BTCUSD 7/6/2025Come Tap into the mind of SnipeGoat, as he gives you a Weekly Market Breakdown of Bitcoins current Price Action to determine Price's next move.

_SnipeGoat_

_TheeCandleReadingGURU_

#PriceAction #MarketStructure #TechnicalAnalysis #Bearish #Bullish #Bitcoin #Crypto #BTCUSD #Forex #NakedChartReader #ZEROindicators #PreciseLevels #ProperTiming #PerfectDirection #ScalpingTrader #IntradayTrader #DayTrader #SwingTrader #PositionalTrader #HighLevelTrader #MambaMentality #GodMode #UltraInstinct #TheeBibleStrategy

Beyond Technical Analysis

Mastering Risk Management: The Trader’s Real EdgeYou’ve all heard it,

“Cut your losses and let your winners run.”

Simple words — but living by them is what separates survivors from blown accounts.

Here’s some tips on how to approach risk management when trading:

☑️ Risk is always predefined: Before I click Buy or Sell, I know exactly how much I’m willing to lose. If you don’t define risk upfront, the market will do it for you.

☑️ Position sizing: Never risk more than 1–2% of your account per trade. Small losses mean you can keep taking high‑probability setups without fear.

☑️ Always use a stop‑loss: No stop? You’re not trading — you’re gambling.

☑️ Stop‑loss discipline: Place stops where the market proves you wrong — not where it “feels comfortable.” Then leave them alone.

☑️ Focus on risk/reward, not win rate: A 40% win rate can still be profitable if your average reward outweighs your risk.

☑️ Risk/reward ratio: Only take trades with at least a 2:1 or 3:1 potential. You don’t need to win every trade — your winners should pay for your losers (and more).

Remember:

“It’s not about being right all the time. It’s about not losing big when you’re wrong.”

Risk management won’t make your trades perfect — but it will keep you trading tomorrow.

And in this game, staying in the game is everything.

💭 How do you handle risk in your trading? Drop your strategy or tip in the comments — let’s share and learn together! 👇

Thanks again for all the likes/boosts, we appreciate the support!

All the best for a good week ahead. Trade safe.

BluetonaFX

Daily Analysis- XAUUSD (Monday, 7th July 2024)Bias: Bearish

USD News(Red Folder):

-None

Notes:

- Strong bearish momentum

on market open

-Looking for price to retest

4hr structure

- Potential SELL if there's

confirmation on lower timeframe

- Pivot point: 3345

Disclaimer:

This analysis is from a personal point of view, always conduct on your own research before making any trading decisions as the analysis do not guarantee complete accuracy.

GBP/USD Pulls Back After Rejection – Buyers Eye Lower LevelsHi everyone,

GBP/USD failed to break above the 1.37500 level and saw a rejection from that resistance, dropping further below the 1.36850 support. Since then, price has consolidated and ranged beneath this level.

Looking ahead, if price remains within this range, we anticipate a move lower to find buying interest between the 1.35300 and 1.34600 levels, which could set the stage for another push higher.

As previously noted, a decisive break above 1.37500 would renew our expectation for further upside, with the next key target around 1.38400. We'll be monitoring price action closely to see how it unfolds.

We’ll continue to provide updates on the projected path for GBP/USD as price approaches this target.

The longer-term outlook remains bullish, and we expect the rally to continue extending further from the 1.20991 January low towards 1.40000 and 1.417000.

We’ll be keeping you updated throughout the week with how we’re managing our active ideas. Thanks again for all the likes/boosts, comments and follows — we appreciate the support!

All the best for the week ahead. Trade safe.

BluetonaFX

ES Short to 6274.50Grabbed 1 hour BSL on a shortened July 3rd trading day.

5 minute bearish market structure shift

1 hour bearish inverse fair value gap

Technicals ^

Participants ran the market higher into all time high's during the holiday week. Gathered shorts, and targetting 6274.50 as a meaningul 1 hour SSL level. Confluences with prior London open.

