True SMC entry module to pass Funded Accounts!!!Hello traders. In this module we aim to explain how to enter the trades along with market makers for high RR entries. Entering like this will protect your Stoploss since your orders are along with the Market makers and market makers defend their positions. As a result your position in also defended in this case. Please pay attention to the annotations made on the chart.

Happy Trading

Team Lamda!!!

Smartmoneyconcept

QML pattern Quasimodo | SMART MONEY CONCEPTHello all. Today we will talk about the reversal pattern "Quasimodo" or QML. Schematically it looks like this:

The price moves in the trend, in POI the structure breaks and after that, the price can not update the previous HH and the downward movement continues (consider a schematic example).

In this example, after the breakdown of the structure, the price reverses to soften and remove internal liquidity, after which a reversal occurs. This is done in order to close a losing position at the expense of those who put their stop losses behind the maximum of the substructure.

There are many names for this pattern, such as three tap setup, but I'm more accustomed to calling it quasimodo. If you like, it's a reworked version of the "head and shoulders" pattern, but in this case you're focusing on the price action instead of the picture.

Criteria for QML formation

1. Use it in HTF POI

2. Watch HTF POI

3.Watch the price action.

4. Premium or Discount zone

To use the pattern effectively, you must analyze the chart of all TFs. And use the pattern as an entry model. For example, the daily TF is bearish. The price is in the premium zone, as well as on the H1 TF began an uptrend, a full of bullish trend in the lower TF, after which we see that the substructure (red) has changed from a rising to a descending. And thus, we expect a continuation of the downtrend.

Important

Don't use this pattern in terms of "drawing". They can draw anything on the chart. I recommend to look for POI in POI of higher TFs.

An additional factor could be substructure fluctuations before FWG or OB. You need to see how the price behaves after their update.

Where to put a stop loss

The first option is a stop-loss for a local FVG/OB

The second - above swing high of substrucutre

Third - above the HTF point of interest, if your RR allows it

EXAMPLE

After updating the all-time high, the daily structure was broken. Then price consolidated, it was worth waiting for the manipulation. It was possible to enter from HTF POI - aggressive entry, but it was possible to wait for confirmation on the LTF (as I do).

I'm expect bullish OF on 4H chart to HTF POI (2D ob)

This "entry into position" is shown as an example, so that you can form an understanding of how to act in this or that situation. In conclusion, the more factors you take into account in your analysis, the higher the probability of working out of the pattern. Also, it's up to you to choose what kind of stop loss you will use. There is no right and wrong, everything depends on your strategy and money management.

The position was opened after the second liquidity raid in the premium market. I hope it was helpful to you. Thank you for your attention

How Smart Money took out our liquidity- Trapped with 2 Change of Character (CHoCH) in order to signal a reversal in trend.

- Took out liquidity along the way to original Order Block

- Damn! they got our Long & Short stop loss.

What to do:

- Keep watching Price Action until we see Break of Structure (BOS) in smaller time frame.

- Plot an entry based on newly constructed Order Block.

- Price came right at discount zone of fib level perfectly.

- GO with the real move at WAGMI entry point!

Everything you need to know about order block 5 RULES | TUTORIALToday we're going to talk about orderblocks. Very simply, an orderblock is the support and resistance of big players. It is stronger and more important than what you draw on a chart expecting a price reaction by classical technical analysis.

This works absolutely everywhere in cryptocurrency, forex, and the stock market.

I have deduced for myself 5 rules of confirmation, and now we will go over each of them. Let's start with schemes and end with an example on a chart.

Orderblock is a candlestick that shows purchases or sales of large capital. When a bullish orderblock is formed, an accumulation or reaccumulation takes place in order to further markup the asset. When a bearish orderblock is formed, a short position is accumulated or reaccumulated. With the purpose of further asset markdown.

The first rule is liquidity.

We have a zone from which the price gets a reaction and goes in the opposite direction. This forms a support zone for those who trade classic technical analysis. Traders place their orders in this zone, which is what the big capital hunts for.

