tomas_jntx

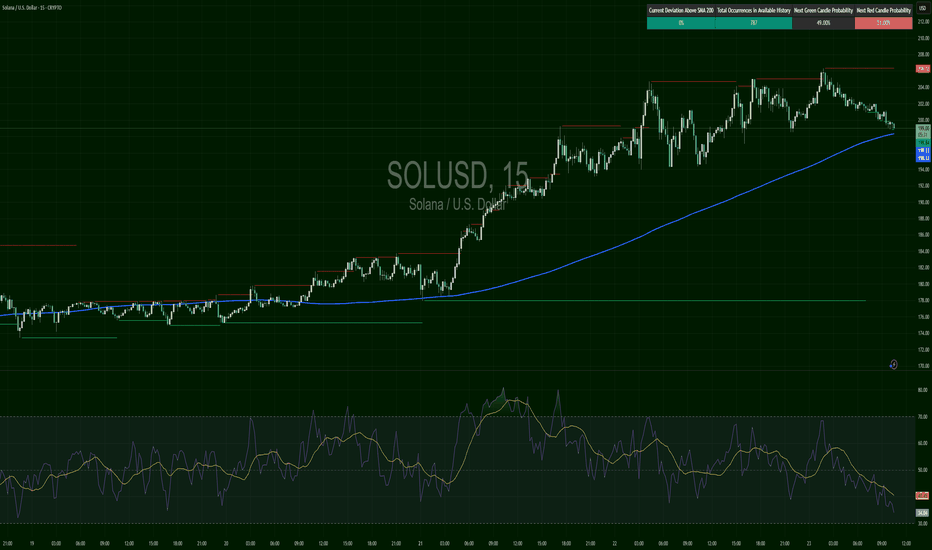

EssentialSOL broke below $198, hitting a low near $179, confirming the short trigger from the last setup. Since then, it’s building a grind-recovery, reclaiming $189 but stalling at a confluence zone ($191.84 resistance and SMA200 near $193.11). RSI at 59.41 still favors buyers — but SOL needs a clean break above $193+ to shift back into bullish territory.

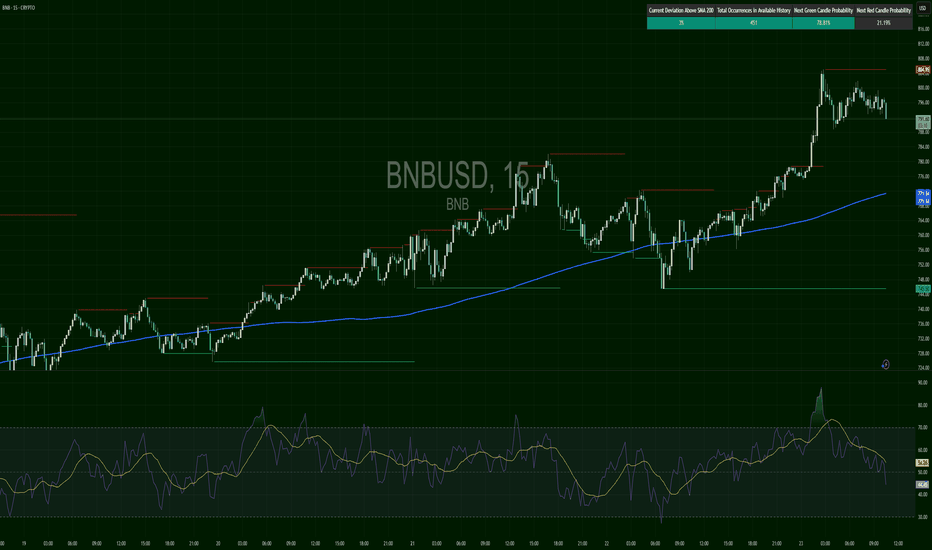

BNB pulled back and held the 200 SMA, then surged from $743 → $785. Price is now consolidating just below the breakout zone. RSI at 60.04, momentum positive but slowing. Watch for breakout >$786 to trigger continuation. Failure to break = possible fade back to $770.

