Negative Risk/Reward: Hidden Edge or Hidden Danger?It’s a topic that sparks plenty of debate.

👉 Can a negative risk/reward ratio actually be part of a winning strategy?

Here’s our take, split between intraday trading and swing trading:

📉 Intraday Trading

☑️ Pros:

• Can work in high‑probability setups (mean‑reversion, range scalps)

• Quick targets often get hit before stops

• Stops can sit beyond liquidity grabs to protect the trade

⚠️ Cons:

• Needs a consistently high win rate

• Prone to slippage and fast spikes

• Can lead to over‑trading if discipline slips

If used, risk must always be pre‑defined — not adjusted mid‑trade.

⏳ Swing Trading

☑️ Pros:

• Occasionally helps avoid being stopped on deeper pullbacks

• Gives breathing room in trending markets

⚠️ Cons:

• Smaller targets vs bigger stops rarely pay off over time

• Lower win rate on higher timeframes makes it hard to sustain

• Exposed to news gaps & weekend risk

Overall, swing trading works best with positive R/R setups (e.g., 2:1 or higher).

☑️ Summary:

Negative R/R can work — but only if:

• The setup is statistically proven & high probability

• You keep risk strictly pre‑defined

• It fits the pair, timeframe & volatility

Most traders are better off sticking to positive R/R — but for experienced scalpers, negative R/R can be a tool rather than a trap.

💭 Do you use negative risk/reward in your strategy?

Only intraday, or do you apply it to swing trades too?

Drop your thoughts below —we're curious to hear how others approach it! 👇

Thanks again for the likes, boosts, and follows — really appreciate the support!

Trade safe and all the best for the week ahead!

BluetonaFX

Riskmangement

Mastering Risk Management: The Trader’s Real EdgeYou’ve all heard it,

“Cut your losses and let your winners run.”

Simple words — but living by them is what separates survivors from blown accounts.

Here’s some tips on how to approach risk management when trading:

☑️ Risk is always predefined: Before I click Buy or Sell, I know exactly how much I’m willing to lose. If you don’t define risk upfront, the market will do it for you.

☑️ Position sizing: Never risk more than 1–2% of your account per trade. Small losses mean you can keep taking high‑probability setups without fear.

☑️ Always use a stop‑loss: No stop? You’re not trading — you’re gambling.

☑️ Stop‑loss discipline: Place stops where the market proves you wrong — not where it “feels comfortable.” Then leave them alone.

☑️ Focus on risk/reward, not win rate: A 40% win rate can still be profitable if your average reward outweighs your risk.

☑️ Risk/reward ratio: Only take trades with at least a 2:1 or 3:1 potential. You don’t need to win every trade — your winners should pay for your losers (and more).

Remember:

“It’s not about being right all the time. It’s about not losing big when you’re wrong.”

Risk management won’t make your trades perfect — but it will keep you trading tomorrow.

And in this game, staying in the game is everything.

💭 How do you handle risk in your trading? Drop your strategy or tip in the comments — let’s share and learn together! 👇

Thanks again for all the likes/boosts, we appreciate the support!

All the best for a good week ahead. Trade safe.

BluetonaFX

How to Use Stop Losses in TradingViewThis video covers stop loss orders, explaining what they are, why traders use them, and how to set them up in TradingView.

Disclaimer:

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. Please trade only with risk capital. We are not responsible for any third-party links, comments, or content shared on TradingView. Any opinions, links, or messages posted by users on TradingView do not represent our views or recommendations. Please exercise your own judgment and due diligence when engaging with any external content or user commentary.

The placement of contingent orders by you or broker, or trading advisor, such as a "stop-loss" or "stop-limit" order, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders.

The Biggest Turning Point Isn’t in the Market — It’s in YouHard truth:

No new strategy, indicator, or tool will work until you change how you operate.

Here’s why:

Strategy hopping is fear wearing a costume.

If you keep switching tools after every loss, you’re not refining — you’re running.

You don’t need more — you need fewer, better decisions.

Simplifying your process is harder than adding new ideas. But that’s where edge lives.

Belief is the multiplier.

Without conviction, you’ll quit before any system has time to work.

🚀 The shift?

For us, it was trusting what we built — TrendGo.

When we finally stopped tweaking and started trusting the system, everything changed: our mindset, our consistency, our results.

The best tool is worthless if you don’t believe in your process.

🧠 Start there.

Why Traders Chase — and Always LoseHard truth:

You don’t miss opportunities. You chase noise.

Let’s break down the real reason you keep “missing moves”:

1. FOMO is not urgency — it’s confusion.

When you enter because “everyone’s talking about it,” you’re not trading a setup. You’re reacting to social proof.

2. Volatility ≠ opportunity.

Big moves look attractive, but if they’re not in your plan — they’re distractions, not trades.

3. The market rewards patience, not activity.

Every click, every chart, every refresh feeds your dopamine — not your edge.

🚫 Solution?

Stop scanning. Start filtering.

Use tools that prioritize structure over noise. That’s why we built TrendGo — to give clarity in chaos and help you avoid traps masked as opportunity.

📌 Don’t chase. Build your edge.

Why Financial Clarity Comes Before Any Forex Trade?Before any strategy or setup, I ask one thing: is my personal financial foundation strong enough to support this trade?

In this reflection, I explore the direct impact that personal finance management has on trading performance — not as an abstract idea, but as a daily reality. When financial clarity is missing, emotional decision-making creeps in. When it’s present, I trade with more patience, discipline, and perspective.

This is not trading advice. It’s a caution to those who see trading as a way out, rather than something built upon stable ground.

Guess what? I am on a Demo Account. I will keep on trading on a Demo Account until I know that I have a solid risk management plan and a trading methodology that both will give me consistent profits.

The whole Idea with personal finance management in forex trading is to know whether you can afford trading and once you know the answer to that what is your game plan.

Just a quick hint.. If your answer is no; meaning that today you cannot afford trading, don't be discouraged, there is still a plan that can be designed. Actually, I think the ones who cannot afford trading are in a better positions than those who can.

The ones who cannot afford trading today, can easily start learning without having the itch to open a live account.

Mastering Volatile Markets: Why Reducing Position Size is Key █ Mastering Volatile Markets Part 1: Why Reducing Position Size is Key

Trading is always challenging, but how do you navigate today's markets? That's a whole different level. Today, we'll move away from the usual "Trump's tariffs are horrendous" discussions. We'll instead focus on how experienced traders profit in the current volatile market.

Right now, we're seeing extreme volatility across many assets. It's not uncommon for markets to move 3% to 10% in a single day , and for indices like NAS100 (Nasdaq), intraday swings of 300 to 500 points can happen in just 5 to 30 minutes.

This can seem like bad news, but as Warren Buffet said in 2008, "In short, bad news is an investor's best friend."

Volatile markets can shake even experienced traders — but they don’t have to. With 16 years of trading experience , we’ll show you exactly how to approach conditions like these with confidence and clarity.

█ Reducing position size is the key to surviving volatility:

The most critical adjustment in a volatile market is reducing position size.

Why? Because when the market moves faster and with bigger swings, your potential risk per trade automatically increases. The key is to keep your d ollar risk the same — even when volatility is exploding.

⚪ Let's take a look at how position size changes when markets change:

2 Weeks Ago — Stable Market:

NAS100 average move per trade = 50 to 100 points

Risk per trade = 100 points = $500 risk (for example)

Position Size = 5 contracts

Today — Volatile Market:

NAS100 average move per trade = 300 to 500 points

To maintain the same $500 risk per trade → Position Size = 1 contract

⚪ The Benefit:

With a smaller position, you can still earn the same profit because the price is moving much more. At the same time, your risk stays controlled , even in these wild markets.

This is exactly how professional traders survive and thrive in volatile conditions — by adjusting to what the market is giving them.

⚪ What Happens If You Don't Reduce Size?

