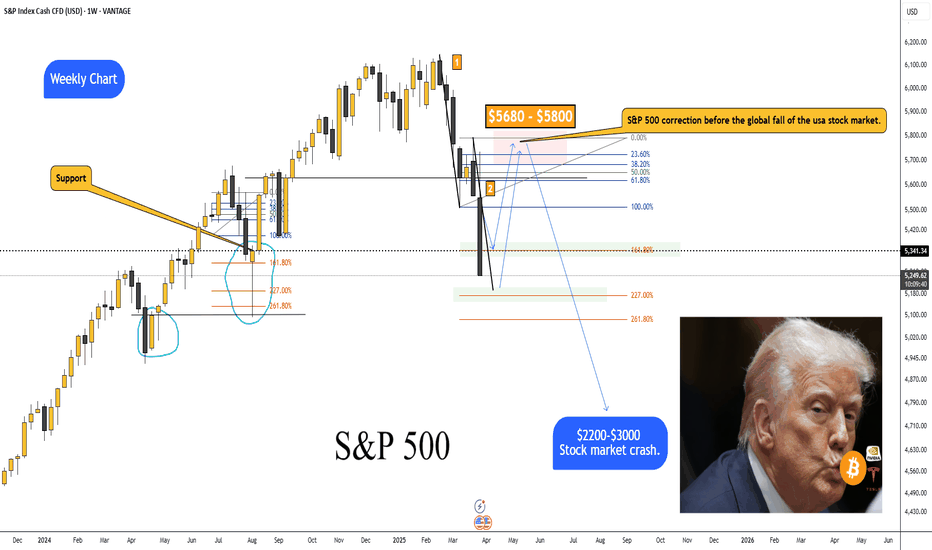

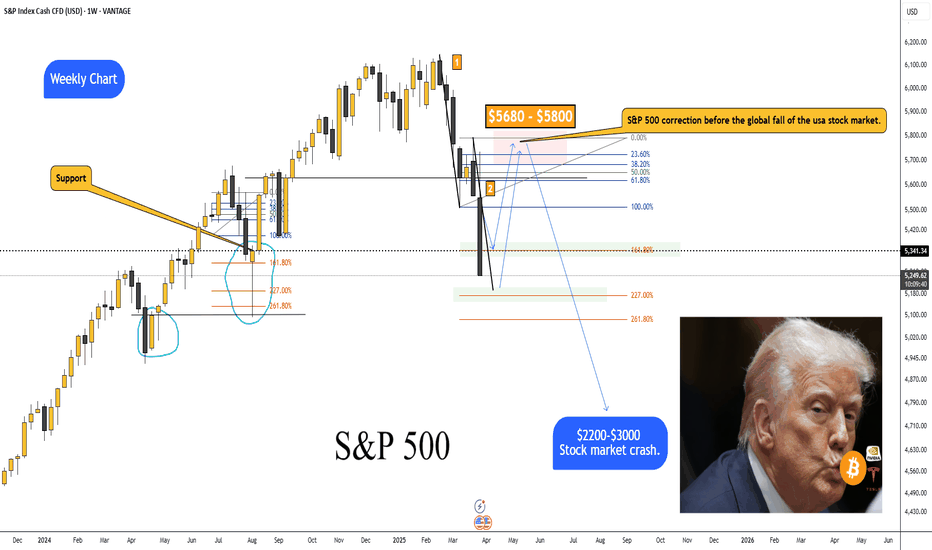

S&P 500 Braces for a Drop to $5,100–$5,177: Is the Correction Coming?

SP500 Reached the target of $5,680 - $5,800 and is going into correction along with Bitcoin 🤔.

Before:

After:

➖ The S&P 500 could fall to the 5100–5177 range due to the following fundamental factors:

FOMC Meeting on May 7: Expected rate hold and potentially hawkish rhetoric from Powell could amplify fears of rate hikes, hitting growth stocks.

➖ Trade War: Uncertainty in U.S.-China negotiations and risks of new tariffs threaten supply chains and corporate profits.

➖ Weak Economy: GDP contraction (-0.3% in Q1), recession fears, and weak PMI data fuel pessimism.

➖ Corporate Earnings: Disappointing guidance from key companies (e.g., Apple, Tesla) could trigger sell-offs.

➖ Sentiment on X: Bearish sentiment reflects market caution.

➖ Global Risks: Retaliatory tariffs and rising gold prices signal a flight from U.S. assets.

Assumption: If the Fed on May 7 emphasizes inflation risks and delays rate cuts, and tariff news remains negative, the S&P 500 could break support at 5500 and reach 5100–5177 within 1–2 weeks, especially amid technical selling and market panic.

SP500 Reached the target of $5,680 - $5,800 and is going into correction along with Bitcoin 🤔.

Before:

After:

➖ The S&P 500 could fall to the 5100–5177 range due to the following fundamental factors:

FOMC Meeting on May 7: Expected rate hold and potentially hawkish rhetoric from Powell could amplify fears of rate hikes, hitting growth stocks.

➖ Trade War: Uncertainty in U.S.-China negotiations and risks of new tariffs threaten supply chains and corporate profits.

➖ Weak Economy: GDP contraction (-0.3% in Q1), recession fears, and weak PMI data fuel pessimism.

➖ Corporate Earnings: Disappointing guidance from key companies (e.g., Apple, Tesla) could trigger sell-offs.

➖ Sentiment on X: Bearish sentiment reflects market caution.

➖ Global Risks: Retaliatory tariffs and rising gold prices signal a flight from U.S. assets.

Assumption: If the Fed on May 7 emphasizes inflation risks and delays rate cuts, and tariff news remains negative, the S&P 500 could break support at 5500 and reach 5100–5177 within 1–2 weeks, especially amid technical selling and market panic.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.