Parallel Channel

Weekly Trading Recap: CADCHF, AUD/NZDJPY, EURCHF ADA May 15 2021Hello everyone:

Welcome back to this week’s trading recap video.

Let's take a look at the trades entered/closed this week.

I will explain my approach on the entry, SL, TP and management.

CADCHF: Running Position

Full analysis/forecast:

AUDJPY: - 1% loss

Full analysis/forecast:

NZDJPY: +0.5% profit

Full analysis/forecast:

EURCHF: - 1.16% loss from slippage

Full analysis/forecast:

ADAUSD: BE

Full analysis/forecast:

Any questions, comments or feedback please let me know. :)

Thank you

Jojo

MISSION ALERT:TELL BITCOIN PUT THE MONEY IN THE BAG💰🏧Im not giving out any financial advice in this video, I am posting to track my progress and to make sure any new traders could scroll past my post and learn something new instead of being told to buy signals or follow another persons trades without actually understanding whats going on for themselves.I used to struggle as a new trader and never had any real idea of what was going on,so here you go.

Banks are clearly the biggest manipulators of the market so i believe it is best to swim with the whales rather than get eaten by a shark(a.k.a. Elon Musk)😂 The concepts i trade with work in all markets and on every time frame, my only job is to be patient and the objective is to take profit!Like and comment if you agree with my post, Give me feedback so i can create better content for you guys!

Detail Look into Parallel Channel In Price Action Analysis

Hello everyone:

Let's take another detailed look into some parallel channels structures/patterns in price action analysis.

Recall my previous educational video on Ascending/descending channel correction, they are higher probability reversal price action structures/patterns.

Today I want to go over the horizontal parallel channel structures/patterns as well where they are more neutral,

more advanced to analyze and forecast the potential direction of the impulse phase following after.

Let's take a look into some of these horizontal parallel channel corrections, and break them down more.

In my opinion, the longer, deeper these types of parallel channels go, the stronger the next impulsive phase will be.

Although they can be tricky depending on whether they are continuation or reversal correction.

I will go over for examples in different markets to pinpoint some of these price action structures/patterns.

Below are some of the important topics that I mentioned in the video.

Reversal Ascending/Descending Channel

Risk Management: 3 different entries on how to enter the impulsive phrase of price action

Multi-time frame analysis

Identify a correction in price action analysis

Continuation and Reversal Correction

Any questions, comments, or feedback welcome to let me know thx :)

Jojo

5 Best Crypto to trade and/or to hold (BNB, ADA, XRP, DOT, LTC)

5 Best Cryptos to trade and/or to hold from a technical, price action point of view. (BNB, ADA, XRP, DOT, LTC)

Hello everyone:

The recent question I've been getting is what cryptos to trade or/and to hold.

Certainly trading and investing (holding) would be different,

so I thought I would outline some coins that have good price action and technical in my view at the current market condition.

Make sure to have your own plan on whether you are trading them or investing (holding),

as they can certainly have different outcomes and management needs to do so.

Remember please also take into consideration risk management and trading psychology as well.

Don't put all your eggs in one basket, spread out your $ to be stable and sustainable.

BNB

ADA

XRP

DOT

LTC

Any questions, comments or feedback welcome to let me know :)

Thank you

Jojo

Weekly Trading Recap: ADA, AUDCAD, GBPCHF, EURUSD May 08 2021

Hello everyone:

Welcome back to this week’s trading recap video. Let's take a look at the trades entered/closed this week.

I will explain my approach on the entry, SL, TP and management.

CARDANO (ADAUSD) - Currently running at BE

Full analysis/forecast:

AUDCAD - Closed 2 trades for about 3.2% profit

Full analysis/forecast:

GBPCHF - Close down for about 1.87% profit

Full analysis/forecast:

NZDJPY - Closed 2 trades for about 0.74% profit

Full analysis/forecast:

EURUSD - Exit for about 0.85% profit

Full analysis/forecast:

Any questions, comments or feedback please let me know. :)

Thank you

Weekly Trading Recap: NZDJPY, AUDCAD, GBPCHF May 01 2021Hello everyone:

Welcome back to this week’s trading recap video. Let's take a look at the trades enter this week.

I will explain my approach on the entry, SL, TP and management.

NZDJPY - running about +2%

Full analysis/forecast:

AUDCAD - running about +4%

Full analysis/forecast:

GBPCHF - running about +3.5%

Full analysis/forecast:

Any questions, comments or feedback please let me know. :)

Thank you

Jojo

U.S. Indices Price Action Market Outlook (S&P500, NASDAQ, DOW)Hello everyone:

Many have asked me about my outlook and analysis on the US indices currently, so let's take a quick look at them.

My overall bias on the indices are bearish. There could be some lower time frames bearish price action to give us confirmation of the bigger sell setups.

All of them are pretty much sitting at the top of the overall higher time frame price action, so certainly has good probability that we can get some bearish reversals.

I will go over them from a mid-long term approach.