Let's say you keep the same position size as in stable markets, but now the market moves 300-500 points against you instead of 50-100. Here's how it plays out (example):

In Stable Markets (NAS100 average move: 50-100 points):

Position Size: 5 contracts

Risk per contract: $10 per point

Risk per trade: 100 points x $10 x 5 contracts = $5,000 risk per trade

In Volatile Markets (NAS100 average move: 300-500 points):

Position Size: 5 contracts (unchanged)

Risk per contract: $10 per point

Risk per trade: 500 points x $10 x 5 contracts = $25,000 risk per trade

Without reducing position size, your risk increases dramatically as the market moves wildly. As a result, your losses will skyrocket when the market moves against you.

█ Summary:

Huge volatility = Smaller position size

Same risk = Same profit potential

Trade smarter, not bigger

This is rule number one when navigating wild markets like the ones we have today.

█ What's Coming Next in the Series:

Part 2: Liquidity Is the Silent Killer

Part 3: Patience Over FOMO

Part 4: Trend Is Your Best Friend

Stay tuned for the next part — and remember, adapting to volatility isn't just about managing risk, it's about mastering the market!

-----------------

Disclaimer

The content provided in my scripts, indicators, ideas, algorithms, and systems is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or a solicitation to buy or sell any financial instruments. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual's trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

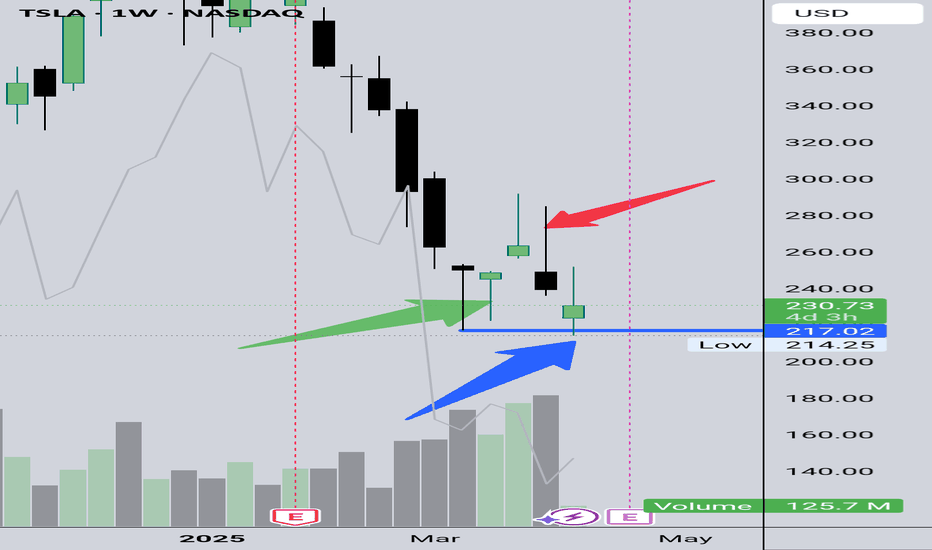

TESLA Always Pay YOURSELF! Tsla Stock were you PAID? GOLD Lesson

⭐️I want to go into depth regarding the this topic but it is a long one with PROS & CONS for doing and not doing it.

Every trader must choose what's best for them but you will SEE when I finally get to the write up that MANY OF THE PROS are NOT FINANCIAL but PSYCHOLOGICAL❗️

Another of 🟢SeekingPips🟢 KEY RULES!

⚠️ Always Pay YOURSELF.⚠️

I know some of you chose to HOLD ONTO EVERYTHING and place your STOP at the base of the WEEKLY CANDLE we entered on or the week priors base.

If you did that and it was in your plan GREAT but... if it was NOT that is a TRADING MISTAKE and You need to UPDATE YOUR JOURNAL NOW.

You need to note EVERYTHING. What you wanted to see before your exit, explain why not taking anything was justified to you, were there EARLY exit signals that you did not act on. EVERYTHING.

🟢SeekingPips🟢 ALWAYS SAYS THE BEST TRADING BOOK YOU WILL EVER READ WILL BE YOUR COMPLETE & HONEST TRADING JOURNAL ⚠️

📉When you read it in black amd white you will have YOUR OWN RECORD of your BEST trades and TRADING TRIUMPHS and your WORST TRADES and TRADING ERRORS.📈

✅️ KEEPING an UPTO DATE JOURNAL is STEP ONE.

STUDYING IT IS JUST AS IMPORTANT👍

⭐️🌟⭐️🌟⭐️A sneak peek of the LESSON after will be HOW & WHEN TO ENTER WHEN THE OPEN BAR IS GOING THE OPPOSITE WAY OF YOUR IDEA.👌

🚥Looking at the TESLA CHART ABOVE you will see that we were interested in being a BUYER when the weekly bar was BEARISH (GREEN ARROW) and we started to consider TAKE PROFITS and EXITS when the (RED ARROW) Weekly bar was still BULLISH.🚥

A Practical Framework for Overcoming Fear in Trading“Fear is not real. The only place that fear can exist is in our thoughts of the future. It is a product of our imagination, causing us to fear things that do not at present and may not ever exist. Do not misunderstand me, danger is very real, but fear is a choice.” - Will Smith, After Earth

Although I firmly agree with this statement, I also have to acknowledge that while fear is a choice, it’s also a biological response to perceived threats like uncertainty, lack of control, and experience.

When faced with these threats the brain activates the amygdala which triggers the fight or flight response releasing hormones like cortisol and adrenaline, preparing the body to respond quickly and instinctively.

If left alone, traders consumed with fear will either seek to take vengeance against the markets, typically referred to as “Revenge Trading” or they’ll hesitate when taking the next position fearing that it would be a repeat of the last. Either way, it never ends well.

In today’s article we’re going to be breaking down fear both figuratively and literally, by gaining a deeper understanding on how it works and what steps we should take to overcome it.

Three Types of Fears in Trading:

Now I’m sure most of you reading this article are familiar with the three types of fears related to trading, so I’ll go through these quite briefly but for those of you who might not be that familiar I’ll leave a short explanation for each of the fears highlighted.

Fear of Missing Out (FOMO):

The apprehension of missing profitable opportunities leads traders to enter trades impulsively without proper analysis, often resulting in poor outcomes. Traders experiencing FOMO generally find themselves in trading signal groups or rely on social media for direction, see my previous article on Trading Vs. Social Media

Fear of Losing Money:

The anxiety associated with potential financial loss can cause traders to exit positions prematurely or avoid taking necessary risks. This fear is closely linked to loss aversion, where the pain of losing is felt more intensely than the pleasure of equivalent gains.

Fear of Being Wrong:

The discomfort of making incorrect decisions can deter traders from executing trades or cause them to hold onto losing positions in an attempt to prove their initial decision was right.

In many respects, traders try to deal with these fears directly but usually without much success. This is because they’re treating the symptom but not the cause.

In order to deal with any of these fears either independently or collectively you’d need to first learn to become comfortable in three very specific areas.

Uncertainty - At its core, trading is a game of probabilities, not certainties. Certainty in trading comes only when you’re able to shift your focus from the outcome of any one trade to your ability to take any one trade regardless of the outcome. Remember, it's not your job to predict the future, rather you should prepare for it.

Past Losses - The outcome of one trade has absolutely no impact on the outcome of the next, and the best way to deal with past losses is to embrace the lessons that came with it.

Lack of Control - Although we cannot control the outcome of a trade, we do control the type of trade we take. We can control when we enter, exit, and how much we risk, which when examined closely carries far more significance than merely seeking to control the outcome.

Debunking The Biggest Myth In Trading

If you won then you were right, if you lost then you were wrong. This is the biggest myth in trading today and one of the main reasons why so many traders chose being right over being profitable.

Instead of accepting a loss, they’ll remove whatever stop loss they had in place in the hope that the market will eventually turn in their favor, refusing to accept that they may have been wrong.

There are very good reasons for this type of behaviour which is tied directly to our identity, social belonging and self-worth. When we’re faced with the possibility of being wrong our intellect, competency and self-image is challenged.

In order to protect ourselves from this challenge, we begin to resist any new information that could conflict or even threaten our existing belief, creating discomfort even when the evidence is clear.

