Impact on the Dollar and Forex — Artavion AnalyticsThe development of central bank digital currencies (CBDCs) — especially the digital yuan (e-CNY) — is becoming a key factor in transforming global currency flows. While the US dollar still dominates, the architecture of global liquidity is beginning to shift.

At Artavion, we see the e-CNY not just as a technological experiment but as a tool of China’s currency policy. Its goal is to strengthen the yuan’s role in international settlements and reduce dependence on the dollar, particularly in developing regions.

Why the Digital Yuan Matters

The e-CNY is already being used in China for retail payments and is being tested in cross-border transactions (e.g., in the mBridge project with the UAE and Thailand). This enables the creation of alternative payment systems not tied to SWIFT.

If the digital yuan gains broader acceptance, especially for commodity and energy settlements, its role in forex will grow, potentially weakening the dollar’s monopoly in certain regions.

CBDCs and Forex Structure

CBDCs won’t displace the dollar in the near term, but they are already influencing the structure of currency trading:

New currency pairs are emerging, especially in Asia;

Transactions are becoming faster and cheaper, particularly in the B2B segment;

Market participants are adjusting strategies to real-time settlements and the potential programmability of currencies.

Risks and Limitations

Privacy: CBDCs are under full state control;

Fragmentation: There is no unified technical standard across different countries’ CBDCs;

Geopolitics: The rise of the e-CNY could intensify currency competition with the dollar.

Artavion’s Conclusion

The digital yuan will not replace the dollar, but it is creating an alternative — especially in regions seeking autonomy from Western financial infrastructure. For traders and investors, this means reassessing currency risks and exploring new opportunities in decentralized settlement channels.

AB=CD

What Is an ABCD Pattern, and How Can You Use It in Trading?What Is an ABCD Pattern, and How Can You Use It in Trading?

Are you looking to improve your trading strategy and technical analysis skills? The ABCD trading pattern may be just what you need. This tool may help you identify potential market reversals and decide when to enter a trade. Keep reading to learn more about the ABCD pattern and how to apply it to your trading strategy.

What Is an ABCD Pattern?

The ABCD pattern is one of the basic harmonic patterns. It gives traders an idea of where the market might reverse. Therefore, when combined with other forms of technical analysis, it may be a great addition to your trading arsenal.

The ABCD pattern comprises two legs, AB and CD, and one retracement, BC, with D as an entry point. More specifically, an ABCD can be identified by:

- AB Leg: A trend starts at A and makes a high or low at B.

- BC Retracement: The price retraces from B to C.

- CD Leg: The trend continues from C to D.

- D Entry Point: Once another high or low forms and traders enter at D.

These price movements create the “zig-zag” or “lightning bolt” shapes.

In fact, ABCD patterns are present across every market and every timeframe. The up-down movements in financial assets represent opportunities to identify and trade ABCD patterns.

Why Use the ABCD Pattern in Your Trading Strategy?

Before we move on to identifying and trading the ABCD pattern, it’s worth explaining why you might want to consider using it. Here are a few reasons traders favour the ABCD pattern:

- It’s one of the harmonic patterns suitable for traders of all experience levels.

- It’s versatile and works for stocks, commodities, and cryptocurrencies*, not just forex trading.

- Traders use ABCD patterns to make informed decisions about potential turning points in the market.

- It can form the basis of a working trading strategy if used correctly alongside other forms of technical analysis.

- It provides quite an effective risk/reward ratio if reversals are caught.

How Traders Identify an ABCD Trading Pattern

The first step in finding ABCDs is to look for that classic zig-zag shape. Once you’ve found one, it’s time to apply Fibonacci ratios to confirm the pattern. If you’re struggling, you can consider using pre-made ABCD pattern indicators or scanners to help your eyes get used to spotting them.

The ABCD pattern requires that the BC leg is between a 38.2% to 78.6% retracement of AB, ideally between 61.8% and 78.6%. This means that if you put a Fibonacci retracement tool at A and B, C should be between 0.382 and 0.786.

The second CD leg should be a 127.2% to 161.8% extension of the BC retracement. For extra confirmation, consider specifying that AB is equal to the same length as CD.

While it can be tempting to start trading based on these conditions, you’ll find that, in practice, identifying point D can be trickier than it seems. That’s why traders typically use Fibonacci ratios, key levels, candlestick patterns, and higher timeframe convergence to confirm their entries, which we will touch on shortly.

ABCD Pattern Examples

Now that we understand how to identify the ABCD pattern, we can start applying it to real price action.

Note that the ratios won’t always be perfect, so allowing for slight variability above or below the defined ratios is acceptable.

Bullish ABCD Pattern

For a bullish formation, the following must be present:

- The AB leg should be between the high A and low B.

- The BC bullish retracement should be between the low B and high C, which is below the high A.

- The CD leg should be between the high C and low D.

- BC is a 38.2% to 78.6% retracement of AB, preferably between 61.8% and 78.6%.

- CD is a 127.2% to 161.8% extension of BC.

Additionally, you may look for AB to be an identical or similar length to CD.

Entry: Traders set a buy order at D.

Stop Loss: The theory suggests traders place a stop below a nearby support level or use a set number of pips.

Take profit: Traders place take-profit orders at the 38.2%, 50%, or 61.8% retracement of CD or hold for higher prices if they believe there’s the potential for further bullishness.

Bearish ABCD Pattern

The bearish ABCD chart pattern is essentially the same, just with the reversed highs and lows. As such:

- The AB leg should be between the low A and high B.

- The BC bullish retracement should be between the high B and low C.

- The CD leg should be between the low C and high D.

- BC is a 38.2% to 78.6% retracement of AB, preferably between 61.8% and 78.6%.

- CD is a 127.2% to 161.8% extension of BC.

You can choose to apply the same AB = CD rules in a bearish ABCD pattern if desired.

Entry: Traders typically place a sell order at D.

Stop Loss: A stop may be placed above a nearby resistance level or at a set number of pips.

Take profit: Traders often take profits at the 38.2%, 50%, or 61.8% retracement of CD or hold for lower prices if there’s a bearish trend on a higher timeframe.

ABCD Pattern Strategy

A momentum-based ABCD trading strategy can help traders confirm potential reversals by incorporating indicators like the RSI (Relative Strength Index). This approach often adds an extra layer of confluence.

Entry

- Traders may wait for point D to form and for the RSI to indicate overbought or oversold conditions, typically above 80 or below 20.

- Additional confirmation can be sought if there is a divergence between price and RSI, signalling weakening momentum.

- Once the RSI crosses back into normal territory, it can suggest a reversal, providing an opportunity to enter the market.

Stop Loss

- A stop loss is often placed slightly above or below point D, depending on whether the formation is bearish or bullish, respectively. This helps potentially manage risk in case the reversal doesn’t hold.

Take Profit

- Traders can consider taking profits at Fibonacci retracement levels of leg CD, such as 38.2%, 50%, or 61.8%.

- Another common target is point C, but traders may also hold the position for longer if further price movement is anticipated.

Looking for Additional Confluence

Given that trading the ABCDs usually relies on setting orders at specific reversal points, consider looking for extra confirmation to filter potential losing trades. Below, you’ll find three factors of confluence you can use to confirm your entries.

Key Levels

If your analysis shows that D is projected to be in an area of significant support or resistance, there’s a greater chance that the level will hold and the price will reverse in the way you expect.

ABCD Timeframe Convergence

One technique to potentially enhance the reliability of ABCD chart patterns is to check for multiple timeframes. When you identify the formation on a lower timeframe—say, the 5-minute chart—you can then look to a higher timeframe chart, such as the 30-minute or 1-hour chart to see the overall trend.

If the pattern converges with the longer-term trend, it strengthens the analysis and increases the likelihood of an effective trade.

Candlestick Patterns

Some traders look for particular candlestick patterns to appear. The hammer and shooting star patterns are commonly used by ABCD traders for extra confirmation, as are tweezer tops/bottoms and engulfing candles. You could choose to wait for one of these candlesticks to form before entering with a market order.

Common Mistakes to Avoid When Identifying an ABCD Chart Pattern

Of course, ABCD patterns aren’t a silver bullet when it comes to effective trading. There are several common mistakes made by inexperienced traders when trading these types of patterns, such as:

- Confusing the ABCD with other harmonic patterns, like the Gartley or three-drive pattern.