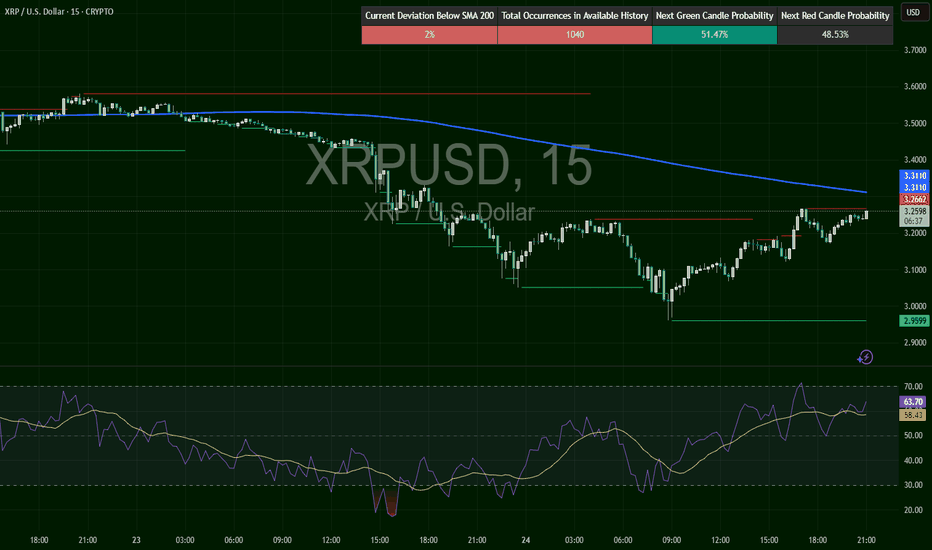

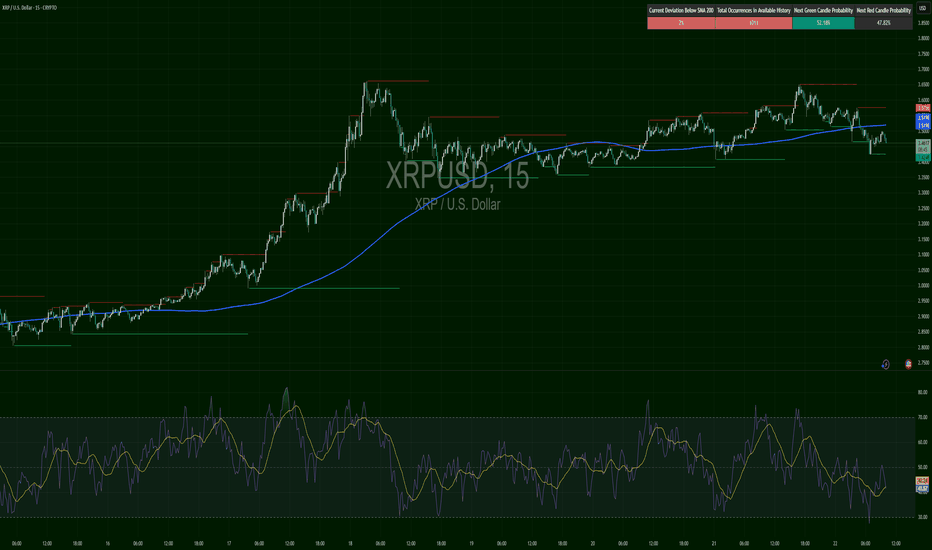

XRP flushed hard to $2.95, then reversed and is now pressing back into prior breakdown levels at $3.26–$3.31. 200 SMA above is resistance at $3.31. RSI at 63.14, bullish and rising. This is the make-or-break retest zone. Break it, and we could see $3.40+ fast. Rejection = trap.

