Important Copy Trading Metrics to AnalyzeHello Traders and Investors,

Today I want to talk about some of the important metrics pertaining to a live trading statement that you should assess before considering which traders to copy. For those of you that are not familiar with copy trading, it's the most revolutionized way for investors and traders to safely invest with professional traders in 2022.

== COPY TRADING SERVICE PROVIDERS ==

LEFTURN Inc.

eToro

collective2

ZuluTrade

FXTM

== WHY COPY TRADING EXISTS ? ==

Unfortunately in the past there's been lots of scams in this industry with fake traders or money managers where investors would give a professional actual cash. The fake trader would deposit the investor's funds in their own personal account, for the investor to then later discover the whole investment was a scam. Luckily however, copy trading was born to help eliminate the possibility of being scammed by fake traders or investment advisors.

---

Let's now review some important metrics pertaining to trading statements. For those of you that are not familiar with myfxbook or FXBlue , these are 2 great third party resources available for traders to showcase their past performance by connecting their MT4 or MT5 account to either myfxbook or FXBlue's API.

== IMPORTANT METRICS TO REVIEW ==

1. First and foremost, is the account verified via a third party vendor?

The first early sign of a fake trader is if their willing to showcase their past results of their live verified trading statement. Be cautious about anyone showcasing their results via screenshots or Photoshop files. Always ask for statements from either FXBlue or myfxbook.

2. Does the trader use his/her real name or an alias name?

We all know that our reputation is our most valuable asset. An early sign of a fake trader might be someone that goes by an alias name.

3. Is the account in which you intend to copy either a demo or live account?

This is very important since most traders can perform well on demo accounts, but can't perform the same on live accounts. When trading live accounts, it has a completely different psychological impact on the trader's mindset since he or she is now trading with live capital.

4. How much equity does the trader have in his/her master account?

Traders that trade with larger accounts tend to have more confidence in their own abilities to perform. Be cautious about traders that are constantly withdrawing large amounts or have little equity in their account.

5. How old is the trading history?

Some traders can perform well for several months especially if their using an EA or some sort of algorithm. Unfortunately for many traders that use fully automated systems, majority of them tend to have a doomsday effect every 6 months to a year. This is why it's important to request at least a year long statement

6. Understanding the trader's strategy

By understanding how the trader enters and exits positions, this will allow you to determine if their strategy works with your risk tolerance and level of comfort.

7. How easily can you contact the trader when you have concerns about the account?

We can't expect the markets to always perform perfectly according to the strategy. Maybe another major crisis is right around the corner that neither you (the investor) or the trader isn't expecting. What's the plan for when the markets are not trending according to plan? How does the trader manage risk in times of uncertainty? Traders that you can easily contact at anytime will give you great ease and peace of mind knowing they are working on adapting to the ever changing market conditions.

8. What is the maximum drawdown?

Knowing the maximum drawdown the trader has had in the past will inform you about how much risk the trader is willing to take on your account. However this metric should be discussed with your trader as they might not take on much risk at first to protect the investor's principal but then increase the risk once the account has significantly grown. Some traders will not risk any of the principal investment but are willing to risk some of the earnings already generated.

9. What are their average monthly returns?

This metric should be proportionate to the maximum monthly drawdown but should also be discussed with your trader to fit your level of risk tolerance

10. How do they manage risk in times of uncertainty?

Does your potential trader use stop losses, do they hedge positions, or close all trades heading into major risk events? Understanding how they manage all risk factors is critical for the life span of the account in which they will trade.

11. What are their fees?

Do they charge a monthly management fee along with a performance fee? Or do they just charge a performance fee? Trader's that only charge a monthly performance fee have greater confidence in their own strategy since they only get paid if the investor makes money first.

12. Which broker are they using?

Some traders want you to register with their broker so they can generate additional revenue through what's referred to as an IB program. Others allow you to use any forex broker and are more interested in generating returns for their investors and not so focused on IB commissions. Trader's that have IB accounts get paid based on the volume traded. Be cautious about traders that want you to register under their IB program with their broker.

