CORRECT AND INCORRECT RISK MANAGEMENTHello everyone!

Today I want to remind you about the risks!

Risk management is very important in every trade , but most traders are too lazy to act according to the rules, so I decided to remind the basic rules.

They look simple, but following them will greatly reduce losses and increase the win rate.

Let's go!

Correct calculation of possible losses

Beginners are AFRAID to think about losses.

And even more so to count them!

But it must be done, otherwise you will lose much more than you should.

Even BEFORE opening a position, you should know how much you are willing to lose under unfavorable conditions.

Cut losses and let your profits grow

It's strange, but people are ready to quickly fix a profit, but not fix a loss.

Premature profit-taking is a normal phenomenon, as is overexposure of unprofitable transactions.

why?

Because traders are afraid of losing profits and hope that the loss will decrease and even turn into profit.

Don't move your stop loss

If you followed the first advice and calculated the stop loss, and after placing it you started moving, then you did not understand the essence!

Stop loss is very important and it is important not to move it.

In each trade, you risk a certain percentage and should not increase this indicator by moving the stop loss.

Monitor your drawdowns

It's unpleasant to lose, it's unpleasant to analyze your losses, but you have to do it.

Without loss analysis, you will not get better as a trader.

You have to keep track of losses, you have to analyze trades to improve your trading and not repeat mistakes.

Opening positions without risk management

Most traders don't think about risk at all, much less risk management.

Most of them open trades without risk management and therefore most of them lose all their money.

Trading without stop losses

The fear of losses and the fear of being wrong leads to the fact that the trader does not set a stop loss.

If you do not set a stop loss, know that the stop loss is still set, how?

It's simple, in this case your stop loss will be equal to your capital.

The position will close when your account is 0.

Is it easier this way?

Let the losses run

Why don't traders close unprofitable positions?

As mentioned above, it's all about hope .

do you think that the price will sooner or later go in your direction?

Perhaps.

But by that time, most likely you will already be closed by margin call.

Ignoring drawdowns and other important indicators of risk management

Ignoring is a favorite thing of novchikov.

They think that they have understood everything, they think that the market will spare them.

Unfortunately, the market doesn't work that way.

Risk management was invented long before you and will be and will be used after you.

And all because it works and without it YOU CANNOT BECOME a SUCCESSFUL PROFESSIONAL TRADER .

And then it's up to you who you want to be.

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

Trading-signals

HOW TO IDENTIFY POTENTIAL SUPPORT AND RESISTANCE 1️⃣ Previous Lows and Highs

The highs and lows act as potential support or resistance levels. The highs, in general, are extremely important because many market participants are constantly staring at them, entering the market either at or near the high.

The human psychology is a funny to observe when the price goes against them. People do not take a loss and do not close a position but keep it and hold on, because psychologically it hurts less, than when you have closed the position and fully realized the money is lost.

Accordingly, when the price returns to the previous maximum, those who bought at this level have an irresistible desire to close the position and get to zero, and begin to close their positions frantically. Those who bought below it usually want to take profits at the old maximum, because they understand it psychologically.

Any prices higher than the maximum seem to be too expensive to potential buyers, and people get upset and leave such a market. When the price accelerates and falls to the previous minimum, these low prices begin to attract buyers. At the end of the day, they missed the first price return to that level and are now grateful for a new chance.

For the same reason, sellers are extremely reluctant to part with their money when the price returns to the previous low, because they have seen a pullback from that low before! And so, they think, "why don't the price bounce again?Unfortunately, there's no way to tell in advance which level will be support and which will be resistance, and there's no way to say with certainty that it will work out the way we want it to. That's why any levels are just areas of interest where we expect a potential, temporary reversal. Accordingly, we will need help from other indicators, say oscillators.

2️⃣ The magic of round numbers

Support and resistance love to form around round numbers. The reason is clear, all these 10, 50 and 100 are the simplest psychological markers on which traders justify their decisions.

In the 1970s, the Dow Jones Industrial could not get broke the 1,000 level. Gold in the 1980s and mid-1990s was always hanging around the magic $400 level, and so on.

The round level is a potential pivot point that we are interested in

3️⃣ Trend lines and moving averages are dynamic support and resistance levels

A good trend line always reflects the underlying trend. One of the simplest rules for determining the significance of a line is how often price has touched or approached it. The more, the better. If price keeps coming back to a low, that level becomes a strong support zone. A similar rule works for trendlines and moving averages. Every time price returns to a trendline or rising moving average and bounces back from it, the line or moving average becomes a dynamic resistance level. The same works for downtrend lines and moving averages.

Therefore, when price returns to an uptrend line, the buy option becomes interesting and the sell option becomes interesting if price touches the descending line or moving average. In this case, an excellent low-risk stop loss can be placed under the line or the sliding line. The principle is the same as if we were building a house and increased the thickness of the roof. The same principle works when the moving average and the trend line are at the same level, they trivially double the strength of the resistance level (or support, if the price goes up).

4️⃣ Emotional zones on the chart indicate possible support/resistance levels

An emotional zone is a place on a chart where the price, going in a strong steady trend, encounters an abrupt, literally explosive reversal on the formation of the next candle/bar.

Gaps are another example of emotional zones. Gaps are formed when buyers or sellers react so emotionally to news that an empty space aka a "gap" forms on the chart.

5️⃣ Proportional movements and pullbacks

If we paraphrase one of the laws of dynamics, we find that for every action there is a counteraction. Prices formed in financial markets reflect nothing less than the psychology of the crowd in motion, so the laws of dynamics apply to them in full measure.

As a result:

It is the changing emotional state of the crowd that we often see in proportional price movements. Perhaps the most famous principle of proportionality is called the 50% rule. For instance, many bear markets, if followed through the DJIA index, lost half their value. In 1901-1903, 1907, 1919-1921, 1937-1938 markets fell by 46, 49, 47 and 50%, respectively. The first phase of the 1929-1932 bear market decline ended in October 1929 at 195, which was exactly half of the September high. Past the halfway mark often serves as a balancing act, often hinting at further price movement or an important reversal ahead.

INTRADAY FOREX TRADINGGreetings everyone.

Today we are going to talk about such a difficult topic as intraday forex trading. The tips below will be helpful to any intraday traders.

🔷 Don't chase the number of trades. Select the most obvious setups.

You have opened a chart. There are no setups. You zoom in the picture, change the timeframes, looking for some reason to enter the market. Does this situation sound familiar? The fact that you, following the stereotype "intraday trading is a lot of deals, almost every minute", really want to open a trade, and then some more. Only this is not trading based on the system, but trading at random. What does it lead to? I think you've guessed it. Enter only when you see a clear, text book setup. Enter the market only when you see clear setups. Ignore confusing, unclear situations. Just wait for clear entry signals.

🔷 Limit the Number of Traded Instruments

Intraday trading requires quick and clear actions. There is no time for long thinking. So, a large number of trading pairs will only confuse and distract you. You don't need 20 charts when trading intraday; limit your portfolio to two or three instruments, no more. In the beginning, I would advise to trade no more than one pair.

🔷 Risk no more than 1% of your deposit in each trade

The psychological pressure is very high when trading intraday. It is very easy to get enraged by a couple of losing trades and start making more and more mistakes trying to win back. It is very hard to stay calm, risking 5-10% of deposit in every trade, because we open trades quite often during the day, and there is just no time to calm down, to assess the situation thoughtfully and without emotions.