This can trigger emotions like anxiety and avoidance behaviour which can show up in the form of hesitation, overthinking, or avoiding placing trades altogether. However, I’m about to share a framework with you that will help you overcome the fear of being wrong and instead of avoiding it, if you follow this framework, you’ll begin to embrace it.

3 Step Process To Profit From Being Wrong

In trading Losses are inevitable. In fact, some of the most successful traders lose far more times than they actually win, and yet they’re still able to make money. This is because you don’t need to be a winning trader in order to be a profitable one.

It’s under this principle that you’ll apply the 3 step process to profit from being wrong.

1. Reframe “Wrong” as “Feedback”

Generally being wrong comes with consequences, in trading those consequences comes in the form of losses. However, you determine how much you’re willing to lose on any given trade. This means that because you control how much you’re willing to lose, you ultimately control the consequences.

The market is a nearly endless pool of trade opportunities and no one trade can determine the outcome of the next. Therefore, a losing trade cannot mean you were wrong, because as long as you still have capital to trade there is another opportunity lining up.

Instead, what the losing trade does uncover is the market conditions in relation to your plan. It’s at this point where you review your initial analysis and see if anything has changed. If nothing changed, then it's likely you may have gotten in a bit too early and you’d just have to wait for the next setup.

However, upon your review, you discover the market conditions have changed, and you now have to re-evaluate your approach, then this is the feedback the market is giving you. This is what it means to take feedback from the markets and this is what it takes to be profitable instead of being right.

2. Separate Identity From Outcome

The mistake many trades tend to make is measuring their success on the outcome of a trade. This is a recipe for disaster because in order for them to feel successful they’d have to win every single time.

This of course is impossible, instead I’d encourage you to separate yourself from the outcome of the trade and focus on just trading. There are only one of three outcomes you can experience in a trade. 1. Loss, 2. Win, 3. Breakeven. When you’re able to accept 1. Loss then you don’t have to worry about numbers 2,3.

Because you control how much you’re willing to lose you should be able to accept what you’re willing to lose, and by accepting what you're willing to lose you’ve then separated yourself from the outcome of the trade and you can now focus on just trading.

To keep you in check with this step here is a very simple but highly effective practice:

✅ Practice saying: “This was a good trade with a bad outcome — and that’s okay.”

3. Celebrate The Process, Not Perfection

“That which gets rewarded gets repeated” If you’re only rewarding yourself when you close a winning trade then you’re simply reinforcing the notion of viewing the markets through the lens of right and wrong.

As we’ve already discovered this view is detrimental to your longevity as a trader and so I would argue that instead of celebrating a winning trade, celebrate your process. Reward yourself every time you follow your plan regardless if the trade resulted in a win, loss or breakeven.

This approach will help you improve your process which in turn will improve your overall returns and performance.

Conclusion

📣 You are not here to be perfect. You’re here to grow, to learn, and to keep showing up — fear and all.

The market rewards the trader who is calm under pressure, humble in defeat and focused on the long game.

Go into this week knowing that fear may still show up — but you’re more prepared than ever to handle it.

Let fear be a signal, not a stop sign.

You've got this. 🚀

Mastering Risk Management in Trading: The Ultimate GuideMastering Risk Management in Trading: The Ultimate Guide

In the world of trading, success isn’t measured only by big wins but by how well you protect your capital from unnecessary losses. Risk management isn’t just a safety net—it’s the backbone of sustainable trading. In this comprehensive guide, we’ll break down the principles and strategies you need to safeguard your account while still maximizing your profit potential.

---

1. Risk-Reward Ratio: The Foundation of Every Trade

- What it is:

The risk-reward ratio is the cornerstone of every trade. It tells you how much potential reward you’re targeting compared to the risk you’re willing to take. For instance, if you risk $100 and aim to make $200, your risk-reward ratio is 1:2—a commonly accepted standard in trading.

- How to use it:

- Always predefine your risk-reward ratio before entering a trade.

- For swing traders, aim for a minimum of 1:2 or 1:3 to justify holding overnight.

---

2. Position Sizing: The Key to Survival

- Why position sizing matters:

Position sizing ensures you don’t over-leverage your account or lose too much in a single trade. Many traders fail because they bet too big and get wiped out after just a few losing trades.

- How to calculate position size:

- Use this formula:

Position Size = (Account Risk $ ÷ (Entry Price - Stop-Loss Price)).

- For example, if you’re risking $100 per trade and the difference between your entry and stop-loss is $5, your position size should be 20 units (100 ÷ 5).

---

3. Stop-Loss Orders: Your Safety Net

- What is a stop-loss?

A stop-loss is your emergency brake. It’s an order you set in advance to sell your position if the price moves against you by a specified amount.

- How to set stop-losses:

- Use technical analysis to place your stop-loss below support levels for long trades or above resistance levels for short trades.

- Avoid placing stop-losses too close to your entry point, as small fluctuations might trigger them unnecessarily.

Here you can see my ratio is on the low side so i can place a tactical TP and SL in relation to liquidity lines.

---

4. The Art of Diversification: Spreading Risk

- Why diversification works:

Putting all your capital into a single trade or instrument increases your risk. Diversification spreads that risk across multiple trades or markets, reducing the impact of any single loss.

- How to diversify effectively:

- Trade across multiple sectors or currency pairs.

- Avoid overexposure to correlated assets (e.g., don’t trade EUR/USD and GBP/USD simultaneously).

---

5. Emotional Discipline: Winning the Mental Game

- Why it matters:

Even the best trading strategy can fail if emotions like fear or greed take over. Emotional trading leads to impulsive decisions, revenge trading, and overtrading.

- How to maintain discipline:

- Stick to your trading plan, no matter what.

- Use tools like meditation, journaling, or physical exercise to manage stress.

---

6. Dynamic Risk Management: Adapting to Changing Markets

- Adjusting your strategy:

Markets are dynamic, and your risk management should adapt. Volatility can change quickly, requiring you to adjust your stop-loss distance or position size.

- Use ATR (Average True Range):

The ATR is a great tool to measure market volatility and decide how much room to give your stop-loss.

---

7. Tracking and Reviewing Your Trades

- The power of a trading journal:

Every trade is a learning opportunity. Keep detailed records of your trades, including your reasoning, execution, and results.

- What to include in your journal:

- Entry and exit points.

- Risk-reward ratio.

- Mistakes or deviations from the plan.

- Lessons learned.

---

Conclusion: Plan the Trade, Trade the Plan

Risk management isn’t just a skill—it’s a habit. By understanding your risk-reward ratio, managing position sizes, using stop-losses effectively, and staying emotionally disciplined, you can protect your capital and increase your chances of long-term success.

Take a moment to reflect: How do you manage risk in your trading? Are there areas you could improve? Start implementing these strategies today, and watch how they transform your trading results.

Popular Hedging Strategies for Traders in 2025Popular Hedging Strategies for Traders in 2025

Hedging strategies are key tools for traders seeking to potentially manage risks while staying active in dynamic markets. By strategically placing positions, traders aim to reduce exposure to adverse price movements without stepping away from potential opportunities. This article explores the fundamentals of hedging, its role in trading, and four hedging strategies examples across forex and CFDs.

What Is Hedging in Trading?

Hedging in trading is a risk management strategy that involves taking positions designed to offset potential losses in an existing investment. This concept of hedging in finance is widely used to reduce market volatility’s impact while maintaining the potential opportunity for returns. Rather than avoiding risk entirely, traders manage it via hedging strategies, meaning they have protection against unexpected market movements.

So, what are hedges? Essentially, they are investments used as protective measures to balance exposure. For example, a trader holding a CFD (Contract for Difference) on a rising stock might open a position on a correlated asset that moves in the opposite direction. If the stock’s price falls, returns from the offsetting position can potentially reduce the overall impact of the loss.

Hedging is common in forex trading, where traders may take positions in currency pairs with historical correlations. For instance, a trader exposed to EUR/USD might hedge using USD/CAD, as these pairs often move inversely. Similarly, traders dealing with indices might diversify into different sectors or regions to spread risk.