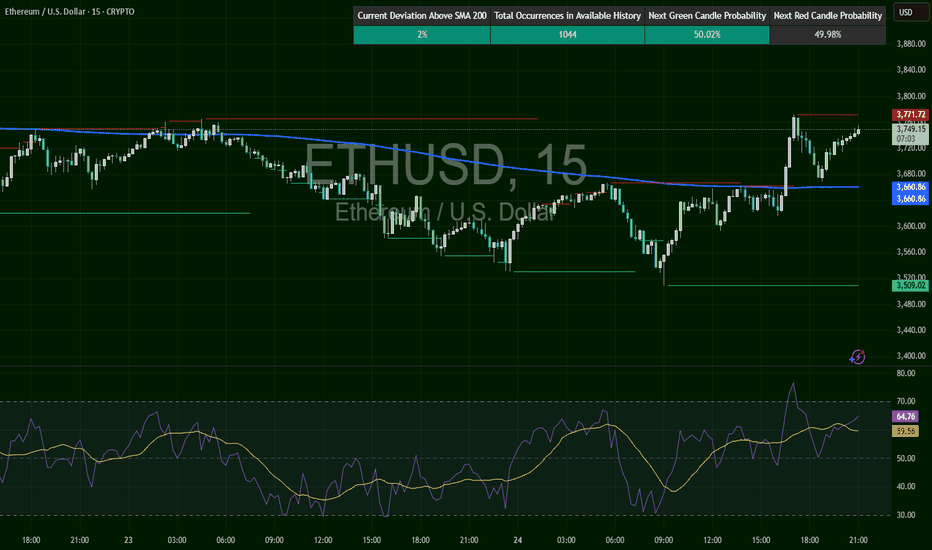

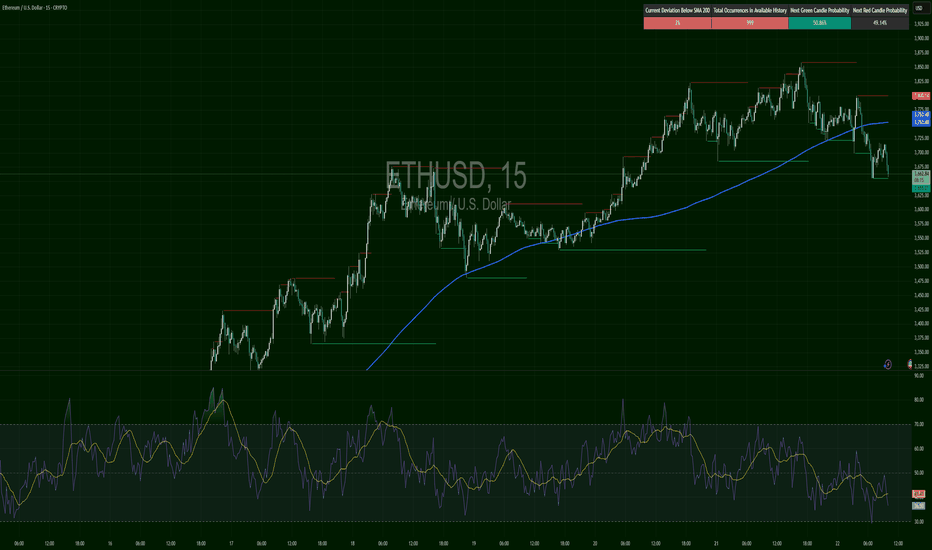

ETH reversed off a major demand near $3,510 and exploded past the 200 SMA into $3,747. Currently, price is resting just under resistance at $3,771, with RSI at 64.49 — strong and trending. If this resistance breaks, next leg up begins. If rejected, expect retest of $3,680–$3,700 range.