- Trading every potential ABCD formation they see. It’s preferable to be selective with entries and look for confirmation.

- Not being patient. ABCDs on higher timeframes can take days, even weeks, to play out.

Experienced traders wait for the pattern to develop before making a trading decision.

- Ignoring key levels. Instead, you could allow them to guide your trades and look for the ABCD pattern in these areas.

The Bottom Line

The ABCD pattern is a versatile tool that can enhance a trader’s ability to identify potential market reversals and refine their overall strategy. When combined with other forms of technical analysis, such as momentum indicators, an ABCD trading strategy can be an invaluable addition to your trading arsenal.

For traders looking to apply the ABCD pattern in forex, stock, commodity, and crypto* markets, consider opening an FXOpen account and take advantage of low-cost, high-speed trading across more than 600 assets. Good luck!

FAQ

What Is an ABCD Trading Pattern?

The ABCD trading pattern is a simple harmonic pattern used by traders to identify potential market reversals. It consists of three price movements: the AB leg, BC retracement, and CD leg, with point D marking a potential entry for a reversal trade. It helps identify changes in trend direction.

How Can You Use the ABCD Pattern in Trading?

Traders identify the ABCD pattern by finding the characteristic zig-zag shape and using Fibonacci ratios to confirm it. Entry points are typically placed at point D, with stop losses and profit targets based on the formation’s structure. Confluence with other technical analysis tools improves its reliability.

Is the ABCD Pattern Bearish or Bullish?

The ABCD pattern can be either bearish or bullish. A bullish ABCD indicates a potential upward reversal, while a bearish ABCD suggests a downward reversal. The structure remains the same, but the highs and lows are reversed.

What Is the ABCD Strategy?

The ABCD strategy revolves around identifying trend reversals using the formation and confirming entry points through tools like Fibonacci retracements or momentum indicators like the RSI for added accuracy.

*At FXOpen UK, Cryptocurrency CFDs are only available for trading by those clients categorised as Professional clients under FCA Rules. They are not available for trading by Retail clients.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Bitcoin Seasonality - Best Month (October) and Best Day (Monday)It's very important for every Bitcoin trader to know its seasonality because this will significantly increase the probability of successful trades. I have been trading Bitcoin for almost 10 years, and I successfully use seasonality patterns to predict Bitcoin price movements. For example, you don't want to go long on Bitcoin during August or September; that's probably a very bad idea. The biggest market crashes usually happen in September. But you definitely want to go long in October or April, as these months are the most promising. Knowledge of these patterns will give you an advantage over standard retail traders. Every trade matters.

Average return by Month (%)

January: +5.1%

February: +12.1%

March: +4.8%

April: ˇ+18.7%

May: +14.2%

June: +4.4%

July: +6.1%

August: -3.1%

September: -8.4%

October: +22.2%

November: +17.9%

December: +7.3%

Average return by Weekday (%)

Monday: +0.63%

Tuesday: +0.18%

Wednesday: +0.54%

Thursday: +0.40%

Friday: +0.37%

Saturday: +0.45%

Sunday: +0.10%

Currently I am bullish on Bitcoin as the price is in an uptrend and the bear market is not confirmed; I expect Bitcoin to hit 115k probably at the end of February. What I also expect is an alt season - alt season is starting right now! So it's time to buy some altcoins. Ethereum should outperform BTC in the next weeks as well.

Write a comment with your altcoin, and I will make an analysis for you in response. Also, please hit boost and follow for more ideas. Trading is not hard if you have a good coach! This is not a trade setup, as there is no stop-loss or profit target. I share my trades privately. Thank you, and I wish you successful trades!

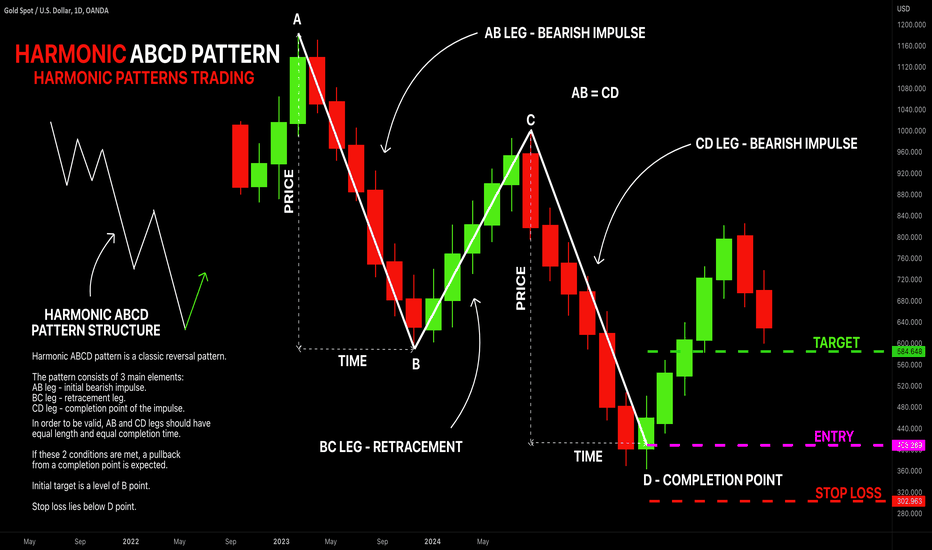

HARMONIC PATTERNS TRADING | ABCD PATTERN & HOW TO TRADE IT

Harmonic ABCD pattern is a classic reversal pattern.

In this article, I will teach you how to recognize that pattern and trade it properly.

This pattern is composed of 3 main elements (based on wicks of the candles):

1️⃣ AB leg

2️⃣ BC leg

3️⃣ CD leg

The pattern is considered to be bullish if AB leg is bearish.

The pattern is considered to be bearish if AB leg is bullish.

AB leg must be a strong movement without corrections within.

A is its initial point and B is its completion point.

BC leg is a correctional movement from B point after a completion of AB leg. The price may fluctuate within that.

B is its initial point and C is its completion point.

CD leg must be a strong movement without corrections within.

C is its initial point and D is its completion point.

❗️ABCD movement is harmonic if the length and the time horizon of AB and CD legs are equal.

By the length, I mean a price change from A to B point and from C to D point.

By the time, I mean a time ranges of AB leg and CD leg.

If the time and length of AB and CD legs are equal, the pattern is considered to be harmonic, and a reversal will be expected from D point at least to B point.

🛑If the pattern is bullish, stop loss must be placed below D point.

🛑If the pattern is bearish, stop loss is placed above D point.

Initial target level is B point.

Usually, after reaching a B point the market returns to a global trend.

What pattern do you want to learn in the next post?

Tow-Legged, ABCD, Elliott WavesFigure 1.1 has two extreme trends and one extreme trading range. This day began with a strong bear trend down to bar 1, then entered an unusually tight trading range until it broke out to the upside by one tick at bar 2, and then reversed to a downside breakout into an exceptionally strong trend down to bar 3.

Two-legged moves are common, but unfortunately the traditional nomenclature is confusing. When one occurs as a pullback in a trend, it is often called an ABC move. When the two legs are the first two legs of a trend, Elliott Wave technicians instead refer to the legs as waves 1 and 3, with the pullback between them as wave 2. Some traders who are looking for a measured move will look for a reversal back up after the second leg reaches about the same size as the first leg. These technicians often call the pattern an AB = CD move. The first leg down begins with point A and ends with point B (bar 1 in Figure 1.1, which is also A in the ABC move), and the second leg begins with point C (bar 2 in Figure 1.1, which is also B in the ABC move) and ends with point D (bar 3 in Figure 1.1, which is also C in the ABC move).

AB ⚡️ CD — Harmonic Patterns 🟣The AB⚡️CD pattern is a highly effective tool utilized in trading to identify potential opportunities across diverse markets, including forex, stocks, cryptocurrencies, and futures.

💜 If you appreciate our guides, support us with boost button 💜

This pattern takes the form of a visual and geometric arrangement, characterized by three consecutive price swings or trends.

When observed on a price chart, the ABCD pattern exhibits a striking resemblance to a lightning bolt ⚡️ or a distinctive zig-zag pattern.

Importance of the ABCD Pattern

The significance of the ABCD pattern lies in its ability to identify trading opportunities across different markets, timeframes, and market conditions. Whether the market is bullish, bearish, or range-bound, the ABCD pattern remains a reliable tool.

