🔮 Nightly  SPY /

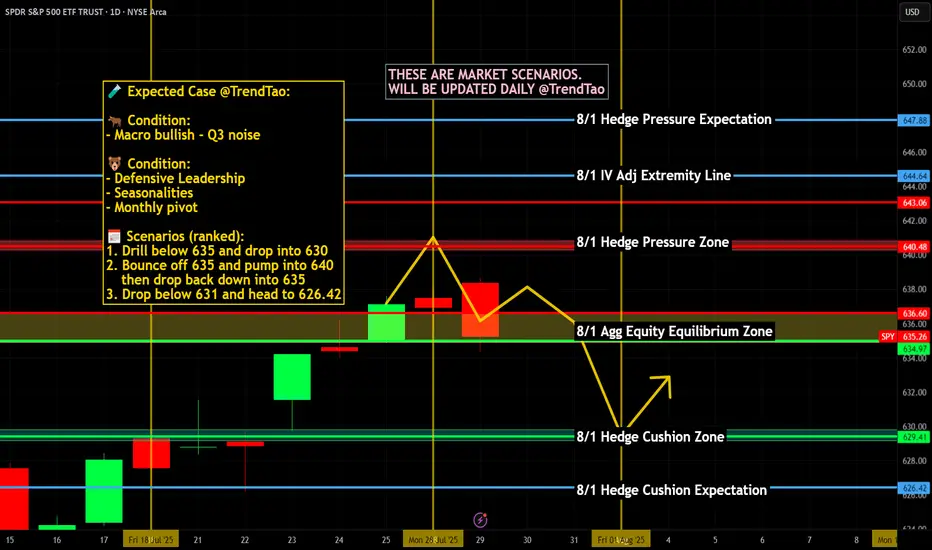

SPY /  SPX Scenarios for July 30, 2025 🔮

SPX Scenarios for July 30, 2025 🔮

🌍 Market‑Moving News 🌍

🧭 Fed Holds Steady Amid Uncertainty

As the FOMC enters its July 29–30 meeting, the Fed is expected to keep rates unchanged at 4.25%–4.50%, even as one or two governors may dissent in favor of rate cuts amid mixed economic data. Recent strength in consumer spending contrasts with weakness in housing and construction.

🌐 U.S.–China Trade Talks Resumed in Stockholm

Talks are under way aimed at extending the tariff truce before the August 12 deadline. Both sides described progress as constructive, though analysts remain cautious on the timeline and potential outcomes.

🛢️ Oil Up / Dollar Firmer, But Risks Remain

Brent crude hit ~$72.50/barrel (+3.5%) while WTI rose to ~$69.20 on a mix of geopolitical tension (possible new Russia tariffs) and trade optimism. The U.S. dollar edged higher following the U.S.–EU trade agreement.

📈 IMF Revises Up Global Growth—but Flags Tariff Risks

The IMF raised its 2025 growth forecast to 3.0% and maintained 3.1% for 2026, citing pre-emptive consumer demand—but warned that ongoing U.S. tariffs and policy inconsistency could dampen momentum.

📊 Key Data Releases & Events 📊

📅 Wednesday, July 30:

FOMC Rate Decision & Powell Press Conference

The Fed is expected to hold interest rates steady. Powell’s remarks will be closely watched for signals on the timing of future cuts and views on inflation and labor markets.

Advance Q2 U.S. GDP Estimate

The first look at Q2 growth is expected around +1.9% YoY, potentially validating a rebound after Q1’s contraction.

June PCE & Core PCE (Personal Consumption Expenditures Index)

The Fed's preferred inflation gauge. Markets will monitor if core inflation remains elevated, which may reinforce policy caution.

⚠️ Disclaimer:

This summary is for educational and informational purposes only—it is not financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #Fed #GDP #inflation #trade #tariffs #markets

🌍 Market‑Moving News 🌍

🧭 Fed Holds Steady Amid Uncertainty

As the FOMC enters its July 29–30 meeting, the Fed is expected to keep rates unchanged at 4.25%–4.50%, even as one or two governors may dissent in favor of rate cuts amid mixed economic data. Recent strength in consumer spending contrasts with weakness in housing and construction.

🌐 U.S.–China Trade Talks Resumed in Stockholm

Talks are under way aimed at extending the tariff truce before the August 12 deadline. Both sides described progress as constructive, though analysts remain cautious on the timeline and potential outcomes.

🛢️ Oil Up / Dollar Firmer, But Risks Remain

Brent crude hit ~$72.50/barrel (+3.5%) while WTI rose to ~$69.20 on a mix of geopolitical tension (possible new Russia tariffs) and trade optimism. The U.S. dollar edged higher following the U.S.–EU trade agreement.

📈 IMF Revises Up Global Growth—but Flags Tariff Risks

The IMF raised its 2025 growth forecast to 3.0% and maintained 3.1% for 2026, citing pre-emptive consumer demand—but warned that ongoing U.S. tariffs and policy inconsistency could dampen momentum.

📊 Key Data Releases & Events 📊

📅 Wednesday, July 30:

FOMC Rate Decision & Powell Press Conference

The Fed is expected to hold interest rates steady. Powell’s remarks will be closely watched for signals on the timing of future cuts and views on inflation and labor markets.

Advance Q2 U.S. GDP Estimate

The first look at Q2 growth is expected around +1.9% YoY, potentially validating a rebound after Q1’s contraction.

June PCE & Core PCE (Personal Consumption Expenditures Index)

The Fed's preferred inflation gauge. Markets will monitor if core inflation remains elevated, which may reinforce policy caution.

⚠️ Disclaimer:

This summary is for educational and informational purposes only—it is not financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #Fed #GDP #inflation #trade #tariffs #markets

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.