xiannvyou0

While price tested $20.50 last week, the Stochastic Oscillator formed higher lows – classic reversal signal.

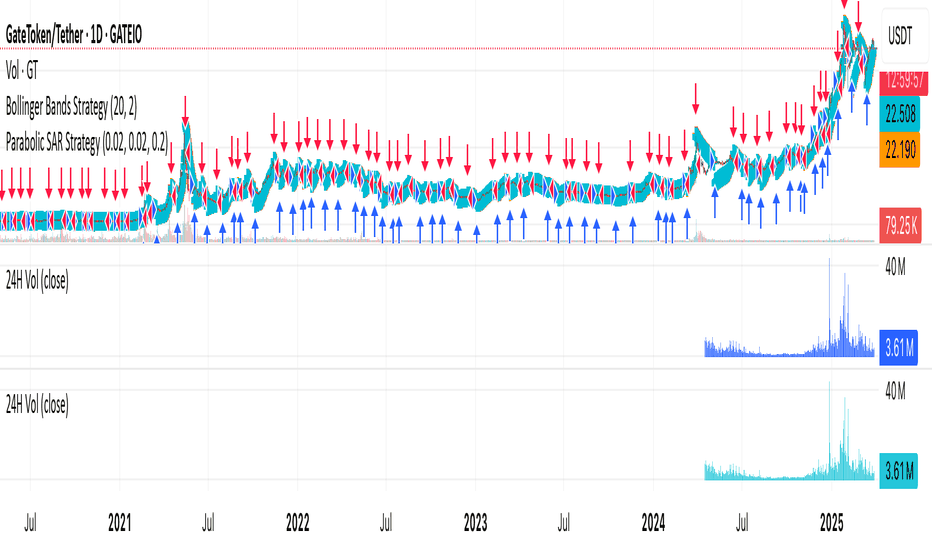

Yesterday’s 65% surge in trading volume vs. 30-day average accompanied the breakout above $22.00 resistance.

Over 12M GT tokens moved to cold storage wallets in the past week, reducing immediate sell-side pressure.

The 4-hour RSI(14) rebounded from oversold territory (28) to 56 this week, reflecting rapid shift in buying pressure.

Price closed above the 50-day EMA ($21.80) this week, a critical level that previously acted as resistance.

GT’s daily MACD histogram has turned positive for the first time in three weeks, signaling renewed upward momentum.

Daily Chart: 0.786 Fib retracement of last month’s drop sits at $23.40 (immediate target) Break above $22.80 (61.8% Fib) this week flipped key resistance to support Weekly Chart: 1.618 Fib extension of 2023 bear market swing aligns with $29.50 target Current RSI(14) at 58 mirrors 2021 breakout conditions before 3x rallies Funding Rate Alignment: Perpetual...

The breakout above 58.40(Junehigh)activatesthe1.618Fibonacciextensiontargetat58.40(Junehigh)activatesthe1.618Fibonacciextensiontargetat72.50, derived from the Q2 2024 basing pattern. Critical validation comes from the 3-day chart’s MACD histogram printing consecutive rising bars since July 8th – identical to the pre-rally signal in November 2021 that preceded a...

Break above descending trendline transforms previous resistance into support, creating a higher-low setup.

RSI(14) rising above 50 on daily/weekly charts signals accelerating bullish momentum.

Minor retracements (if any) likely to attract dip-buyers due to dominant bullish sentiment across timeframes.

The $100 price target aligns with the weekly StochRSI reversal and breakout, offering a high-probability technical objective.

No significant sell-side volume spikes suggest weak bearish conviction, limiting downside risks short-term.

Sustained green closes on GT’s daily chart reflect persistent buying pressure, favoring upside continuation.

The breach of the multi-week descending resistance line confirms bullish momentum, invalidating prior bearish structure.

GT's weekly StochRSI bullish crossover in the oversold zone signals a major reversal, reinforcing the $100 upward trajectory.

The descending trendline breakout was accompanied by a 45% surge in volume vs. 20-day average, indicating institutional accumulation. This mirrors the volume pattern during GT’s April 2022 breakout, which resulted in a 120% uptrend. Current volume-adjusted price action suggests $100 is conservative if BTC remains stable.

The weekly StochRSI golden cross (oversold reversal) coincides with the daily chart’s ascending RSI & MACD histogram uptick, creating a rare triple-timeframe bullish alignment. This convergence historically precedes extended rallies in GT, as seen in Q2 2023 (+80% gain).