By recognizing the completion of the pattern at point D, you can get a perspective trade entries. Furthermore, the ABCD pattern helps you determine the risk-to-reward ratio before initiating a trade. When multiple patterns converge within the same timeframe or across different timeframes, it strengthens the trade signal and increases the likelihood of a profitable outcome.

Finding an ABCD Pattern

The ABCD pattern has both a bullish and bearish version. Bullish patterns indicate higher probability opportunities to buy or go long, while bearish patterns suggest opportunities to sell or go short.

To identify an ABCD pattern, it is essential to locate significant highs or lows on a price chart, represented by points A, B, C, and D. These points define the three consecutive price swings or legs of the pattern: the AB leg, the BC leg, and the CD leg.

Trading is not an exact science, so traders often employ Fibonacci ratios to determine the relationship between the AB and CD legs in terms of both time and price. This approximation assists in locating the potential completion of the ABCD pattern. When patterns converge, it increases the probability of successful trades and enables you to make more accurate decisions regarding entries and exits.

Types of ABCD Patterns

There are three types of ABCD patterns, each having both a bullish and bearish version. To validate an ABCD pattern, specific criteria and characteristics must be met. Here are the characteristics of the bullish and bearish ABCD patterns:

📈 Bullish ABCD Pattern Characteristics (buy at point D):

To effectively trade the bullish ABCD pattern, you might consider the following characteristics:

1. Find AB:

Identify point A as a significant high and point B as a significant low. During the move from A to B, ensure that there are no highs above point A and no lows below point B.

2. After AB, then find BC:

Point C should be lower than point A. In the move from B up to C, there should be no lows below point B and no highs above point C. Ideally, point C will be around 61.8% or 78.6% of the length of AB. However, in strongly trending markets, BC may only be 38.2% or 50% of AB.

3. After BC, then draw CD:

Point D, which marks the completion of the pattern, must be lower than point B, indicating that the market has successfully achieved a new low. During the move from C down to D, there should be no highs above point C.

4.1 Determine where D may complete (price):

To determine the price level at which point D may complete, Fibonacci and ABCD tools can be utilized. CD may equal AB in price, or it may be 127.2% or 161.8% of AB in price. Alternatively, CD can be 127.2% or 161.8% of BC in price.

4.2 Determine when point D may complete (time) for additional confirmation:

For additional confirmation, you can analyze the time aspect of the pattern. CD may equal AB in time, or it may be around 61.8% or 78.6% of the time it took for AB to form. Additionally, CD can be 127.2% or 161.8% of the time it took for AB to form.

5. Look for Fibonacci, pattern, trend convergence:

Convergence of Fibonacci levels, pattern formations, and overall trend can strengthen the trade signal. Therefore, you should look for instances where these elements align.

6. Watch for price gaps and/or wide-ranging candles in the CD leg:

As the market approaches point D, it is important to monitor for any price gaps or wide-ranging candles in the CD leg. These may indicate a potential strongly trending market, and you might expect to see price extensions of 127.2% or 161.8%.

📉 Bearish ABCD Pattern Characteristics (sell at point D):

To effectively trade the bearish ABCD pattern, you might consider the following characteristics:

1. Find AB:

Identify point A as a significant low and point B as a significant high. During the move from A up to B, ensure that there are no lows below point A and no highs above point B.

2. After AB, then find BC:

Point C should be higher than point A. In the move from B down to C, there should be no highs above point B and no lows below point C. Ideally, point C will be around 61.8% or 78.6% of the length of AB. However, in strongly trending markets, BC may only be 38.2% or 50% of AB.

3. After BC, then draw CD:

Point D, which marks the completion of the pattern, must be higher than point B, indicating that the market has successfully achieved a new high. During the move from C up to D, there should be no lows below point C and no highs above point D.

4.1 Determine where D may complete (price):

To determine the price level at which point D may complete, Fibonacci and ABCD tools can be utilized. CD may equal AB in price, or it may be 127.2% or 161.8% of AB in price. Alternatively, CD can be 127.2% or 161.8% of BC in price.

4.2 Determine when point D may complete (time) for additional confirmation:

For additional confirmation, you can analyze the time aspect of the pattern. CD may equal AB in time, or it may be around 61.8% or 78.6% of the time it took for AB to form. Additionally, CD can be 127.2% or 161.8% of the time it took for AB to form.

5. Look for Fibonacci, pattern, trend convergence:

Convergence of Fibonacci levels, pattern formations, and overall trend can strengthen the trade signal. Therefore, you should look for instances where these elements align.

6. Watch for price gaps and/or wide-ranging bars/candles in the CD leg:

As the market approaches point D, it is important to monitor for any price gaps or wide-ranging bars/candles in the CD leg. These may indicate a potential strongly trending market, and you might expect to see price extensions of 127.2% or 161.8%.

💜 We're eager to hear from you!

⚡️Did the ABCD pattern article hit the mark for you? We're all about delivering content that's useful and easy for traders like yourself. Your feedback means a lot—it guides us in enhancing our articles to better serve you.

Take a moment to let us know what you think. Did we cover the topic thoroughly? Were our explanations crystal clear? Is there something you wish we'd delve into more?

Your time and thoughts are truly appreciated. Thanks for being a cherished reader, and we can't wait to hear your feedback!

Linking Time with Price LevelThe relationship between time and price level can be observed through the analysis of price charts and technical indicators. Technical analysis involves the use of charts and indicators to identify patterns and trends in price movements. One important aspect of technical analysis is the identification of support and resistance levels, which can help traders make decisions about when to buy or sell a particular asset.

Technical indicators can also be used to analyze the relationship between price and time. For example, moving averages can be used to identify trends in price movements over a specific period of time. The slope of the moving average can indicate the strength of the trend, while the distance between the price and the moving average can indicate the level of deviation from the trend.

In addition to technical indicators, traders also use fundamental analysis to assess the relationship between time and price level. Fundamental analysis involves the study of economic and financial data to identify factors that can influence the price of an asset. For example, changes in interest rates, inflation, and political events can all have an impact on the price of an asset over time.

To summarize, the relationship between time and price level is complex and multifaceted. Traders use a variety of tools and techniques to analyze this relationship, including technical indicators, charts, and fundamental analysis. By understanding the relationship between time and price level, traders can make more informed decisions about when to buy or sell a particular asset.

Regarding the development of price ratios, the expected price level and the expected price movement for the wave can be determined by analyzing technical indicators such as Relative Strength Index (RSI) and Price Oscillator. The RSI can be used to identify the overbought and oversold conditions of an asset, while the Price Oscillator can indicate the strength of the trend. By analyzing these indicators, traders can develop price ratios and make informed decisions about when to enter or exit a trade.

Finally, it's important to note that the relationship between price and time is not always straightforward. While technical analysis and fundamental analysis can provide valuable insights, they are not foolproof. Traders need to be aware of the limitations of these tools and use them in conjunction with other forms of analysis and risk management strategies.

The ABCD Pattern: from A to DHello dear @TradingView community!

Are you familiar with the ABCD pattern?

The ABCD pattern is a highly effective tool utilized in trading to identify potential opportunities across diverse markets, including forex, stocks, cryptocurrencies, and futures. This pattern takes the form of a visual and geometric arrangement, characterized by three consecutive price swings or trends. When observed on a price chart, the ABCD pattern exhibits a striking resemblance to a lightning bolt or a distinctive zig-zag pattern.

Importance of the ABCD Pattern

The significance of the ABCD pattern lies in its ability to identify trading opportunities across different markets, timeframes, and market conditions. Whether the market is bullish, bearish, or range-bound, the ABCD pattern remains a reliable tool.

By recognizing the completion of the pattern at point D, you can get a perspective trade entries. Furthermore, the ABCD pattern helps you determine the risk-to-reward ratio before initiating a trade. When multiple patterns converge within the same timeframe or across different timeframes, it strengthens the trade signal and increases the likelihood of a profitable outcome.

Finding an ABCD Pattern

The ABCD pattern has both a bullish and bearish version. Bullish patterns indicate higher probability opportunities to buy or go long, while bearish patterns suggest opportunities to sell or go short.

To identify an ABCD pattern, it is essential to locate significant highs or lows on a price chart, represented by points A, B, C, and D. These points define the three consecutive price swings or legs of the pattern: the AB leg, the BC leg, and the CD leg.