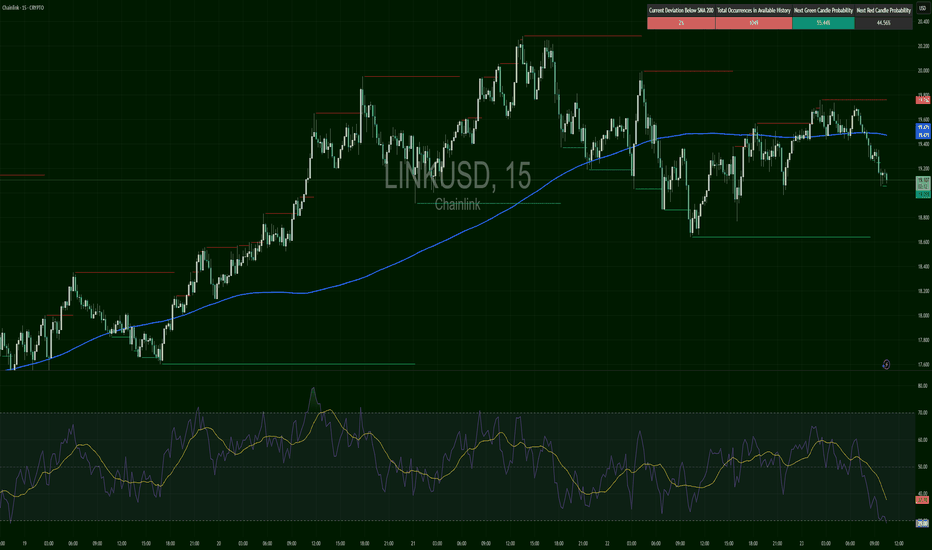

LINK broke trend structure clearly. After peaking around $19.76, it rolled over, crossing below the 200 SMA. RSI hit 30.54 — deeply oversold. Price is now compressing near $19.05. A rejection from $19.20–$19.30 would confirm bearish continuation. However, if RSI bounces above 40+ and price flips $19.35, it could fake out bears.

DOGE is now printing a clear lower high structure. After rejecting $0.271, price is stair-stepping down below the 200 SMA. Support around $0.258 has held (briefly). RSI at 37.00, still weak. Structure invalidates short only if bulls reclaim $0.265. As of now, every bounce is sold.

BNB remains clean and trend-respecting. After touching $804, it’s pulling back orderly with RSI cooling to 52.38. Price still above the 200 SMA and no structural damage is seen. A hold above $786 keeps the trend LONG. A move below $780 flips momentum briefly, but no reversal yet.

SOL topped out at $206 and now coils near the 200 SMA at $198. RSI at 36.38 is heavy but not diverging. Structure turning from trend to distribution unless $200+ gets reclaimed quickly. $198 is the last line of support. Break below and short trigger confirms.

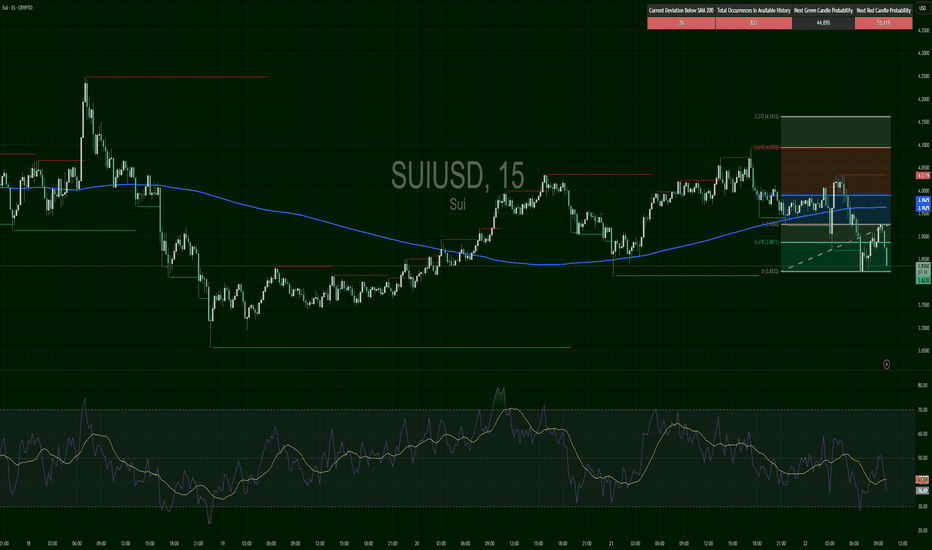

SUI failed a breakout at $4.05, reversed hard, and now trades near the 0.618 fib zone ($3.88). Price dipped as low as $3.82 before stabilizing. RSI curling from oversold (~30), indicating early recovery attempt. Structure still bearish unless bulls reclaim $3.96–$4.00. Risky but bounceable.