Logic ^

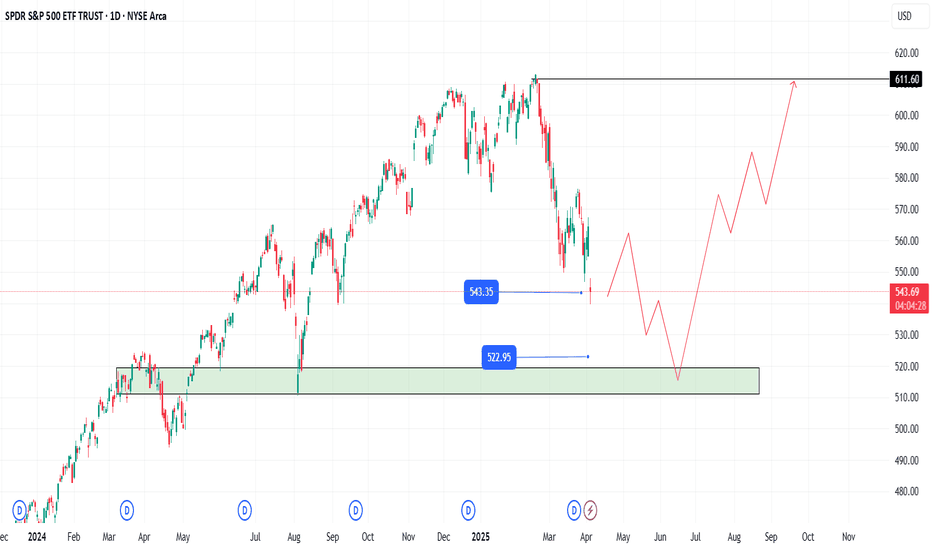

Opportunity Beneath the Fear: SPY's Reversal SetupIn the Shadow of Headlines: SPY’s Drop Could Be 2025’s Big Opportunity

As markets react sharply to renewed tariff fears and Trump-related headlines, SPY continues its descent. Panic is setting in—but behind the noise, a strategic opportunity may be quietly forming.

While many rush to exit, others are beginning to position for the bounce. A well-structured entry strategy could be key to turning uncertainty into gains.

Entry Zone (Staggered):

🔹 543: First watch level—look for signs of slowing momentum.

🔹 515: Deeper entry point as the selloff extends.

🔹 <500 (TBD): Stay flexible—if panic accelerates, this could mark a generational setup.

Profit Targets:

✅ 570: Initial rebound target.

✅ 590: Mid-range level if recovery builds.

✅ 610+: Full recovery potential—rewarding those with patience and vision.

Remember: Headlines fade, but price action and preparation stay. This selloff may continue—but it might also be laying the foundation for 2025’s most powerful move. The key? Enter with discipline, protect your capital, and let the market come to you.

⚠️ Disclaimer: This content is for educational purposes only and does not constitute financial advice. Trading carries significant risk. Always conduct your own research and use proper risk management.

4-Dimensional Investing: Evolving Beyond News, Charts, and Math 📚 4-Dimensional Investing: Evolving Beyond News, Charts, and Math

Most people start learning about stocks in a 1-dimensional way — by following the news.

But news is noisy.

Some is fake, some is "buy the rumor, sell the fact", and sometimes the price moves the opposite of what the news suggests. So, many give up on news and turn to...

📊 2D: Technical Analysis (TA)

TA has been around since the 1980s, when personal computers went mainstream. It's visual and intuitive — charts, lines, indicators. You see price action unfold on-screen and feel like you're deciphering the market in real time.

Some traders even build entire systems off indicators like RSI, MACD, or moving averages. They think:

"Aha! The chart did this, so next time I’ll do that."

But often, "next time" doesn't work the same.

TA is fundamentally historical — it's about pattern recognition and hoping history repeats.

It’s like counting the color of every fallen leaf, trying to predict the next one.

We needed something better. So the institutions turned to…

🧠 3D: Quantitative Modeling

Enter the quants — physicists, mathematicians, engineers. They model the markets like rocket science using multi-dimensional equations. Think LTCM (Long-Term Capital Management), led by Nobel Prize winners.

Quant models are more sophisticated than charts — they simulate human behavior with precision. But there's a problem: humans change.

A model may work… until people start behaving differently.

Markets are not just math. They’re psychology, emotion, fear, greed.