Accordingly, this level is pierced by the flow of orders, which activates these stops.

This is how liquidity is removed from the area.

The last bearish full-body candle will be our orderblock. It is important that it updates past lows. An analogy would be the wicks of candle, which removes liquidity from past lows. The wick of a candle in this case is an orderblock on a lower TF.

The second rule is confirmation

After withdrawal of liquidity we expect confirmation of this orderblock - that is absorption and movement in the opposite direction.

The confirmation should be impulsive. That is, we should not see how the price is stuck in this confirmation. It concerns the absorption (updating) of the order block. It is possible inside the candle (orderblock). But personally, I try to take the "book variant".

Local consolidations can indicate the weakness of the movement. It doesn't mean that the orderblock will not work out in the end, but the probability decreases.

The third rule is structure breaking (bos)

One of the key points is the breakdown of structure that this orderblock provides. This is how we can understand the mood of the market and the intentions of big capital.

In this example, we can highlight the main structure with the yellow line. It is after updating a significant structural element that we can be almost sure of the truth of our orderblock.

If we don't see a break in structure, then this movement may just be a correction within a downtrend. So keep an eye on this one.

The fourth rule is the law of force (momentum)

After confirming our orderblock, we can see a prolonged correction in the OTE (make a Fibo). That is, we should see an impulse and after it a slow sluggish movement downwards, which will also form liquidity behind each local high. This is not a necessary factor, but if it is present, the probability of a trend reversal will increase many times over.

The fifth rule - the volume and spread of candles

The candlesticks should be full-bodied with increased volumes. It will be important to monitor the "distance" that the price has done. All these factors will also indicate the veracity of the movement. This recommendation concerns more about swing trading, moments when the price is in a trend for a long time without a serious correction and test of the formed order block.

Examples on the chart

On the daily TF I marked a Sell to Buy move. I marked it this way because there were no warrant blocks to satisfy me on the higher timeframe. This area will act as a zone of interest.

The structure on the Hourly TF looks like this. Consequently, we expect a confirmation of our orderblock through a break of the structure. The price entered the sell to buy zone and tested the order block, which was formed from the wick of the candle.

We saw an impulse exit and watch the price go up sluggishly, forming liquidity behind each low. Therefore, we expect an orderblock test.

I recommend backtesting on chart history to better understand how order block works. Thank you for your attention, I hope it was useful

Smart Money vs Retail traders (How to Think Like Smart Money)😱 There were a few people there talking about their losses, that they had no idea what to do and I wrote this to them:

It's mostly the fault of mainstream media + youtubers + twitterers etc. It's really easy to communicate the simplest approach that everyone understands and subscribes too. Note that if everyone is on the same side... Usually most people are wrong. They take past events too much at face value. But the market is constantly changing. Its to buy on the upside and not during pullbacks + HODL HODL HODL. With that said they really have no idea where they should get out and get in. That's fine by the way. News can be picked up by any of us from the news portals. They don't inform anyone about the negative side of things. It's a tough place to be and you can't take it half as seriously as it is communicated. Unless you are an investor (REAL) you are looking at the market long term. A multi-year perspective. Of course it doesn't pay off here either. The crypto market is still pretty damn small. No one is too late. Now most of you are losing time, but everyone has to start somewhere. I was in the same situation in 2017. I was drowning. Now I'm still looking at these corrections from + xxxxx% profit. Unfortunately we have to give ourselves time in the market and endure pullbacks of -20-30-40-50-60% to see 3000% profits. Realizing upwards during the upswing is not a bad thing. For me, a huge part of my strategy is to have a lot of money on the sidelines. That's why. Especially on 4H trend changes I sell everything that is not bullish. Then I sell others too if they break the trend and just trade.

💡 We are in the best market in the world, but psychologically the hardest market. If you learn to manage these things and use volatility to your advantage rather than your disadvantage, then it's a game changer.