Trading is not an exact science, so traders often employ Fibonacci ratios to determine the relationship between the AB and CD legs in terms of both time and price. This approximation assists in locating the potential completion of the ABCD pattern. When patterns converge, it increases the probability of successful trades and enables you to make more accurate decisions regarding entries and exits.

Types of ABCD Patterns

There are three types of ABCD patterns, each having both a bullish and bearish version. To validate an ABCD pattern, specific criteria and characteristics must be met. Here are the characteristics of the bullish and bearish ABCD patterns:

📈 Bullish ABCD Pattern Characteristics (buy at point D):

To effectively trade the bullish ABCD pattern, you might consider the following characteristics:

1. Find AB:

Identify point A as a significant high and point B as a significant low. During the move from A to B, ensure that there are no highs above point A and no lows below point B.

2. After AB, then find BC:

Point C should be lower than point A. In the move from B up to C, there should be no lows below point B and no highs above point C. Ideally, point C will be around 61.8% or 78.6% of the length of AB. However, in strongly trending markets, BC may only be 38.2% or 50% of AB.

3. After BC, then draw CD:

Point D, which marks the completion of the pattern, must be lower than point B, indicating that the market has successfully achieved a new low. During the move from C down to D, there should be no highs above point C.

4.1 Determine where D may complete (price):

To determine the price level at which point D may complete, Fibonacci and ABCD tools can be utilized. CD may equal AB in price, or it may be 127.2% or 161.8% of AB in price. Alternatively, CD can be 127.2% or 161.8% of BC in price.

4.2 Determine when point D may complete (time) for additional confirmation:

For additional confirmation, you can analyze the time aspect of the pattern. CD may equal AB in time, or it may be around 61.8% or 78.6% of the time it took for AB to form. Additionally, CD can be 127.2% or 161.8% of the time it took for AB to form.

5. Look for Fibonacci, pattern, trend convergence:

Convergence of Fibonacci levels, pattern formations, and overall trend can strengthen the trade signal. Therefore, you should look for instances where these elements align.

6. Watch for price gaps and/or wide-ranging candles in the CD leg:

As the market approaches point D, it is important to monitor for any price gaps or wide-ranging candles in the CD leg. These may indicate a potential strongly trending market, and you might expect to see price extensions of 127.2% or 161.8%.

📉 Bearish ABCD Pattern Characteristics (sell at point D):

To effectively trade the bearish ABCD pattern, you might consider the following characteristics:

1. Find AB:

Identify point A as a significant low and point B as a significant high. During the move from A up to B, ensure that there are no lows below point A and no highs above point B.

2. After AB, then find BC:

Point C should be higher than point A. In the move from B down to C, there should be no highs above point B and no lows below point C. Ideally, point C will be around 61.8% or 78.6% of the length of AB. However, in strongly trending markets, BC may only be 38.2% or 50% of AB.

3. After BC, then draw CD:

Point D, which marks the completion of the pattern, must be higher than point B, indicating that the market has successfully achieved a new high. During the move from C up to D, there should be no lows below point C and no highs above point D.

4.1 Determine where D may complete (price):

To determine the price level at which point D may complete, Fibonacci and ABCD tools can be utilized. CD may equal AB in price, or it may be 127.2% or 161.8% of AB in price. Alternatively, CD can be 127.2% or 161.8% of BC in price.

4.2 Determine when point D may complete (time) for additional confirmation:

For additional confirmation, you can analyze the time aspect of the pattern. CD may equal AB in time, or it may be around 61.8% or 78.6% of the time it took for AB to form. Additionally, CD can be 127.2% or 161.8% of the time it took for AB to form.

5. Look for Fibonacci, pattern, trend convergence:

Convergence of Fibonacci levels, pattern formations, and overall trend can strengthen the trade signal. Therefore, you should look for instances where these elements align.

6. Watch for price gaps and/or wide-ranging bars/candles in the CD leg:

As the market approaches point D, it is important to monitor for any price gaps or wide-ranging bars/candles in the CD leg. These may indicate a potential strongly trending market, and you might expect to see price extensions of 127.2% or 161.8%.

💜 We would love to hear your feedback!

Did you find the article on the ABCD pattern helpful? We strive to provide valuable and informative content for traders like you. Your feedback is important to us as it helps us improve our articles and better serve our readers.

Please take a moment to share your thoughts and suggestions. Did the article cover the topic comprehensively? Were the explanations clear and easy to understand? Is there anything you would like us to add or elaborate on?

We appreciate your time and input. Thank you for being a valued reader, and we look forward to hearing your feedback!

From A to D:How to Use the ABCD Pattern to Forecast Market MovesAre you familiar with the ABCD trading pattern?

In this article, I will provide a comprehensive explanation of the ABCD trading pattern, including its characteristics, how to identify it, and how to use it in trading. So, sit back, relax, and enjoy the information provided in this article.

The ABCD ( AB=CD ) pattern , It's a harmonic pattern that is easily recognizable on a price chart and is composed of four points. This pattern follows a specific sequence of market movements that traders can use to predict potential price swings in the future. The ABCD pattern can be applied in various market conditions, including both bullish and bearish markets, and can be used to speculate on the movement of different forex pairs by simultaneously selling one currency and buying another. However, it's important to keep in mind that the ABCD pattern should not be the sole basis for making trading decisions. It should be used as a tool to inform your decisions.

The first step in opening a position using the ABCD pattern is to identify the pattern on a price chart. Multiday charts can provide insight into the behavior of forex markets over an extended period. You can use daily, hourly, or minute-by-minute charts to spot the pattern, but it's crucial to choose a time horizon that aligns with your goals. For instance, traders looking to hold positions for days or weeks may prefer daily charts instead of minute charts.

Once you have selected the appropriate chart type, you can search for the ABCD pattern to identify bullish or bearish signals.

Let's now take a closer look at how the AB=CD pattern forms and how to spot it:

When identifying the ABCD pattern, traders focus on the legs or moves between points. The moves in the direction of the overall trend are denoted as AB and CD, while BC represents the retracement.

Once you think you have identified an ABCD pattern on a price chart, the next step is to use Fibonacci ratios to validate it. This process can also help you pinpoint where the pattern may complete and where to consider opening your position.

The "classic" ABCD pattern follows a specific sequence of market movements, with the following rules:

In a "classic" ABCD pattern, the BC line should ideally be 61.8% or 78.6% of AB. To determine this, traders often use the Fibonacci retracement tool on the initial move from point A to point B. The BC line should end at either the 61.8% or 78.6% Fibonacci retracement level of AB. This helps confirm the validity of the ABCD pattern and gives an idea of where to potentially open a position.

Once the BC leg of the pattern is complete, traders would typically look for the CD leg to reach the 127.2% or 161.8% extension of the BC leg. At this point, traders might consider entering a sell position if the pattern is bearish or a buy position if the pattern is bullish.

The ABCD pattern extension occurs when the CD leg extends beyond the typical 127.2% and reaches 161.8%. This indicates that the price trend may continue in the same direction for a longer period, providing a potentially profitable trading opportunity for traders who have correctly identified the pattern. It's important to note that this extension is not always reliable and should be used in conjunction with other technical analysis tools to confirm the validity of the trade.

Note: In strongly trending markets, the retracement (BC) may not reach the usual 61.8% or 78.6% of AB, but only 38.2% or 50%. It's important to adapt to market conditions and adjust your analysis accordingly.

Moreover:

During the move from A to B, the market should not exceed either A or B.

During the move from B to C, the market should not exceed either B or C.

During the move from C to D, the market should not exceed either C or D.

For a bullish ABCD, point C must be lower than A, and D must be lower than B.

For a bearish ABCD, point C must be higher than A, and D must be higher than B.

To identify an ABCD pattern on your TradingView trading chart, follow these six steps:

1 ) Log in to your TradingView trading account and open a market chart.

2 ) Locate the AB line. Remember that this move should be completely contained within points A and B.

3 ) Locate the BC retracement. This should reach either the 61.8% or 78.6% level of the move from A to B.

4 ) Draw the CD line. Using the AB and BC lines, you should be able to predict where point D will fall. CD will generally be equivalent to AB and either 127.8% or 161.8% of BC in both price and time.

5 ) Keep an eye out for price gaps and wide-ranging bars in the CD leg. These can indicate that an extension is forming, implying that CD may be longer than AB.

