supertrader72

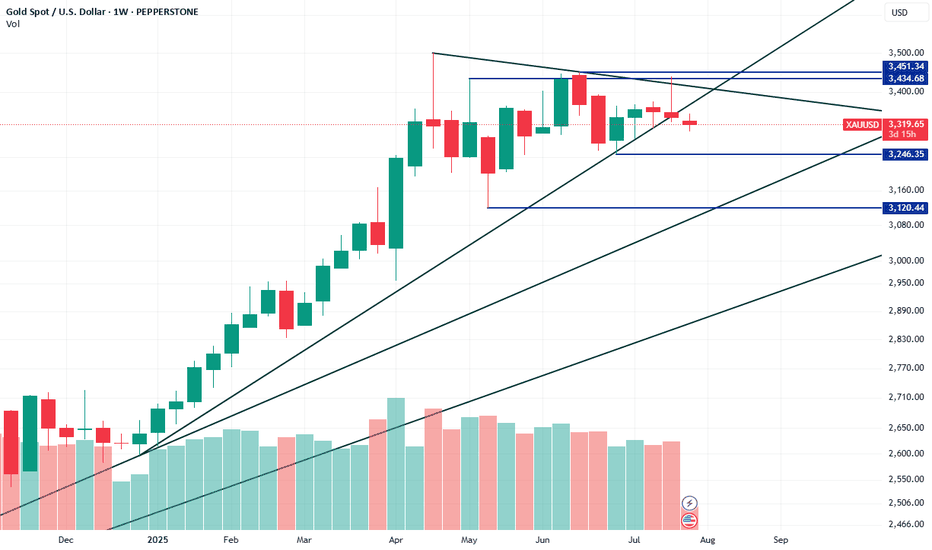

XAUUSD has broken its most recent descending trendline on the Weekly chart, signaling a possible short-term reversal. It’s now approaching a higher-timeframe descending trendline, which could act as resistance. The next key demand zone is around 3246; if that fails, the more significant demand lies at 3120. Despite this pullback, the macro trend remains bullish....

Gold continues to attract demand as a safe-haven asset amid ongoing global political tensions. Institutional traders have increased their net long positions by approximately 1,000 contracts, signaling growing confidence in the bullish outlook. On Friday, Gold printed a new Higher High, surpassing last week's peak — a technical sign of continued upward momentum....

After the bears dominated two weeks ago, the bulls regained control last week and could potentially extend the rally into this week. The latest jobs data played a key role—unemployment dropped to 4.1% from 4.2%, and Non-Farm Payrolls (NFP) rose to 147K—which initially triggered a pullback in gold on Thursday. However, bullish momentum returned strongly on Friday,...

2 weeks in a row, the sellers were in control. The downward force this week is strong. The possibility of a further drop in the future is highly probable. However, there's also a potential recovery next week. Overall, it's still an uptrend; however, I won't ignore the new LH that formed this week as well.

Last week was a bearish one for XAUUSD, following a strong bullish surge the week prior. The key question now is: can gold reclaim the highs it reached two weeks ago? From a macro perspective, institutions remain net long and have even increased their long positions, signaling continued confidence in gold as a safe-haven asset. On the geo-economic front, tensions...

Gold exhibited considerable uncertainty, as sellers pushed the price back to nearly its starting point this week. Is it profit taking? What do institutions know that we don't, as they increased their long positions this week? 81% of institutions are long. So, where the whales are is where I want to be. Note: This is not advice. This is for educational...

XAUUSD created a new LH and didn't want to continue last week's demand. However, it also created a new HL. Who takes precedence in this scenario? The HL since it's an overall Up Trend. It might consolidate in the next few days and the 4th of June will be a good indicator if it break to the upside or continue to drop.

BTCUSD created new Highs 2 weeks ago (almost 112,000). Last week, it created a new LH and bearish engulfing pattern. Sellers took over and the odds it will continue to drop down to 90,000 as a form of correction is highly probable.

Gold corrected itself all the way down to 3120 yesterday which is a significant demand level by institutions. Price then rebounded and closed at 3150. If it creates a confirmed HL by the end of Friday, the odds and probability XAUUSD will go back to its supply area at 3500 is highly probable. Price will also depend on macro fundamentals. The weekly shows a...

Despite being an Up Trend, XAUUSD still has a possibility to drop down to the 62% retracement line.

XAUUSD is moving towards the 50% retracement per analysis. If it breaks the 50% then down to 62%. Overall, XAUUSD is still in an up trend which can't be ignored. A correction is necessary.

A few of high impact news tomorrow and it will determine if XAUUSD will continue its trend or break further correct itself tomorrow. If it breaks 3300, the probability it will drop further for correction is highly probable. If not then it will continue its trend to the upside.

Institutions reduced their long contracts last week. I am bearish XAUUSD. Getting a correction around 3380 - 3400 is a good supply area. So, Buyers beware.

XAUUSD created a new HL today. Correction is over. The continuation of the trend will continue until it creates a new LH if it chooses. Otherwise, I am going to remain bullish with XAUUSD.