strongJaguar35078

Bitcoin needs to fill the gap around 85,000, which is visible on the Bitcoin futures. The best time to do this is over the weekend. Target: 86,000-87,000

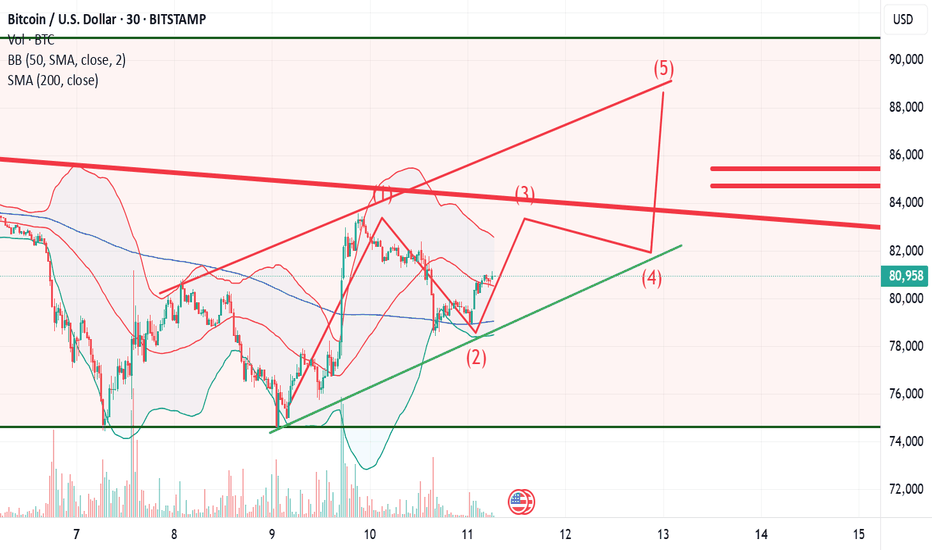

Consolidation in a triangle, then a breakout downwards

The first target for BTC is 84500. The second target is 87000. Then - down

BTC is working out a triangle figure. Accordingly, the last wave should be completed. Which gives opportunities for intraday trading until the beginning of the next week. After exiting the triangle, we move down.

The main idea is that a plan to create a cryptocurrency reserve will be presented at the Crypto Summit on the evening of March 7. Before this event, large players will accumulate short positions. After the presentation of the plan, a sell-off of BTС is expected.

BTC is forming a flag figure, the exit from which will most likely be downwards

First complete the head-and-shoulders pattern and then trade within the 72-90 corridor

BTС will move down in the channel to the support level in the area of 70-75. Then a sideways corridor with a resistance level of 90-95 and support of 70-75.

The wave is expected to end on March 25. After that, there will be another breakout downwards. In the period up to March 25, there will be consolidation in the form of a flag

Most likely, a weak downward movement will continue to the border of the formed flag/wedge. And it makes sense to buy at its lower limit. If before this time its upper limit of 72-74 is broken, of course you can also buy BTC