Everything you need to know about order block 5 RULES | TUTORIALToday we're going to talk about orderblocks. Very simply, an orderblock is the support and resistance of big players. It is stronger and more important than what you draw on a chart expecting a price reaction by classical technical analysis.

This works absolutely everywhere in cryptocurrency, forex, and the stock market.

I have deduced for myself 5 rules of confirmation, and now we will go over each of them. Let's start with schemes and end with an example on a chart.

Orderblock is a candlestick that shows purchases or sales of large capital. When a bullish orderblock is formed, an accumulation or reaccumulation takes place in order to further markup the asset. When a bearish orderblock is formed, a short position is accumulated or reaccumulated. With the purpose of further asset markdown.

The first rule is liquidity.

We have a zone from which the price gets a reaction and goes in the opposite direction. This forms a support zone for those who trade classic technical analysis. Traders place their orders in this zone, which is what the big capital hunts for.

Accordingly, this level is pierced by the flow of orders, which activates these stops.

This is how liquidity is removed from the area.

The last bearish full-body candle will be our orderblock. It is important that it updates past lows. An analogy would be the wicks of candle, which removes liquidity from past lows. The wick of a candle in this case is an orderblock on a lower TF.

The second rule is confirmation

After withdrawal of liquidity we expect confirmation of this orderblock - that is absorption and movement in the opposite direction.

The confirmation should be impulsive. That is, we should not see how the price is stuck in this confirmation. It concerns the absorption (updating) of the order block. It is possible inside the candle (orderblock). But personally, I try to take the "book variant".

Local consolidations can indicate the weakness of the movement. It doesn't mean that the orderblock will not work out in the end, but the probability decreases.

The third rule is structure breaking (bos)

One of the key points is the breakdown of structure that this orderblock provides. This is how we can understand the mood of the market and the intentions of big capital.

In this example, we can highlight the main structure with the yellow line. It is after updating a significant structural element that we can be almost sure of the truth of our orderblock.

If we don't see a break in structure, then this movement may just be a correction within a downtrend. So keep an eye on this one.

The fourth rule is the law of force (momentum)

After confirming our orderblock, we can see a prolonged correction in the OTE (make a Fibo). That is, we should see an impulse and after it a slow sluggish movement downwards, which will also form liquidity behind each local high. This is not a necessary factor, but if it is present, the probability of a trend reversal will increase many times over.

The fifth rule - the volume and spread of candles

The candlesticks should be full-bodied with increased volumes. It will be important to monitor the "distance" that the price has done. All these factors will also indicate the veracity of the movement. This recommendation concerns more about swing trading, moments when the price is in a trend for a long time without a serious correction and test of the formed order block.

Examples on the chart

On the daily TF I marked a Sell to Buy move. I marked it this way because there were no warrant blocks to satisfy me on the higher timeframe. This area will act as a zone of interest.

The structure on the Hourly TF looks like this. Consequently, we expect a confirmation of our orderblock through a break of the structure. The price entered the sell to buy zone and tested the order block, which was formed from the wick of the candle.

We saw an impulse exit and watch the price go up sluggishly, forming liquidity behind each low. Therefore, we expect an orderblock test.

I recommend backtesting on chart history to better understand how order block works. Thank you for your attention, I hope it was useful

Orderblocks

HP Bos vs LP Bos - Supply & Demand Trading Hello traders

In this example, I will show you what HP BOS (break of structure) and HP POI (point of interest) look like, and on the right side you can see an example of low probability BOS (break of structure) and low probability POI (point of interest).

BOS (break of structure)

-Break of structure or BOS is the term used by

traders, and it simply indicates a break of the recent structure

We have 2 types of BOS

1. High probability BOS

2. Low probability BOS

High probability BOS

-You can see the high probability BOS on the left. The price impulsively breaks through the most recent structure, the momentum is present, and at the end, we see a good candle close, the price did not leave a big wick.

Low probability BOS

-You can see the low probability BOS on the right. The price barely breaks through the most recent structure, momentum is not present, and at the end the price leaves a large wick - the characteristic of a large wick is that the price no longer has momentum.