So, the best variant is to risk only a small part of your capital. That in case of a string of losses you will stay morally steady and be able to continue trading in order to recover these losses later. Try to aim not to earn much at first, but to earn steadily.

🔷 Monitor the news

The release of important economic data can easily turn the market in either direction. And while this factor is neutralized by the timeframe size when trading on daily charts, in intraday trading you have to pay attention to news releases. Do not trade half an hour before and after the news release. If you see some kind of Price Action setup, but half an hour later the news comes out just wait. After the news release, if the market moves in the direction indicated by the setup, you can enter the market. But not before the news release.

🔷 Watch the higher timeframe

Forex charts of the same currency pair can be completely different. It all depends on the timeframe, on the selected timeframe. And if you trade, for example, on H1, then it will be useful to look at the higher timeframe like H4. But we have to do it wisely considering the stage of the event on the higher timeframe.

🔷 Limit your profits / losses for 1 day

First, never set yourself a goal: to make N points in one day. This leads to looking for non-existent points to enter the trade, feeling angry at the market, and in the end, there are just quiet days when it's hard to extract your N pips even in theory, let alone in practice. I'm talking specifically about setting limits. A kind of total take profit and stop loss on trades within one day. It may seem silly at first sight, but this approach helps a lot in maintaining the discipline which is so important in intraday trading.

🔷 Consider the daily volatility of the traded pair

Let's assume you know that the average distance from the High point to the Low point of the daily candlestick for pair X is 100 pips. If your profit on a trade opened during intraday trading was about 70-80 pips, then it would be logical to close the position, because the potential for movement is almost exhausted. Likewise, if the price has already gone 70 pips in the trend, and a new pattern appears in the same direction, it would be quite stupid to open a new trade, because the price is about to "run out of fuel".

🔷 Do not leave the position for the next day

A serious error of beginners is to leave open positions overnight. Think about it: why should the set up that you found intraday be valid tomorrow? The market has long forgotten about it. The traders have a lot of new data, signals, someone has opened positions on higher timeframes, and so on. So why should your position hold?

By leaving open positions overnight you are simply playing roulette, trying your luck. And luck has no place in Forex. So, in order to avoid unnecessary losses, if at the end of the American session you have open positions, no matter what just close them.

How to Read A Price Chart▶️ How Does the Market Move?

At any given point in time, the market is likely to be moving in one of three directions: up, down, or sideways. Which direction is up? Which direction is down? And which way is sideways? When the market is moving up or down, it is said to be in a trend. When the market is moving sideways, it is typically in a period of consolidation. There are two types of trends that markets can be in: a bullish trend continuation trend or a bearish continuation trend.

▶️ Bullish Trend Continuation:

Buyers can control price action when the market is in a bullish trend. This market identified by price action that has started at an Initial Low and continued to rise up, achieving a New High when it breaks and closes above the previous high. As the market retraces, price action will continue to fail to break and close below the most recent structure lows. This will create a Higher Low. As the process repeats itself, we see a pattern of new highs and higher lows being created. This pattern reflects the changing dynamics of the market, and provides insight into the market's future movements. When price action is presenting this type of pattern, trend continuation traders should look for opportunities to buy in the market.

▶️ Bearish Trend Continuation:

A bearish trend continuation pattern indicates that the current downtrend is likely to continue. The sellers have taken control of the market and are looking to drive prices lower. This process is identified by price action starting at an initial high and then moving downward. This creates a new low as it breaks and closes below the previous structure lows when looking left. As the market pullbacks, price action fails to break and close above the most recent highs. This has created a Lower High. As the process repeats itself, we see a pattern of new levels being created, followed by decreases in the level of the old level. If you're a trend continuation trader, be on the lookout for selling opportunities in the market.

▶️ Consolidation:

When the market is in a period of consolidation, it is difficult to tell whether it is heading in a bearish or bullish direction. Instead, price action is “choppy” as there is no clear directional movement. During the period of consolidation, trend continuation traders should be careful when looking for trading opportunities.

▶️ Support and Resistance

After the formation of a New High, the market will retrace and create a higher low. When a movement occurs, the now-forming area of resistance is an indication that something important is happening. As price action pushes up from the newly created higher lows, that resistance level becomes the last line of defense for sellers to try and stop the buyers from rallying. Failure to break through the resistance level could indicate an uptrend period or reversal. If the price moves past the resistance level, this means that the trend is continuing. Remember the previous NH that turned into resistance after the retrace? Well, once this resistance level is broken, it becomes support. If price action retraces back down from our recent highs, this structure level should support the overall trend.

▶️ Forming Structure:

To create a valid new structure high or low, we need to watch for the market to break and close above/below the previous structure. When a trend is bullish, the market can create a "Higher High" near or above the highest point reached in the trend. When a trend is bearish, the market can create a "Lower Low" by trading near or below the lowest point reached in the trend. In order to have a valid Higher High, Higher Close, we need a candlestick that breaks and closes above the previous candles' all-time highs. It is only after we have generated a new structure that is highly formed that we can consider it to be a valid one. If you are looking for a bearish trend, simply use the opposite.

▶️ Why Is Structure Important?

Structure is important because it can help you predict where price action is likely to go. Previous support and resistance levels in the market act like a magnet, pulling price action towards them. When price action reaches high levels that have been hit multiple times in the past, it is considered to be a major structure level. It is important to pay attention to the main structural levels, because it is likely that the price action will be related to these levels.

Smaller ebbs and flows of a trend can be detected inside minor structure levels. These levels serve as both support and resistance, although they lack the strength of the primary structure levels indicated above.

COMMON CAUSES FOR OVERTRADING👋 Hello, fellow Forex traders!

Overtrading is the most common problem, especially for traders trading on lower timeframes. It can arise for a number of reasons, so if you don't know what the main purpose of your trading is - i.e., what instruments you trade on, how you trade, what your trading strategy is, your motivations, personal styles and your trading and personal history I will give some explanations why traders become addicted to trading and give some possible solutions to this problem, hoping that among them you find your own solution.

In order to determine when you become overly active, you need to have some basic criterion with which you can build off and thus be able to determine the amount of deviation from this value - it could be, for example, the number of trades made or your trading volume. Of course, there can be situations where a high trading frequency is acceptable, such as when markets are volatile and there are significantly more trading opportunities than usual.

1️⃣ Emotional Trading

This happens when a trader trades forex, transfixed by feelings of excitement and pleasure, rather than for profit. Just like most people who play in a casino. If your goal is solely to have fun and get emotionally excited, then you must also realize that in the long run you are likely to develop an addiction to trading, and you are unlikely to profit. If you want to profit from your trading, then you need to change your goals, forget the fun and excitement, and move to a more professional and structured approach whose desired result would be trading productivity expressed in monetary or percentage terms.

2️⃣ Lack of trading strategy

When a trader does not have a rule-based strategy and, therefore, any parameters for determining when to trade and when not to trade, any price movement in the market tempts him. In this situation traders are very prone to chase trends and often find themselves buying when the trend is down and selling when the trend is up. They get the impression as if they are doing everything in vain, as if the market is watching their actions.

Do you know this situation? The most important thing you can focus on is developing your trading strategy, which clearly identifies whether there is a particular trading opportunity, fundamental data, technical analysis or a combination of both. This will help you become more selective in your trading.

3️⃣ Boredom

In a quiet market where traders spend most of their time in front of their computer screens, there will be times when there are weak or no trading opportunities. It’s time when traders can get bored. These are natural periods in trading. For some traders, this can be very challenging especially for beginners, traders whose trading activity is based on emotional excitement, who work on enthusiasm. An important question you should ask yourself is the following: "Am I trading to relieve boredom or to make money?"

