samuellon122

From the chart, we have clearly to see that it broke the resistance line. With the positive cpi data from the gbp currency, we have a basic fundamental for us to know that, coming this week will reach to our target price.

On May 5, 2025, the EUR/CHF currency pair experienced a significant technical development, breaking through a key resistance level at 0.93300. The unexpected stagnation in inflation exerted downward pressure on the Swiss Franc, contributing to the EUR/CHF's upward momentum. From a technical perspective, the EUR/CHF had been forming a symmetrical triangle pattern...

in 9 May 2025, unemployment rate announced 6.9%. which is higher than forecast with 6.8%. Due to this news. there is a bull on Tuesday 13/05/2025. This indicate the market is going to long run. Break of structure and adjustment has completed. now is time enter into the market.

with the GDP announcement on 30/04/2025, market show the negative result. During the day, it showed that the market is going downward as retail trader might follow the previous market react. However, on friday, trader has follow back the news and buy into the market.

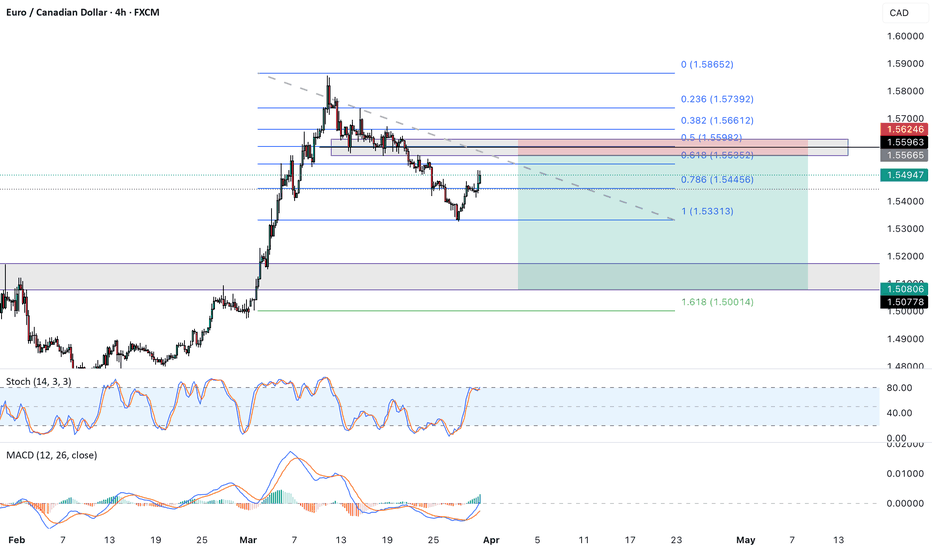

With the news announced on 30/04/2025, GDP of CAD currency showed that it had a negative result compare to forecast. Market react according to the result. We have to wait of pullback from the chart only enter into the market to maximise the return from the market.

From the view, the currency pair break of resistance, continue with the long term trend line with follow the gdp news of CAD currency pair.

In 12 March 2025, Bank of Canada announced overnight rate same as forecast result which is 2.75%. While 18 March 2025, Consumer price index seem increase different 0.5% from forecast result. Both also have a good impact to the Canada currency. From the chart, we saw the break of structure happen, currently pending for the reversal and confirmation.

In 26 March 25, CPI of AUD currency has announced the actual result 2.4%. As the result is lower than forecast, which would lead to retail investor unfavorable to buy more AUD currency. From the chart, we can noticed there is breakout of trendline and we have to wait for reversal to have the confirmation and enter into market.

After CPI date release on 21/11/2023, the chart has been slowly adjust and break of trend line. Due to the inflation rate increase, will expect the interest rate increase on CAD currency. Hence, we will tend to sell the GBP currency to buy the CAD currency. From the chart, the back testing established, so let see the bearish time .

Pullback and adjustment has been done. Time to focus on the trade. But do remember Fed Chair Powell Speaks happen in less than 3 hours. You can manage your lot size to determine the entry level and stop loss level.

We always have to do backtesting to ensure the chart is go with the trend. To avoid the unnecessary waste of the time afford to trade on the wrong matter.

Backtesting has set up. After the break of the price and done on backtesting. Can start to enter the market.

It has build up the support. By looking at the trend, it is at the uptrend. Do not go adverse on the trade. follow the backtesting.

Follow the backtesting. Always use backtesting method. You will able to earn money from the market.

After few rejection from the supply zone, wit the clear from the moving average. As from the zone to zone. is time to trade

After the CPI news announce, the chart has slowly build up the double bottom. Slowly it has start to shoot up First TP: 1.25358 Second TP: 1.26273 Enjoy of the week guys!

Affter backtesting, is time for us to enter into the market. Dont be greedy, slowly progress will make your life perfect.

After announcement on Consumer Price Index on 24/05/2023. We finally get to see the chart has been change to up trend position. Same Game rules, we for bounce back and get the money on hand.