13. How often can you request withdrawals?

If you're able to withdrawal funds as often as you like, that's a bonus and again shows greater confidence.

Forexsignals

GoldViewFX HISTORICAL DATA = BLUE PRINTWe always advise, as the basis of all technical analysis, is to zoom out and view the overall range and find price ranges similar to the current price range.

This allows us with a greater chance to map out a potential blue print for the current range by following how price reacted historically in the same range. This allows you to see how the historical range is being respected both ways and only by zooming out and bringing the historical range in view, in line with the current range, we are able to identify and predict these movements in the most basic form.

We then use indicators and setups to trade within those levels for specific entries and exits.

Please don't forget to like, comment and follow to support us.

GoldViewFX

XAUUSD TOP AUTHOR

Testing My Forex Trading Strategy My technique that i used to determine whether to buy or sell a currency pair at any given time.

that technique is based on three Fondamental Points :

CCI (convergence /divergence)

Tops / Bottoms

Trendline

Fibo retracement.

For thiis pair , we expacet an strong bearish to dwon level for next weeks approx (3-4 months)

So Lets see the result by testing this time with EUR NZD

For more information how to learn this method ,you can inbox me at any time

HEAD AND SHOUKDERS PATTERNWhile we get ready for the holidays we thought we would post some chart patterns for our newbies over the next few days.

The head and shoulders pattern is a formation of 3 peaks with the head being the highest peak (Lowest on inverse). The entry should be below the neckline (Above on inverse). The measure of take profit can be taken by measuring the peak of the head from neckline and using this range, as an indicator of the take profit level.

Please do give us a like, comment and follow to support us.

GoldViewFX

XAUUSD TOP AUTHOR

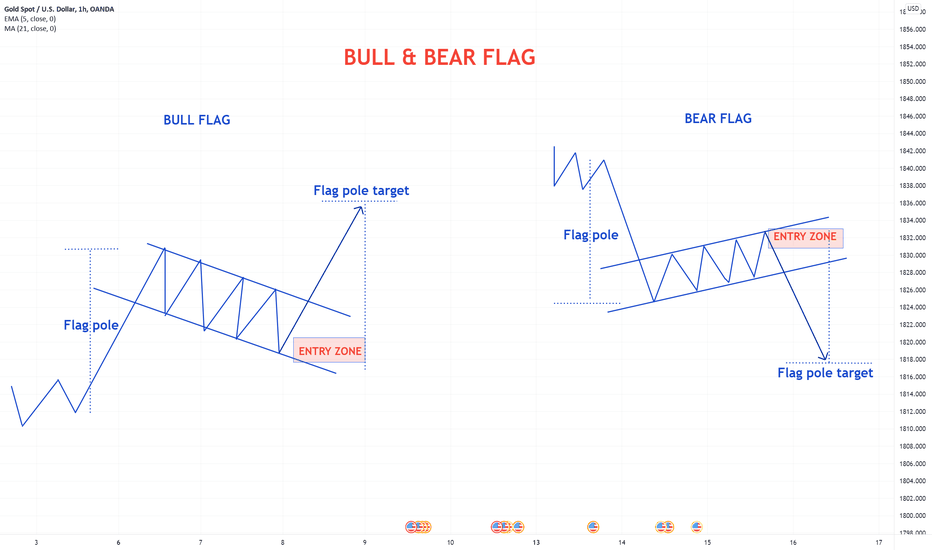

BULL & BEAR FLAG PATTERNSBULL FLAG

This pattern occurs in an uptrend to confirm further movement up. The continuation of the movement up can be measured by the size of the of pole.

BEAR FLAG

This pattern occurs in a downtrend to confirm further movement down. The continuation of the movement down can be measured by the size of the pole.