4️⃣ You need the money

This is one of the worst situations in trading. It is a strong and powerful state, but it will not contribute to good trading overall if your decision-making is focused solely on making money and not on your trading strategy. Evaluating your financial needs and the effectiveness of your trading is very important. And you don't have to adjust your search for entry signals with what you don't have enough for beer. Any action you can take to alleviate your acute need for money will be a big step forward for you.

5️⃣ Enthusiasm in Trading

Novice traders are full of enthusiasm. Traders who are entering new markets and using new trading methodologies also tend to be more enthusiastic and passionate. While this enthusiasm is undoubtedly a positive quality, there is also a dark side to it, seeing it as excessive enthusiasm and looking for any opportunity to open a trading position.

Maintain your enthusiasm, but channel it into developing your trading strategy and discipline. If you have certain trading considerations, practice them on a simulator/demo account, where costs are obviously much lower.

6️⃣ Lack of Patience

Traders who suffer from a lack of patience become addicted to trading because they will take opportunities that are not part of their trading strategy, and thus they will naturally make more trades than necessary. Develop patience in yourself, look for opportunities to analyze the markets, and take the time to just look at them rather than act on them. You might want to try practicing self-awareness to help identify and work with overcoming the desire to alleviate feelings of impatience.

7️⃣ Revenge Trading

This is when traders have lost money in losing positions, making mistakes or accidentally opening positions, etc. and are usually eager to "get their money back". Despite the fact that the goal of such behavior/thought is positive, the subsequent behavior usually is not. Simply put, a desire to "get even".

Traders chasing their losses will deviate from their trading strategy by opening positions that are probably profitable, whether they are consistent with their trading strategy or not, for, according to their psychological mindset, their goal now will be to make money, not to stick to their trading strategy. If you have incurred major losses or lost a large amount of money in a number of trades, you should generally take a time out. This timeout will allow you time to redirect your trading state and refocus, and most importantly, it will break the "losing money → feeling angry → wanting your money back" behavioral pattern. Time out breaks this behavioral pattern and allows you to refocus - use breathing and relaxation techniques or take a slow walk that will help you dilute your emotions and reduce your desire for revenge trading.

8️⃣ Fatigue

When you are tired, physically or mentally, your brain does not have enough energy to function at full capacity, and with low "fuel" your work will have low levels of self-control.

It is self-control, not a trading strategy, that is needed to engage the brake in your brain to stop your trading, and that requires a source of energy. When you are tired and your fuel level is low, your self-control will also be low, there will be more chances for excessive and unreasonable trading. Rest and glucose (which we get with food and sweets) are the two main factors in optimizing brain function on the energy level. When you trade, you must be firmly convinced that you are awake and full of energy.

✅ Thus, there are several reasons why traders overtrade, and I have provided you with some possible solutions to help you overcome them. Analyze which one might be most appropriate to your situation, test them out and write about them in the comments.

DOUBLE TOPS/BOTTOMS🔵The double top and double bottom are a pattern that can be used to find a counter-trend trading opportunity. This pattern can also be used as an entry technique in the markets. When this pattern is seen, the market is signaling to traders that a particular level of structure is important because price action is refusing to break and close above or below it.

A double top and bottom are a sign that the market is failing to break through previous levels. When identifying a trend continuation pattern in bullish market, the trader is looking for a new high in a price action, followed by a pullback, followed by the market again hitting a new high. In cases of a double top, the market does not rally high enough or close above the previous top, indicating that the price action does not have strength to break through the previous level.

🔵 Filters

Although it is possible to trade the double top and bottom successfully as mentioned above, I have added a few filters to eliminate some of the false signals and to be sure that I take only the high probability trades. There are many different filters that you can use when trading, but the main one I use is the Relative Strength Index (RSI). I look for overbought and oversold conditions as well as divergence to help me make decisions.

When identifying this pattern, I first look for the RSI to be overbought for double top and oversold for double bottom. If this happens, then I have a valid trigger bar. After price action retests the trigger bar, I look for divergence.

🔵 Divergence:

A divergence between the RSI and price is formed when the two send contradictory signals. If price is producing repeated high and lows, the RSI should also be trending up. Divergence occurs when price is producing higher highs and higher lows, yet the RSI shows a higher high, then a lower high. In the case of a double top, as price action gives us an initial high (trigger bar), followed by an equal high (the retest), the RSI usually prints a lower high, suggesting that the trend may be losing momentum.

🔔 The best place to put stop loss is above or below double top/bottom.

As with any trading technique, your stops for this pattern will ultimately be up to you and I would advise that during your back testing you test out multiple areas, but here are some common rules that I use for this pattern. When placing a stop on a double top and bottom, I will take 1-2 ATR way and put it above or below the high and low of the pattern.

HOW TO SPOT A REVERSALLet's see how the characteristics of a reversal and a pullback differ.

📈 A pullback:

- Usually occurs after a strong price movement;

- It does not last long;

- The fundamental (macroeconomic) data does not change;

- In an uptrend there are hints of its continuation, similarly for a downtrend.

📉 Reversal:

- Can occur at any time;

- Long term;

- The fundamental data is changing it is often the reason for the reversal;

- In an uptrend there is no hint to its continuation, the buyers' strength decreases (and vice versa for a downtrend).

Unfortunately, there are of course no guaranteed methods to determine where there is a pullback and where there is a trend. I would buy this one for any money, and everyone would buy it. That is why it is determined by a number of different instruments, from a simple multiframe analysis and trend lines to various systems.

🔴 Reversal: Fibonacci Levels

Although I myself am not a fan of Fibonacci levels and its many counterparts, it seems that everyone uses them but me. Let's listen to the practitioners of this tool, since the market likes it so much. According to them, statistically, pullbacks most often occur at levels 38.2%, 50% and 61.8% those Fibonacci retracement levels.

If price broke through those levels, it could very well be a trend reversal. But technical analysis is not science, so we will always deal with probabilities. In the case of Fibonacci, pullbacks are identified like this:

As you can see, each pullback tests a certain level before reversing further along the trend. And this repeats itself. But if price were to confidently break through these levels one after the other, that would indicate a long-term reversal.

🔴 Reversal: Pivot Points

Another method of determining the reversal is the use of the pivot points. In an uptrend, the lower support points (S1, S2 and S3) will act as conventional levels, breakout of which can indicate a change of trend, but not a reversal. And vice versa for resistance points (R1, R2 and R3).

Breakdown of these levels is another hint to a reversal.

🔴 Reversal: Trend Lines

Trend lines are generally an elementary method of determining if a trend has changed or if it is a pullback. If you combine trend lines with candlestick combinations and price action patterns, you can get really impressive results.

🔴 Reversal: Price Highs and Lows

Finally, my favorite method for identifying pullbacks and reversals is to use the basis of Dow theory: price lows and highs.

The simplest technique for this is described by Martin Pring.

Pring gives the simplest explanation that improves the basic understanding of any market.

📊 Market condition of price

As you can see, using simple techniques, we can build up practical decision options for determining whether price is reversing or going further along the trend. Trends, pullbacks, and consolidation are the three pillars of any market. I also advise you to be extremely attentive to candlestick combinations in reversal zones, whether it be trend lines , pivots , or other tools.

Study them. Keep screenshots. Look for them on the history. Do not be lazy. This is the only way to learn, over time, to better identify price behavior. At some point, you will feel it on an intuitive level. But this is just a continuation of your trading practice, which has moved, after many months of practice, to a new level.

