xManinderSinghx

Essential📈 ZEEL Breakout Alert Price smashing through resistance at ₹145 with strong volume surge 🔥 ✅ 12%+ up today ✅ Breakout after accumulation ✅ Projected RVol: 10.1x 🧠 Volume pattern + earnings improvement = Smart money action? #ZEEL #Breakout #StockMarketIndia #TradingView #TechnicalAnalysis NSE:ZEEL

🔌 MOSCHIP TECHNOLOGIES – Semicon Swing Setup ⚡ Sector: Electronics | Semiconductors | MCap ₹3,609 Cr 📉 Stock has seen a healthy correction after a vertical rally 🔁 Now forming a base with sideways consolidation 📈 Price attempting to reclaim ₹184 resistance zone 🧠 Fundamentals: 🟢 EPS YoY: +350% 📈 Sales QoQ: +77% 📦 Avg Vol: ₹87 Cr | RoE: 11.2% 🔥 Profit margin...

⚡ IREDA – VCP Breakout Loading? 🔋 Sector: Renewable Finance | MCap ₹46,990 Cr 📊 Chart Analysis: A clean Volatility Contraction Pattern (VCP) forming on the weekly chart — 📉 Each dip is shallower 📦 Volume contraction visible 📈 Tight price action near ₹175 resistance 🟢 Breakout Zone: ₹175 Strong fundamentals with rising EPS & sales 🚀 Watch for heavy volume...

🎬 BALAJITELE | Monster Falling Wedge on Monthly! Over 2 decades of price compression in a massive falling wedge pattern! This setup on the monthly chart is rare and powerful. 📉 Price has been respecting long-term support 📈 Breakout from upper wedge resistance could be explosive 🧾 Fundamentals still weak – turnaround in business key 🔑 CMP: ₹82.91 | AvgVol:...

🔎 AMBALALSA | Long-Term Ascending Triangle 📈 This 20-year chart is a gem for pattern hunters! AMBALALSA is consolidating within a massive ascending triangle, with price approaching the apex. 🟢 Support trendline intact since 2013 ⚫ Resistance around ₹70–75 tested multiple times ⚖️ Current zone (₹38–42) is the make-or-break area! ➡️ Breakout = multiyear move...

📉 TTML | Squeezing into Decision Zone 📌 TTML has been coiling into a descending triangle on the weekly timeframe after its parabolic rally. A decisive move is on the horizon. ⚠️ 🔻 Multiple lower highs 🔸 Horizontal support around ₹50–65 🔍 Tight range = pressure building Fundamentals? Not great — but that never stopped momentum traders. ⚡ 🧾 Sales have been...

📊 JYOTISTRUC | Bottoming Out Within a Rising Channel? Jyoti Structures is showing early signs of strength after a rebound from the lower trendline of its rising channel. 👇 🔹 Multiple rejections near ₹40 — clear upper resistance 🔹 Higher lows forming — ascending support trendline respected 🔹 Recent bounce from ₹15 zone with volume uptick 🔹 Currently consolidating...

🔄 Trend Reversal in Progress? | Sindhu Trade Links Ltd (BSE: SINDHUTRAD) After months of being trapped in a falling channel, Sindhu Trade Links is now showing signs of bottoming out 👇 📉 Formed a strong double bottom near ₹13 📈 Broke above short-term resistance post reversal 🧭 Moving towards the upper trendline (~₹36 zone) 💹 Relative strength also improving...

📈 SIYSIL Monthly Breakout Alert 🚨 | Cup & Handle Formation Siyaram Silk Mills Ltd ( NSE:SIYSIL ) has delivered a textbook Cup & Handle breakout on the monthly chart — a rare and powerful pattern suggesting strong long-term upside! ✅ Breakout above multi-year resistance ✅ Volume confirmation on breakout 📊 ✅ Retesting the breakout zone around ₹780 – ₹800 ✅...

📊 ECOSMOBILITY (India) - Trend Reversal in Progress? After a prolonged downtrend, $ECOS has shown a clear base formation and is now attempting a breakout. 📈 ✅ Bottom formation complete ✅ Alpha Buy Signal triggered ✅ Buying Force: 57.4% ✅ Relative Strength (RS): 23.3 ✅ Volume Surge: 2.7x projected Rvol 🔍 With improving momentum, relative strength, and support...

📈 Stock Watch: AJAXENGG 🗓️ Date: April 16, 2025 AJAXENGG is showing signs of strength after a long consolidation phase! 🔍 🔹 Breakout Alert: The price is breaking out from a tight range with increasing volume. 🔹 Trend: UP 📈 🔹 Investofino Trend: ✅ 95.86% (Strong Bullish) 🔹 Bullish Stats: 1W Return: 13.86% 1M Return: 11.87% 3W Tightness: 8.43% 🔹 RSI (14): 64.39...