6 ) Trade the possible retracement at point D. If you've identified a bearish ABCD pattern, consider opening a sell position. On the other hand, if you've found a bullish one, consider buying.

And here are a couple of examples:

I hope you found this guide on identifying the ABCD pattern useful. Let me know your thoughts in the comments section below, and don't forget to like and follow me if you found this guide helpful.

🔠 The ABCD PatternThe ABCD is a basic harmonic pattern. All other patterns derive from it. The pattern consists of 3 price swings. The lines AB and CD are called “legs”, while the line BC is referred to as a correction or a retracement. AB and CD tend to have approximately the same size. A bullish ABCD pattern follows a downtrend and means that a reversal to the upside is likely. A bearish ABCD pattern is formed after an uptrend and signals a potential bearish reversal at a certain level. The rules for trading bullish and bearish ABCD patterns are the same, you will just need to take into account the direction of the pattern you trade and the movement of the market it predicts.

🔷Classic ABCD

The point C should be at 61.8%-78.6% of AB. The point D, in its turn, should be at the 127.2%-161.8% Fibonacci expansion of BC.

Notice that a 61.8% retracement at the point C tends to result in the 161.8% projection of BC, while a 78.6% retracement at the C point will lead to the 127% projection.

🔷AB = CD

Here CD has exactly the same length as AB. In addition, it takes the market the equal time to travel from A to B as from C to D. As a Result, AB and CD have the same angle. This type of ABCD pattern is seen quite often and is popular among traders.

🔷ABCD Extension

ABCD extension refers to when CD is the 127.2%-161.8% extension of AB. CD can be even 2 times (or more) bigger than AB. There actually are some signs that can hint that CD will be much longer than AB. They are a gap after point C or big candlesticks near point C.

📊Trading with ABCD pattern

The key thing you should remember is that you can enter the trade only after the price reached the point D.

Study the chart looking at the price’s highs and lows. It may be helpful to use ZigZag indicator (Insert – Indicators – Custom – ZigZag) that marks the chart’s swings.

Watch the price as it forms AB and BC. In a bullish ABCD, C must be lower than A and should be the intermediate high after the low at B. Point D must be a new low below B.

When the market arrives at a point, where D may be situated, don’t rush into a trade. Use some techniques to make sure that the price reversed up (or down if it’s a bearish ABCD).

The best scenario is a reversal candlestick pattern. A buy order may be set at or above the high of the candle at point D.

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work, please like, comment and follow ❤️

Bullish AB=CD alternate patternAB=CD pattern

The regular AB=CD pattern, both the AB and CD are exactly the same length and/or pips on a forex chart- BUT- the alternate AB=CD is where the CD is longer then the AB leg/length- there can be a range of fib retracements and/or extensions which are part of this simple AB=CD pattern but that is OKAY.

Scott Carney - creator of harmonic pattern rules and Harmonic Trading -- shows the essentials in minutes. He outlines the foundation of the AB=CD pattern in harmonic patterns in this effective presentation. If you like to further under this whole subject, please subscribe to his youtube channel: Harmonic Trading.

His wisdom and insights about this subject will clarify everything you need to know about all harmonic patterns. You might even trade better and make more profits with your forex trading too. Which is what we strive to do is work less & play more in life.

LEARN HARMONIC PATTERNS TRADING | ABCD PATTERN 🔰

Hey traders,

Harmonic ABCD pattern is a classic reversal pattern.

This pattern is composed of 3 main elements (based on wicks of the candles):

1️⃣ AB leg

2️⃣ BC leg

3️⃣ CD leg

The pattern is considered to be bullish if AB leg is bearish.

The pattern is considered to be bearish if AB leg is bullish.

AB leg must be a strong movement without corrections within.

A is its initial point and B is its completion point.

BC leg is a correctional movement from B point after a completion of AB leg. The price may fluctuate within that.

B is its initial point and C is its completion point.

CD leg must be a strong movement without corrections within.

C is its initial point and D is its completion point.

❗️ABCD movement is harmonic if the length and the time horizon of AB and CD legs are equal.

By the length, I mean a price change from A to B point and from C to D point.

By the time, I mean a time ranges of AB leg and CD leg.

If the time and length of AB and CD legs are equal, the pattern is considered to be harmonic, and a reversal will be expected from D point at least to B point.

🛑If the pattern is bullish, stop loss must be placed below D point.

🛑If the pattern is bearish, stop loss is placed above D point.

Initial target level is B point.

Usually, after reaching a B point the market returns to a global trend.

What pattern do you want to learn in the next post?

❤️If you have any questions, please, ask me in the comment section.

Please, support my work with like, thank you!❤️

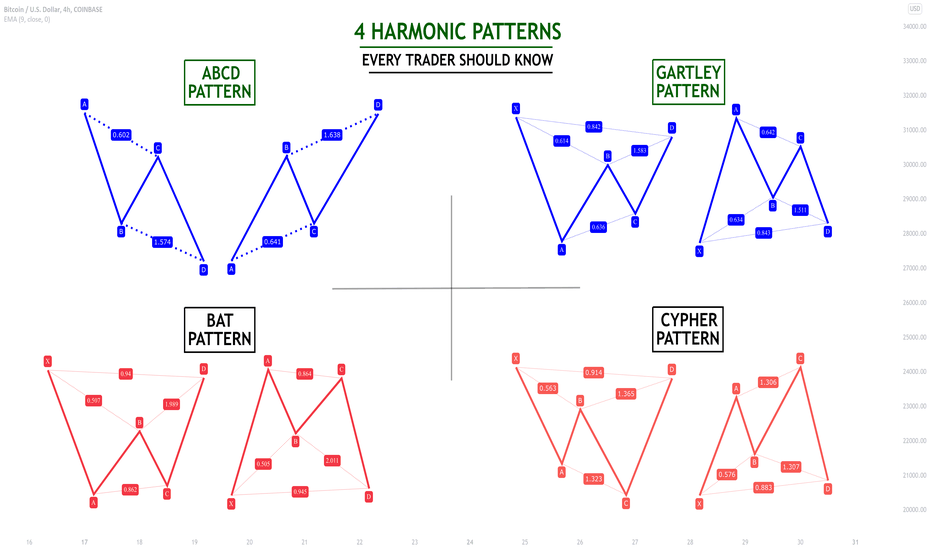

4 Harmonic Patterns Every Trader Should Know 📚

Hey traders,

In this post, we will discuss 4 phenomenally accurate harmonic patterns that you must know.

1️⃣The first and the simplest harmonic pattern is called ABCD pattern.

This pattern is based on 3 legs of a move:

✔️Initial impulse (bullish or bearish). AB leg

✔️Retracement leg with a completion point lying within the range of the initial impulse. BC leg.

✔️Second impulse with a completion point lying beyond the range of the initial impulse (it must have the same direction as the initial impulse). BD leg

Equal AB and CD legs indicate a highly probable retracement from D point of the pattern.

❗️Please, note that the time horizon and the length of the impulses must be equal.

2️⃣The second harmonic pattern is called Gartley Pattern.

This pattern is based on 4 legs of a move and has a "W/M" shape form.

To identify a Harmonic Gartley Pattern we measure the retracement of B/C points with Fib. Retracement tool and extension of D point of a harmonic pattern with Fib. Extension tool:

✔️ - The retracement of B point should lie between 0.618 level and 0.786 level of XA leg (Fib. Retracement of XA)

*it can touch both 0.618 and 0.786

✔️ - The retracement of C point should lie between 0.618 level and 1.0 level of AB leg(Fib. Retracement of AB)

*it can touch both 0.618 and 1.0

✔️ - D point should lie strictly on 1.272 extension of AB leg (Fib. Extension of AB)

*it should strictly touch 1.272

Such a formation indicates a highly probable retracement from D point of the pattern.

3️⃣The third harmonic pattern is called Bat Pattern.

This pattern is based on 4 legs of a move and has a "W/M" shape form.

To identify a Harmonic Bat Pattern we measure the retracement of B/C/D points of a harmonic pattern with Fib. Retracement tool:

✔️ - The retracement of B point should lie between 0.5 level and 0.618 level of XA leg (Fib. Retracement of XA)

*it can touch 0.5 but it can’t touch 0.618

✔️ - The retracement of C point should lie between 0.618 level and 1.0 level of AB leg(Fib. Retracement of AB)

*it can touch both 0.618 and 1.0

✔️ - The retracement of D point should lie strictly on 0.886 level of XA leg (Fib.Retracement of XA)

*it should strictly touch 0.886

Such a formation indicates a highly probable retracement from D point of the pattern.