Experienced drivers don't think about when to squeeze the clutch and when to change the gear stick. Not only that: they can even feel the dimensions of the car. Seemingly unbelievable thing: you are inside and you feel that there is 5 cm from the bumper to the sidewalk. In trading, you just have to reach a similar level of intuitive perception based on hours of theory and practice. Therefore, the specific instrument is not so important. Much more relevant is your level of proficiency in it.

American Trading SessionThe American trading session is considered the largest in terms of volume and strength of market movements. All this is connected with the American economy, which is larger and stronger than the economies of other countries. The ability to correctly identify and use market fluctuations in the American session will help everyone earn a lot and quickly.

The opening hours of the American trading session in New York are from 8:00 to 17:00.

The largest financial platforms in New York and Chicago create the main activity of the American trading session.

Trading sessions

At 9 o'clock in New York, the largest market in the world opens - the New York Stock Exchange.

At this time, the giants of the financial world come into play and the market is gaining momentum. An hour later, another major exchange opens, which is called the commodity exchange, the Chicago Mercantile Exchange.

Due to the overlap of the two sessions of London and America, there is a lot of activity and a lot of volume at the beginning of trading.

High activity is observed almost throughout the entire session and stops when the offices of financial giants close in New York. After about one hour, the offices in Chicago also close, marking the end of the session.

Assets

With the opening of the American trading session, trading begins on large platforms in the USA, Mexico, Brazil, Canada.

In Canada, during the American trading session, trading opens on the TSE and CSE exchanges in Toronto, ME in Montreal. At the same time, trading starts on the Mexican Stock Exchange BMV.

During the American trading session, the largest Brazilian exchanges also begin trading: Bovespa in Sao Paulo, as well as BVRJ in Rio de Janeiro.

During this period, key indices are traded:

NASDAQ is a group of stock indices of five thousand companies listed on the exchange of the same name.

XAX is an index traded on AMEX and reflects the dynamics of stock prices and depositary receipts of all companies traded on the exchange.

The Dow Jones is one of the largest indices in the United States, including securities of organizations in almost all industries, except transport and utilities.

The S&P 500 is the stock index of the 500 largest companies on the NYSE and NASDAQ.

S&P/TSX is an index of high–capitalization companies whose securities are traded on the TSE.

Mex IPC is a Mexican stock index that includes securities of 35 large companies traded on the Mexican BMV.

BOVESPA is a Brazilian index based on the securities of 71 large companies traded on the exchange of the same name.

Thus, the American trading session takes place during the work of the world's largest exchanges, where most of the most significant stock indices are traded.

Currency pairs

The pairs that include the currency of one of the countries of this session have the greatest volatility during the American session:

Pairs with the US dollar:

AUD/USD, EUR/ USD, GBP/ USD, NZD/ USD, USD/BGN, USD/CAD, USD/CHF, USD/CZK, USD/DKK, USD/HKD, USD/HUF, USD/ILS, USD/JPY, USD/MXN, USD/NOK, USD/PLN, USD/RON, USD/RUB, USD/SEK, USD/SGD, USD/TRY, USD/ZAR

Pairs with the Canadian dollar:

CADJPY, CADCHF

The volatility of the euro–Mexican peso pair is also increasing.

Features

By right, the American trading session is considered the most active session among others. The main reason is the large economies of London and America, which are trading simultaneously at this time.

As you have already understood, the high volatility that is observed during the American session is capable of destroying any trader's account. It will be extremely difficult and dangerous for beginners to trade at this time.

The beginning of trading is considered an excellent time for scalpers, because during these hours there are strong price jumps, since strong movements can literally earn a decent profit in minutes.

After 11:00, sharp unexpected jumps may occur in the market caused by the actions of large American players, often working together and trying to get maximum profit by reducing the number of players in the market after the closing of European trading.

Before the weekend, during the American trading session, there is usually a pullback on the main trends, since Japanese investors do not trade, European investors leave for the weekend, and American investors try to lock in profits and not leave positions for the next week.

Conclusion

The American trading session is the most volatile part of the entire trading period. During this period, it is worth making transactions with caution, since powerful movements caused by large players are not uncommon.

This session is best suited for scalpers due to fairly strong fluctuations within the day, when a fairly large movement can be taken in a short period.

The most careful approach should be taken to assets related to the US dollar in one way or another, and, accordingly, follow the US news published mainly at the beginning of the session.

How The 80/20 Rule Applies To Forex TradingToday's article will be entirely devoted to reflections on such wonderful topics as: psychology, risk, workspace management, and analysis.

20% effort gives 80% results

Many people probably heard about Pareto's law, the so-called 20/80 principle.

Whether you agree with it or not, let us project this statement to the approach to trading as a technical analyst. What is the 80% result obtained with 20% of effort? I believe that only with the right psychological approach and attitude trading will give 80% of the result with 20% of effort.

Hence the simple truth even a child can be taught to trade. But it doesn't mean that he/she will bring a stable and guaranteed income in the long run. I mean technically trading is a very simple thing, if not complicated.

Is it difficult to find the trends according to Dow's theory? Find the right patterns on the chart according to Steve Nisson or price action methods? To delve into Elliot waves or swings to apply them in practice? All these things may scare only a beginner trader.

But this article is not for beginners, it is for people who have some experience in trading. Thus, the bare technical aspect gives only 20% of the result and the rest will fall on your shoulders.

The obstacle to successful trading is the trader

We all can agree that the main obstacle to successful trading is the trader himself. You can distinguish an implication in favor of algorithmic trading, and a bold disadvantage in the manual trading. I would not say so, for the simple reason that it is easier for a trader to adjust to the current market situation and the process that is not included in the logic of the algorithm.

But for this it must be developed a sixth sense: intuition, NOT your technical skills. By intuition and a sixth sense I mean, of course, only experience and knowledge, embedded at a subconscious level, rather than trading at random.

And what are non-technical skills? It is clear that these are such basics as risk and money management, because this is the root cause of all troubles and misfortunes for a trader if he doesn't follow them.

Often, during active trading, most traders have words like discipline, willpower in their minds and of course excitement, greed and pursuit of money. These are the exceptional, aggressive emotions that lead to the draining. I can't teach you how to deal with it, everyone's character is different, but you need to break down these emotions.

It's impossible to make a million in a month, six or a year out of a thousand. No matter how you look at it, if you break the rules your MM you’ll get a guaranteed loss. But if you work systematically and according to the rules, you can have stability and turn over a profit.

The small things we miss.

It's no secret that life consists of the little things, put together in large formations. If you leave them out, in an instant they will all pile up and collapse like a snowball at the most inopportune moment. One of these little things is the workspace.

The ergonomics of things in your room (chair, desk, device, color of curtains, view out the window) to the color of the bull candle on the chart. The little things that are subconsciously perceived every day. And it's up to you whether they will help, or vice versa, press and aggravate.

Is it possible to trade successfully when there are screaming children, an un-walked dog, or an uncomfortable chair? You're staring blankly at a poisonously colorful schedule and trying to trade. It may well be that everyone has their own view of cozy and comfortable work, but what I see in this picture is a lack of focus on all levels.

We need to remove all outside triggers so that nothing distracts from seeing the essence. Make hours of silence in the house so no one bothers you during that time.

So, here's what gets you 80% of the results: order, discipline, deliberate action, motivation. It's not as much effort as charting. It comes to the aid of a variety of types of organization and management, once you radically put order in yourself, in your life, and you will do it always and then the results of trading will noticeably improve.