Please don't forget to like, comment and follow to support us,

GoldViewFx

XAUUSD TOP AUTHOR

MARKET STRUCTURE 🗒🗒🗒I am not the best painter, but i tried to show you the difference between the structure that we have in every market. And it doesnt depend if its crypto/stocks or forex everything is the same in terms of structure.

Trade in the direction of the HTF MARKET STRUCTURE.

Do you want more examples like that ? Comment below ..

RISK ON vs RISK OFFI tried to show you in this example what is the difference between risk on and risk off, what financial instrumnets rise during times of finacial stress aka risk off and what instruments rise during time of financial optimism aka risk on.

RISK ON - is when investor are looking to multiply their money, they are looking for RISK. MORE RISK - MORE MONEY

RISK OFF - is when investors are looking to keep/save their money, they are looking to protect more than to RISK. MORE PROTECTION - LESS MONEY

P.S - Where do you think CRYPTOCURRENCY market goes? Into a RISK ON or RISK OFF financial instrument ? Comment below

Forex Signal Scam???Hello, Trades,

I'm a new forex trader and I'm spending a good time becoming a good forex trader but I want to point the biggest scam or point which you should avoid at the beginning.

Point 1 - Forex not going to rich us. It works like a business and it takes good time

Point 2 - Don't be greedy too much cause nobody can guarantee you in this market

Point 3 - Forex Signal not going to help you to become a good profitable trader and it's surely scam not everyone but most of them

Point 4 - Yes you can spend your money by following signals or copied trades if you have enough money and are ready to lose or don't want to cry or don't want to blame

Point 5 - Starting I expect a 50% return but now I'm looking for 5-10% growth per month. That's the difference

Now let's talk about why you should avoid or Join Forex Signals Provider. Again, I'm not pointing to all signal providers but most of them do this and we just take the position without thinking after they provide the signals.

I've joined 2 Premium Signal providers and a few Free Signal provides as well cause they offer more signals in paid or premium channels but the logic is the same. They provide 3-5 signals every day and they offered TP1(20 Pips), TP2(50 Pips), TP3(100 Pips). Really good right. But what's the problem then?

The problem is they basically do RR 1:1 not 1:3 but how do they offer 3 TP then? Here we go, they Set their Stop loss of 100 Pips. Once I get this I stopped to follow all types of signals. Cause if they do 1:3 then their TP3 should be 300 Pips, not 100 pips. And we're risking 100 Pips to get only 20 Pips? What's the logic behind this?

As a beginner, I'm doing great and proud of myself but when they said they have 5 years experience then why do they take the risk of 100 Pips to get TP1(20 Pips). I thought I should share all these points. Might be helpful.

Because, if I go for 1:3 then stop loss 30 Pips and aim 90 pips or stop loss 100 Pips and aim 300 Pips. Simple as that. Please let me know if I get this right or not. May Be I could do some mistakes to understand this concept. Your valuable comment helps me to understand or become a good trader. God bless us all and wish everybody to succeed.

Know When To Close Your Trades!It's important to know when to hold a trade and when to close it.

Knowing can be difficult, however ask yourself - would I open a position at the current price?

For example, if you have bought a trendline and the trendline breaks should you close the trade? We say yes.

The exception to this is backtesting. If you backtest manual exits of a trade you can find the optimal exit strategy for your trade plan.

AUDNZD like Wyckoff's AccumulationMonthly chart of AUDNZD looking like going through Wyckoff's Accumulation phase...

If it break the Trendline then it possibly going to be long let's watch what Is going to be Happen...

I also watched Bitcoin is also going through Wyckoff's Accumulation phase...

.

.

.

CAD/JPY Short - 01 June 2021 | Hybrid Move Result: +3.00%Hey all,

Another quick breakdown of a Hybrid setup taken this month..

The trade initiated from a Sr. Daily Zone which was created all the way back in January 2018, where price showed a beautiful trendline break and a huge crash in price. Overall the monthly time-frame was sitting at major value as well together with the weekly chart being in need of a reversal after the strong 2020 and 2021 volatility in the markets.