POI (point of interest)

- POI | Supply & Demand is the place where we want to sell or buy

We have 2 types of POI

1. High probability POI

2. Low probability POI

High probability POI

-When we want to select the HP POI , we want to see that the momentum is present, as in the example on the left. The price did not leave a wick, it impulsively broke the high, and we see a nice closing of the candle.

Low probability POI

-When we see a low probability POI, we don't want to see that OB as a potential trade opportunity. On the right, you can see the low probability POI. The price has no momentum, it leaves a big wick which tells us that the momentum is weakened.

I hope this example helped you to better understand the difference between high probability BOS & POI and low probability BOS & POI, if you have any questions, drop it down below.

What is OrderBlock ⁉️ ‼️ Order Blocks are candles where Market Makers (Banks) have placed their positions, generally, the market returns to those candles and they are never violated.

There're 2 types of Order Blocks:

1. The Bullish Order Block is the last bearish candle before the bullish movement, that Break The Market Structure Higher. Represents a high possibility of holding the price, when the price returns to it.

2. The Bearish Order Block is the last bullish candle before the bearish movement, that Break The Market Structure Lower. Represents a high possibility of holding the price, when the price returns to it.

The Overnight Diagonal That Manipulated Your Falsified GainsNow as of recently I have become submerged into Elliott wave theory.

It helps me define order flow on a fractal level and with the implementation of certain other order flow concepts,

I can then define the intent of order flow between sessions.

Elliott wave is fundamental in understanding market structure. Impulses and Corrections are fundamental in driving liquidating factors into the market and also actually

helping in drawing the correct Fibonacci levels as EWT has rules. And as traders we need rules as with every game, but it adds to confluence and the overall strategy in defining

well positioned entries.

Another Concept I implement is the Volume Spread analysis. Everyone has their take on volume, but volume is their as a leading indicator to show you between each timeframe which

transactions were of the dominant force, and also who is the dominating pressure inside each candlestick no matter the time frame.

With this knowledge you can then break down each candlestick to define the motive and where and why and to which extent order flow may extend and the overall transactional bias in the market by seeing the divergences

between the spread and the volume.

This is definitely a good foot print as well blending in session open times and closes. I personally enjoy the killzone theory conceptualized by ICT as it does help with timing and is based around the major session times when

volume enters the market.

Wyckoff models are a good study as blending volume spread analysis will aid in picking potential market tops and bottoms, EWT sealing the cap with knowing how certain intentions by large market participants are fractalized.

This here is the Overnight Diagonal which is very manipulative.

Diagonals take time to notice, but VSA helps bring confluence in determining whether or not the timing of a trade is high probability.

Remember, then manipulator always win, as that what manipulators are all for, self interest.

Supply and Demand Confirmation Entries ☑️The thing that catches most traders out is they don’t know what zone will hold, that’s why it’s always best to wait for the higher time frame zone to be mitigated, wait for the break of structure to confirm the trend is changing, then execute. Wait for confirmation ☑️