How To Remove Doubts in TradingHave you ever wondered why do you feel uncomfortable when you enter a trade, doubt your prediction and then look at it and realize, if you had entered, here or here, everything would have worked out, but damn, something kept you from doing it?

So, what could it be, why would there be such doubts before entering the trade?

In my opinion these doubts may be caused by the following:

▶️ The absence as such a trading system, at least some (where and under what conditions entries are made).

▶️ No trading plan, looking at which it will be easier to work before trading, there will be past examples of successful entries, which may well affect the next one.

Size of the trade. Psychologically it is easier to trade with a smaller amount risk than with a larger one.

Say, you never risk not more than 3% of your capital, but you still do not feel comfortable. You should feel comfortable with the size of the trade. For example, if you have $50 000, but $500 is too much for you and it is hard to part with it? In that case work on the minimum, which is, say $100. Gradually, once again, gradually increasing its size. You trade with $100-200 per trade, move on to $300-400 risk per trade.

When you trade with $100-200 per trade, the stake is small, you not afraid to lose this amount but when you increase the risk, then the problems begin, doubts begin to plague you.

✅ Doubt is the worst enemy of the human mind.

So how to deal with all of this?

Trade an amount that you can afford to lose comfortably, gradually increasing it as confidence grows. Sum that you are afraid to lose can lead to a lost capital, because there will be a great desire to restore the figures on the screen. There is a concept in trading - "Turtle trader" - which implies that you have to grow slowly in trading.

Believe in yourself and in your trading system.

Make notes on previous trades, where it is better to enter and where it is undesirable, history repeats itself. An important point, do not trade when you are upset about something, or just not in the mood, when you are tired. When you trade, you should not have extraneous thoughts, especially negative ones. Read a book on psychology, for instance, relax, or trade on a demo if you really want to trade.

To sum up

When you experience self-doubt, don't make the situation worse. Everyone experiences doubts. This is normal when trading in such chaotic markets. If you are a novice trader, take comfort in the fact that your doubts will subside once you have honed your trading skills and gained trading experience.

If you're an experienced trader, it may be helpful to remind yourself that everyone has slumps sometimes. You'll regain your strength if you keep trading. The key to success is to remember that insecurity usually leads to stagnation.

European Trading SessionHello everyone!

Today we continue the review of trading sessions on the forex market.

The European Trading session is next in line.

Let's get started!

The European trading session is considered the most volatile of all. The main reasons for high volatility are the coincidences of the opening of the session with the work of the Asian session, in addition, the European session closes during the opening of the American stock exchange.

It is at this time that 5 major financial platforms are operating – the exchanges of London, Frankfurt, Paris, Luxembourg and Zurich.

Trading sessions

Zurich, Frankfurt, Paris, Luxembourg are three major trading platforms that open at 2:00 New York time, while the London Stock Exchange, the main trading center, opens at 3:00.

The opening time of trading in Europe is considered to be from the beginning of work in London, since it is on the London site that 30% of all transactions are made.

The largest companies and banks enter trading on the London Stock Exchange at about 4:00 New York time, so at this time there is the greatest volatility.

Opening hours

The period of such activity lasts about 2 hours, after which the activity of traders decreases and it is lunchtime in the offices.

With the opening of trading in America at 9 o'clock, a new momentum of volatility begins in the European trading session. The activity will last about two hours, after which it will gradually fade due to the closure of the Frankfurt, Zurich, Paris and Luxembourg exchanges.

Stock Market assets

With the opening of the European session, trading begins on the largest exchanges in Europe: the London LSE, the Austrian WBAG, the Berlin, Munich and Hamburg stock Exchanges in Germany, the Irish Stock Exchange, the Italian ISE, the Spanish BM in Madrid, the Swiss SWX, the Stockholm Stock Exchange in Sweden, as well as groups of pan-European exchanges Euronext and OMX.

During the work of the largest exchanges in the European session, the fundamental European indices are traded:

Euro Stoxx is a group of indices of 600 companies of different capitalization levels located in 18 Eurozone countries.

FTSE – index of securities of the 100 largest companies traded on the London Stock Exchange

CAC 40 – Euronext Paris Blue Chip Index

DAX – index of securities of 30 companies with high capitalization of the Frankfurt Stock Exchange

IBEX 35 – blue chip index of the BM exchange

FTSE MIB – index based on quotations of 40 largest companies on ISE

OMX STKH30 – Swedish index of securities of 30 companies with the largest capitalization traded on the Stockholm Stock Exchange

SMI – stock index of the 20 most liquid companies of the Swiss Stock Exchange

The MOSBIRZHI Index is a Russian index of shares of 50 companies belonging to the blue chips of the Moscow Exchange, calculated in rubles.

RTSI is an index of shares of the 50 largest companies on the Moscow Stock Exchange, calculated in US dollars.

Currency pairs of the European trading session

During the European session, currency pairs of countries whose exchanges are active at this time have the greatest volatility.

Currency pairs with euro:

EUR/USD, EUR/JPY, EUR/GBP, EUR/AUD, EUR/CAD, EUR/CHF, EUR/NZD, EUR/TRY, EUR/SEK, EUR/NOK, EUR/HUF

Currency pairs with the pound:

GBP/USD, GBP/AUD, GBP/BGN, GBP/CAD, GBP/CHF, GBP/CZK, GBP/DKK, GBP/HKD, GBP/HUF, GBP/JPY, GBP/NOK, GBP/NZD, GBP/PLN, GBP/RON, GBP/SEK, GBP/SGD, GBP/TRY, GBP/ZAR

Swiss Franc pairs:

AUD/CHF, CAD/CHF, CHF/BGN, CHF/JPY, CHF/RON, CHF/TRY, NZD/CHF, USD/CHF

It is also necessary to pay attention to the currency pairs of the US dollar with the Swedish, Czech, Danish krona, as well as the Hungarian forint, the volatility of which also increases slightly during the European session, especially in its last hours, when the European session intersects with the American one.

Features

Intersecting with two sessions at once: the Asian and the American, the European session becomes very volatile during the hours of intersection. It is at this time that scalpers come into play, who earn on fast movements and sharp trend changes. Due to such high volatility, beginners are not advised to trade at this time or should at least be very careful, because one move in the European session can destroy all capital.

A distinctive feature of the European Session is powerful movements and rapid change of quotes.

The lion's share of movement and trends is formed when the European Trading Session comes into play. This session also features a lot of manipulations – false breakouts, probing levels and collecting stop losses.

That is why it is very important to be attentive during this session and not risk a large percentage of capital.

Conclusion

The European trading session itself is very volatile, because it is at this time that financial centers around the world turn on. However, during the intersection of sessions, volatility increases significantly, which creates large jumps and price movements.

It will be very difficult for beginners to trade at this time, because strong movements will often reach stop losses, there will be a lot of false breakouts after which they will turn around sharply.

At the same time, professional traders who are able to analyze a large amount of information and are able to make quick decisions will be able to earn a lot of money.

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

Why Perfectionism is Killing Your TradingDo you have a tendency to perfectionism?

So, the biggest question is, do you have a tendency toward perfectionism?

"Perfectionists are people whose standards are very high and out of reach; they are people who are strenuous, involuntary, and unstoppable in their pursuit of an unattainable goal and who evaluate their own worth solely in terms of effectiveness and accomplishment of the task at hand."

Does this sound like you?