The 4hour started to top out here after the daily showed a clearly over-extended run. When the double top formed at the 4hour chart, price confirmed the bearish bias with a clean 4hour star formation to the downside and a clean move later on. The orange candles at my chart are from our unique entry indicator developed to be optimal for our supply and demand zones.

If you have any questions, feel free to comment below!

Kind regards,

Max Nieveld

USD/SGD Long - 01 June 2021 | Hybrid Move Result: +3.00%Hey all,

Another quick breakdown of one of our key strategies.

The trade initiated from a Daily Jr. Zone stacked with a key quarterly and monthly trendline and of course a clean weekly area of demand. Beautiful price-action in my opinion at the higher-timeframes.

The overall higher time-frames were perfect when the trade was executed and the Dollar index was also located in multiple layers of demand. The last couple months we've been eyeing the dollar

for a clean recovery higher, the main reason for this was the fact that price was located in a key area of value at the monthly time-frame, at the weekly time-frame and at the daily time-frame as well|

by stacking our unique zones, we can gain an edge in the markets and by utilising multi currency analysis this trade was executed live together with a scale-in position which is still running with an additional

+3.16% locked in profits due to our trailing stop loss.

The 4hour entry was formed strongly after a bit of slowing down for the recent 4hour candlesticks. Price exploded to the upside due to fundamentals, even though we do not

trade fundamentals or check the news due to the subjectivity of it, we do love the volatility it brings to the table.

Text book setup in my opinion which provided some good profits.

Kind regards,

Max Nieveld

NZD/CHF Long - 21 May 2021 | Hybrid Move Result: -1.00%Hey All,

The trade initiated from a Daily Counterzone stacked with a clean area of weekly demand as well perfect in my opinion with the main idea to break the daily trend and

continue the higher-timeframe bias to the upside. Overall the setup was pretty complex due to the Counterzone analysis, yet clear enough to find and edge.

The 4hour strategy was executed after price formed a clean star formation and exploded to the upside after some more deceleration. The 4hour started to create a small double bottom formation

with our automatic Hybrid Strategy entry when the 4hour star closed. At the daily time-frame prices reached the downward sloping trendline formation which was never broken to the upside, instead

price moved towards the downside creating a deeper daily lower low and continue the trend.

Good trade, good edge.

The One Chart Pattern That You Must Trade!!!The One Chart Pattern That You Must Trade

What's a "first pullback"?

This is just the first pullback after a significant price event. For example:

- The first pullback after a trend line break.

- The first pullback after a breakout.

- The first pullback after break down (short).

- The first pullback after any wide range candle.

- The first pullback after a break to new highs

EX:

The first pullback after a trend line break.

The first pullback after a breakout.

The first pullback after a breakout EMA

The first pullback after a break to new highs.

The first pullback after a breakout from the range

Algo makes me happy. ALGOs are here to stay. They obviously cannot be taken for granted. One thing I tell friends that purchase an Algo in the form of a Tradingview Script, is that it will help their trading decisions and confirm technical Analysis made by them.

On my quest of finding a good Algorithm, not only for signals and accuracy, but supporting instruments, I came to Elite Signals Algo .

Again, the goal if an Algo is to support your own Technical Analysis. With almost 80% accuracy, this instruments can help your decision making and maintain emotions on the control level.

One of the coolest features is the auto drawing of Support and Resistance level. They are VERY accurate and combined with Candlestick pattern recognition, your day trading becomes very powerful.

Is the Algo making me a lazy Trader? No, not at all. Its a supporting tool, same as any indicator.

Are you interested in this great tool? Follow the link and send me any question you have.

Enjoy your day trading!

Disclaimer

This idea does not constitute as financial advice. It is for educational purposes only. You can use the information from this post to make your own trading plan for the instruments discussed or other instruments. Trading carries a risk; a high percentage of retail traders lose money. Please keep this in mind when entering any trade. Stay safe.

