Tokyo Plast: (Swing) Watchout for the breakout and trade using the marked levels as SL and TGT. The trade has a potential to offer a RR of 1:5. Keep Learning. Note: Do your own due diligence before taking any action.

APL Apollo Tubes: On the verge of a breakout. Watch for the closing to get a clear signal. This trade has a higher profitability if well taken. Keep Learning. Note: Do your own due diligence before taking any action.

Bliss Pharma (Swing): Bliss Pharma is getting accumulated near the supply zones, meaning the script is set for a probable and significant up move via breaking the crucial supply area. The ideal entry, SL and TGT zones are highlighted. Bliss Pharma offers a trade with RR of more than 1:6. Note: Do your own due diligence before taking any action.

Bank of India (Swing): BOI is on a nice setup. Here the present position offers a trade with RR of more than 1:4. Script is also well set for a significant up move by breaking the previous supply zone. Appropriate buying and profit booking zones are highlighted. Check out my earlier views for a better understanding. Note: Do your own due diligence before taking...

Orient Cement (Long): Despite the volatility in the broader and small cap indices this script has setup well for a significant up move by breaking the crucial supply area. OC present position also offers a trade with RR of more than 1:4. Note: Do your own due diligence before taking any action.

Nifty FMCG (Weekly Chart): Though this index has given a 800 point rally today, a significant resistance lies ahead. Watch out for a retracement in the upcoming days. Cheers Keep Learning

Nifty 50: The index has failed to hold our previously mentioned support @ 22300. A gap of 575 points has also been left down. What happened? The previous support @ 21700 was bought in. Followed by the short covering which also led to the formation of a strong bullish candle. What next? We have to wait for the next few days candle to verify the volume and...

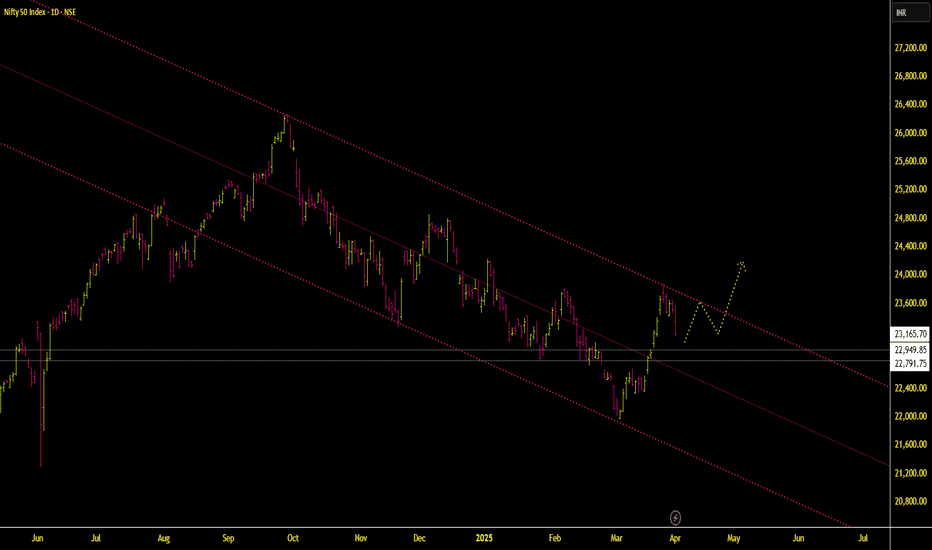

Nifty 50: As mentioned in our earlier posts Nifty 50 index has come down from 23875 to 23165 in the last 3 days. The immediate resistance lies @23600-23700, while the support @ 22300. What's possible next? Nifty 50 has to come down over the next few days to 200-300 points to continue its possible upward trajectory. Buy on dip market is on hold until...

Nifty 50: As mentioned in our earlier posts Nifty 50 index has confirmed its reversal trend through its 1500 points rally over the last 5-7 days. The immediate resistance lies @23850-23950, while the support @ 22300. What Next? Nifty 50 has to come down over the next few days to 22900-23100 to continue its upward trajectory. From here on its a buy on dip...

Gift Nifty: The index is at crossroads and waiting for a clear decision to be taken. Its so far not clear who will keep going bulls or bears.

Veto Switchgears (Swing): Script is also well set for a significant up move by breaking the crucial supply area. Veto with the present position also offers a trade with RR of more than 1:6. Appropriate supply, demand and target zones are highlighted. Check out my earlier views for a better understanding. Note: Do your own due diligence before taking any action.

Gateway Distriparks (Swing): Gateway is on a nice setup. Here the present position offers a trade with RR of more than 1:7. Script is also well set for a significant up move by breaking the all time high. Appropriate demand and target zones are highlighted. Check out my earlier views for a better understanding. Note: Do your own due diligence before taking any action.

PTC India (Swing): PTC is on a nice setup. Here the present position offers a trade with RR of more than 1:5. PTC is also well set for a significant up move by breaking the all time high. Appropriate supply and demand zones are highlighted. Check out my earlier views for a better understanding. Note: Do your own due diligence before taking any action.

TPL Plastech (Swing): TPL is well set for a significant up move by breaking the all time high. Appropriate support and resistance are highlighted. Trade offers a RR of more than 1:5. Check out my earlier views for a better understanding. Note: Do your own due diligence before taking any action.

Muthoot Microfin (Swing): This script is well set for a significant up move by breaking the IPO base . Appropriate supply, demand, resistance and target zones are highlighted. Trade offers a RR of more than 1:9. Check out my earlier views for a better understanding. Note: Do your own due diligence before taking any action.

SHREDIGCEM (Swing): This script is well set for am up move for the upcoming days. Appropriate support, resistance, and target zones are highlighted. Trade offers a RR of more than 1:7. Check out my earlier views for a better understanding. Note: Do your own due diligence before taking any action.

Bajaj Consumer: (Swing) Bajaj Consumer is well set for a 75-80% move in the upcoming months. Appropriate resistance, support and target zones are highlighted. Trade offers a RR of more than 1:5. Check out my earlier views for a better understanding. Note: Do your own due diligence before taking any action.

Kellton Tech: (Swing) Kellton is well set to to double in the upcoming days. Appropriate supply, demand and target zones are highlighted. Trade offers a RR of more than 1:6. Check out my earlier views for a better understanding. Note: Do your own due diligence before taking any action.