Importantly, hedging involves costs, such as spreads or holding fees, which can reduce potential returns. It’s not a guaranteed method of avoiding losses but rather a calculated approach to navigating uncertainty.

Why Traders Use Hedging Strategies

Different types of hedging strategies may help traders manage volatility, protect portfolio value, or balance short- and long-term goals.

1. Managing Market Volatility

Markets are unpredictable, and sudden price swings can impact even well-thought-out positions. Hedging this risk may help reduce the impact of unexpected volatility, particularly during periods of heightened uncertainty, such as geopolitical events, economic announcements, or earnings reports. For instance, a forex trader might hedge against fluctuations in a currency pair by taking positions in negatively correlated pairs, aiming to soften the blow of adverse price movements.

2. Balancing Long- and Short-Term Goals

Hedging allows traders to pursue longer-term strategies without being overly exposed to short-term risks. For example, a trader with a bullish outlook on an asset may use a hedge to protect against temporary downturns. This balance enables traders to maintain their primary position while weathering market turbulence.

3. Protecting Portfolio Value

Hedging strategies may help investors safeguard their overall portfolio value during market corrections or bearish trends. By diversifying positions or using opposing trades, they can potentially reduce significant drawdowns. For instance, shorting an index CFD while holding long positions in individual stocks can help offset sector-wide losses.

4. Improving Decision-Making Flexibility

Hedging provides traders with the flexibility to adjust their strategies as market conditions evolve. By mitigating downside risks, they can focus on refining their long-term approach without being forced into reactive decisions during volatile periods. This level of control can be vital for maintaining consistency in trading performance.

Common Hedging Strategies in Trading

While hedging doesn’t eliminate risks entirely, it can provide a layer of protection against adverse market movements. Some of the most commonly used strategies for hedging include:

1. Hedging with Correlated Instruments

One of the most straightforward hedging techniques involves trading assets that have a known historical correlation. Correlated instruments typically move in alignment, either positively or negatively, which traders can leverage to offset risk.

For example, a trader holding a long CFD position on the S&P 500 index might hedge by shorting the Nasdaq-100 index. These two indices are often positively correlated, meaning that if the S&P 500 declines, the Nasdaq-100 might follow suit. By holding an opposing position in a similar asset, losses in one position can potentially be offset by gains in the other.

This approach works across various asset classes, including forex. A well-planned forex hedging strategy can soften the blow of market volatility, particularly during economic events. Consider EUR/USD and USD/CAD: these pairs typically show a negative correlation due to the shared role of the US dollar. A trader might hedge a EUR/USD long position with a USD/CAD long position, reducing exposure to unexpected dollar strength or weakness.

However, correlation-based hedging requires regular monitoring. Correlations can change depending on market conditions, and a breakdown in historical patterns could result in both positions moving against the trader. Tools like correlation matrices can help traders analyse relationships between assets before using this strategy.

2. Hedging in the Same Instrument

Hedging within the same instrument involves taking opposing positions on a single asset to potentially manage risks without exiting the original trade. This hedging strategy is often used when traders suspect short-term price movements might work against their primary position but still believe in its long-term potential.

For example, imagine a trader holding a long CFD position in a major stock like Apple. The trader anticipates the stock price will rise over the long term but is concerned about an upcoming earnings report or market-wide sell-off that could lead to short-term losses. To hedge, the trader opens a short position in the same stock, locking in the current value of their trade. If the stock’s price falls, the short position may offset the losses in the long position, reducing overall exposure to the downside.

This is often done with a position size equivalent to or less than the original position, depending on risk tolerance and market outlook. A trader with high conviction in a short-term movement may use an equivalent position size, while a lower conviction could mean using just a partial hedge.

3. Sector or Market Hedging for Indices

When trading index CFDs, hedging can involve diversifying exposure across sectors or markets. This strategy helps reduce the impact of sector-specific risks while maintaining exposure to broader market trends.

For example, if a trader has a portfolio with exposure to technology stocks and expects short-term declines in the sector, they can open a short position in a technology-focused index like Nasdaq-100 to offset potential losses.

Another common approach is geographic diversification. Traders with exposure to European indices, such as the FTSE 100, might hedge with positions in US indices like the Dow Jones Industrial Average. Regional differences in economic conditions can make this a practical strategy, as markets often react differently to global events.

When implementing sector or market hedging, traders should consider the weighting of individual stocks within an index and how they contribute to overall performance. This strategy is used by traders who have a clear understanding of the underlying drivers of the indices involved.

4. Stock Pair Trading

Pair trading is a more advanced hedging technique that involves identifying two related assets and taking opposing positions. This approach is often used in equities or indices where stocks within the same sector tend to move in correlation with each other.

For instance, a trader might identify two technology companies with similar fundamentals, one appearing undervalued and the other overvalued. The trader could go long on the undervalued stock while shorting the overvalued one. If the sector experiences a downturn, the losses in the long position may potentially be offset by gains in the short position.

Pair trading requires significant analysis, including fundamental and technical evaluations of the assets involved. While this strategy offers a built-in hedge, it can be risky if the chosen pair doesn’t perform as expected or if external factors disrupt the relationship between the assets.

Key Considerations When Hedging

What does it mean to hedge a stock or other asset? To fully understand the concept, it’s essential to recognise several factors:

- Costs: Hedging isn’t free. Spreads, commissions, and overnight holding fees can accumulate, reducing overall potential returns. Traders should calculate these costs to ensure the hedge is worth implementing.

- Market Conditions: Hedging strategies are not static. They require adaptation to changing market conditions, including shifts in volatility, liquidity, and macroeconomic factors.

- Correlation Risks: Correlations between assets are not always consistent. Unexpected changes in relationships driven by fundamental events can reduce the effectiveness of a hedge.

- Timing: The timing of both the initial position and the hedge is critical. Poor timing can lead to increased losses or missed potential opportunities.

The Bottom Line

Hedging strategies are popular among traders looking to manage risks while staying active in the markets. By balancing positions and leveraging tools like correlated instruments or partial hedges, traders aim to navigate volatility with greater confidence. However, hedging doesn’t exclude risks and requires analysis, planning, and regular evaluation.

If you're ready to explore hedging strategies in forex, stock, commodity, and index CFDs, consider opening an FXOpen account to access four advanced trading platforms, competitive spreads, and more than 700 instruments to use in hedging.

FAQ

What Is Hedging in Trading?

Hedging in trading is a risk management approach where traders take offsetting positions to potentially reduce losses from adverse market movements. Rather than avoiding risk entirely, hedge trading aims to manage it, providing a form of mitigation while maintaining market exposure. For example, a trader with a long position on an asset might open a short position on a related asset to offset potential losses during market volatility.

What Are the Three Hedging Strategies?

The three common hedging strategies include: hedging with correlated instruments, where traders take opposing positions in assets with historical relationships; hedging in the same instrument, where a trader suspects a movement against the direction of their original position and opens a trade in the opposite direction; and sector or market hedging, where a trader uses indices or regional diversification to reduce exposure to specific market risks.

What Is Hedging in Stocks?

Hedging in stocks involves taking additional positions to offset risks associated with holding other stocks. This can include shorting related stocks, trading negatively correlated indices, or using market diversification to reduce exposure to sector-specific downturns.

How to Hedge Stocks?

To hedge stocks, traders typically use strategies like short-selling correlated equities, diversifying into other asset classes, or opening opposing positions in related indices. The aim is to limit downside while maintaining some exposure to potential market opportunities.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

TradeCityPro Academy | Dow Theory Part 3👋 Welcome to TradeCityPro Channel!

Welcome to the Educational Content Section of Our Channel Technical Analysis Training

We aim to produce educational content in playlist format that will teach you technical analysis from A to Z. We will cover topics such as risk and capital management, Dow Theory, support and resistance, trends, market cycles, and more. These lessons are based on our experiences and the book The Handbook of Technical Analysis.

🎨 What is Technical Analysis?