Which brings us to the new frontier…

🤖 4D: AI-Powered, Language-Driven Investing

This is where LLMs (Large Language Models) enter the game.

People often ask me:

“Why use LLMs for trading? Why not traditional ML like LSTM?”

Here’s my answer: Markets are made of humans, and humans communicate through language.

Not numbers. Not charts. Not just price.

Now, with LLMs, we can:

Analyze any human-created document (news, filings, tweets, speeches)

Understand sentiment in real context

Capture nuance — the stuff traditional models miss

LLMs don’t just convert text to numbers. They learn meaning.

This adds a fourth dimension to our trading models: language + reasoning + context + behavior.

Underneath, it’s still powered by classic ML and deep learning. But now the machine can think more like a human — with intuition, memory, and adaptability.

---

🌐 The Future Is 4D Investing

We're not saying this is the final answer to markets. But it’s a major leap forward.

Trading is one of the hardest prediction problems in the world.

And now we have a tool that bridges the gap between math and human behavior.

Welcome to the era of 4D investing —

Where the future of trading is built with language, context, and AI.

Let’s explore it together in 📖qs-academy. 🚀

AUD_USD WILL GO UP|LONG|

✅AUD_USD has retested a key support level of 0.6540

And as the pair is already making a bullish rebound

A move up to retest the supply level above at 0.6584 is likely

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR/USD Rally Pauses Near 1.18000 – Higher Targets in SightHi Everyone,

Last week, price action delivered the 1.18000 level we had been calling for, and as expected, dynamic resistance around that area proved to be significant.

Looking ahead, we anticipate EUR/USD will continue to test the 1.18000 level this week while holding above the 1.16680 support zone. A strong break above last week’s high could attract further buyers, paving the way for a move towards the 1.19290 and ultimately the 1.20000 levels. We’ll share further updates on the projected path for EUR/USD if price breaks above this level.

The longer-term outlook remains bullish, with expectations for the rally to extend towards the 1.2000 level, provided the price holds above the key support at 1.10649.

We will continue to update you throughout the week with how we’re managing our active ideas and positions. Thanks again for all the likes/boosts, comments and follows — we appreciate the support!

All the best for a good end to the week. Trade safe.

BluetonaFX

BTC Smart money Bullish don’t be fooled !**BITCOIN MICROSTRUCTURE ANALYSIS: Institutional Accumulation Through Order Flow Divergence**

The current BTCUSD market structure presents a compelling case study in institutional accumulation mechanics, utilizing sophisticated order flow analysis to identify smart money positioning ahead of retail market participants.

**Technical Infrastructure Analysis**

The convergence of multiple analytical frameworks reveals a coordinated accumulation pattern across various timeframes and exchanges. Volume Profile Analysis on the primary chart indicates substantial institutional interest between $108,000-$110,000, with the Point of Control (POC) establishing a robust foundation for directional bias determination.

**Order Flow Microstructure Dynamics**

The Bitfinex footprint data reveals critical microstructural imbalances that traditional technical analysis often overlooks. The current candle displays a **-4.52 delta** with price resilience at $109,480, indicating aggressive institutional absorption of retail selling pressure. This negative delta combined with price strength represents a classic **Wyckoff accumulation signature** - large participants are utilizing iceberg orders and hidden liquidity pools to build positions without triggering algorithmic momentum systems.

**Smart Money Positioning Mechanics**

Three key indicators confirm institutional accumulation:

1. **Cumulative Volume Delta (CVD) Divergence**: Both spot and perpetual markets showing negative CVD (-95.77K spot, -50.05K perp) while price maintains elevation, indicating off-exchange accumulation through dark pools and cross-trading networks.

1. **Open Interest Expansion**: The increase from 77.89K to 78.75K contracts with minimal funding rate pressure suggests fresh institutional capital rather than retail speculation.

1. **Volume Profile Concentration**: The heatmap reveals 105.85M in trading volume concentrated within the $108K-$110K range, representing systematic accumulation rather than random market activity.

**Institutional Arbitrage Mechanics**

The funding rate dynamics (0.001783 with periodic negative spikes to -0.000753) indicate sophisticated carry trade positioning. Institutions are likely utilizing the negative funding periods to establish leveraged long positions while simultaneously hedging through spot accumulation, creating a self-reinforcing feedback loop.