Once again patience is key, if the bearish price action does not develop or continue, then no trade and entry, move on to other opportunities and different scenarios.

SPX

NAS

DOW

Any questions, comments or feedback welcome to let me know.

Thank you

Jojo

Detail Breakdown on GOLD Mid-Long Term OutlookHello traders:

Today I breakdown GOLD's current price action, and I discuss the potential possibility on the mid to long term outlook.

There could be different possible scenarios from the price, so its a good practice to have a solid trading plan and management.

Mid term wise I prefer to see price makes one more move to the downside, breaking previous lows and hit the bottom for the HTF flag/channel structure before reversing.

Alternatively we can also expect price to consolidate here and form a LTF impulse to breakout of the LTF flag/channel as well.

In both cases, long term outlook is certainly bullish if we get a completion of the LTF flag/channel that will have high probability to lead into next bullish impulse run.

Any questions, comments or feedback welcome to let me know.

Thank you

Jojo

Gap fill and a downtrend on TSLAHappy Friday trading everyone. We are looking at a recent gap fill that happened (the gap on 19-22 Feb) the fill just earlier this week. Since we filled we are currently still in a downtrend (short term) looking for a test of either 601 on or a break above and test 790 range. Watch this carefully over the next week or so as we grind through May.

OIL higher time frame outlook (Multi-time frame analysis)

Hello everyone:

Doing a quick bearish outlook on oil.

I like the price had a strong reversal bearish price action from the top of the HTF double tops area, and could lead into further continuation on the LTF

I will be patiently waiting for price to develop into the price action I want to see before executing any trades.

Thank you

Jojo

AUDCAD Continuation Sell (Multi-Time Frame Analysis)

Hello everyone:

Looking at AUDCAD for continuation sell opportunities.

WE can see price had a bearish impulse phrase on the HTF, after breaking out from the rising wedge, and is now forming consolidation which can lead into the next down move.

I would be waiting for a confirmed breakout from the continuation correction, and any LTF correction to get in on the sell

thank you

P.S. If you enjoy a video analysis breakdown moving forward, please let me know :) thx

Jojo

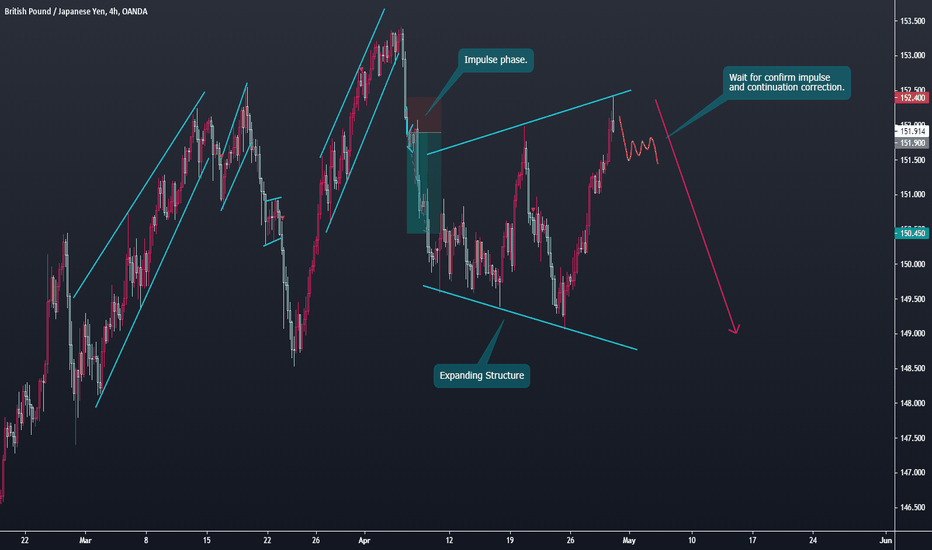

JPY Bearish Outlook (GJ, AJ, NJ, CJ)

Hello traders:

Similar like the USD outlook, I have made a quick video breaking down some of the JPY pairs I am looking at.

Same trading plan and risk management approach like the USDs, I would wait and see the bearish development first before enter any positions.

So watch out for some LTF development on some of these pairs in the up coming days.

Thank you

USD Outlook (GU, EU, AU. NU)Hello everyone:

Welcome back to a quick updates on the USD.

In this quick video I breakdown 4 USD pairs that are shaping up to for a good sell potential on them.

All of them will need a bit more development to give me the positive confluence to enter the trades, so patient is key here.

IF the price doesn't develop into what I like to see, then no entry for me. :)

EURUSD

s3.tradingview.com

GBPUSD

s3.tradingview.com

AUDUSD

s3.tradingview.com

NZDUSD

s3.tradingview.com

Any questions, comments or feedback welcome to let me know :)

Thank you

Weekly Trading Recap: GBPCHF, EURUSD Apr 24 2021Hello everyone:

Welcome back to this week’s trading recap video. Let's take a look at the positions that closed down this week.

I will explain my approach on the entry, SL, TP and management.