Technical Analysis (TA) is a method used to predict price movements in financial markets by analyzing past data, especially price and trading volume. This approach is based on the idea that historical price patterns tend to repeat and can help traders identify profitable opportunities.

🔹 Why is Technical Analysis Important?

Technical analysis helps traders and investors predict future price movements based on past price action. Its importance comes from several key benefits:

Faster Decision-Making: No need to analyze financial reports or complex news—just focus on price patterns and trading volume.

Better Risk Management: Tools like support & resistance, indicators, and chart patterns help traders find the best entry and exit points.

Applicable to All Markets: Technical analysis can be used in Forex, stocks, cryptocurrencies, commodities, and even real estate.

In the previous session, we explained Principles 3 and 4 of the Dow Theory. Be sure to review and study them, and if you have any questions, let us know in the comments.

📑 Principles of Dow Theory

1 - The Averages Discount Everything (Not applicable to crypto)

2 - The Market Has Three Trends

3 - Trends Have Three Phases

4 - Trend Continues Until a Reversal is Confirmed

5 - The Averages Must Confirm Each Other

6 - Volume Confirms the Trend

📈 Principle 5: Trends Persist Until a Clear Reversal Signal Appears

Full Explanation:

Dow Theory says that once a market picks a direction—like going up (bullish trend) or down (bearish trend)—it keeps moving that way until something big and obvious says, “Nope, we’re turning around!” Think of it like momentum: the market’s lazy and sticks to its path unless it gets a solid reason to switch.

What’s a Trend? It’s the market’s overall direction. Uptrend means higher highs and higher lows (prices keep climbing). Downtrend means lower highs and lower lows (prices keep dropping). Sideways means it’s stuck in a range.

What’s a Reversal Signal? In an uptrend, if prices stop making new highs and start forming lower highs and lows, plus break a key level (like support), that’s a sign the trend’s flipping. In a downtrend, it’s the opposite—higher highs and lows plus breaking resistance mean it’s turning up.

Why Does This Happen? Markets reflect crowd behavior. When everyone’s buying or selling, the trend builds steam and doesn’t stop until the crowd’s mood shifts big-time.

Key Point: Small dips or spikes don’t count. A little drop in an uptrend? Normal. You need a clear pattern or a big break to call it a reversal.

Practical Use: Traders use this to avoid panic-selling on tiny moves and wait for strong signals before jumping ship.

Simple Example:

It’s like riding a bike downhill—you keep rolling fast until you hit a wall or slam the brakes.

📊 Principle 6: Trends Must Be Confirmed by Volume

Full Explanation:

This principle says a trend isn’t legit unless trading volume backs it up. Volume is how much is being bought or sold. If the trend’s real, volume should match it—high volume means lots of people are in on it, low volume means it might be fake or weak.

Uptrend: Prices rising with growing volume? That’s a strong bull run—buyers are all in. Prices up but volume’s tiny? Could be a fluke or manipulation.

Downtrend: Prices falling with big volume? Sellers mean business—bear trend’s solid. Falling prices with low volume? Might just be a quick dip, not a real crash.

How Volume Confirms: It’s like a lie detector for trends. Big volume says, “This move’s for real!” Low volume says, “Eh, don’t trust it yet.”

Extra Detail: In an uptrend, if volume starts dropping, it’s a warning—buyers might be losing steam. In a downtrend, low volume could mean sellers are running out of ammo, hinting at a bounce.

Why It Matters? Dow believed volume shows the market’s true energy. No crowd, no power—simple as that.

Practical Use: Traders check tools like OBV (On-Balance Volume) or volume bars. If a stock jumps but volume’s dead, they might skip it it’s a trap.

Simple Example:

It’s like a party if tons of people show up dancing, it’s a real vibe. If just two guys are there, it’s probably lame.

🎉 Conclusion

We’ve reached the end of today’s educational segment! We’ll start by explaining all of Dow Theory’s principles, and in the future, we’ll move on to chart analysis and the strategy I personally use for trading with Dow Theory. So, make sure you fully grasp these concepts first so we can progress together in this learning journey!

💡 Final Thoughts for Today

This is the end of this part, and I must say we have a long journey ahead. We will continually strive to produce better content every day, steering clear of sensationalized content that promises unrealistic profits, and instead, focusing on the proper learning path of technical analysis.

⚠️ Please remember that these lessons represent our personal view of the market and should not be considered financial advice for investment.

TradeCityPro Academy | Dow Theory Part 2👋 Welcome to TradeCityPro Channel!

Welcome to the Educational Content Section of Our Channel Technical Analysis Training

We aim to produce educational content in playlist format that will teach you technical analysis from A to Z. We will cover topics such as risk and capital management, Dow Theory, support and resistance, trends, market cycles, and more. These lessons are based on our experiences and the book The Handbook of Technical Analysis.

🎨 What is Technical Analysis?

Technical Analysis (TA) is a method used to predict price movements in financial markets by analyzing past data, especially price and trading volume. This approach is based on the idea that historical price patterns tend to repeat and can help traders identify profitable opportunities.

🔹 Why is Technical Analysis Important?

Technical analysis helps traders and investors predict future price movements based on past price action. Its importance comes from several key benefits:

Faster Decision-Making: No need to analyze financial reports or complex news—just focus on price patterns and trading volume.

Better Risk Management: Tools like support & resistance, indicators, and chart patterns help traders find the best entry and exit points.

Applicable to All Markets: Technical analysis can be used in Forex, stocks, cryptocurrencies, commodities, and even real estate.

📚 Recap of the Previous Session

In the previous session, we explained the first two principles of Dow Theory. Make sure to review and study them, and if you have any questions, feel free to reach out to us in the comments.

📑 Principles of Dow Theory

1 - The Averages Discount Everything (Not applicable to crypto)

2 - The Market Has Three Trends

3 - Trends Have Three Phases

4 - Trend Continues Until a Reversal is Confirmed

5 - The Averages Must Confirm Each Other

6 - Volume Confirms the Trend

🌟 Principle 3: Trends Have Three Phases

In Dow Theory, the primary trend (which can be a Bull Market or Bear Market) is divided into three distinct phases. These phases reflect market behavior and investor psychology over time. Here’s a detailed explanation:

📉 Accumulation Phase

Definition: This phase begins when the market is at its lowest point (in a bull trend after a bear market) or when general pessimism prevails. Smart investors, professionals, and those with a long-term vision (like large funds or experienced traders) start buying.

Characteristics:

Prices are still low, and economic news is typically negative (e.g., recession, high unemployment).

Trading volume is low because the general public lacks confidence and doesn’t participate.

Price changes are small and gradual, making the market seem "lifeless" or directionless.

Psychology: This phase marks a transition from despair to hope. Smart investors recognize that the worst is over and that the real value of assets exceeds their current price.

Example: Imagine after a major crash like 2008, some big companies stabilize their prices, but the media still talks about "collapse." Professionals step in here. Or with Bitcoin at $16K, most people thought it was heading to zero and were hopeless!

📈 Public Participation Phase

Definition: This phase occurs when the primary trend is clearly established, and the market starts moving more strongly. Economic news improves, and the general public (retail investors) enters the market.

Characteristics:

Prices rise quickly (in a bull market) or fall sharply (in a bear market).

Trading volume increases significantly as participation grows.

Analysts and media begin confirming the trend with positive reports.

Psychology: Confidence in the market grows, and greed (in a bull market) or fear (in a bear market) gradually takes over. This is where market momentum accelerates.

Example: In a bull market, you might see indices like the Dow Jones hitting new records weekly, with ordinary people buying tech or industrial stocks.

💰 Distribution Phase

Definition: This is the end of the primary trend. In a bull market, smart investors who bought during accumulation start selling to take profits. In a bear market, panic selling subsides, and some buy in hopes of a recovery.

Characteristics:

Prices may still be high, but volatility increases, and signs of weakness emerge.

Trading volume might remain high, but discrepancies between volume and price (e.g., price drops with high volume) appear.

News is still positive, but professionals know the market is overvalued.