📈 Stock in Focus: HIKAL LTD 💥 +10.56% | CMP ₹450.50 | Trend: Sideways 🔍 Key Highlights: ✅ Alpha Buy Signal Triggered (📈 +8.50) ✅ Investofino Score: 87.48% (🔥 Bullish Zone) ✅ Strong Relative Volume: 134.88% ✅ RS Rating: 97.5 🟢 | Stage 3 (Topping) 📊 Returns: • 1W: +12.65% • 1M: +12.64% • 3M: +11.52% ⚡ Bullish momentum building with high volume spike and strong...

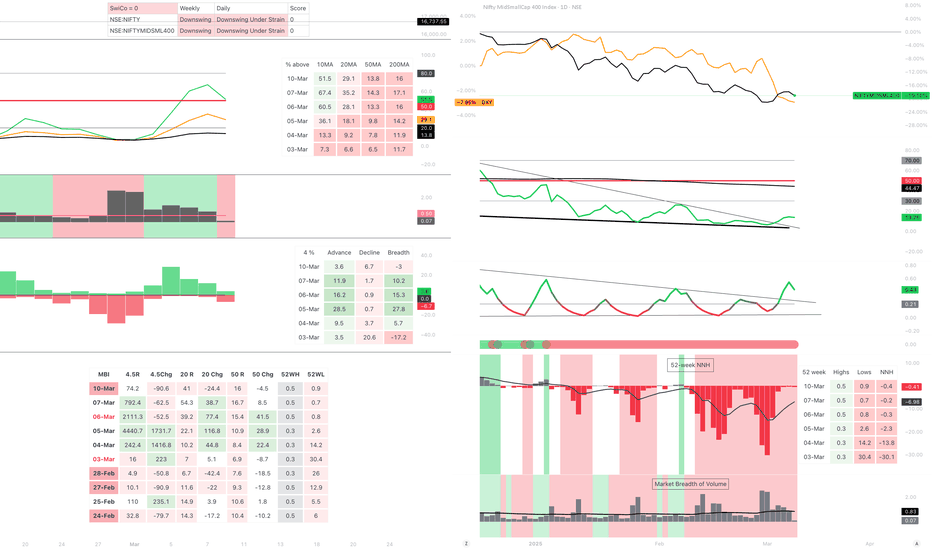

📈 Technical Indicators & Market Breadth 1️⃣ Moving Averages: % Stocks Above 10MA: 51.5% ✅ (Improving) % Stocks Above 20MA: 29.1% 🔻 (Weak) % Stocks Above 50MA: 13.8% ❌ (Very Weak) % Stocks Above 200MA: 16.0% ❌ (Bearish) 2️⃣ Advance-Decline Data: Advancers: 3.6% Decliners: 6.7% Breadth: -3 (Negative) 3️⃣ Momentum Indicators: Market Breadth improving slightly NNH...

📊 Stock Watch: GRM OVERSEAS LTD (NSE) 🔥 ✅ Price Action: +3.09% 📈 ✅ Current Price: ₹240.80 ✅ RS Rating: 96.7 (Strong Momentum) ✅ Alpha: 11.04 ✅ Signal: BUY 🟢 🔍 Breakout in Progress? The stock is showing strength with improving relative strength and bullish price action. Watching for further confirmation! 🚀 #StockMarket #Trading #GRMOverseas #Breakout #Investing

⚡ SARDA ENERGY & MIN LTD (NSE) - Breakout Watch! ⚡ 📈 Symmetrical Triangle Pattern tightening—breakout loading? 🔍 Stock testing resistance near 52WH ✅ RS Rating: 97.7 | Alpha Signal: BUY 📊 Strong accumulation, momentum building! Is this ready for a breakout move? Let’s discuss! 👇🔥 #Breakout #StockMarket #SARDA #Trading #Investing

🚀 PG ELECTROPLAST LTD (NSE) - VCP Breakout Incoming? 🚀 📈 Volatility Contraction Pattern (VCP) in action! 💥 Stock testing resistance near 52WH ✅ RS Rating: 91.0 | Alpha Signal: BUY 📊 Strong base formation—momentum building for the next leg up! Is this the next breakout opportunity? Let’s discuss! 👇🔥 #VCP #Breakout #Trading #PGEL #StockMarket

🔥 AXISCADES TECH LTD (NSE) - VCP Breakout? 🔥 📈 Volatility Contraction Pattern (VCP) forming with multiple tightening phases! 💥 Breakout above resistance in progress! 🚀 ✅ RS Rating: 99.4 | Alpha Signal: BUY 📊 +84.08% move from the last breakout! Is this the next explosive move? Drop your thoughts below! 👇💬 #VCP #Breakout #Trading #StockMarket #AXISCADES

📊 Stock Analysis Update | Feb 3, 2025 🔍 🚀 Investofino Score: 49.4% 📈 ADR: 8.3% 📉 52WL: 118.12% | 52WH: 16% 📊 Volume Surge: 630% 🔹 The stock is breaking out of a downward trend with a recent push above key EMAs. 🔹 10WEMA acting as resistance, but momentum is picking up. 🔹 Volatility remains high with increased relative volume. Is this a potential reversal or...