rinvest

Man if there was only a regulated, K.Y.C./A.M.L. compliant neutral bridge asset that was able to provide deep liquidity in a trustless manner so that central banks, clearing houses and governments could reduce friction in cross-border payments and accelerate the velocity of money as a way to save the global economy from a debt bubble and liquidity freeze by...

The markets that Ripple/O.D.L./XRP is intended for are collectively measured in the trillions of dollars per day. Connect the dots: The DTCC, clearing houses, FX market/post-trade settlement (6+ trillion a day in volume), R3 Corda, VISA Earthport, SWIFT, correspondent banking, wholesale CBDC's, transition from LIBOR to SOFR (Sandie O'Connor recently added to...

See: Post-trade settlement, Clearing houses, fx market. Development of CDBC's, stablecoins, payment systems issued on the XRPL for interbank settlement (XRP not intended for the retail investor). For reference listen carefully to Patrick Griffin describe the use case in this IIF showcase video from 2014: www.youtube.com Not financial advice.

I don't hold any. Good project. Terrible name. www.algorand.com --------- Marshall Islands have built their CBDC on the Algorand blockchain, albeit a permissioned "co-chain" version of it, and against the recommendation of the IMF. See: Marshallese Sovereign (SOV) sov.foundation Partnered with SFB Technologies for identity management Also see: USDC on Algorand

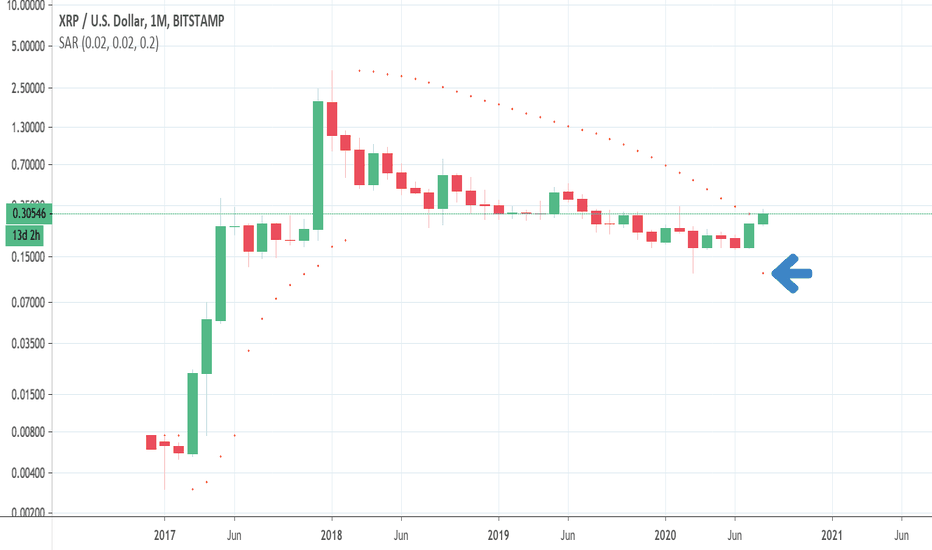

Long-term trend has reversed. No price predictions. Crypto is not a zero-sum game and XRP has its place. All boats rise. Think of Ripple as open architecture upon which anything of value can be exchanged for anything else of value and settled nearly instantly. Yes, supply is large, but do not forget that each XRP is only divisible by 6 decimal places. Then do...