XLM fell aggressively from $0.4850 and broke below its SMA 200 for the third time in two sessions. RSI rebounded from oversold (~30), currently hovering near 42. The price is stabilizing near $0.4550 support — possible relief bounce brewing, but no higher highs yet. Caution advised.

ETH broke sharply below $3,750 and sliced beneath the 200 SMA with strong volume. RSI slipped to ~41 and remains suppressed. Price tested the $3,655 demand zone and bounced slightly, but bulls are clearly losing grip. Any bounce below $3,730 is suspect for continuation shorts.

XRP broke structure on the downside after failing to hold $3.59, slicing through the 200 SMA. Momentum flipped bearish with RSI stuck under 50, signaling distribution phase. Support rests at $3.42. Bulls need a fast reclaim of $3.50 to regain control — until then, lower highs dominate.

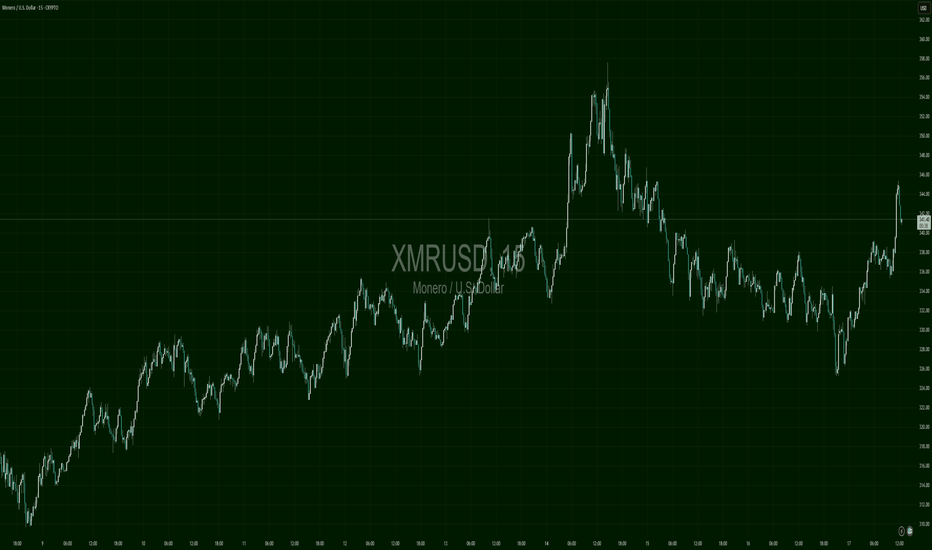

XMR is breaking out of a multi-day range, pushing past $344 after compressing around $336. Prior structure showed rangebound accumulation. As long as it holds above $338–340, bias remains bullish. Overhead space opens toward $350+.

LTC rallied from $89 to just over $101.50 in a volatile swing. The structure shows bullish compression with higher lows forming beneath $101. A push through $101.80–$102 would likely initiate a fast breakout toward $104+. Bearish only if price breaks $98.80.