4️⃣The fourth harmonic pattern is called Cypher Pattern.

This pattern is based on 4 legs of a move and has a "W/M" shape form with C point lying beyond the range of XA leg.

To identify a Harmonic Cypher Pattern we measure the retracement of B point with Fib. Retracement tool and extension of C point with Fib. Extension tool:

✔️ - The retracement of B point should lie between 0.382 level and 0.618 level of XA leg (Fib. Retracement of XA)

*it can touch both 0.382 and 0.618

✔️ - The extension of C point should lie between 1.272 level and 1.414 level of XA leg(Fib. Extension of XA)

*it can touch both 1.272 and 1.414

✔️ - D point should lie strictly on 0.786 retracement of XC leg (Fib. Retracement of XC)

*it should strictly touch 0.786

Such a formation indicates a highly probable retracement from D point of the pattern.

🦉What is good about these patterns is the fact that they are objective.

Since each point of the pattern is measured with Fibonacci levels, one can avoid subjectivity.

Try harmonic pattern trading and you will see how efficient this strategy is.

Do you trade harmonic patterns?

❤️Please, support this idea with like and comment!❤️

BTC - Harmonic Patterns pt.1 'THREE DRIVES PATTERN' (beginners)You may be wondering why you keep losing money in the markets. Well, we've all been there - more often than we wished for. But we asked for it every single time. So, why is that?

After years of repeatedly or constantly losing money, I know very well what I've been doing wrong for so long. I came to the conclusion that I - and most people I observed or know in person - keep losing money because of several factors, one of which I will elaborate in this sheet:

The absence of a system

Many people, who are new to the world of trading and investing, especially those who have suffered (severe) losses in the past, are drifting around, clueless, and are seeking for a helping hand that is supposed to guide them around in the world of making and losing money. That state of helplessness and the general accessability of the internet and social media is the perfect playground for fraud. Since there has been a wave of fake (marketing) gurus all over the internet for quite a while, that many fell victim to, the term 'system' is now broadly misunderstood and causes fear among those who were scammed by 'THE MAGIC AND ALWAYS WORKING SYSTEM'. Usually 'gurus' on the internet charge money for providing a system or pretending to educate people about how to 'REALLY' make money. So what is a system?

Before finally adopting or developing a system, one must know what a system is defined by, and what criteria a system has to meet. So what does a system do?

A system is supposed to allow one to evaluate more or less reliable entry points/levels. But what does that mean? It means that you don't want to participate in EVERY major move the markets offer you to be part of. In fact a system will focuse on a very specific kind of moves, and you are only supposed to trade/invest according to the potential entry that the system you use provided. You will most likely miss out on many moves, and you will think about the amounts of money you could have made if you had just been part of that one major move that you can't stop thinking about. That thought-process is self destructive though, and will lead to suffering even more losses because most people force themselves to not miss out on the next move, in order to finally be part of the wave that makes the real money. But what defines a proper system? How do you know it works? Well, there is only one way to find out.

One who sticks to a system - or several - would only want to take the entries the system provides for them, regardless of what happens outside of their system's frame. And yes, that means missing out on many, many, and many more major moves. However, atually making money by applying a system leads to 'strategy building', which focuses on, or consists of 'money management' and 'risk management'. That is a whole other topic though, which I am looking forward to explaining in further educational posts, but not in this one.

A system is supposed to allow you to evaluate ONE specific entry, according to specific conditions that have to be met. In order to allow you to pick up on what I'm trying to say I have prepared a very simple example of a system (also referred to as 'technique'). Since many people wanted to be part of the crypto-spikes that we have recently seen, and bought coins at all time highs, I decided to demonstrate several harmonic techniques on the BTC chart.

First of all: Where are we? Where is the example taking place?

For having a better idea about the scale and location I added this snapshot of the BTC chart in the daily timeframe:

(ALL FOLLOWING SNAPSHOTS WERE TAKEN IN 13H TMF)

A system, or technique, may be very simple. The strategy your system will be part of will be more complex. But the system itself may surprisingly be very simplistic. For instance: I have been trading with the use of 'harmonics' for a very long time. I focused on TWO different types of harmonic patterns.

1) AB=CD patterns (ABCD)

2) Three Drives patterns

In this case, you could make use of the examples I will provide in a second in two different ways, since they'd have given away a short signal on BTC at the ATH.

1) actually shorting BTC, which isn't a very popular method, since not many brokers offer the ability to short sell crypto currencies, and if they do, it often is very expensive to execute. However, some still do it, and this would've been a perfect entry for a short order.

2) interpreting it as a warning signal to either a) getting out of BTC or to b) not buying more coins.

I'll introduce the 'Three Drives pattern' in this post, because it was a very clean, textbook-like pattern in this specific case:

So, this is the pattern I have spotted that the BTC ATH (all time high) consists of/portrays. As I have mentioned several times already, a system shall provide an entry. So, only if the requirements are met, you are allowed to make a trade. Since some of you may be unaware of what a three drives pattern is, and how to trade it, i will break it down for you:

A three drives pattern is a series of lower lows or higher highs which occur in a very specific relation to each other and usually indicate the market may turn around after completing the pattern. It focuses on analysing the time/price relation between said highs or lows. In detail:

It consists of three drives, as the name gives away, which may be a series of three consecutive higher highs, or lower lows:

bearish:

bullish:

each drive is interconnected with a corrective move, the corrective moves will play a very decisive role in determining the entry.

bearish:

bullish:

The numbers (1.27) that the three drives pattern, that Tradingview offers, already includes, measure the price excess of the correction move in relation to the next high.

In order for the trade to be executed the price excess must either be 1.27 or 1.618 (1.62 approx.).

If you're uncomfortable with the three drives drawing tool you could simply measure it by yourself using a fibonacci retracement featuring the 1.27 and 1.618 extensions and apply it on the corrective moves of the three drives pattern, just like this:

The following drive should then bounce off the 1.27 or 1.618 extension. You must apply the Fib rectracement on the second correction wave too.

The end of the 3rd drive, which should bounce off the 1.27 or 1.618 extension too would then initiate the trade. You would SIMPLY (according to this system) make a trade.

All that you have to do is to find a system that has proven to work out to a certain degree in the past (always do never ending backtesting), implement it in your strategy (risk-, and money management) and strictly take the entries that your system provides for you. A system is supposed to give you the confidence you need to blindly execute it according to its rules and requirements. The only way to gain said confidence is to a significant amount of backtesting

over and over again, and literally studying the system. A trade that you are afraid of to take, for whatever reason, can still be interpreted as a strong signal to close your current positions, as in the case of this BTC example. Not many people would dare to simply short BTC on the ATH, but relatively many people would probably start takeing profits or selling their coins if they spotted a short entry - according to whatever system(s) they may use. There is not THE perfect system out there. Find a system you can apply confidently and implement it in your strategy.

Now, the remaining question is where to take profits once you're in. The Three Drives pattern offers several take profit levels. There may be other ways to successfully take profits, but this is the way that has proven to be the most profitable one for me:

I usually simply attach a FIB retracement to the end of the first correction move and to the end of the 3rd drive , and I take partial profits at each of these marked levels. (0.382; 0.5; 0.618; 1.0; 1.27; 1.618).

Back to the REAL example:

the entry:

the take profits:

While there are many ways to apply or trade the Three Drives pattern, and some focuse on the retracements in specific, while I focuse on the extensions of the correction moves only. I don't pay much attention to the retracement level of the correction moves because there simply isn't a reliable retracement level. Some fall back to 0.382 while others retrace as far as 0.618 or 0.786.

The issue with trading and investing is, that one's ANALYSIS is one thing, but actually initiating a trade, spotting the chance of making money in time and not hesitating to take action is a whole other thing. The only way to act with confidence when the time has come and to actually making the trade is to apply a system that has PROVEN to work. If you don't have a system you won't have the guts to take the chance for a good trade because you burned your hands in the past. Focuse on the entry. Not on where prices may go in the future. If you got your entry right, you can take profits wherever you want to. An analysis doesn't make money. The trade does. The market may do whatever, no one knows what tomorrow will bring, so focuse on the only thing you can influence: The entry and the risk that comes with it. And take profits. Especially in these times.

