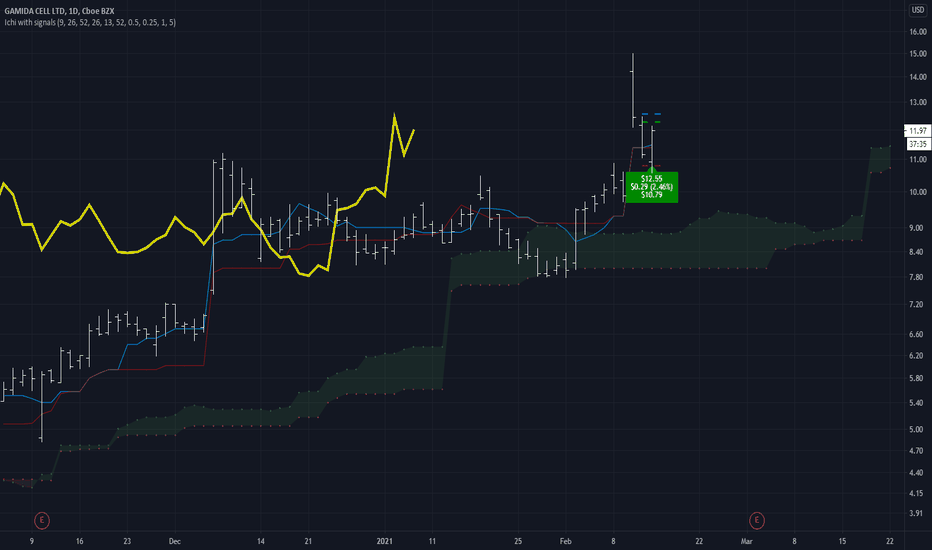

This chart contains an explanation and breakdown of a trading strategy I've been following with decent success. The basic idea of the strategy is that in the few days following the event of a ticker meeting all entry requirements, there is likely to be a pop of at least a few %. By taking a long position when the conditions are fresh, we can hope to capture a nice...

Another cloud twist trigger like NXPI a few days ago, it'll be good to get another data point on whether these ones tend to be too late to be worth entering or if that was just randomness taking effect

Trigger this time is the lagging span, least common of the 4 triggers but also the most successful among the trades where i've been tracking that. My current settings are still: 9/26/52/26/13/52/0.5/0.1/0.5/5

I've been MIA for the past little while, just haven't been finding the time to post these. Will try to get back on track going forward!

I"m not sure what if any affect dividend payouts have on this strategy, probably worth some analysis

This one is interesting because it's not a chart i would be interested it just from looking at the price action. But it hits all the ichi criteria, so let's see how it does

this one's a little weird on the ichimoku front, as the base and conversion lines shared values ever since earnings, but it does count as a cross when it popped over today. Meanwhile there's a lot to like about this chart; nice boost after earnings that persisted without giving back ground, and now momentum is building behind it (i think this is what Ichi is...

Ichi indicates W is about to break out of it's channel. let's see!

Strong momentum here, looking for continuation based on the leading span crossover. GO ANTMAN

I'm a little biased against this type but we've seen a few go really big lately so let's go for it.

revisiting exit strategy yet again. I now think 0.5/0.1/1 is the way to go. That super tight stop loss def seems like more of a stop profit in most cases.

Making a pretty drastic change in the exit strategy; well, same strategy just tightening up the stdDev multipliers a LOT. new stop loss is going to be just 10% what it was, trailstop activation trigger is cut in half, and trail stop is going from 0.25 to 0.1. These are all configurable in the script. been doing some backtesting and it seems like this tactic of...