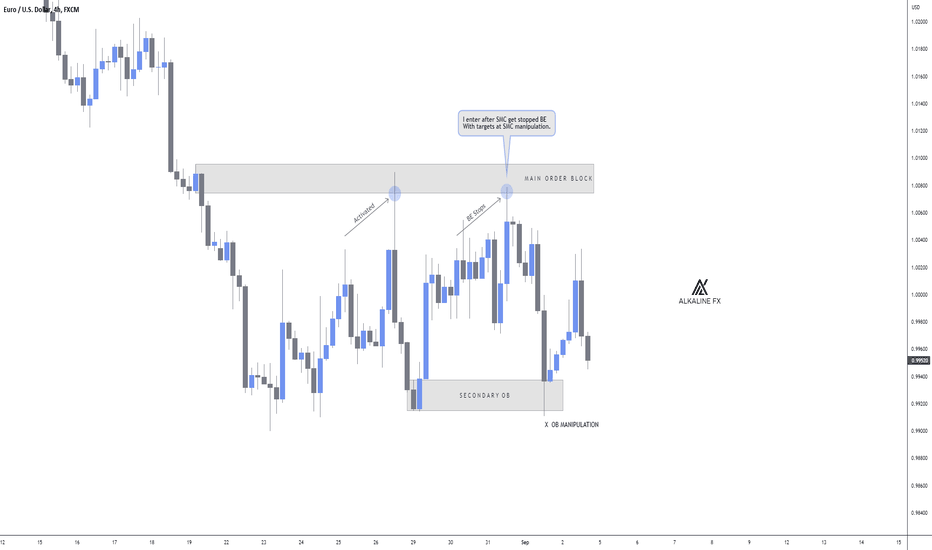

Smart Money Manipulation 🥊Alkaline is back baby! 💣

As smart money concepts gain popularity, liquidity increases.

I have taken a month away from trading to study the new forms of market manipulation and have been pleasantly surprised by what I have found.

Here is my discovery:

1) The market is currently focusing on taking liquidity from breakeven positions over fixed stop losses.

This is because emotional traders put their stops to BE quickly to avoid pain, especially during indecisive markets.

2) Order blocks are the perfect manipulation areas.

If you take time out to backtest significant order blocks, you will notice price will tap and lure or simply sweep above/below the zone before going in the intended direction.

3) That tight stop loss you are using is doing more damage than good.

Scale into your positions, trust me when I say this will reduce your emotions and give you a more relaxed trading style.

4) Use your brain, even if you are in denial.

If the majority of traders lose money, and the majority of traders now use smart money concepts, do the maths.

It feels good to be back after a long month of studying, I have lots of new things to teach and share.

I will be taking on new students shortly, have a great weekend everyone 👋

[Candlestick Patterns] Just need to know these three!#Candlestick #CandlePattern #Tocademy #Tutorial

Hello traders from all over the world, this is HAMZA_ZDH=)

I was unexpectedly surprised by many of you who liked and supported my last post about the basic concept of TA( Technical Analysis ). Today I prepared a brief lecture about the Candlestick Pattern, one of the most fundamental phenomenon and behaviors that traders must be well-informed. In fact, we should be very familiar with these textbook contents and interpret it in a glimpse on the technical chart unconsciously. Just like we don't pay direct attention about each breathes when breathing, like we don't care each and all of the alphabets when we speak, or like we don’t perceive location of each keyboards every moment as we type, this very technique should be performed automatically and quickly by observing dominant formations of candlestick bars.

As a matter of fact, comprehending market trends and price actions only by referring to the candlesticks is yet too spurious. It should be used in such a way to weight on certain scenarios in a macroscopic view, rather than deriving precise and specific PRZ(Potential Reversal Zone)s and distinguish the accurate market trend. It’s never like ‘The price must go up because this pattern just appeared’. Furthermore, I strongly believe that the reliability of the candlestick pattern strategy is declining especially in recent financial market, where we encounter countless non-traditional and abnormal situations that were not very common in the past. Hence among the existing ‘Textbook’ candlestick pattern strategies that can easily be found on Google , there are particular patterns that are still very reliable on current market and there are ones that are not as reliable as it used to be. So here, I will organize everything very clearly for you guys.

⁉️ What is OrderBlock? ‼️ Order Blocks are candles where Market Makers (Banks) have placed their positions, generally, the market returns to those candles and they are never violated.

There're 2 types of Order Blocks:

1. The Bullish Order Block is the last bearish candle before the bullish movement, that Break The Market Structure Higher. Represents a high possibility of holding the price, when the price returns to it.

2. The Bearish Order Block is the last bullish candle before the bearish movement, that Break The Market Structure Lower. Represents a high possibility of holding the price, when the price returns to it.

Mini Course : Order Block Course Hi Trader's ,, How Are You Today ? Enjoy In Holiday ,, Buy Don't Forget To Learn Too In Holiday ..

Let,s Take A Very Fast And Mini Course For : Order Block ,,

First : What IS The Order Block Mean ?