Whatever it is that you do, may it be automated or manual trading, the only way to prove a system is working, is to backtest it. Over and over again, on hundreds or thousands of examples.

Thank you for taking the time to reading this rather complex and long article. Cheers ;)

A-B-C Pattern (Bearish entry 2/5)One of my favorite entry patterns on daily, 4 hour or 1 hr chart pattern (can use on lower time frames too)

Example of a bearish 4 hour A-B-C pattern GBPJPY attached chart:

Rules:

1) Wait for 0 leg to A leg (bearish trend) then

2) Wait for A leg to B leg (bullish pullback back upwards, but not above A price) then

3) Entry once B leg breaks the low of A leg price, with a stop loss comfortably above entry (4 hr chart, so account for that in stop and lot size).

4) B leg to C leg is daily trend and take profit/ set target leg of this pattern.

Example chart had a target of 70 pips on 10 pm to 10 am, three 4 hr candles. *This is highest liquidity and volume 12 hrs per day. 1:3 or 20 pip/60 pip risk reward would have worked great.

Educational: AB=CD pattern w/ BTC exampleOne fairly easy and useful pattern for determining reversals is the AB=CD pattern.

The pattern simply looks for two rising or falling legs up or down respectively. Then one simply measures the retracement level from point B followed by the projection from C (luckily tradingview has a tool to assist with this). If these values equal a 0.618 or 0.786 retracement followed by a 1.272 or 1.618 projection respectively, the pattern is likely to indicate a reversal of the current trend. For example, above we can clearly see the pattern almost perfectly matched the required levels of 0.618 and 1.272.

However, no pattern is guaranteed, so it is always recommended to seek out confirmation. As we can see in the above example, there is bearish reversal divergence that can be seen on both RSI and MACD (dotted green lines), whereby price is rising while oscillators are falling, indicating an even greater likelihood for a reversal.

Upon confirmation of a reversal, one can then target Fibonacci retracement levels as key points of interest as can be seen above.

A nice part about this pattern is how simple it is to spot and draw out particularly with tools available on tradingview.

Hopefully you are able to use this pattern as another useful tool in your arsenal!

eurgbp harmonic patternhello everyone EurGbp is ricing like a rocket right now

we expect to reach resistance line that mentioned in chart

here is that AB=Cd is complete and we expect a gartley pattern as well

notice that its opposite of trend so Enter with at most 3% of your equality

notice that target is based on fibonacci and lowest profit that is available in this case

my strategy is based on

1 : fibonacci

2 : harmonic pattern gartley and Ab=CD

3 : trend line and channel trading

4 ; Rsi h4

notice that in order to enter this trade you should see some confirmations like : candlesticks formation , indicator,s signs (ichimoku , moving average and ... )

then at last wait for break higher low to enter short

Hope you Enjoy

♥ { comment in below and share you opinion with my team } ♥

this is MkyTradingGroup

EDUCATION + WORK Harmonious pattern ABCD + "Three movements" BATI wrote a series of articles on harmonious patterns. On the coin, which I trade from time to time for about two years, a harmonious ABCD pattern is now formed. I decided to publish the information here on the site. I combined a teaching idea with a trading one. Immediately I showed the options for working on a coin, so as not to spam trading ideas and spend time on it. Below I will describe in detail. First, on working on the tool, and then below I will give a little training material. I’ll cut the text as much as possible, as I understand that people don’t want to read a lot of text, for some people this is an overwhelming task)))).

On the chart itself, I showed potential movements depending on the retention / breakout of local support / resistance levels.

______________________________

1 work option.

The price has almost reached point D, which could become a potential pivot point in this local movement.

ABCD is nothing more than part of the movement in the channel. Channel width 100%. Therefore, in case of confirmation of point D and a price reversal, the potential first profit is + 100%. If this happens, then the ABCD pattern is reorganized into a harmonious pattern of "Three movements." I have shown the areas of potential reversal and observation on this chart.

2 option work.

A variant of work if the ABCD pattern is not confirmed and point D does not become a price reversal zone. The formation of a triple bottom. Pivoting bullish shape.

The downward stopping zone I showed on the chart. I doubt that it will be pierced, how this will ruin the canvas for the work of the "artist" in the future.

To an important zone of resistance and confirmation of this figure + 100%

Full working out of the figure triple bottom + 300%.

Option 3 (unlikely)

If the price breaks through the support zone (green area) and is fixed in a downward movement below it. Then you should forget about trading this cryptocurrency and "turn gray on the fence" until a good entry point appears. But even in such a situation, when they will do a "trick", you can partially take the movement + 40%.

Note that in any movement options with the correct entry points (reversal zones), the risk is minimal, the profit is maximum, both locally in movements, and is possible when the trend develops and in the global one.

____________________________________

The previous trading idea for this coin in this pair, which gave + 40%.

Actually now, as in the global price forms a symmetrical triangle , this downward movement is nothing more than a pullback after breaking the triangle up.

The result after a while + 40%.

The same coin is only a trade for bitcoin .

BAT / BTC Fractal 2019. History repeats itself. Potential + 180%

And the result is + 40% and now rollback.

Notice, everything goes according to the fractal plan.

___________________________________________________________________________

LEARNING MATERIAL on the theme of harmonious patterns ABCD and "Three movements".

1) ABCD pattern .

This is the simplest version of a harmonious pattern. Nevertheless, the figure is an important brick on the way to understanding the principles of constructing harmonic figures and, moreover, is part of most of them.

ABCD is a reversal pattern foreshadowing a change in market trends. That is, the figure helps to predict when the price ends the growth and prepares to fall, or vice versa, completes the fall and prepares for growth. A key feature of the pattern is the symmetry of the AB and CD knees.

The figure begins with a rise or fall in price on the segment AB. The BC segment is usually a sharp correction, the size of which should fit in 38.2% - 88.6% of AB. Ideally, the size of the correction should be from 61.8% to 78.6%.

At point C, the price reverses and continues to move parallel to segment AB. In this case, point D should be in the range of 113% - 261.8% of the knee BC .

The main rule is to observe the symmetry of the pattern. Ideally, the length of the elbow CD should be fully consistent with the length AB. That is, it means matching both in time and in price.

Rules for trading a pattern:

1) The length AB should correspond to the length of the CD.

2) The time it took for the price to go from point A to B should be similar to the time from C to D.

This harmonious ABCD pattern has two varieties:

1) Bearish pattern .

2) Bullish pattern .

Bearish ABCD pattern gives a sell signal.

Bullish pattern ABCD gives a buy signal.

TNT / USD 1 day. Harmonious bearish pattern ABCD .

ETH / USD 1 day. Harmonious bullish ABCD pattern.

In real trading on the market, there are a variety of variations of this pattern. But, it’s a good rule to observe the corresponding sizes of AB and CD corrections, since it is much more difficult to trade an asymmetric pattern. Asymmetric, incomprehensible patterns are better to skip.

If I trade such formations, then without a Fibonacci grid, I do not need it. I already see what she has to show. In most cases, this is a working analysis tool and at the beginning of your analysis you should use a Fibonacci grid.

In trading these formations, I use strong support / resistance levels, the symmetry of this formation and healthy logic in the calculations. Tradingview has a template for this harmonious ABCD pattern and the "three movements" pattern. This simplifies the work and makes it possible to quickly search for this formation on the chart.

______________________________________

2) Model of the pattern "Three movements".

The Three Movement model is a fairly well-known pattern. Its analogues can be found in wave analysis (diagonal triangle) and the book of Linda Raschke (three Indians). It is very reminiscent of ABCD , as if a continuation of this formation. This is a price movement in an upward or downward channel . In the framework of harmonious trading, we consider this model taking into account the Fibonacci ratios.

In the classic version of the "Three Movements" pattern, it is provided that movements 2 and 3 complete on projections 1.27 or 1.618. Correction of movements 1 and 2 - at the levels of 0.618 or 0.786. In the real market, models with ideal proportions are quite rare. Therefore, if you want to really earn money, get used to the fact that book "idealized" patterns in the real market are very rare. You need to be able to trade what is, and not what you want.

This model has a greater predictive property if it is in the expected end of the trend. Typically, the formation of the “Three Movements” is a signal that the market already does not have enough strength to continue the trend and perhaps the beginning of at least a correction.