💡 Institutions (fund managers, pension funds, banks and whales) think in long term horizons and monitor price action based on that (Years, Decades) Small investors, retail traders monitor things in low time frames (Minutes, hours, days). Small investors quickly switch between optimism and pessimism based on current price movements and news in the media. It can be a bull market one day and a bear market for a small investor the next. Institutional investors are not sentimental, they assess the growth rate of the market sector, the total market size available, the adoptation/acceptance, the growth of the network, the analysis of revenues (to predict profitability years and decades in advance). If an institutional investor draws a conclusion, they hold it until the underlying financial situation changes. Small investors usually have limited money to invest, so they often resort to leveraging, which typically results in full liquidation. Leveraged trades have "unlimited" potential losses, and therefore small investors (who do not like to buy spot because it is not "cool") can easily "drop out" of trading because of the "unlimited" losses from leverage. Think about it... as a retailer, you have your precious and hard-earned money on the line. Do you have time to lose what you've worked hard to earn, or even more? Why can't you accept that this is a profession? We study in university for 3-10 years to get an average salary afterwards. But here we are not willing to spend a couple of years without constantly taking time away from yourself with losses? Levrage are not bad. The user is the dangerous one.

😱 There is a reason why 90% of retail traders lose money.

💡Institutionalists brazenly exploit those with few resources and fear. Institutional investors have access to billions of dollars worth of resources and have teams of quantitative/statistical experts who control the automated trading algorithms.

Institutional investors have deep pockets and can influence the general sentiment of the market through the press (news, social media and interviews). Institutional investors influence the news that small investors read. Institutionalists are well known for advertising higher prices to retailers to "buy at the top", This is the FOMO factor (Fear of Missing Out). They are also notorious for creating tremendous market fear (FUD - Fear Uncertainty and Doubt), which encourages retailers to "sell at the bottom".

💡 Institutions are also actively involved in futures, options and derivatives markets. They all actively benefit from short-term price cycles as well as longer-term accumulation strategies. The institutions are sophisticated, financially strong and have expertise. Institutions make money by attracting small investors into the market (via FOMO) and then liquidating their positions (via FUD). In the market, one person's loss is another person's gain.

💡 There is a learning curve that 90% of your people want to skip and get rich overnight. Unfortunately, this is not reality. Knowledge is incredibly important. If you want to be a doctor, or a surgeon, you don't just walk into the operating room and say give me a knife and I'll cut this guy open and operate him without any knowledge. You really have to know what you're doing. If you're an engineer or you want to be an engineer, without training or knowledge, it would be very difficult for you to build a bridge or a skyscraper. You need the knowledge. If you want to be a teacher, but you don't know the subject matter, it would be very difficult to teach students in a meaningful way if you don't even know what you are teaching. So it is essential to acquire knowledge, but that knowledge has to come from the right people. So mentoring is also vital. Everyone must also understand the psychological aspects of investing and trading. Because a lot of people lose money in the financial markets. Not because they are stupid, but because their emotions get the better of them. Focusing on learning is incredibly important, it changes your life. Of course, this doesn't just apply to investing and trading. It applies to everything, which is why the financial markets are so incredible in their ability to create meaning in life, if people are open to it, and if they don't focus too much on money, then money will simply be the result of doing things the right way. Over time, if you do things the right way, you will become rich, you don't have to become a millionaire overnight. If you want to do that, you will probably lose all the money you put into the hands of institutions that want your money, want you to be captivated by a fantasy world.

The reality is that you need the knowledge to fight the big players and win.

💡Self-control is also a must. All wealth will pass without self-control. Self-control makes you keep the money you earn. There are many examples of this among people who have won huge amounts of money without earning it. For example, people who win lottery. These people basically give back all the money they made because they didn't really earn it. A lot of times, the money they didn't earn is put back. When you earn money with self-control, you never have to give it back! It is yours and will continue to grow.

💡 The key is to get off your ass and get moving. Remember these things and you'll be fine.