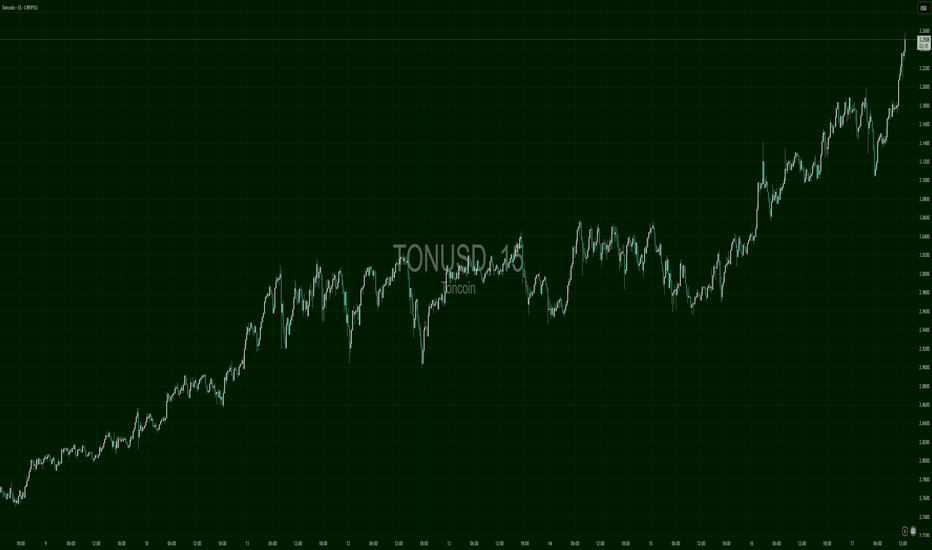

TON is in a clean step-rally structure. Since bottoming near $2.75, it has surged non-stop, forming higher bases each time. Now approaching $3.25–$3.30 resistance zone. If broken, next target lies at $3.40+. Trailing support is $3.18.

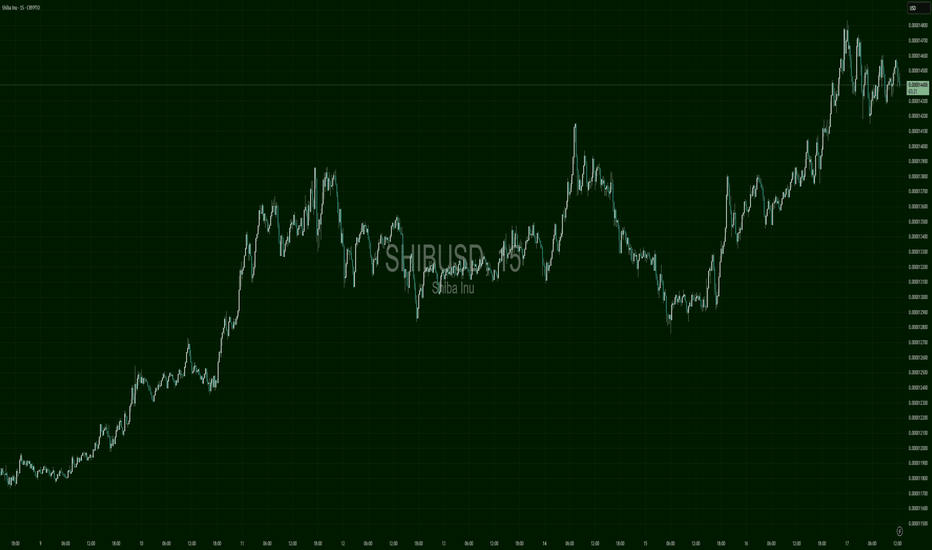

SHIB had a strong trend from $0.00001150 to $0.00001480, then saw a healthy pullback into $0.00001330 before bouncing back to retest highs. A potential cup and handle formation is playing out here. Immediate support sits at $0.00001420 — bulls must defend this to confirm bullish continuation.

APT broke out from $4.70 base and surged to $5.30+. After a deep pullback, it formed a solid V-bottom and reclaimed $5.00 quickly. Price now moves with strength toward previous high. The breakout level to clear is $5.25–$5.30 for fresh leg up.

SUI made an explosive move from $3.25 to $4.20+ in two days. After peaking, it's consolidating in a tight bull flag around $4.00–$4.07. Momentum is cooling slightly, but the uptrend remains intact. Clear breakout trigger sits at $4.10+ for new highs.