerating here. So, I bought a small portion of AGQ at 55.35USD. It is more and more clearly that the expensive metal such as Gold \Copper \ Ag is in the strong bullish market. I will keep to buy in if...

From K2 to K4, It is a strong bullish three soldiers advancing pattern with increasing demands. It is likely that K4 will close upon the high price area. And, it is likely to be a valid break up here. The potential target is about 127-130K after 3 weeks. On the other hand, Compared to the nearest motive move, The demands keeps at the lowest level. It is an...

From K1 to K6, It is a small scale consolidation or a bullish triangle pattern. The supply pressure is decreasing too. It seems that K7 or K8 will break up or fall down. If the following candles close upon the neckline, It is likely that another bull run will start here to test 14USD area. On the other hand, If the following candles close below the uptrend...

K2 verified a potential fake down of K1. And,the supply pressure near the neck line keep decreasing. It seems that K6 will choose to break up or fall down. If the following candles close upon the neck line, I will try to buy in. If the following candles close below K3, The risk will sharply...

From K1 to K3, It is a bullish three soldiers advancing pattern, But unfortunately, it still failed to close upon a nearest resistance. K3 start with a bull gap and break up a downtrend line of a large scale consolidation range. If the following candles break up the resistance or consolidate around it, It will be a good place to buy it there. On the other...

K4 close at high price area, but still failed to close upon the downtrend line, If K5 close upon the line, The strong bullish momentum will be verified here, And the market will accelerate to test or break up 112K area. It is also possible that the market consolidate around the downtrend line, And days later, it chose to break up or fall down. If I didn’t bought...

K5 close below K2, It verified the resistance or the bear gap at K2. It seems that the following candles will fall to test 0.382-0.5fib area. I will try to buy it there. I don’t think the three years bull market will be terminated here, I am expecting another bull run to test or break up the resistance again. On the other hand, If K6 or the following candles...

There are 4-5 candles consolidate around the resistance, And the demands keep decreasing. Compared to K3, the demand at K4 increased, but it failed to close upon K3. If K5 is a doji candle close at low price area, Or,If K5 starts with a bear gap to close below K4, It is likely that the following candles will fall to test 0.5fib area. I will try to buy it...

There are 4 candles close upon the neckline of a potential bullish triangle pattern, It seems that another bull run will start here. I am expecting an accelerate motive wave to touch or break up the target line. On the other hand, If K4 couldn’t close upon K1 to verify the strong bullish momentum, It is also possible that a short-term consolidation will carry...

K1 and K2 verified a potential strong support, If the following candles K5 or K6 close upon the downtrend line like K2, Another bull run will keep climbing up. It will be a good place to buy it around the downtrend line. If the following candles consolidate around the resistance to verify the bullish momentum, It will also a good place to buy it around the...

It seems that K3 is breaking up the resistance of a potential bullish triangle pattern. It is good place to buy it here immediately. It is also possible that after breaking up the resistance, The market will fall to retest it, And then, it will be another good place to buy it there. Long-41.5/Stop-40/Target-55

There are 4 candles close upon the neckline of a potential bullish triangle pattern, It seems that another bull run will start here. I am expecting an accelerate motive wave to touch or break up the nearest higher high at about 72USD. On the other hand, If K5 couldn’t close upon K4 to verify the strong bullish momentum, It is also possible that a short-term...

After a three years bull market, The recent candles verified a continuous strong supply pressure. I am expecting a doji candle of K5 or K6 to terminate the bull market here. If K5 and K6 couldn’t close upon K4, It is likely that the resistance will push the market to test the support. Perhaps a bear market will start here. At the same time, Other crypto coins...

From K1 to K3, It is a three soldiers advancing pattern, It close below the uptrend line and the neck line of a potential double top pattern. It seems that a short-term bear run will fall to test 102K area. I will try to buy it there if the following candles couldn’t close below 0.618fib line. On the other hand, If K4 return back upon the neck line...

K3 is a weak break down, It failed to close below K2. It seems that K4 will test the uptrend line to verify K3 was a fake down or not. If K4 close upon K3, Another bull run will start here to test 112K area. If K4 or K5 are doji candles around the support, It is likely that a sharp price correction will start here to test 102K area.

K1 and K2 break up the downtrend line of a potential bullish triangle pattern. If K3 still stand upon the line, It will be a valid break up. On the other hand, If the following candles close below K2 immediately, K1 will be a fake up candle, And the risk will sharply increase. Long-33.4/Stop-33.08/Target-36