Psychology: In a bull market, excessive optimism (Euphoria) dominates; in a bear market, complete despair sets in. This is where the trend reverses.

Example: At the peak of the dot-com bubble (2000), tech stocks kept rising, but professionals began exiting, and then the crash followed.

Key Note: These three phases occur in sequence, and understanding them helps analysts identify the market’s position in the larger cycle. In a bear market, the phases reverse: panic selling (like distribution), temporary recovery (like participation), and final capitulation (like accumulation).

🔍 Principle 4: The Averages Must Confirm Each Other

Charles Dow believed that for a primary trend to be confirmed, two key market indices—the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA)—must move in the same direction. This principle stems from economic and logical significance in Dow’s time and is still considered a key metric. Here’s the full explanation:

📊 Economic Logic:

Industry and Transportation: In Dow’s era (late 19th and early 20th centuries), the U.S. economy relied heavily on industrial production and transportation (e.g., railroads). If industrial companies (producers of goods) were growing, demand for transportation (moving goods) should also rise.

Thus, aligned movement in these indices signaled a healthy economy.

Mutual Confirmation: If only one average rises (e.g., industrials go up but transportation doesn’t), Dow saw it as a sign of weakness or an unsustainable trend.

🤑 Practical Application:

Bullish Trend: In a bull market, both averages should reach new highs (Higher Highs). If the DJIA hits a new record but the DJTA fails to confirm and stays lower, the uptrend is questionable.

Bearish Trend: In a bear market, both should hit new lows (Lower Lows). Lack of confirmation (e.g., industrials fall but transportation doesn’t) might signal the end of the downtrend.

Divergence: If the averages diverge (one rises while the other doesn’t), Dow viewed it as a warning of a potential trend change.

⚖️ Technical Details:

Timing: Confirmation doesn’t need to be simultaneous but should occur within a reasonable timeframe (e.g., weeks or months).

Volume: Though not directly mentioned in this principle, handbooks emphasize that high volume during confirmation adds credibility to the trend.

Classic Example: In 1929, the industrial average began falling, but transportation initially resisted. When transportation also dropped, the bearish trend was confirmed, leading to the Great Depression.

🎉 Conclusion

We’ve reached the end of today’s educational segment! We’ll start by explaining all of Dow Theory’s principles, and in the future, we’ll move on to chart analysis and the strategy I personally use for trading with Dow Theory. So, make sure you fully grasp these concepts first so we can progress together in this learning journey!

💡 Final Thoughts for Today

This is the end of this part, and I must say we have a long journey ahead. We will continually strive to produce better content every day, steering clear of sensationalized content that promises unrealistic profits, and instead, focusing on the proper learning path of technical analysis.

⚠️ Please remember that these lessons represent our personal view of the market and should not be considered financial advice for investment.

TradeCityPro Academy | Risk to Reward👋 Welcome to TradeCityPro Channel!

Let’s dive into another educational segment. After discussing capital management and risk management, we now turn to one of the most crucial concepts before entering technical analysis: Risk to Reward!

📌 Understanding Risk-to-Reward in Real Life

Before we start, let me give you an example of risk to reward from the real world, outside of financial markets. Imagine you are considering investing in a startup technology company that has launched a new product.

Risk: You estimate that you might lose $500 of your investment due to uncertainty about the product's success and intense market competition.

Reward: However, if the product succeeds and the company grows, you could make a profit of up to $2000.

In this example, the risk-to-reward ratio is 1:4, meaning for every $1 at risk, you could earn $4 in reward. This ratio can help you decide if this investment is appealing. If you believe the risk is acceptable and the potential reward is valuable, you might choose to invest.

⚠️ The Reality of Risk-to-Reward in Trading

In the real world, if you are a logical person, we all adhere to risk to reward principles. However, it’s puzzling how, in financial markets, you often close your profitable trades as quickly as possible while staying in losing trades for months. This indicates a failure to adhere to risk to reward principles.

Before I explain risk management and related concepts, make sure you've viewed the previous sections on risk management and capital management. Remember, if you're not setting stop-loss orders, this lesson might not be very useful for you.

🔍 What is Risk-to-Reward in Trading?

In financial markets, risk to reward refers to the ratio between the level of risk an investor takes with a specific investment and the potential reward from that investment. This concept helps investors evaluate whether a particular investment is worth the risk.

When trading, if you are about to open a position, set a stop-loss. If your stop-loss is triggered, resulting in a $10 loss, your target profit should be at least $20, creating a risk to reward ratio of 2. I won’t open a position with less than this!

It's important to note that risk to reward alone doesn't hold much meaning. It gains significance when considered alongside win rate. The chart I will share clarifies the relationship between win rate and risk to reward.

Look at the chart below. If your risk to reward is 1 and your win rate is 50%, you are breaking even—neither gaining nor losing. For risk to reward ratios below 1, you need a win rate of 100% to break even. Our logical risk to reward ratio is 2, where a 40% win rate keeps you profitable. We should allow our minds room for error rather than always striving for accuracy.

🛠️ Understanding Trading Tools

Let’s take a simple look at our tools. The chart showcases two types of tools: short position and long position, applicable for both falling and rising markets. The tool displays your risk to reward ratio in the middle, with the stop-loss percentage below and the profit percentage above for long positions, and vice versa for short positions.

📈 Why Should You Use a Risk-to-Reward of 2?

Why do you implement a risk to reward of 2? Consider this: if I opened 10 positions this week, with 6 hitting stop-loss and 4 reaching targets, my total loss would be $60. However, due to adhering to a risk to reward ratio of 2, my total profit would be $80, resulting in a net gain of $20!

This illustrates the importance of adhering to risk to reward principles. Even if we lose more trades than we win, we can still be profitable in the end. The key is to focus on the overall outcome rather than individual battles.

❌ What Happens If You Don’t Maintain a Standard Risk-to-Reward?

Now, consider what happens if I don’t maintain a standard risk to reward. For instance, if I open a position with a risk to reward ratio of 0.5, even if I make a profit, a subsequent loss could negate that gain.

If you are involved in financial spaces, you may have encountered signal channels that share their positions, encouraging you to follow for profitable outcomes. For example, if they claim to profit from 95 out of 100 positions, you might feel that winning sensation. But what is their risk to reward ratio? A ratio of 0.1 means that if they hit just a few stop-losses, you could end up in a loss.

Be cautious of misleading advertisements and high-return claims. If you manage to achieve a 5% to 10% profit monthly and sustain it for a year, even starting with $100, your trading record will be respected, leading to more funding opportunities. Avoid falling into traps set by opportunistic individuals.

🚀 Practical Trading Considerations

Consider this: if you want to open a position but your target is above a major resistance level, and the likelihood of reaching it seems slim, I personally prefer not to open that position. It indicates that my entry point may not be optimal.

❤️ Friendly Note

In closing, I encourage you to keep your positions until you reach your risk to reward target. Avoid checking the chart until you hit that point. Set alerts and make decisions only then. Always adhere to these rules for all your positions, not just one. Don’t worry about losing out on profits; instead, approach trading with calmness.

Finally, remember that a profit in a position is not truly realized until it is closed and transformed into something tangible—food, clothing, a house, or a car.

Overtrading Chaos: Classroom Insights & Quick FixesWatching my students get caught up in the whirlwind of overtrading was like watching a rollercoaster ride gone wrong - all that excitement turned into stress, quick decisions based on gut feelings rather than strategy, and seeing their accounts shrink before my eyes. Here's what I've noticed firsthand:

-Emotion Over Logic: They were making choices fueled by the fear of missing out or trying to get back at the market after a loss, not because it was the smart move. Spot on. Emotional trading is the quickest path to financial ruin. It's all about managing those emotions.

-Exhaustion: The constant screen time was draining them, both physically and mentally. This is why I always preach about the importance of having a life outside of trading. Burnout is real and it clouds judgment.

-Costly Habits: Those small fees and spreads started adding up, eating away at their profits with each impulsive trade. Always remember, every trade has a cost. Overtrading is like death by a thousand cuts.