Easy setups in tradingI love these simple setups in trading. They keep recurring and are easy to identify if you know what to look for.

Basically, such a setup consists of three simple components.

1. the impulse. A strong move that is different from previous moves.

2. the correction of the movement.

3. the continuation. Breakout from the corrective movement in the direction of the impulse.

Ideally, the continuation is followed by a pullback. This offers excellent entry opportunities.

However, such a setup is by no way the "holy grail". Nevertheless, every trader should know the standard setups.

Happy Weekend everybody!

Commodity Prices and Currency MovesCommodity Prices and Currency Moves

When trying to distinguish the relationships between certain commodities and currencies around the world it helps to realize that situations can change and the relationships are fluid. However, there are some time-tested relationships that have been established over the years that may continue to hold true well in to the 21st century. Let’s take a look at a few of the most reliable correlations between commodities and the currencies they influence.

AUD/USD – Markets eye data

AUD/USD and Silver

What are commodities?

The prevailing thought around trading circles is that Gold and the AUD/USD (Australian Dollar / U.S. Dollar) is the ultimate correlation to follow, however, Silver is actually more reliable. It’s no secret that Australia has a significant portion of their economy tied to mining, but most don’t realize the scale with over 2% of the workforce employed by it, over 5% of the GDP relying upon it, and it contributes around 35% of the nation’s exports. Therefore, the fluctuations of the metal market have a large impact on the outlook for the AUD.

Pound to Canadian Dollar

USD/CAD and West Texas Intermediate Crude Oil

Commodity Prices and Currency Moves best currency pairs

Benefits of trading the forex market

West Texas Intermediate or WTI is the main type of oil traded in North America and is incredibly influential to the Canadian economy. It’s no secret that the U.S. is the world’s foremost consumer of oil (at nearly 19 million barrels per day (bpd), well ahead of 2nd place China at almost 11 million bpd), but many people don’t realize how they get said oil.

Live FX News

Many make the false assumption that Saudi Arabia is the nation with which it relies on a majority of its oil imports, but a third of oil imports comes from Canada, with Saudi Arabia contributing just over 17%. Interestingly, out of the 19 million bpd the US consumes 10 million bpd are produced in-house, but since Canada exports so much oil to their larger neighbors to the south, their currency is intrinsically tied to the value of the black gold.

USD/NOK and Brent Crude Oil

While these correlations are the most recognized and reliable in the early part of the 21st century, it doesn’t mean that they are the only ones. There are plenty of commodities around the world, and the ever-changing global landscape means that certain industries will diminish while others rise up.

According to some estimates, the known oil reserves will only supply the world until around 2040, after which we may have to find another form of making our machinations operate.

Commodity Prices and Currency Moves

Charting Basics – Bars vs. CandlesticksCharting Basics – Bars vs. Candlesticks

Charting Basics – Bars vs. Candlesticks Services Online

What are bars and candlesticks?

A chart is a graphical representation of historical prices. The most common chart types are bar charts and candlestick charts. Although these two chart types look quite different, they are very similar in the information they provide.

Bar and candlestick charts are separated into different timeframes. Each bar or candlesticks represent the high, low open and close price for a specific period of time Charting Basics – Bars vs. Candlesticks candlestick trading

Understanding Forex Charts

When looking at a daily chart , each bar/candle represents one day of trading activity Charting Basics – Bars vs. Candlesticks

gold trading basics

When looking at a 15min chart, each bar/candle represents a 15 min period, or session, of trading activity.

Why are bars and candlesticks important?

