rasooldavarpanah

Given the current price conditions and the attention this token has garnered, it is worth taking a risk step at the bottom of its descending channel for much higher targets.

Everything went according to the previous analysis and we reached the target of 2.7. Taking profit at this point would be logical and the marked red area would be a worthwhile price to buy back in the long term.

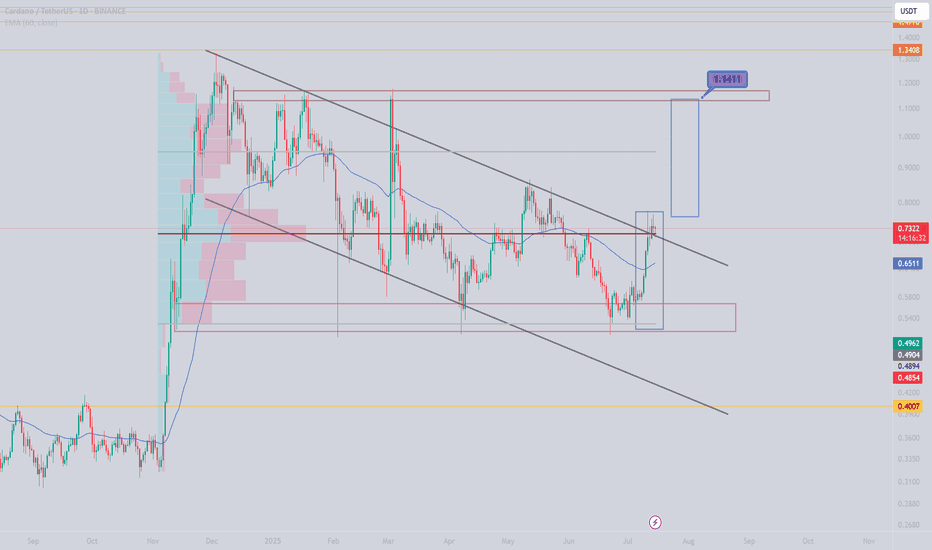

With the price stabilizing above the volume range and the descending channel, and if the market sentiment remains positive, we can expect growth to 1.14 in the first step and then 2.

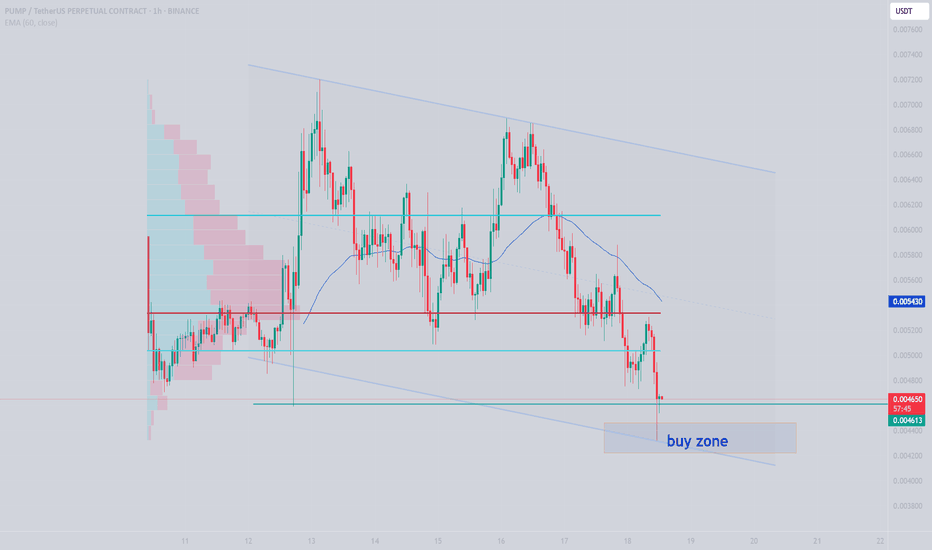

Given the deep correction and the expectation of a deeper correction and the lack of good demand from the breakeven range, we expect further declines to the specified range. With due risk management, it would be reasonable to enter around this area.

The price is in the local area If the price stabilizes above the volume range and the trend line and moving average 60 We can expect growth to the range of 2.90 and 3 and then 3.4 thousand dollars. Don't forget risk management and always expect any movement from the market.

Given the price structure and current conditions, the current price data is valuable and worth the risk. I also kept liquidity for lower levels to reduce the average with each drop. Please note that this is our team's personal opinion and is not a buy or sell offer. Sincerely.

The specified range is important, and if the upward trend is maintained, market sentiment remains positive, liquidity enters, and we see good momentum from this currency in the above timeframe, we can consider the specified scenario probable.

It has good momentum But we need to see what it does with the range it is set at If we see demand on the higher timeframe, I think it is worth the risk.

I'm ready for a new strategy.I think this could be logical. What do you think?

Considering the monthly candle close and the important breakeven and montomai range that it has taken I expect growth to reach the 19 range in the first price step

Considering the positive news about this currency, which has started operating in six American cities and is attracting attention and focus, and from the technical perspective that you can see, I think it is worth the risk and with proper risk and capital management, we can have it in our portfolio.

Given the structured nature of this token, both technically and the fundamental conditions that I studied, I think it has the right conditions for risk taking and I expect more than 200% growth for it.

Given the compression box, the price is in complete uncertainty and we need a catalyst to give direction to the price. If the price stabilizes at 88,000, it is not far to expect to see the 96,000 range, and if there is not enough fuel, a lower bottom than the previous one will still be possible. A break of the indicated box is important.

On the weekly chart, there is a clear bullish guard, but on the daily chart, we have a lower low and high, which is confirmation of the downtrend. If the trend breaks and stabilizes above the 0.60 range and a higher low and high is observed on the daily chart, we can have confirmation of the uptrend.

Considering the intersection of the volume range and VWAP and a valid bullish trendline and price support from this range, I consider this a good opportunity to enter this asset. I wanted to share with you friends.

It gave a lower bottom than I expected. If it is supported before reaching the breakeven level, it is a sign of strong support. Otherwise, I expect a price reaction when it reaches the breakeven level and the bottom of the descending channel.

With the weekly candlestick that closed last night, There are no signs of weakness in the Ethereum chart and I expect to see a 1650 range based on the liquidity inflow chart. Of course, this analysis is completely dependent on macroeconomic data and we will have to see what happens in the next few days with Mr. Trump's tariffs, unemployment rates, and the Fed...

We expected demand when the price reached the $85 range, but given the current market conditions, there was no good demand. Now, if the $85 range is lost and stabilized below it, we expect a further decline to the $74 range, and otherwise, we expect the price to grow to higher numbers and unimaginable targets for Litecoin.