**Market Microstructure Implications**

This accumulation pattern typically precedes **Phase C markup** in Wyckoff methodology, where institutional players transition from absorption to active price discovery. The thin volume profile above $112,000 suggests minimal resistance once the breakout occurs, creating conditions for rapid price expansion toward the $113,600 target.

**Risk-Adjusted Positioning Strategy**

The confluence of volume profile analysis, order flow dynamics, and institutional positioning indicators supports a high-probability long bias with the following parameters:

- **Entry Zone**: $109,000-$109,200 (current accumulation range)

- **Risk Management**: Stop loss at $108,200 (below institutional POC)

- **Target Sequence**: $110,653 → $112,000 → $113,600

- **Confidence Level**: 90% (upgraded from initial 75% based on footprint confirmation)

**Forward-Looking Market Structure**

The sophisticated nature of this accumulation pattern suggests institutional preparation for a significant directional move. The combination of hidden liquidity absorption, funding rate arbitrage, and volume profile concentration creates optimal conditions for sustained upward momentum once the $110,000 psychological resistance is cleared.

This analysis exemplifies how advanced order flow techniques can provide substantial informational advantages over traditional technical analysis, particularly in identifying institutional positioning ahead of retail market recognition.

*Position sizing should remain within 3-5% of total portfolio allocation, with dynamic risk management protocols adjusted based on evolving market microstructure conditions.*

XAUUSD ShortElite Analysis

Price broke under top structural liquidity grey zone.

Price BOS bearish on the 30 minute time frame.

Price transitioned in the 1m, 3m, and 5m time frame bearish.

Price came to multiple OB or LP to confirm short entries.

Price came to a CIC LP (Candle Inside Candle Liquidity Pool) that was inside structural liquidity and rejected with a violent bearish wick on the 30m time frame.

Executed on the 10m time frame on MT5, Tradelocker, and a futures TopStep Account.

2025 Q1 + 6M/12M ranges 8h interim cycling bullish.

s1 @ 5554

r1 @ 5592

macro r1 @ 5738

sustain above and macro rotation pushes higher, r2 @ 5921.

its 8 days into the trading month and we've spent the entire 1M atr with extension to the downside.

8H / 1D interim rotation is bullish and no hh on di- since feb 27, despite almost a 500pt drop.

Extended boxes for 6M / 12M, and major levels noted for annual sup/res also marked.

In the last 20+ years, 12M candles closing red still printed an avg 4.74% H above the open; and after hitting lows, closed the year with an 9.97% rebound.

The rotation is a feature not a flaw.

Accept that it's fixed, and you'll see that nothing is broken.

You'll know the signal when you see it.

Appreciate the risk.

Down the road - Gold Outlook June 30 - July 24, 2025FX_IDC:XAUUSD

📰 The past weeks has been a wild ride for gold prices, caught between the fiery conflict in the Middle East and a deluge of crucial economic data from the U.S. 📈 Adding to this, a detailed technical analysis provides a deeper look into gold's immediate future.

**Geopolitical Drama Unfolds & Peace Prevails!** 🕊️ ceasefire negotiations.

Initially, gold was shrouded in uncertainty 🌫️ due to the Iran-Israel war, with markets bracing for potential U.S. involvement and a full-blown escalation. Daily tit-for-tat attacks between Iran and Israel kept everyone on edge, and the question of U.S. intervention remained a nail-biter 😬, though President Trump did announce a 14-day "timeout".

Then came the dramatic twist on June 21st: "Operation Midnighthammer" saw the U.S. unleash bunker-buster bombs on Iranian uranium enrichment facilities. 💥 Short time later, the U.S. declared mission accomplished, stating their goal of destroying these sites was achieved, and no further attacks would follow.