Technical Analysis includes the study and mapping of trends and price patterns through various technical indicators, or studies. This relationship between price and time can help traders not only see and interpret more data, but can also help pinpoint areas of indecision or reversal of sentiment Charting Basics Bars vs Candlesticks

Pound Set to Snap Losing Streak Vs US Dollar COVID-19

(This will be discussed in more detail within the Understanding Candlesticks section of the course) As a result, technical analysis is used to help determine the probabilities entries and exits in order to develop a strategy, or methodology forex trading signals

Candlesticks Trading

Bearish candles are typically red. It means the opening price was higher than the closing price for the specified time interval. Bullish candles are typically green. It means the opening price was lower than the closing price for the specified time interval Charting Basics Bars vs Candlesticks

Technical Forex Strategies

Charting Basics Bars vs Candlesticks

Social trading

Live Forex Signals Social trading involves the free sharing and using of information amongst a group of traders. The information provides access to new trading ideas, risk management and client sentiment. Social trading integrates the exchange of information into an online discussion. It creates a community feeling as traders can work together to plan specific trading ideas. In addition to sharing research, traders can also pool funds to generate greater gains.

Social trading is a broad category of trading and can include elements of copy trading and mirror trading. Traders can share information about individual trades that can be copied by other traders, or specific trading strategies that can be mirrored by other investors. Social trading can span the foreign exchange markets, as well as stock and commodity markets.

Is social trading profitable?

There are several benefits associated with social trading. Even if one is not open to online social interactions with other traders, there are specific aspects of social trading that can be beneficial. Social trading chatrooms with a moderator allow traders to follow trades and ask questions. This can be a good way for novice traders to learn more about trading and how to make profitable trades.

How does social trading work?

Social trading is generally performed on social trading platforms. Investors can trade within a community and replicate the style of expert traders. Moderators, who are usually experts, drive these discussions. Social trading can also involve aspects of copy trading and mirror trading.

An offshoot of social networking, social trading has created a different way to test financial information. In the past, investors would focus either on fundamental analysis or technical analysis . With forex trading, however, traders can share information about the current market environment and offer insight into future market movements, thus driving trading decisions. For some traders, it has changed the rules of analysis.

Most social trading takes place online. It provides traders with psychological support and can offer different points of view. By emulating some of the techniques learnt in a social trading environment, traders can often improve their trading strategies, risk management techniques and trading psychology . Forex trading focuses on short-term trading. This can in turn provide additional liquidity to the markets. Using social trading, one can also access the historical performance of members and can see the returns produced by specific strategies.

Social trading forum

Social FX platforms often provide a chart forum and social newsfeed. Members are constantly providing information about a specific subject. Traders can post their trading ideas as well as information to back up their thesis. Below is an example of a social trading interaction inside our online Next Generation trading platform, on the trading forum. Traders can engage with other traders and our market analysts to discuss the price evolution of the financial instruments that they are currently watching.

Create a live account to access this exclusive feature of our platform. It can be used as a forex trading forum, stock trading forum, or for any other financial market that you are interested in trading.

Social trading vs copy trading

With FX trading, one can garner ideas from many social trading networks. Copy trading, on the other hand, involves solely copying the trades of another investor. The goal of copy trading is for the trader to have the same positions as the investor they are copying. When copying another trader, one doesn’t receive the layout of the trader’s strategy and follows their trades blindly.

Traders can also invest their capital in a thematic investment. These are funds that turn capital over to specific traders who then act as portfolio managers. In essence, one is participating in copying funds. This is a bit like a funds investment, but instead of investing in hedge funds, one is investing a pool of capital into a fund that copies multiple traders. This provides diversity in copy trading and allows returns to be uncorrelated. Traders can perform this on their own, but it’s imperative for traders to ensure that they are not putting all their eggs in the same strategy basket.

What are the risks of social trading?

Like any trading activity, there are risks involved in social trading a market. Whether when copying another investor’s strategy or using the information to create their own trading decisions, traders should understand that there are risks involved and subsequently create their own risk management strategy. All trading leaders will, at some point, lose money. Individuals should feel comfortable that the risks are in line with their individual tolerance levels. The more capital risked, the greater the reward. They should also be aware that some social trading platforms charge a fee.

