vs_sayin

PremiumFirst, it’s important to remember that USDT Dominance (USDT.D) tends to move inversely with the market. In simple terms: — If USDT.D rises, the crypto market usually drops. — If USDT.D falls, the market typically rallies. On the lower timeframes, USDT.D has broken out of a descending wedge formation, which is generally considered bullish. Additionally, a double...

Bitcoin has formed a rising wedge pattern, typically considered a bearish reversal structure, suggesting a potential retracement ahead. Watch for a possible breakdown around the $83,800 level. If this level is breached, price may head toward the $79,000–$80,000 zone, where stronger buying interest is expected. This potential move also aligns well with key...

Qtum has formed a rectangle in weekly time period. Whenever it reachs the bottom, always turned back to gather upside liquidty till now. The other interesting thing is, when Qtum first went upwards for liquidty, it took over 2 years to gather all remaining short liqudations. When it did again, it took less than a year. So the scale of time for gathering liquidty...

Bitcoin dominance is currently showing signs of weakness and appears to be losing momentum for another upward move. If we see a breakdown below the 62% level, a sharp decline toward 57% is likely. During this phase, it may feel like an altcoin season is approaching, but in reality, most altcoins will likely just be retracing previous losses rather than entering...

XRP has a giant head and shoulders formation in daily chart. If it breaks 2$ level support zone, XRP may lose at least -%30 of it's value. You can use it for short. Safe entry would be below 2$ with a closeure of daily candle. Or.. Simply short right from here but it would be risky.

Bitcoin has broken a bearish flag in medium time frames. If a rebound comes would be an opportuinty to get short positions. The problem with Bitcoin is not only the bearish flag currently working on. It has a change of character in daily time frame which I posted a lot about it another of my analysis. I don't think the values of assest is cheap at the moment....

The Parameter known as TOTAL has a currently working bearish pennant formation. Market is bearish and every green candle on Total means another Short opportuinty. If Total breaks 2.58T (which is a montly pivot value), we can expect more dumps. 2.36 would be the main target. When Total reachs 2.36, look for a long wick. If the daily candle close isn't...

ENA might be forming an head and shoulders formation which could cause a significant drop in value. Be careful if the level of 0.34 breaks. It's also a great short opportunity. Thanks for reading.

Aptos recently hunted lots of short positions during last crash. In February 2 most of the assets crashed a lot. And there is still remaining liquidity and imbalances within the last long wick. APT has formed a bearish flag in it's consolidation rectangle. It's headed trough 4.5$. Thanks for reading.

In short time frames, USDT.D has formed an Head and Shoulders pattern. If the neckline is broken, we expect a little dump in here which will make some of alts recover for a short while. Due to BTC dominance is a lot higher than a week ago, I consider to long Bitcoin only.

S has formed a mini bearish flag which will push S towards down. It's target also lined up with an Orderblock left behind. Reasonable entry would be 0.4760

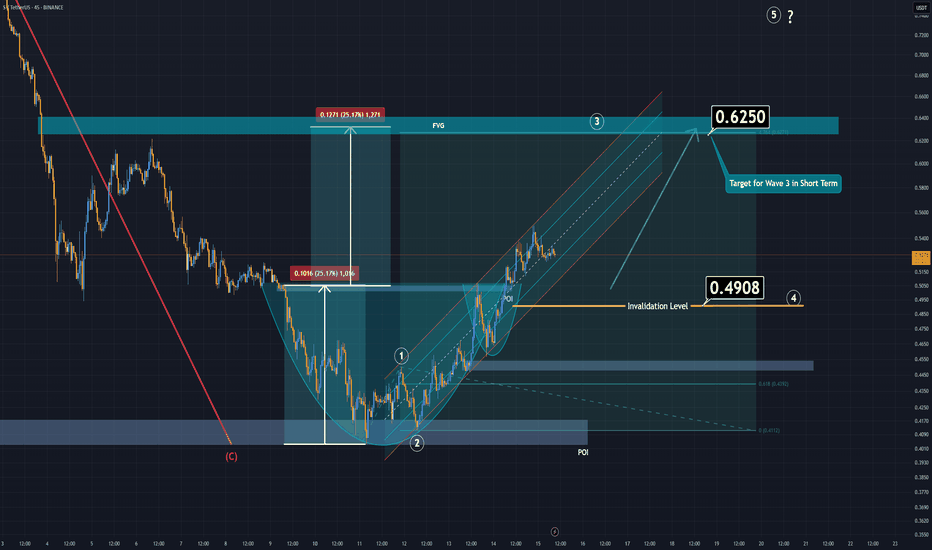

In short time frame the S, AKA "Ex FTM" has formed a Cup&Handle pattern. The breakout has already copleted. If it can stay above the invalidation level, S can reach the level 0.62 easily. For a better perspective for long term, S also completed it's Bearish A-B-C waves and seems bullish again. Good Luck.

USDT.D has vioalated the previous analysis. It's breaking out the parallel channel which may engage a bullish flag pattern to activate. As an extra, there will be PCE reports coming soon. If you see green candles on assest, don't dive in to long positions blindly. Many of the parameters and signals are showing that prices about to go cheapher. Market might be...

At the moment, S is going in a parallel channel through upwards. Either right from around here or from a lower demand zone, S will be going through 0,63 level. It's a low risk trade and might be usefull. Below the are 0.58 which is marked on the chart might be dangerous and would be a usefull stoploss. If you can follow the chart in low time frame wait for a 4...

USDT.D is moving in a parallel channel. It's also forming a bullish flag which is bad for the assests unless its invalidated. For a shorter wiev, it's moving in a rectangle and I'm expecting a move towards downwards. For a longer wiev, keep an eye on the levels I marked on the chart. The level of %5.3 is strongly important for market.

After the big collapse of the AI majors due to Deepseek events, many of the AI based assets lost its value more than they gained over six months. Near is gainin momentum and gives signals to move upwards. Closing a candle above monthly resistence (3.8), may result Near to grow over +%20 or maybe even more. Target for this set up should be around 4.5 due to...

Remember the time that we broke out the major bull flag in Bitcoin? It caused many new all time high levels in recent months. The problem is that Bitcoin lost its 5 waved bullish momentum. We see an upwards move only because of the fundemantel news. I believe we are currently in a correction phase known as A-B-C pattern according to Elliot Waves theory. In order...

ETH has formed a descending wedge formation which could help itself to climb a little bit more higher. Breaking above the accumulation box could lead to an upwards move for ETH. You can get a long position around 1950. Good Luck.