Iran's response, "Operation Annunciation of Victory," on the following Monday, involved missile strikes on U.S. military bases in Qatar and Iraq. 🚀 Interestingly, these attacks were pre-announced, allowing for safe evacuations and thankfully, no casualties. 🙏

The biggest surprise came from President Trump as he declared, "Congratulations world, it's time for peace!" 🎉 He then brokered a ceasefire between Israel and Iran, which, despite being fragile, largely held, leading to the war's end.🤝 Both nations, as expected, officially claimed victory – a common move to satisfy their citizens. 🏅

Personally, I was genuinely surprised that the U.S.President mediated ceasefire, actually brought the conflict to a close – but it's a welcome outcome! 🙏

**Economic Data & Fed's Steady Hand** 💹🏛️

The cessation of hostilities triggered a steady downward slide in gold prices from June 24th to 27th. ⬇️ This dip initially met some market resistance but it ultimately prevailed, especially with the release of mixed U.S. economic data, which, despite being varied, was generally interpreted positively by the market.

The spotlight also shone on the Federal Reserve, with several representatives speaking and Fed Chair Jerome Powell undergoing a two-day Senate hearing. 🎤👨⚖️ Powell meticulously explained the Fed's rationale for holding interest rates steady, despite market pressures. 🤷 However, recent whispers suggest the Federal Reserve might actually cut rates in September! 😮

## Geopolitical News Landscape 🌍📰

India / Pakistan

Pakistan rejected claims that it supported militant groups active in Indian Kashmir. India issued a formal protest but reported no fresh border clashes during the week.

Outlook 🔮: De-escalation is possible in the short term. However, unresolved disputes over water rights (Indus Treaty) could reignite tensions.

Gaza Conflict

Heavy Israeli airstrikes killed dozens in Gaza, including civilians near aid centers. The UN warned that U.S.-backed aid systems are failing. Humanitarian corridors remain blocked.

Outlook 🔮: Ceasefire talks may resume in July, but success depends on international pressure and safe humanitarian access.

Russia / Ukraine

Russia advanced 36 sq mi in eastern Ukraine, deploying outdated T-62 tanks. Ukraine reinforced defensive lines, aided by Western military packages.

Outlook 🔮: The front remains volatile. Sustained Western support will be key to halting further Russian gains.

U.S. – China Trade War

A breakthrough deal was signed for China to fast-track rare-earth exports to the U.S. Talks on tech transfer and tariffs continue behind closed doors.

Outlook 🔮: A phased de-escalation is possible, but deep trust issues linger, especially over semiconductors and AI.

🌐 Global Trade War

Several countries, including Brazil and Thailand, imposed fresh restrictions on Chinese imports, echoing the U.S. stance. Global supply chains remain fragmented.

Outlook 🔮: Trade blocs like the EU and Mercosur may take on greater importance as countries hedge against rising protectionism.

Trump vs. Powell

Fed Chair Powell resisted political pressure, stating rate cuts are unlikely before September. Trump called him “stubborn” and demanded immediate easing.

Outlook 🔮: The Fed’s independence is under strain. If Trump wins re-election, major policy shifts could follow.

📈 U.S. Inflation

Despite tariffs, core inflation remains elevated. Powell warned of persistent price pressures. Trump insists the Fed should cut rates to boost growth.

Outlook 🔮: A rate cut later in 2025 is possible—if labor market data weakens. Until then, inflation will remain politically explosive.

## Technical View 📐📈

**Current Market Context:** Gold plummeted to $3,273.67 USD/t.oz on June 27, 2025, marking a 1.65% drop from the previous day, which confirms the strong bearish momentum. The price action shows a significant retreat from recent highs around $3,400.

**ICT (Inner Circle Trader) Methodology Analysis:**

* **Market Structure:**

The trend is clearly bearish, with a definitive break of structure (BOS) to the downside.

* **Order Blocks:**

Several bearish order blocks have been identified at prior resistance levels, specifically in the $3,380-$3,400 range.

* **Fair Value Gaps (FVG):**

The aggressive sell-off has created multiple imbalances, particularly in the $3,350-$3,320 range.

* **Liquidity Pools:**

Buy-side liquidity above $3,400 has been swept. Sell-side liquidity is now accumulating below the $3,270 lows, which is the current target zone.

* **Session Analysis:**

The London session showed aggressive selling, followed by a continuation of bearish momentum in the New York session. The Asia session could see consolidation or further declines.