This harmonious Three Movement pattern has two varieties:

1) Bearish pattern .

2) Bullish pattern .

LTC / USD 1 day. Harmonious bearish pattern "Three movements" ( ascending channel ).

In the example, we see that the upward trend price has broken, which triggered a trend reversal.

ETH / USD 1 day. Harmonious bullish pattern "Three movements" ( downward channel ).

As we see, the next correction wave reached the resistance line of the downward channel . The target is taken.

Learn to “predict” a more likely future. Always have different options for your work in a given situation. Work according to the basic plan, based on the situation that is being implemented.

In order to trade in a market in which the deposits of most traders are destroyed, you must have vast experience, and be a whole head taller for the rest.

EDUCATION + WORK Harmonious pattern ABCD + "Three movements" BATI wrote a series of articles on harmonious patterns. On the coin, which I trade from time to time for about two years, a harmonious ABCD pattern is now formed. I decided to publish the information here on the site. I combined a teaching idea with a trading one. Immediately I showed the options for working on a coin, so as not to spam trading ideas and spend time on it. Below I will describe in detail. First, on working on the tool, and then below I will give a little training material. I’ll cut the text as much as possible, as I understand that people don’t want to read a lot of text, for some people this is an overwhelming task)))).

On the chart itself, I showed potential movements depending on the retention / breakout of local support / resistance levels.

______________________________

1 work option.

The price has almost reached point D, which could become a potential pivot point in this local movement.

ABCD is nothing more than part of the movement in the channel. Channel width 100%. Therefore, in case of confirmation of point D and a price reversal, the potential first profit is + 100%. If this happens, then the ABCD pattern is reorganized into a harmonious pattern of "Three movements." I have shown the areas of potential reversal and observation on this chart.

2 option work.

A variant of work if the ABCD pattern is not confirmed and point D does not become a price reversal zone. The formation of a triple bottom. Pivoting bullish shape.

The downward stopping zone I showed on the chart. I doubt that it will be pierced, how this will ruin the canvas for the work of the "artist" in the future.

To an important zone of resistance and confirmation of this figure + 100%

Full working out of the figure triple bottom + 300%.

Option 3 (unlikely)

If the price breaks through the support zone (green area) and is fixed in a downward movement below it. Then you should forget about trading this cryptocurrency and "turn gray on the fence" until a good entry point appears. But even in such a situation, when they will do a "trick", you can partially take the movement + 40%.

Note that in any movement options with the correct entry points (reversal zones), the risk is minimal, the profit is maximum, both locally in movements, and is possible when the trend develops and in the global one.

____________________________________

The previous trading idea for this coin in this pair, which gave + 40%.

Actually now, as in the global price forms a symmetrical triangle , this downward movement is nothing more than a pullback after breaking the triangle up.

The result after a while + 40%.

The same coin is only a trade for bitcoin.

BAT / BTC Fractal 2019. History repeats itself. Potential + 180%

And the result is + 40% and now rollback.

Notice, everything goes according to the fractal plan.

___________________________________________________________________________

LEARNING MATERIAL on the theme of harmonious patterns ABCD and "Three movements".

1) ABCD pattern.

This is the simplest version of a harmonious pattern. Nevertheless, the figure is an important brick on the way to understanding the principles of constructing harmonic figures and, moreover, is part of most of them.

ABCD is a reversal pattern foreshadowing a change in market trends. That is, the figure helps to predict when the price ends the growth and prepares to fall, or vice versa, completes the fall and prepares for growth. A key feature of the pattern is the symmetry of the AB and CD knees.

The figure begins with a rise or fall in price on the segment AB. The BC segment is usually a sharp correction, the size of which should fit in 38.2% - 88.6% of AB. Ideally, the size of the correction should be from 61.8% to 78.6%.

At point C, the price reverses and continues to move parallel to segment AB. In this case, point D should be in the range of 113% - 261.8% of the knee BC.

The main rule is to observe the symmetry of the pattern. Ideally, the length of the elbow CD should be fully consistent with the length AB. That is, it means matching both in time and in price.

Rules for trading a pattern:

1) The length AB should correspond to the length of the CD.

2) The time it took for the price to go from point A to B should be similar to the time from C to D.

This harmonious ABCD pattern has two varieties:

1) Bearish pattern.

2) Bullish pattern.

Bearish ABCD pattern gives a sell signal.

Bullish pattern ABCD gives a buy signal.

TNT / USD 1 day. Harmonious bearish pattern ABCD.

ETH / USD 1 day. Harmonious bullish ABCD pattern.

In real trading on the market, there are a variety of variations of this pattern. But, it’s a good rule to observe the corresponding sizes of AB and CD corrections, since it is much more difficult to trade an asymmetric pattern. Asymmetric, incomprehensible patterns are better to skip.

If I trade such formations, then without a Fibonacci grid, I do not need it. I already see what she has to show. In most cases, this is a working analysis tool and at the beginning of your analysis you should use a Fibonacci grid.

In trading these formations, I use strong support / resistance levels, the symmetry of this formation and healthy logic in the calculations. Tradingview has a template for this harmonious ABCD pattern and the "three movements" pattern. This simplifies the work and makes it possible to quickly search for this formation on the chart.

______________________________________

2) Model of the pattern "Three movements".

The Three Movement model is a fairly well-known pattern. Its analogues can be found in wave analysis (diagonal triangle) and the book of Linda Raschke (three Indians). It is very reminiscent of ABCD, as if a continuation of this formation. This is a price movement in an upward or downward channel. In the framework of harmonious trading, we consider this model taking into account the Fibonacci ratios.

In the classic version of the "Three Movements" pattern, it is provided that movements 2 and 3 complete on projections 1.27 or 1.618. Correction of movements 1 and 2 - at the levels of 0.618 or 0.786. In the real market, models with ideal proportions are quite rare. Therefore, if you want to really earn money, get used to the fact that book "idealized" patterns in the real market are very rare. You need to be able to trade what is, and not what you want.

This model has a greater predictive property if it is in the expected end of the trend. Typically, the formation of the “Three Movements” is a signal that the market already does not have enough strength to continue the trend and perhaps the beginning of at least a correction.

This harmonious Three Movement pattern has two varieties:

1) Bearish pattern.

2) Bullish pattern.

LTC / USD 1 day. Harmonious bearish pattern "Three movements" (ascending channel).

In the example, we see that the upward trend price has broken, which triggered a trend reversal.

ETH / USD 1 day. Harmonious bullish pattern "Three movements" (downward channel).

As we see, the next correction wave reached the resistance line of the downward channel. The target is taken.

Learn to “predict” a more likely future. Always have different options for your work in a given situation. Work according to the basic plan, based on the situation that is being implemented.

In order to trade in a market in which the deposits of most traders are destroyed, you must have vast experience, and be a whole head taller for the rest.

Euro/ Pound Scott Carney's/ Divergence Software Harmonic Scanner---Possible Product Review---

Okay, I have some serious mixed feelings today. I dont typically trade on mondays as today is the shake up of the market from the weekend and people's emotions from the market. So, I thought I would buy Scott Carney's harmonic scanner for trading view. the software was very pricey and i honestly had i very high hopes for the software. i wanted to use the software for the smaller time frames like the 1 minute and 5 minute interval as it takes a while to chart the patterns properly just so i could add a few more trading oppritunities to my day.

here we have the pattern software pick up a bat pattern on the euro pound. Im very picky about my patterns, especially my anchor legs as those are going to be the frame for the patterns backbone to build off (the abcd pattern).

i like my anchor legs to be significant swing high/ low points as they provide great areas of S/R levels as well. the swing points printed on the screen are 27 and 88. that means 13 or 44 candles must print either lower highs or higher lows prior to the swing point and the same after in inverse order as they happened coming up to the swing point. the softwares algorithm is picking up XA points in some random spots which i think is causing alot of the patterns to be invalid before the pattern is even completed.

Now, I understand this is Scott Carney's lifes work, trading career wise, and im a self taught student of his teachings straight from his books. i just bought the 3rd volume and it answered a ton of questions i had and filled in a lot of gaps. i wish i had the old patterns i had drawn up previously when i first encountered his work and tried to mimick it on my profile so you can see the progression. so, no way am i saying this stuff is wrong im just saying it seems the software is printing in random spots that seem to fit a coding argument.