Answer : There Are Many concepts For Order Block ,, But the Real And Easily concepts For It Is " Order Block it's The Area There Banks And Big Companies Take There Orders From it "

Second : How To Get It On Chart ?

Answer : We Have 2 Patterns For It ,, Bullish And Bearish As You Se On Chart ,,

In Bullish We Have 2 Way ,, In Down Trend We Get " Low ' High ' Lower High ' Higher High ' Lower High " Then Enter Our Trade

Or In Also Down Trend We Get " Low ' High ' Lower Low ' Higher High ' Lower High " Then Enter The Trade ..

In Bearish Pattern We Also Have 2 Way To Entry ,, In Up Trend We Get " High ' Low ' Higher Low ' Then Break Out The Low And Test It And Entry "

Stop Lose Be Above The Area With 20 - 40 Pips Only

IF You Get New Information From me ,, Please Like And Comment

Bearish Orderblock with SH Powerful setups 🔥Definition. Order blocks in forex refer to the collection of orders of big banks and institutions in forex trading. The big banks do not just open a buy/sell order, but they distribute a single order into a check of blocks to maximise the profit potential. These chunks of orders are called order blocks in trading

Market structure basics - SMCIn this example, we are going over the basic terminologies of market structure we use in Sonarlab.

Terminology Market Structure

BOS: Break Of Structure - we use this terminology when a swing high or low gets broken when a trend continues.

CHoCH: Change of Character - we use this when there is a change in trend.

SH: Swing High

SL: Swing Low

Protected SH/SL: the swing high that is likely to hold since it is in sync with the trend

⁉️ How to identify orderblocks? ‼️ Order Blocks are candles where Market Makers (Banks) have placed their positions, generally, the market returns to those candles and they are never violated.

There're 2 types of Order Blocks:

1. The Bullish Order Block is the last bearish candle before the bullish movement, that Break The Market Structure Higher. Represents a high possibility of holding the price, when the price returns to it.

2. The Bearish Order Block is the last bullish candle before the bearish movement, that Break The Market Structure Lower. Represents a high possibility of holding the price, when the price returns to it.

THE ICT BREAKER!hello, so you want a model that will get you profits? LOOK NO FURTHER!!!!

this is the ICT BREAKER, this mode (and other confluences) is ALL, YOU, NEED.

if you confluence the BREAKER with...

- BMS

- OTE

- PREM /DISC RANGE

- INTERNAL LIQUIDITY

WHAT. MORE. COULD. YOU. WANT.

what is labelled, as the purple box, THAT IS YOUR BREAKER BLOCK, YOU TRADE IN HERE WITH THE RIGHT FRAMEWORK AND CONFLUENCES.

ICT IMBALANCE / FVG / LIQUIDITY VOIDLiquidity void, Fair Value Gap, Imbalance... These terms are interchangeable.

As a Charter Member ill tell you what I've shown here, is a basic depiction, as I got asked a question on what is an imbalance?

An imbalance, is an imbalance in price, where price has NOT efficiently delivered orders in the market, price will like to revisit these areas, of imbalance, as seen here. The diagram on the left depicts the ideal model of what an imbalance is, the chart on the right is an in time example.

if you notice one of these getting filled, at a place where you are bearish/bullish... well.... there is your trade!

USDJPY LRDER BLOCKSHey❤️, big institutions usually use order-blocks to trade and help them make tons of money.i too sometimes use it. Bearish order-blocks,signifies. Bearish trend is about to happens same with bullish

Order-block best thing is to always trade what you see and never what you think. This indicator can be found on trading view scripts, type “order-block finder by Wugamblo.

Share your thoughts with me about this indicator

Jesus loves you and died for you ❤️

What is an Order Block? 🎯Why are order blocks formed?

Order blocks are created when a breakout move doesn't go to plan.

If banks get caught in a fake breakout move, they aren't going to sit and cry about it.

They are going to push the price back up/down so that they can close out of their negative positions to join the correct side of the market.

Stop using order blocks that have no logic, widen your chart perspective.