Perfectionists suffer from setting excessively high standards, fear of failure, procrastination, never being satisfied with their successes and can become emotionally unstable if their standards are not met, which can often be the case in trading; they fear competition, are not trainable, are meticulous in their way of thinking, being overly self-critical and intolerant of mistakes, and can also be prone to high levels of fear of possible failure.

Fear of loss, hesitation, fear of pulling the trigger, falling into extreme frustration or anger when your trading strategy fails or when you miss an entry point, or if you are extremely self-critical of your forex trading activity, can be evidence that you are prone to perfectionism.

One way to test you for a tendency toward perfectionism is to have the words "have to" in your vocabulary or thinking.

7 ways to overcome the tendency toward perfectionism

So, if you have some tendency toward perfectionism, what can you do?

1️⃣ One of the most useful things and important principles to remember is that humans are prone to make mistakes (that they are imperfect) and therefore you, as a forex trader, are also prone to make mistakes (that you are also imperfect). Following this as one of your trading beliefs, as part of your mental map, can be very helpful in that it will keep your reactions to events more realistic and less emotionally intense.

2️⃣ Since you are operating in an imperfect and uncertain environment, it is crucial for you to learn to think in terms of probabilities. Interestingly, research in behavioral finance has consistently shown that people are not so effective at drawing conclusions or thinking probabilistically, which is a skill that many people will need to develop in themselves. Mark Douglas (author of Zone Trading) writes, "every trade has a probabilistic outcome that does not preclude the possibility of loss. A shift in thinking from the concept of perfection to the concept of probability will help shape trading behaviors that improve the quality of trades and response to events.

3️⃣ Try to do your best to strive for excellence rather than obsessing over being the best; set a goal to become a good trader (but not the best in the world) and focus on it. Focus on learning and improving, including understanding, you accept mistakes and learn from them.

4️⃣ Focus on your trading process, not just the outcome. By focusing on your trading process, you fence yourself off from some of the anxiety and frustration that occurs when you are too attached to your results. Try to focus on how well you're trading, not just how much money you've made or lost.

5️⃣ Train yourself to take on the challenge of trading and find enjoyment in what you do. The process of having fun along with learning is the foundation of effectiveness. By accepting this, you will also allow yourself to look at the ups and downs of trading from a different angle, and this rethinking of the situation will give you a different perception of these events, with less frustration and emotional turmoil.

6️⃣ It is important to note that being able to see forex losses and drawdowns as learning opportunities is not self-judgmental. One of the disadvantages of the perfectionist can be his negative reaction to mistakes, missteps, and his inability to learn from them. Mistakes provide us with ample opportunities to learn and improve performance, but only when we actually perceive them as such.

7️⃣ Finally, it is important to learn to accept that your personal fortune is not your own capital that you are a worthy individual regardless of your trading performance at any given time. On a fundamental and profound level, this is a key belief for optimal human functioning, a sense of happiness, and successful trading.

✅ Conclusion

You won't win every trade. And that's perfectly normal. Remember that it's inherently human to make mistakes in an uncertain environment a world of perfection is out of reach; we live in a probabilistic world.

HOW OFTEN DO YOU NEED TO CHECK THE CHARTS?How many times have you looked at the chart trying to figure out if this signal is worth taking or not? And how many times have you made a profit in such cases?

You don't have to look for good trades on purpose. You just wait and react.

How often you should check the chart in forex trading, as well as the reasons why our brain sees trades where there are not there (and what to do about it), we're going to talk about today.

There is no need to search for trades at all.

Good signals are visible immediately. Instantly. Like 2 frogs above. You do not have to look for them. You turn on the terminal, and you see everything at once. You do not guess, do not draw, do not change the scale of the chart (narrower/wider).

If you do not see a signal on the chart in the first 1-2 seconds, it is not there.

In general, if you know at least 4-5 techniques of technical analysis , you, if you want, will find at any time on any chart a signal in any direction.

At any time on the chart, if you want you can find any signals. Impatience, desire to make money, bitterness after a previous unsuccessful trade or euphoria after a successful one all this clouds our brains and we look for the trades where there are none, proving ourselves right at the same time.

The longer you look at the chart, the more trades you’ll see

According to research by scientists, our brain works in such a way that the less often we encounter a familiar and familiar phenomenon, the more often we start to notice it.

Think about this phrase. Once you're looking for trades, you find them.

The vigilante syndrome

There was an interesting experiment: in an area with high crime rates, teams of volunteer vigilantes were introduced, who reported any violations of public order to the police.

At first, only serious crimes were reported. But then the crime rate in the neighborhood dropped significantly, and the vigilantes began to call the police for less important things: crossing the road in a wrong place or someone walking on the street at night, that sort of nonsense.

The Phantom Menace

In yet another experiment, people were shown several sets of sketches with completely different facial expressions: from frightening to totally friendly. And they were asked to choose from them the ones that looked threatening.

In the beginning, people chose the most "beastly" faces quite adequately, but then the scientists began to remove them from the samples leaving more "normal" faces. And people began to call those faces that seemed harmless to them at first threatening.

Why? Because they were told to SEE the threatening faces.

The experiments described above clearly show that when you look for something, you are bound to find it. So do the trades on the chart.

Our brain tries to match all the facts so as to confirm our point of view. And this leads to losses.

The only way to combat this effect, according to psychologists is to define your goals as precisely as possible and write down specific wording.

In the case of trading the cure is simple - a checklist.

If a trade corresponds to all of the checklist items there is a signal. If they do not correspond to at least one you are simply bored.

Practice using a demo account

Naturally, having installed a new system on the char you will not see trades in 2 seconds. Any new strategy requires that you get used to it. A demo account is an excellent way to do that.

How long should you get used to a new trading system? It depends on the timeframe and the frequency of trades. If it is intraday trading a week is enough. If it is a daily chart (D1), then about a month.

How often do you need to check the chart?

Whatever timeframe you have that's how you should check it. If D1 - once a day, if H1 - once an hour and so on. On timeframes below D1, you should limit the trading range when you are looking for signals. Checking charts at night on low timeframes usually makes no sense.

To summarize: the more you look at the chart, the more wrong trades you have (they can be profitable, given the random nature of the market, but not according to the system). The best signals are visible immediately, literally in the first second.

Asian Trading SessionHello everyone!

Each trading session has its own characteristics.

According to these features, you as a trader should act.

And today I want to discuss with you the specifics of the Asian trading session.

Working hours

The Asian trading session is open from 19:00 to 4:00 New York time.

Trading in Asia begins with Tokyo, the main trading center is opened, the Tokyo Stock Exchange, followed by all the major financial institutions of Japan.

The centers of activity of the Asian session are Tokyo, the largest financial center in Asia. Then, in an hour, Hong Kong and Singapore open, which contributes to the increase in trading.

The trading peak is reached at the opening of the European session, which overlaps with the Asian one at 2:00 New York time.

The Asian and Pacific sessions coincide in terms of working hours and therefore they are often considered as one.

The trading period at this session coincides with the opening hours of the largest Asian exchanges, such as the Hong Kong Stock Exchange, the Israeli TASE, the National Stock Exchange and BSE in India, the Shanghai and Shenzhen Stock Exchanges in China, the Abu Dhabi Stock Exchange and DFM in the UAE, the Saudi Stock Exchange, Singapore SGX, Korean KRX, as well as the Japanese TSE, which in many ways is the market conductor in the Asian session. Also, during this period of time, trading is underway on the Australian ASX, the New Zealand Stock Exchange in Wellington, as well as the Port Moresby Stock Exchange.