* **Smart Money Concepts:**

Heavy selling pressure suggests "smart money" distribution. There's been strong bearish displacement from $3,380 down to $3,270, indicating the market is currently in a "sell program" phase.

**Gann Analysis:**

* **Gann Angles & Time Cycles:**

The primary 1x1 Gann angle has been broken, pointing to continued weakness. Key price squares indicate resistance at $3,375 (25²) and support at $3,249 (57²). Daily cycles suggest a potential turning point around June 30-July 1, while weekly cycles indicate continued pressure through early July.

* **Gann Levels:**

* Resistance: $3,375, $3,400, $3,481 (59²)

* Support: $3,249, $3,136, $3,025

**Fibonacci Analysis:**

* **Key Retracement Levels (from recent swing high to low):**

* 78.6%: $3,378 (Strong resistance)

* 61.8%: $3,348 (Key resistance zone)

* 50.0%: $3,325 (Psychological level)

* 38.2%: $3,302 (Minor resistance)

* 23.6%: $3,285 (Current area of interest)

* **Fibonacci Extensions (Downside Targets):**

* 127.2%: $3,245

* 161.8%: $3,195

* 261.8%: $3,095

* **Time-Based Fibonacci:**

The next significant time cluster is July 2-3, 2025, with a major cycle completion expected around July 15-17, 2025.

**Institutional Levels & Volume Analysis:**

* **Key Institutional Levels:**

* Major Resistance: $3,400 (psychological + institutional)

* Secondary Resistance: $3,350-$3,375 (order block cluster)

* Primary Support: $3,250-$3,270 (institutional accumulation zone)

* Major Support: $3,200 (monthly pivot area)

* **Volume Profile Analysis:**

* High Volume Node (HVN): $3,320-$3,340 (fair value area)

* Low Volume Node (LVN): $3,280-$3,300 (potential acceleration zone)

* Point of Control (POC): Currently around $3,330

**Central Bank & Hedge Fund Levels:**

Based on recent COT data and institutional positioning, heavy resistance is seen at $3,400-$3,430, where institutions likely distributed. An accumulation zone for "smart money" re-entry is anticipated at $3,200-$3,250.

**Cycle Timing Analysis:**

* **Short-Term Cycles (Intraday):**

Bearish momentum is expected to continue for another 12-18 hours. A daily cycle low is likely between June 29-30, with a potential reversal zone on July 1-2 for the 3-day cycle.

* **Medium-Term Cycles:**

The current weekly cycle is in week 3 of a 4-week decline. The monthly cycle indicates a mid-cycle correction within a larger uptrend. For the quarterly cycle, Q3 2025 could see a major low formation.

* **Seasonal Patterns:**

July-August is typically a weaker period for gold ("Summer Doldrums"). September has historically been strong for precious metals ("September Effect"), setting up for a potential major move higher in Q4 2025 ("Year-End Rally").

**Trading Strategy & Levels:**

* **Bearish Scenario (Primary):**

* Entry: Sell rallies into the $3,320-$3,350 resistance zone.

* Targets: $3,250, $3,200, $3,150.

* Stop Loss: Above $3,380.

* **Bullish Scenario (Secondary):**

* Entry: Buy support at $3,250-$3,270 with confirmation.

* Targets: $3,320, $3,375, $3,400.

* Stop Loss: Below $3,230.

**Key Events to Watch:**

* **US PCE Data:**

Fresh downside risks could emerge ahead of the US Personal Consumption Expenditures (PCE) Price Index data release.

* **Fed Communications:**

Any hawkish rhetoric from the Federal Reserve could further pressure gold.

* **Geopolitical Developments:**

Ongoing global events could trigger safe-haven demand.

**Conclusion:**

The technical picture for gold suggests continued short-term weakness, with the metal testing its 2025 trend line at $3,290 following last week's rejection at the $3,430 resistance. However, the longer-term outlook remains constructive, given gold's robust performance year-to-date. Key support at $3,250-$3,270 will be crucial in determining the next significant price movement.