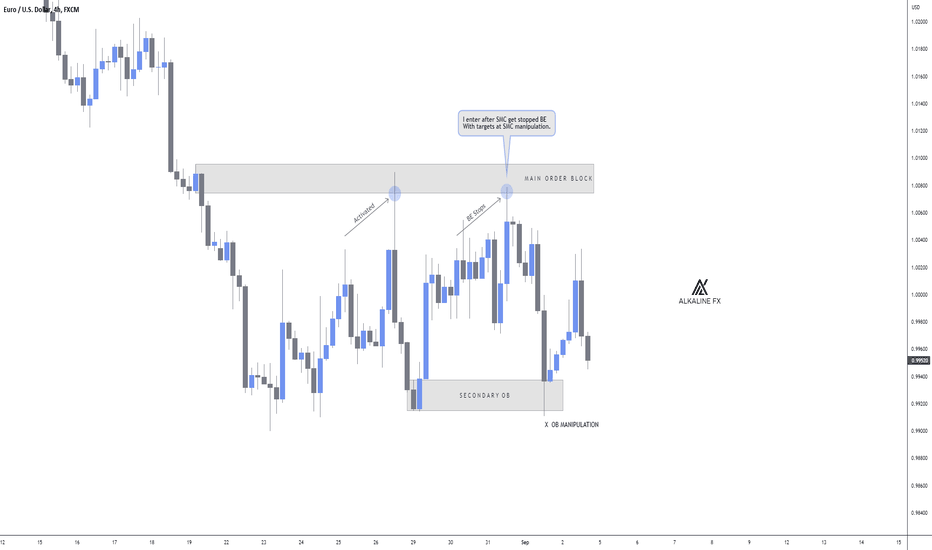

Smart Money Manipulation 🥊Alkaline is back baby! 💣

As smart money concepts gain popularity, liquidity increases.

I have taken a month away from trading to study the new forms of market manipulation and have been pleasantly surprised by what I have found.

Here is my discovery:

1) The market is currently focusing on taking liquidity from breakeven positions over fixed stop losses.

This is because emotional traders put their stops to BE quickly to avoid pain, especially during indecisive markets.

2) Order blocks are the perfect manipulation areas.

If you take time out to backtest significant order blocks, you will notice price will tap and lure or simply sweep above/below the zone before going in the intended direction.

3) That tight stop loss you are using is doing more damage than good.

Scale into your positions, trust me when I say this will reduce your emotions and give you a more relaxed trading style.

4) Use your brain, even if you are in denial.

If the majority of traders lose money, and the majority of traders now use smart money concepts, do the maths.

It feels good to be back after a long month of studying, I have lots of new things to teach and share.

I will be taking on new students shortly, have a great weekend everyone 👋

GBPUSD SELLS REVIEW, SIMPLE TRADE SETUPThis is a quick review on the trade i had on GBPUSD, guys this is the simplest way to trade . Break in Market Structure on the higher time frame , then go to lower time frame to look for entry.

remember to subscribe and share to all traders and aspiring traders you know.

What to do when you do not have any good POIsWatch this video to learn how to adjust your thought process when the market does not give you any valid POIs to work with. I struggled with this for a long time.

ORDERFLOW & LIQUIDITYPlease like, share & comment on my educational post.

--------------

After a BOS we expect price to pullback and

mitigate a significant zone in the previous

range before continuing

to break structure again.

If we do not get this mitigation it is likely that the

high/low that failed to mitigate will become liquidity.

GBPUSD Using the Element of TimeThe element of time is a technical analysis tool that I've previously elaborated on -> Check links to related ideas.

The illustration is pretty self-explanatory.

First attempt failed, however price presented a better opportunity a couple hours later which ultimately yielded all our profits for the week.

I will provide my thought process, execution and exits for this trade in a subsequent recording :)

Stay tuned !

What is an Order Block? 🎯Why are order blocks formed?

Order blocks are created when a breakout move doesn't go to plan.