But here’s the good news - I've got some immediate steps I take to turn things around:

1)Trade Log Love: I get them to write down every trade, focusing on the reasons behind their decisions. It’s amazing how this simple act helps them learn from their actions. A trade log isn't just about accountability; it's about education. Every trade is a lesson.

2)Take a Breather: I enforce a little break after each trade. It's like hitting the reset button for your brain, ensuring the next trade isn't just a reaction to the last. This is critical. It’s about breaking the cycle of reactive trading. Think of it as forced discipline.

3)Quality Time: I shift the focus to waiting for those golden opportunities, teaching them that sometimes the best trade is the one you don't make. Patience in trading is not just a virtue; it's a strategy. The markets reward those who wait for the right moment.

Come join me as I navigate through the overtrading storm, helping my students, and maybe you too, become more thoughtful, strategic traders! This is what I call practical wisdom. Overtrading is a symptom of not having a solid plan. I'd recommend this course of action to any trader looking to turn their habits around.

Kris/Mindbloome Exchange

Trade Smarter Live Better

Is It Possible to Predict Market Direction with Certainty?Someone asked me about predicting market movements with certainty. In response to a question about detecting large orders and forecasting market direction, let’s explore how markets truly operate and how to grow as a trader.

The Nature of Market Movement

Markets move through collective behavior, not individual orders. Even when sentiment indicators show a near 50:50 split between short/long positions, markets can still trend strongly in one direction. Why? Because market movement depends on:

The aggressiveness of orders (market orders vs. limit orders)

Timing of trade execution

Position sizes and their distribution

Psychological factors affecting mass behavior

Example:

Imagine BITSTAMP:BTCUSD with apparently balanced sentiment. Yet, if long positions are primarily passive limit orders while shorts are aggressive market orders with tight stops, the price could trend down sharply despite the "balanced" ratio.

The Illusion of Certainty

There is no way to predict market direction with certainty. The market comprises millions of participants with:

Different analysis methods

Various timeframes (scalpers to long-term investors)

Diverse motivations (hedging, speculation, investment)

Unique reactions to the same news

Real-world Example:

During major news events like FOMC meetings, you'll often see prices swing violently in both directions. Why? Because even with the same information, traders interpret and react differently based on their:

Portfolio needs

Risk tolerance

Trading timeframe

Overall market view

Building Better Trading Habits

Instead of seeking certainty, focus on developing good trading habits:

1. Risk Management First

Use proper position sizing (never risk more than 1-2% per trade)

Set stops based on technical levels, not arbitrary numbers

Example: If trading support/resistance, place stops beyond the next significant level, not just at round numbers

2. Asymmetric Returns

Aim for trades where potential profit exceeds potential loss

Target 1:2 risk-reward at minimum

Example: If risking $100, your minimum target should be $200 profit

3. Consistency in Strategy

- Stick to your trading plan even when other strategies look attractive

- Document all trades and review regularly

- Example: Keep a trading journal with setup, entry, exit, and lessons learned

4. Building Good Habits

Start each day with market analysis

Review major news and potential impact

Set clear entry/exit rules before trading

Regular review of trading performance

Example Schedule:

- 8:00 AM: Market overview

- 8:30 AM: Review potential setups

- 9:00 AM: Check for news events

- 4:00 PM: End-of-day review

Common Pitfalls to Avoid

1. Strategy Hopping

Switching strategies frequently based on recent performance

Following multiple traders with different approaches

Solution: Commit to one approach for at least 3 months

2. Overtrading

Taking trades out of boredom or FOMO

Solution: Set daily/weekly trade limits

3. Revenge Trading

Trying to recover losses quickly

Solution: Take a break after losses, review what went wrong

Remember: The market doesn't care about what you want. It moves based on collective action, not individual desires. Focus on adapting to market conditions rather than trying to predict them.

Your success in trading isn't determined by how much you know, but by how well you apply what you know through consistent, disciplined habits.

123 Quick Learn Trading Tips #3: Better turn up the heat123 Quick Learn Trading Tips #3: Better turn up the heat 🔥

Ever wonder why some traders seem to have all the luck? 🤔 They're not just lucky; they've built an iceberg of hard work, discipline, and even failures beneath the surface of their "success." Don't just chase the tip – build your own solid foundation.

Here's what that iceberg looks like in trading:

Hard work: 📚 Studying markets, developing strategies, and always practicing. No shortcuts here! 🚫

Patience: ⏳ Giving up short-term gains for long-term strategies. Don't rush. Good traders wait for the best opportunities.

Risks: 🎲 Take smart trades, not reckless ones. Be brave, but not foolish.

Discipline: 🎯 Follow your trading plan. Don't let your feelings make you change it. Trust what you learned before. Trust your strategy.

Failures: 🤕 Everyone loses money sometimes. Learn from your losses. It's important to get back up and keep going.

Doubts: 😟 Managing emotions and fear is crucial. It's normal to have doubts.

Changes: 🔄 The market always changes. You need to change your strategies too. Be ready to adapt.

Helpful habits: 📈 Consistent analysis and risk management are your bread and butter. Stick to good routines.

Want to build a success iceberg? 🧊

Better turn up the heat 🔥

– it's going to be a long, cold journey beneath the surface.

👨💼 Navid Jafarian

So, stop scrolling through my TESLA pics 🚗 and get back to analyzing those charts! 📊 Your iceberg isn't going to build itself. 😉

Different Types of W Patterns and How to Trade ThemHello dear KIU_COIN family 🐺 .

Recently, I decided to provide some educational content for you, my dear audience, and introduce some essential and basic trading terms.

Here’s what you should know: In these lessons, we will cover three different seasons:

🔹 Season 1: Reversal and continuation patterns.

🔹 Season 2: How to use RSI and other indicators to find good entry points.

🔹 Season 3: Definitions of Fibonacci and seasonality in trading.

Stay tuned for valuable insights! 🚀

✅ For the first section of 🔹 Season 1 , I’ll be covering W patterns— a well-known bullish reversal pattern :

As you can see in the chart above, we usually have three types of W recovery patterns , which are the most important ones for us. However, in this section, we just want to get a general understanding of them. In the upcoming section, we will learn how to trade them and explore how they actually appear on the chart and the story behind them !

✅ This is the first and most common type of W pattern:

✅ This is the second type of W pattern:

✅ This is the third type of W pattern:

Ok, guys; I think this is enough for today, and I hope you enjoyed this educational content. However, don't forget to ask your questions below and support me with your likes and follows for more of this content. 🐺🔥

TradeCityPro Academy | Risk Management👋 Welcome to TradeCityPro Channel!

Let’s continue with another training session after the first part, which was about Capital Management, and dive into the important topic of Risk Management.

🕵️♂️ Risk Management as a Profession

One of the heaviest responsibilities, riskiest roles, and most demanding efforts in studying or working in a company lies in the field of Risk Management.

The job of risk management exists in various fields, including banking, insurance, investment, and consulting. People working in this field are responsible for identifying financial, operational, or project-related risks and designing strategies to reduce or manage them.

The income of a risk manager varies depending on the country, industry, level of experience, and scope of the project. In developed countries, risk managers in financial industries can earn high incomes. On average, in the United States, the annual income of a risk manager ranges between $80,000 and $150,000.

💰 Risk Management in Financial Markets

Risk management is one of the most important skills and concepts in the world of finance, business, and even daily life. It helps you identify, assess, and control potential risks to avoid unexpected losses.

💡 What is Risk Management?

Risk management is the process of identifying and assessing potential threats and then taking actions to reduce or eliminate their negative impacts. This process helps you make more informed decisions and protect your capital or resources from unnecessary risks.

In financial markets, risk management means identifying, evaluating, and controlling risks related to investments to prevent major losses. This includes setting a Stop Loss, diversifying your investment portfolio, using leverage responsibly, and sticking to your trading strategy. The primary goal is to preserve capital and optimize profits by managing potential risks.

💵 Why Should We Manage Risk?