GBPCHF - Running 2% profit

Full analysis/forecast:

EURUSD 0 Closed for BE

Full analysis/forecast:

Any questions, comments or feedback please let me know. :)

Thank you

Jojo

Weekly Trading Recap: LTCUSD, XLMUSD, BNBUSD, GBPCHF Apr 17 2021Hello everyone:

Welcome back to this week’s trading recap video. Let's take a look at the positions that closed down this week. I will explain my approach on the entry, SL, TP and management.

Litecoin (LTCUSD) - Running about 2% profit

Full analysis/forecast:

Stellar (XLMUSD) - Running about 2.5% profit

Full analysis/forecast:

Binance Coin (BNBUSD) - closed down for +9.5% profit

Full analysis/forecast

GBPCHF - Closed down for +0.5% profit

Full analysis/forecast:

Any questions, comments or feedback please let me know. :)

Thank you

Jojo

How to identify a correction for the next impulse move ? How to identify if a correction is finished/completed and ready for the next impulse move ?

Hello everyone:

In this educational video I will go over how to properly identify a correction in price action analysis.

I recently made a price action workshop live stream video that went over everything on impulse - correction, structures/patterns, continuation and reversal corrections,

but I still get a lot of questions on identifying corrections itself.

How to draw, use the trendlines to identify a correction, and how to understand they are going to complete/finish.

In my opinion this is the most important part in technical analysis.

We need to understand that the market moves in phrases, it can only be in the impulsive phrase or corrective phrase.

The key to trading is to understand when a correction finishes, we are going to get the impulsive phrase which will give us traders a better edge in the market to enter, where the momentum is strong.

I have made many educational posts on price action analysis, specifically on continuation or reversal correction, which I will put the links below.

Any questions, comments, or feedback welcome to let me know.

Thank you

Jojo

Price Action Workshop

www.tradingview.com

Impulse VS Correction

Continuation and Reversal Correction

Multi-time frame analysis

Continuation Bull/Bear Flag

Reversal Ascending/Descending Channel

Reversal Double Top/Bottom

Reversal Head & Shoulder Pattern

Reversal “M” and “W” style pattern

Reversal Impulse Price Action

Expanding Structure/Pattern

Weekly Trading Recap: BNBUSD, GBPJPY, GBPUSD, XLMUSD, Apr10 2021Hello everyone:

Welcome back to this week’s trading recap video. Let's take a look at the positions that closed down this week. I will explain my approach on the entry, SL, TP and management.

Binance Coin (BNBUSD) - running about +8% profit, will exit at $500

Full analysis/forecast

GBPJPY - Exit for +3% profit first trade, and -1% loss on second scale in.

Full analysis/forecast

GBPUSD - Exit for +2% profit

Full analysis/forecast

Stellar (XLMUSD) - running about +1% profit, SL still at BE

Full analysis/forecast:

EURNZD - Exit for +0.5% profit

Full analysis/forecast

NZDCAD - exit for about -0.25% loss.

Full analysis/forecast

Any questions, comments or feedback please let me know. :)

Thank you

Jojo

Weekly Trading Recap: BNBUSD, LINKUSD, EURAUD April 03 2021Hello everyone:

Welcome back to this week’s trading recap video. Let's take a look at the positions that closed down this week. I will explain my approach on the entry, SL, TP and management.

BNBUSD - Running about 1.5%

Full analysis/forecast

LINKUSD - Running about BE

Full analysis/forecast

EURAUD - 1 % profit

Full analysis/forecast

NZDCHF -1% loss

Full analysis/forecast:

GBPJPY - 1% loss

Full analysis/forecast:

Any questions, comments or feedback please let me know. :)

Thank you

Jojo

Risk Management: Entry in the impulsive phrase of price action Hello everyone:

Welcome back to another video on risk management.

Today I want to discuss a few possible entries that we can do in the market when we spot the next impulsive phrase of the market condition.

I will break down the 3 types of entries that I always look for when I am about to execute a trade.

Sometimes we will see all 3 entries present themselves, and sometimes we might only see 1 or 2. So let's dig into these entries.

All entries are based on the continuation or reversal structure on the LTF mostly.

So I need to see a LTF correction forming and potentially completing before setting any of these entries.

In addition, they have to be aligned with the HTF overall direction and bias. Multi-time frame analysis is key.

All my entries are stop entry order, meaning the market needs to hit a certain price before getting triggered. Buy Stop or Sell Stop order.

You may see variations of these entries in different strategies or styles, but here are my take on them and my way of using them in my trading.

Let me give a few examples of each on different markets and pairs to show the potential move and possible entry criteria.

Below are same other Risk Management you should know in trading.

Risk Management 101

Risk Management: How to set a Take Profit (TP) for your trades

Risk Management: How to Enter and set SL and TP for an impulse move in the market

Risk Management: How to scale in the impulsive phrase of the market condition?

Risk Management: Combine everything you learn to prevent blowing a trading account

Impulse VS Correction

Continuation and Reversal Correction

Multi-time frame analysis