Currency pairs

It should be understood that during the Asian session, the Asian currency is characterized by increased volatility.

Currency pairs with the Japanese yen:

AUD/JPY, CAD/JPY, CHF/JPY, EUR/JPY, GBP/JPY, HKD/JPY, NZD/JPY, SGD/JPY, TRY/JPY, USD/JPY.

Currency pairs with the Australian dollar:

AUD/CAD, AUD/CHF, AUD/USD, EUR/AUD, GBP/AUD.

Pairs with Hong Kong Dollar:

EUR/HKD, GBP/HKD, SGD/HKD, USD/HKD.

There is also an increase in volatility in the currency pairs CHN/USD, CHN/RUB, EUR/SGD, GBP/SGD, USD/SGD. It is these pairs that traders pay the main attention to during the Asian session.

Session Features

The Asian session is considered to be the calmest session, where sharp fluctuations are practically excluded, so it will be easier for beginners to trade at this time.

Due to the fact that the market is closed on the weekend, on Monday, driven by the news of what happened over the weekend, the price can create strong movements and even form gaps.

Asian traders form a trend that is most often supported by European and American traders.

The main players during the Asian session are the Japanese Central Bank, as well as large companies. The economies of Japan and China are export-oriented, which causes their companies to be more active in foreign exchange transactions.

Due to the active activity of the state in the market, which are caused by the currency interventions of the Japanese Central Bank, significant deviations of the Yen can be observed, and since 16% of all transactions in the market take place with the participation of the Yen, this also affects other currencies.

Conclusion

It should be understood that most of the time the market is influenced by the state, which by its actions (interventions) pushes the market and creates a trend. That is why news monitoring, tracking the economic indicators of the Asian region, greatly help to predict the future movement of the market.

The Asian session is the quietest trading period, the most suitable for training beginners. Strong jumps are quite rare, while trends are often replaced by strong sideways movements. Volatility during the Asian session is considered to be the lowest, which makes it the least convenient for scalping strategies and the greatest for technical analysis.

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

Trading BooksI can say unequivocally that without reading the trading book in this market you can't go far.

People who do not develop will eventually end up with nothing. The well-known argument what is better, books or practice, makes no sense they are parts of a single coin.

The question of "what to read" is also abstract. There is plenty of meaningful reading. Except that I would advise not to bury yourself especially in books about the stock market, if you work in the Forex market, for example. The candles are different there (daily gaps between sessions), and it's a different world.

Don't skip books about trading psychology. They are often fascinating and your brain will rest after looking at the charts all day.

Practice on the charts. Read again. Work through them again. In parallel, work with a live chart. That's how you slowly become a trader.

Always keep in mind the main thing whatever is described in the book, it is only a particular view of one author and there are thousands of such views. What you need is a personal, individual approach to the market. If trying to copy or adopt someone else's style of trading you will not get far.

You can only trade by being yourself. And to become a self-sufficient trader, you must break through the mind of someone who's been in the market for decades. Take from them what suits you psychologically and create your own. Only yours that you will then not be able to pass on to anyone.

What books to read

This is a very popular question. There are a lot of books to read.

Books on technical analysis;

Books on psychology of trading;

Books and articles about price action.

Your task, averagely, is to get at least a general idea about trading at first.

Therefore, read about the basics of technical analysis:

Reuters. Technical Analysis for Beginners.

The basics of candlestick analysis:

Steve Neeson. Japanese Candlesticks. Chart Analysis of Financial Markets

Gregory Morris. Method for analyzing stocks and futures

Psychology:

Mark Douglas. Trading in the Zone.

Edwin Lefebvre. Memories of a Stock Speculator

Sometimes a whole book is worth reading for the sake of a single phrase that can sort out the mess in your head.

How to Read a Trading Book

Most books, as you know are easier to find in electronic form.

Personally, I read mostly in electronic form on my MacBook and iPad. Why is it convenient to read on the laptop exactly the trading books? Well, you can immediately open the chart, practice what you read, plus write down the appropriate thoughts in your electronic diary, take screenshots.

An alternative method is print the books you want on a laser printer. Some people get it at work and others buy a simple laser printer at home.

You can buy the least expensive model and print thousands of pages. It is not difficult to staple them and your eyes will be less tired (although I am more than satisfied with the apple screen). Likewise, a good e-reader like the Amazon Kindle or Pocketbook.

No one owns the market. Hence the logical consequence there is no grail, no secret mathematical formula or method of guaranteed prediction. Not in any book or course. Not a single indicator. Not one candlestick pattern or price action pattern. No teacher on the planet that "knows the market." No guaranteed signals that make you feel good. There aren't any.

There is only mathematical probability and all the traders in the world are learning to "tilt" it slightly in their direction, reducing losses and increasing profits. The market is a zero-sum game. Money constantly moves from one hand to another without ever sticking around.

Many hedge funds last 3-4 years and disappear. Now you made a million, tomorrow you gave 2, the day after you made 4, lost 5, went bankrupt, came back again, etc. Books allow us to learn a lot of these stories.

Thousands, tens of thousands of author's views are what trading books are all about. Not a guarantee, not some special way to suddenly become a unique forecaster by reading it.

Stability In Forex TradingWhy so few traders manage to bring their trading to the level of stable earnings, when trading becomes a source of income, and not a source of constant disappointment?

Because before you start to get the "easy" money that everyone comes to this industry, you will have to go a long way to make a lot of mistakes, each of which will cost you money. To fall down many times and get up more times, to lose money at the same time without losing the motivation to move forward, to learn yourself and change your attitude to trading. In addition to all of this, the difficulty is that no trader knows how much time it will take him. And the truth is that 95% don't have the strength and patience to do it.

I can point out 3 main criteria for stable trading:

The right attitude to losing trades.

Confidence in your strategy.

Availability of trading rules and most importantly the desire to follow them.

1. Accepting losses.

To survive in this field, a trader has to learn to properly deal with losses, without that he will not be able to make a profit in the long run. Just like in sports, first you learn how to fall properly, then everything else.

The thirst for quick money, which is present in almost everyone at the initial stage, generates fixation on profits. With this attitude the trader becomes highly vulnerable and morally unprepared to accept and tolerate losses. Nobody likes making mistakes and losing money. And large losses cause a lot of stress, which can lead to emotional burnout, depression and even deprive the strength to continue trading.

Trader's dependence on the expectations of the result of each deal will invariably make him experience emotions. And emotions will push him to make erroneous actions. These constant emotional swings take away the trader's strength and leave him with no opportunity to improve his trading. He's busy just trying to keep his mental balance somehow.

How do most traders try to solve this problem? They try to avoid losses and fight their emotions.

But that's impossible, you, see? This is a vicious circle.

What you can and should do is to shift your attention from the result of each trade to the result of a time period (for example, a month). It is very important to understand and accept that: in any sequence of trades, there is a random distribution of profitable and losing trades.

This will help reduce the emotional component of trading. When you do not expect any result from a trade, the result of the trade ceases to matter and causes emotions that push you to take the wrong actions. The trader's job is to make his trading as psychologically comfortable as possible.

2. Strategy

A strategy is a method. Most traders, having suffered another failure, begin to change their trading strategy or look for another one. They sincerely believe that the problem is in it. That it is the strategy which does not let them to earn profit. But there are no profitable or unprofitable strategies. Traders make them so.

In fact, a strategy is not supposed to provide a trader with profit. It has only one function. It should provide trader's understanding of WHAT, WHERE and WHEN to trade. And the sooner the trader stops shifting responsibility from himself and his actions to his strategy, the faster he will learn.