When allocating capital to forex trading, traders should start with determining the amount of capital they are willing to lose to generate the gains they are looking to achieve. They must also be realistic. For instance, a trader cannot expect to risk $50 to make $5,000. Traders should carefully look through the risk profiles associated with different social trading leaders and see if they are in line with expectations.

While one can set up an algorithmic trading mechanism, it is considered unwise to leave money unattended. As a very minimum, it is recommended that traders check their trades at least once every day. The best due diligence is to understand the logic behind the trading decisions made by a leader, and to be interactive in asking questions about the strategy one is using.

Summary

Social involves the sharing and using of information amongst a group of traders. There are several types of social trading, including strategy mirroring and copy trading. The information provided in social trading allows access to new ideas, risk management, and sentiment. Social trading can drive a community feeling as investors work together to formulate specific trading ideas. News feeds in social trading platforms offer access to real-time ideas that describe a strategy in detail. In addition to sharing research, social trading can also involve pooling funds to generate greater gains.

Social trading community

Some platforms provide a search criteria so traders can customize their social trading experience. Traders should test drive their trading for a while first before they start copying other investors. Traders should also ensure that the risk score is in line with their expectations and the maximum drawdown is not outside their tolerance level.

This can mean that they have an average return of 20% annualized but will regularly make and lose more than 50% on their trades. If the average return is 20% and the standard deviation of the returns is 50%, the Sharpe ratio is 0.4.

Why trade CFDs on currency pairs?

If, on the other hand, the average return is 20% and the standard deviation of the returns is 10%, then one will have a Sharpe ratio of 2. This is very good. The maximum drawdown offers information about the peak-to-trough drop. One should understand that if a leader has a maximum drawdown of 30%, a trader copying this person’s trades could lose 30% from peak-to-trough. MT4 Copy Trading

In our interactive trading platform, our forex trading community and stock trading community are particularly popular in comparison with other assets. You can access forex commentaries and stock market chatrooms to keep up to date with the latest news and analysis of the financial markets. using forex signals

Why so many Trader Fail!Chart patterns in trading

The key is to spend time learning the basic rules so you can use these methods most effectively with your trading strategy. See our stock chart patterns guide for a comprehensive overview of the 11 most important chart patterns you may come across.

While the idea of trading patterns may seem strange, it’s based on carefully tested methods which underline their usefulness to traders. Importantly, patterns are factors to consider when calculating where to enter, set stop-loss orders, and where to set your profit targets.

Beginner’s Guide for Trading USDJPY

Recognize how price movements can develop into price patterns

Manage risk with stop losses and set profit targets

Types of trading patterns

While this may not inspire confidence at the outset, these are formations that arise and track the changes in support and resistance. There are also more complex trading patterns such as head and shoulders, cup and handle and double tops/bottoms.

Once you have learned these skills, you will be able to apply them in any financial market that you choose, from shares to indices and forex. Pattern recognition can form the basis of trading strategies for day traders, swing traders and longer-term position traders alike and can be applied to anything from five-minute to weekly charts.

Rectangles and, in particular, triangles, have a wide number of varieties that can be used. In essence, all price patterns are looking at the interaction of supply and demand over time and establishing sensible ways in which to react when these trading patterns form. This means you will know how you to react in terms of risk management and closing out.

Typically, you would look for volume levels to decline over the time that the pattern forms.

Candlestick Trading | The Heart of Forex

If volume isn’t declining, this doesn’t necessarily mean that there is a problem with the pattern; however, something you should be on the lookout for is a volume spike when the breakout occurs. This tends to have a beneficial effect on the overall strength of the pattern from then on.

Another effect that can be greatly beneficial to look out for when breakouts occur is a gap in the price. This shows a surge in demand for the instrument surge in supply if it’s a short trade which adds a great deal of price confirmation for the trader.

Learn Online Forex Trading

The previous chart demonstrated an example of an ascending triangle with an upward breakout. As there is no directional bias as to which way patterns are going to break out, we also need to look at an example of what a downward break on an ascending triangle looks like.