ocaptain

PremiumJoin me and thousands of our fellow traders as we participate in community-driven workshops, learn from top trading professionals, and hear what our exclusive projections are for the crypto market in 2021.

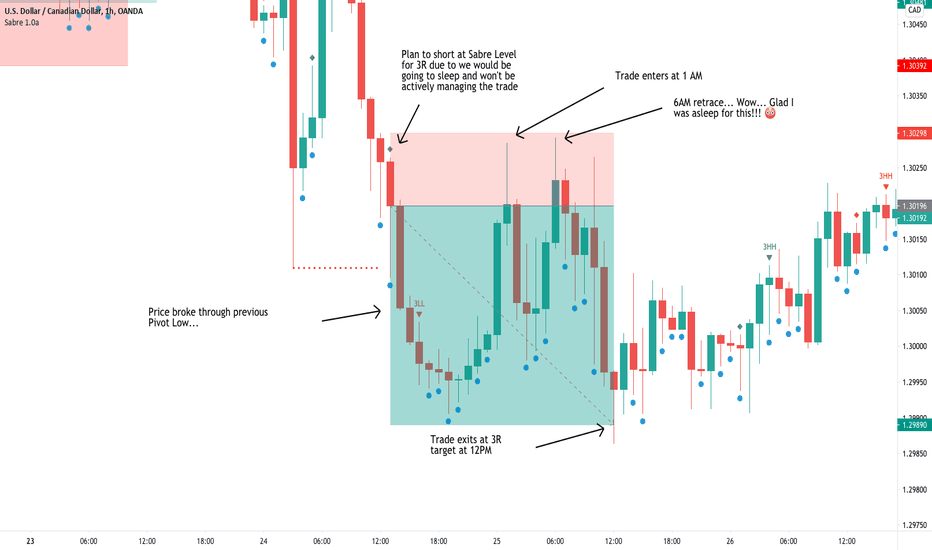

How do you document your trades? In a spreadsheet? In a trading journal? Directly on the chart? How much is too much? How little is not enough? I say you need to document enough to tell the story properly. Every trade tells a story. As with all good stories you have a protagonist and an antagonist. Good guys and bad guys. The hero and the villain. And then,...

In my earlier article, " Proving Your Trading System with Backtesting ", I demonstrated how, in the Futures market, you could backtest your trading system, see what works and what doesn't, change your variables, and rinse & repeat until you have a winning trading formula. You GET this winning formula by torture-testing (ahem, *back*testing) your system under...

Thanksgiving is a distinctly American holiday, where our nation takes pause to reflect on all the things we have to be thankful for due to the actions of a courageous band of dedicated men and women who crossed a dangerous ocean to an unknown continent for the simple hope... of freedom. As traders, I am glad that we all, regardless of our national origin, our...

In my earlier article, " Proving Your Trading System with Backtesting ", I outlined the HOWs and WHYs of backtesting. Does your trading system work under all conditions? Under what conditions might it *not* work? Can you remove those instances from your plan? Under what conditions might you *improve* your win rate? In another article, " The Unexamined Trader ",...

Wouldn’t it be great to see the future? To see where turning points in price will occur with a high degree of accuracy? To see if a trading system that you developed or bought or learned actually works? Well, you can, with a method called BACKTESTING. Backtesting performs three important functions: 1: It helps you IDENTIFY the reliability / win rate of your...

When I started trading I was extremely excited about the possibilities that lay before me… The dream of changing your work ethic from “working for your money” to “putting your money to work for you” was intoxicating. I took every class, read every book, followed every “guru” I thought would help me get that ‘edge’, that secret sauce, to make me a great trader....

This is a companion video to my "Trade Like a Pirate" article showing how the Long & Short tool can help you manage your "aRRR" - Your Reward-to-Risk Ratio. Whether you are trading a Company, a Currency, or Commodity, you want to Consistently trade your positions in terms of Risk and Reward for consistent results and to not "blow up your account" with a bad trade.

Ever since the invention of the Mutual Fund, then IRAs, or even going back to the ownership of individual stocks, the “common man” has been taught to “Buy and Hold” when it comes to their investments. Even today, investors are taught to put their hard earned dollars in a “lock box” and told to "let it grow"... We are told things like “Let time be on your side”…...

This is a key pivot level where Supply and Demand keep fighting. Currently in a downtrend with decreasing RSI at each Pivot High. What was strong demand (with 3 hits) is now penetrated and became Supply. Go short on the retrace if price returns

RTY experienced an explosive move down from a pivot level which historically has been a favorite pivot point, once being Supply, then becoming demand, etc... Looks like we are currently in Supply mode. Take the Short at supply if price has the strength to retrace Expect 3:1 profit and if possible trail it from supply level to supply level as long as we...

ES is in an uptrend on the higher timeframe with positively correlated RSI - Higher Highs are producing higher RSIs allowing us to ride the trend. Take the retrace in a quality demand zone . Target the opposing Supply Zone for a Set-and-Forget 3R profit or use a trailing stop if you will manage the trade actively.

One of the amazing things about trading the financial markets is that it is the only industry where we “common folk” have the potential to EXPONENTIALLY grow our income day after day, week after week, year after year. All our lives, from opening up our first lemonade stand to landing our first job, we are taught to make LINEAR income: to exchange TIME for MONEY....

Socrates famously said “The unexamined life is not worth living.” Why do we do what we do, why do we feel the way we feel about something, or what is our purpose in life? These questions brought about generation after generation of journals, diaries, and random thoughts from some of our greatest thinkers from Socrates himself, to Jonathan Edwards in early America,...