If banks get caught in a fake breakout move, they aren't going to sit and cry about it.

They are going to push the price back up/down so that they can close out of their negative positions to join the correct side of the market.

Stop using order blocks that have no logic, widen your chart perspective.

📚 Inducement: What Is It ⁉️Inducement is a trap before an area of supply or demand.

Price will usually lure impatient buyers/sellers into the market before the zone is met to create liquidity.

Once the impatient traders get trap [ped and stopped out, the true move begins.

This just goes to show the importance of sitting on your hands!

Traders, if you have your own opinion about this idea, write in the comments section, I always reply. 💬

🚨 RISK DISCLAIMER:

Trading Crypto, Futures, Forex, CFDs, and Stocks involves a risk of loss.

Please consider carefully if such trading is appropriate for you.

Past performance is not indicative of future results.

Always limit your leverage and use a tight stop loss.

--------------------------------------------------------------------------------------------------------

Please like, subscribe, and share this idea with others! ⬇️

--------------------------------------------------------------------------------------------------------

How to win your continuations and avoid bad tradesHi,

Those who follow me know that I only trade with pure price action and volume . If you are someone who also hates the subjectivity of indicators then you'd find this interesting.

This is what I look for before taking continuation trades, keep in mind that what's important when you trade like that is the concept of weak high/lows and strong highs/lows.

When you find those points all you have to do is trade with the trend then find the last point of supply/demand and take your entry.

Hope this helps.

A Brief Overview of My Market Approach Brief explanations

I form my narrative based on ICT concepts, I form my entries based on the free Phantom Trading content. My appraoch is based on my understanding of these concepts, which may not be objectively correct according to their teachmgs, but it's what works for me

Premise: M1 flow - Typically I look to trade M1 flow in line with M15 flow, but not always

HTF AOI: W to M5 - Since I trade on the M1, I consider anything M5 or higher to be a higher time frame

Markets: DXY, EURUSD, USDCHF - I choose EU and UF due to their correlations with the dollar index. EURUSD has the best inverse correlation, USDCHF has the best direct correlation of all the majors

Minimum Risk to Reward Ratio (RRR) 3.2 - This gives me around 3R and should about cover commissions.

LTF Confirmation entry method

Liquidation - price liquidates a level on the M1 (bonus for HTF liquidation)

Mitigation - price mitigates a HTF level, in the form of a return to supply/demand or a raid of liquidity

CHoCH - price changes character by breaking above supply in a downtrend or breaking below demand in an uptrend

SD/DS Flip (supply to demand, demand to supply) - in an uptrend, price reacts to a level of demand, fails to create a higher high, and breaks structure to the downside (DS Flip) ; in a downtrend, price reacts to a level of supply fails to create a lower low, and breaks market structure to the upside (SD Flip)

FVG (Fair value gap) - added confluence if there is unmitigated imbalance associated with the entry level

My favorite setups are just my favorite presentations of the setup, there are a number of other factors that can shape the setup. The important thing for me is that I pay attention to the narrative the pattern is telling me, instead of simply trading the pattern. Understanding the narrative behind the patterns adds edge to my discretion and often helps me stay out of less probable trades/trading areas.

I will be posting a video to youtube that includes an oral summary of what is presented here, I will post an update to the idea when the video is released (this coming Sunday, 2 Jan 2022).

WHY DO WHAT THE 90% ARE DOING WHEN YOU SHOULD DO THE OPPOSITEI saw an enormous liquidity pool being created by price on GBPUSD. All i was anticipating was for price to come attack that area which i call the HOTSPOT. The market is seeking for liquidity time after time,so have it in mind that price is built to attack all strategies. Liquidity is the only reason price moves,this is why even after all the confluence and confirmations you get according to your strategy you still find yourself loosing,that is because you got caught up at the HOTSPOT. All strategies work but if you can understand where price wants to attack you can become exceedingly consistent in this market. Bear in mind that price do not care about your strategy,all price cares about is your money