Before diving into the explanations, let’s illustrate the concept of risk management with a life example: Do you give the same kind of gift to your parents or partner as you would to a distant relative or a friend you recently met? Of course not! Everyone holds a different level of importance in your life.

Now let’s examine this in financial markets. It’s better to have different risk management strategies for your setups and strategies based on market conditions. Categorize them into different groups using your Excel data and setups.

As a side note, in this training, when we talk about risk, we mean the amount of capital you will lose after entering a position and hitting your stop loss not just the amount of capital involved in the position.

Additionally, if you don’t have a written trading plan, strategies, or if you don’t document your positions in Excel or any other platform, this will not be beneficial for you and may result in future losses.

💼 Implementing Risk Management in Trading

We need to categorize our trades based on market conditions, daily circumstances, chart setups, strategies, win rate, written trading plans, and our trade entry checklist.

Here’s how I categorize trades: Very Risky - Risky - Normal - Confident

1️⃣ Very Risky

For this category, it’s better to have a separate account purely for testing, FOMO, or experiments. These trades have very few confirmations (1–2). Trade with less than 0.1%–0.25% of your main capital in this category.

2️⃣ Risky

These trades are opened in your main account because they generally meet some confirmations but lack key ones. For instance, you anticipate a resistance breakout and go long before confirmation. These trades usually have a small stop loss, leading to higher risk-to-reward ratios. Use 0.25%–0.5% of your capital for these trades.

3️⃣ Normal

These trades have most confirmations but might miss a few. For example, out of 10 items on your checklist, 6–7 are confirmed. These form the majority of trades. Be cautious about the win rate of this category, as it should be higher than your overall average. Use 0.5%–0.75% of your capital here.

4️⃣ Confident

These trades have all major confirmations, and your strategy’s triggers are activated. Additionally, 8–9 out of 10 items on your trade entry checklist are confirmed. These are your most confident trades. Use 0.75%–1% of your capital for these trades.

⚠️ Daily Risk Management

Don’t use your entire daily risk limit at once. For example, if your daily risk is 1.5%, keep some risk in reserve in case your first trade hits its stop loss. This allows you to recover and even profit later in the day.

Focus on normal trades. These should form the majority of your trades since they maintain a healthy win rate. Risky trades might lower your win rate, while confident trades occur less frequently and won’t significantly impact your overall win rate.

📝 Building Risk Management and Consistency

Risk management based on your checklists and spreadsheets can take around 6–8 months to develop, starting after learning technical analysis. In the beginning, allocate 0.5% risk per trade while documenting your trades.

This will prevent unnecessary self-blame for stop-loss hits in risky trades and help you trade confidently with a solid plan.

❤️ Friendly Note

If you don’t follow these principles, trading might become an on-and-off journey, leading to frustration and eventual market exit. In the end, your money will go to traders who adhere to these rules.

If you’ve read this far, congratulations! Unlike misleading social media ads, this guide offers genuine, practical insights. Be proud of your effort and focus on applying these principles. Let’s progress together and elevate our lives through financial markets. 😊

COFORGE Options Trading Strategy: Breakout and Momentum-BasedIn this post, we’ll explore a couple of options strategies for COFORGE using the data for strike price 9000 . By closely monitoring the price action and key option data, we can make informed decisions that align with market trends. Here’s how we can approach trading this stock’s options effectively:

Key Option Data Breakdown

Call Short Covering: Indicates that the market sentiment is bullish as traders are closing their call positions, signaling a potential upward movement.

Put Writing: A strong sign of bullishness as traders are actively writing puts, expecting the price to stay above the 9000 strike.

Call and Put LTP (Last Traded Price):

Calls LTP: 278.8 (indicating that calls are gaining traction).

Puts LTP: 100.7 (a lower LTP for puts suggests lower demand).

Open Interest (OI) and Change in OI:

Calls OI Change: -47,850 (indicating a reduction in call positions due to short covering).

Puts OI Change: +123,975 (signifying an increase in put writing, which reinforces the bullish sentiment).

Strategy 1: Buying the Call or Put Based on the First 5-Minute Candle

This strategy involves observing the price movement in the initial 5 minutes after the market opens and deciding whether to buy a call or put, depending on the price action and option data.

When to Buy the Call or Put:

If the first 5-minute candle shows a bullish move, consider buying the call option as the market sentiment appears to be in favor of upward movement.

If the first 5-minute candle shows a bearish move, consider buying the put option. However, given the overall data showing strong put writing, this could be less likely.

Why It Works:

The first 5 minutes are crucial for gauging market sentiment, and with the data indicating strong bullishness (due to call short covering and put writing), a call option is likely to perform well.

Considerations:

This strategy requires watching for clear momentum during the first 5 minutes. If the market remains indecisive, it may be better to stay on the sidelines to avoid wasting premium.

Strategy 2: Breakout Strategy – Buy Calls or Puts on the Break of Highs

This strategy involves waiting for a breakout of the call or put’s high price. The breakout indicates a shift in momentum, and we’ll enter the trade based on whichever direction triggers first.

When to Buy the Call:

Watch for the call’s high price (389.85). If the call option breaks this level, it signals that the upward momentum is gaining strength. Buy the call to capitalize on the breakout.

When to Buy the Put:

If the call option doesn’t break its high and the price starts to show weakness, consider buying the put once it breaks its high (360.6). However, the data suggests that the market bias is bullish, so a call breakout is more likely.

Why It Works:

Breakouts are powerful signals of market momentum. Since the data shows heavy put writing, the call option is more likely to break its high first. This creates an opportunity to buy calls in a bullish trend.

Considerations:

Always monitor the volume and the price action for confirmation of the breakout. If both calls and puts test their highs without clear direction, consider waiting for a clearer signal.

Conclusion:

Given the strong bullish sentiment reflected in the options data—call short covering and put writing—the most reliable strategy is Strategy 2. Watch for a call breakout above 389.85 or a put breakout above 360.6 (if the call fails to break its high). The bullish bias suggests that the call option is more likely to outperform, but a breakout in either direction can trigger the strategy.

Pro-Tip: Set a stop loss just below the breakout level to manage risk effectively. The market sentiment is heavily tilted towards bullishness, so a call option breakout is the most probable outcome.

Master Short-term Trading in Stock, Forex, and Crypto MarketsMaster Short-term Trading in Stock, Forex, and Crypto Markets

Short-term trading is a fast-paced approach that demands skill, strategy, and quick decision-making to capitalise on small price moves in financial markets like stocks, forex, and crypto. This article dives into advanced techniques, adaptive strategies, and psychological discipline needed to improve your trading edge.

Choosing the Right Market and Asset for Short-Term Trading

Short-term trading isn’t just about finding an opportunity; it’s about picking the right market and asset that aligns with your strategy, risk tolerance, and trading style. Different assets and markets move in unique ways, and understanding their traits can sharpen your trading decisions and improve your ability to identify favourable setups.

Stocks

When short-term trading stocks, movements often hinge on company-specific events like earnings reports, product launches, or even management changes. Ideal stocks for short-term trading typically include those in technology or high-growth sectors, which tend to show greater volatility and liquidity. However, specific stock trading hours limit opportunities (with after-hours trading often seeing lower volume), which can reduce flexibility compared to 24-hour markets like forex or crypto.

Forex

Known for its high liquidity and 24-hour trading cycle 5 days a week, the forex market offers ample short-term trading opportunities, particularly with major currency pairs like EUR/USD or GBP/USD. These pairs are heavily traded, leading to tighter spreads, which is essential for traders looking to make multiple trades in a single day. The forex market is also influenced by economic data releases and geopolitical events, making it a good match for traders who stay updated on global news and market sentiment.

Commodities

Trading commodities like gold, oil, and silver can add diversity to short-term trading. Commodities often see increased activity during times of economic uncertainty or when inflationary pressures are high. Precious metals like gold, for instance, are seen as so-called “safe havens,” attracting short-term traders during volatile market periods. Energy commodities, such as oil, also offer strong moves tied to supply and demand shifts, including geopolitical developments and inventory reports.