**Upcoming Week's Economic Calendar (June 29 - July 4, 2025):** 🗓️🌍

🗓️ Get ready for these important economic events (EDT)

* ** Sunday , June 29, 2025**

* 21:30 CNY: Manufacturing PMI (Jun) - Forecast: 49.6, Previous: 49.5

* ** Monday , June 30, 2025**

* 09:45 USD: Chicago PMI (Jun) - Forecast: 42.7, Previous: 40.5

* ** Tuesday , July 1, 2025**

* 05:00 EUR: CPI (YoY) (Jun) - Forecast: 2.0%, Previous: 1.9%

* 09:30 USD: Fed Chair Powell Speaks

* 09:45 USD: S&P Global Manufacturing PMI (Jun) - Forecast: 52.0, Previous: 52.0

* 10:00 USD: ISM Manufacturing PMI (Jun) - Forecast: 48.8, Previous: 48.5

* 10:00 USD: ISM Manufacturing Prices (Jun) - Forecast: 70.2, Previous: 69.4

* 10:00 USD: JOLTS Job Openings (May) - Forecast: 7.450M, Previous: 7.391M

* ** Wednesday , July 2, 2025**

* 08:15 USD: ADP Nonfarm Employment Change (Jun) - Forecast: 80K, Previous: 37K

* 10:30 USD: Crude Oil Inventories - Forecast: -5.836M

* ** Thursday , July 3, 2025**

* Holiday: United States - Independence Day (Early close at 13:00) 🇺🇸⏰

* 08:30 USD: Average Hourly Earnings (MoM) (Jun) - Forecast: 0.3%, Previous: 0.4%

* 08:30 USD: Initial Jobless Claims - Forecast: 239K, Previous: 236K

* 08:30 USD: Nonfarm Payrolls (Jun) - Forecast: 129K, Previous: 139K

* 08:30 USD: Unemployment Rate (Jun) - Forecast: 4.2%, Previous: 4.2%

* 09:45 USD: S&P Global Services PMI (Jun) - Forecast: 53.1, Previous: 53.1

* 10:00 USD: ISM Non-Manufacturing PMI (Jun) - Forecast: 50.3, Previous: 49.9

* 10:00 USD: ISM Non-Manufacturing Prices (Jun) - Forecast: 68.7

* ** Friday , July 4, 2025**

* All Day: Holiday - United States - Independence Day 🎆

**Gold Price Forecast for the Coming Week** 🔮💰

Given last week's market movements, there's a strong likelihood that the downward trend in gold prices will continue.🔽 However, fresh news can always flip the script! 🔄 As of now, I expect gold to dip further to $3255 by mid-next week. Yet, a brief rebound towards $3300 isn't out of the question before a potential drop to $3200 by week's end or early the following week. 🤞

Please take the time to let me know what you think about this. 💬

-------------------------------------------------------------------------

This is just my personal market idea and not financial advice! 📢 Trading gold and other financial instruments carries risks – only invest what you can afford to lose. Always do your own analysis, use solid risk management, and trade responsibly.

Good luck and safe trading! 🚀📊

XAUUSD - Breakdown: - RISK ON/ Post NFP Week - July Part 1📆 New week for TVC:GOLD OANDA:XAUUSD

- Expecting RISK ON / Optimistic Sentiment

- Israel/Hamas ceasefire = Optimism

- Tariff war max pain priced in

- No New FUD / No Funda

- No heavy news, let PA do its thing, show up & take your dough💰

- I will post more once I see PA develop further, I usually do not trade Mondays!!

July 6, 2025: Strategic Forex Weekly OutlookWelcome back, traders!

In today’s video, we’ll be conducting a Forex Weekly Outlook, analyzing multiple currency pairs from a top-down perspective—starting from the higher timeframes and working our way down to the lower timeframes.

Our focus will be on identifying high-probability price action scenarios using clear market structure, institutional order flow, and key confirmation levels. This detailed breakdown is designed to give you a strategic edge and help you navigate this week’s trading opportunities with confidence.

📊 What to Expect in This Video:

Higher timeframe trend analysis

Key zones of interest and potential setups

High-precision confirmations on lower timeframes

Institutional insight into where price is likely to go next

Stay tuned, take notes, and be sure to like, comment, and subscribe so you don’t miss future trading insights!

Have a great week ahead, God bless you!

The Architect 🏛️📉