It will take time for you to feel confident in your strategy. Time to adjust the method to yourself, to your understanding of the market. You can take any strategy you like as a basis and taking into account your weaknesses and strengths determine how and what you will trade.

3. Compliance with rules

The third and perhaps the most important criterion for stable trading is the presence and observance of rules. This is what will bring the trader profit in the end.

Trading rules have only two functions:

To provide a trading strategy with a positive mathematical expectation.

Provide correct models of trader's behavior in different trading situations.

So that it is possible to control emotions and not to leave the psychological comfort zone.

When successful traders are asked what is most important to achieve success none of them focuses on their strategy, they do not talk about the magic money management or special knowledge. But all of them say that it's important to follow their rules in a disciplined manner.

All traders who make money fanatically follow their rules. Because they know that strict adherence to trading rules is what makes them profitable. The market pays us money for our disciplined actions. We pay it for experience and it pays us for discipline. Most traders are mainly busy analyzing their trades and forget about their own behavior and trading mindset.

The desire to follow the rules arises only when you realize that they reduce your losses, which automatically increases your profitability.

Unfortunately, there is no ready algorithm for creating rules. They are individual, and that is the difficulty of learning to trade. The only guideline in their creation is that they must LIMIT your losses. Everything else is up to you.

Learn to listen to yourself by methodically and persistently striving to improve your trading. If you give yourself time to learn first, setting aside the desire for instant results, you will definitely come to have your own trading system sooner or later. An individual system which will bring you money.

Winning Trader is Patient TraderHello friends, like every forex trader on Earth, I sometimes ask myself what are my strengths and weaknesses? How have I changed, and what qualities have I developed in myself? Today we're going to talk about how you can develop it. How susceptible are you to impatience?

Impatience in ordinary life.

But what does it mean to be able to "delay making a decision"? For me, it means handling things calmly and being disciplined. I don't have to do rash things right away and can bide my time for action. This is equally true for trading as it is for real life.

Wait until you get a good discount for something you've wanted to buy for a long period of time. After all, there are many things that seem to be needed, but their purchase may well have to wait until the seasonal sale.

This behavior, also called "delayed gratification," protects me from making hasty and emotional decisions. I would not be satisfied if I bought something recklessly, only to get the thing right away but pay a high price for it. My focus is on the risk/reward ratio. So, the risk of making a bad decision is relatively low.

I think it's not easy to just wait it out these days. The sensitivity to consumption and the wide variety of offerings makes it difficult to refrain from buying something right away without waiting out the right situation. Due to the ability to pay in installments, people are able to buy expensive items right away. Many people spend money on rash decisions and get into debt just because they can't wait.

Several years ago, I read Daniel Goleman's book “Emotional Intelligence”. Among others, he described long-term experiments with children who became particularly successful and incorruptible if they learned at an early age about delayed decision-making.

The essence of the experiment was this: a child was offered a candy and told that he could eat it now, and if he didn't eat the candy right away, but waited twenty minutes, he would get two candies. So, those children who agreed to wait, then in adulthood were much more successful than fans of "fast" candy.

What does this mean for the trade?

I think delayed gratification has several positive effects on trading.

You have to wait out the right situation and you have to refrain from recklessly entering the market.

You must wait for the perfect set-up that will execute according to all the rules.

You should not take profits too early, and should calmly wait and close a position only when your rules allow you to do so.

You must be firmly aware of when you should not trade and when your individual trading strategy will not be profitable.

You must control your risks to stay in the game.

You must know that you can only succeed in trading in the long run and that you cannot get rich quickly.

Nowadays, I have begun to notice that I am primarily looking for reasons NOT to enter the market. It is only when there is no reason to trade that I open a position. The market no longer pressures me, and I try not to be influenced by my emotions. I have to wait for the right setup and the right conditions. The emphasis is on first-class odds, not second-class and beyond. All you have to do is wait it out.

Another point that is never talked about. It's pushing through situations. Here's an example: you have an open position and it has reached a stop loss. You want to win back, and at the next signal you enter the market with bigger lot position. Again, you take a loss. You follow your emotions and open in the same direction with an even bigger lots, without even waiting for your strategy signal. You probably already know the end of the story. This is a push-pull situation, when you're trying to have some kind of impact on something you can't influence.

Exercise

Instead of describing any self-evident conclusions from the above, I offer you a simple exercise, which allows you to understand whether you have developed the skill of waiting or not.

Take an hourglass, for 3-5 minutes (no less), turn it upside down, and just watch the grains of sand pile down into the empty half of it. Your task is to wait until the last grain of sand falls down. Do not try to control your thoughts.

So, after you've completed the task, remember what thoughts and emotions you had while you were watching the sand? If you were starting to get mad at how slowly the sand is falling away, you were trying to figure out how much time is left, you were cursing to yourself about this "stupid task" that doesn't let you see pictures of cats, you were remembering how many important things you have to do today, or even failed to wait until the sand falls to the other half of the hour congratulations. You have a problem with patience. But if you calmly waited for the last grain of sand, you had no desire to speed up the process in any way, you just watched the sand until the very end without emotion or irritation. You don't have a problem with patience, at least not obviously.

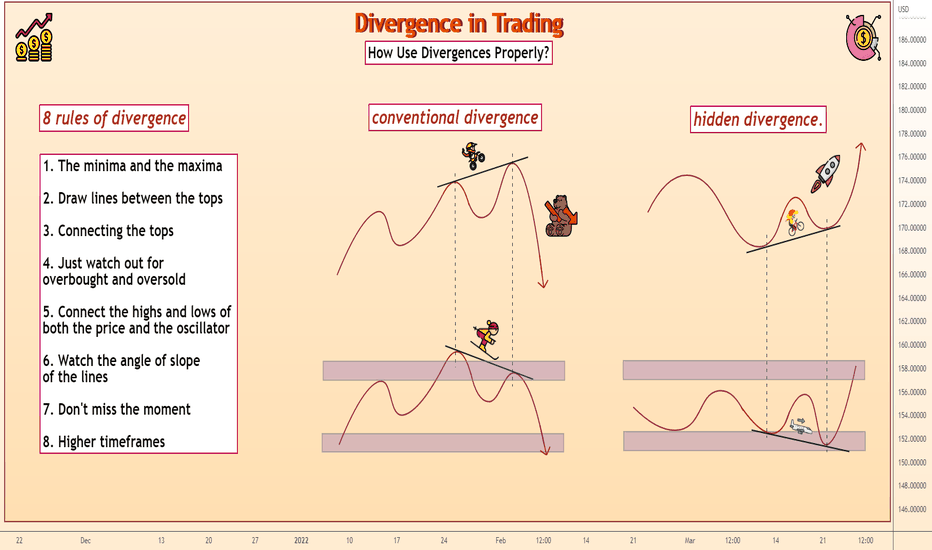

Divergence in TradingThe essence of divergence is very simple: The divergence of price and indicator movements.

When price updates higher highs and the oscillator updates lower highs, it is divergence in its classic form. It could be stochastic, RSI, MACD, CCI and hundreds of other oscillators. Some traders believe divergence is the only oscillatory signal worth looking at.

From stochastics creator George Lane to Alexander Elder, hundreds of professional traders have described divergence in their books.

What is the essence of the divergence?

When the price reaches its maximum value, the oscillator should reach it too. The same is true for the minimum values. This is how it works in a normal situation. If the oscillator and price decide to mark different values - we're talking about divergence.

It can be used in two main cases:

conventional divergence;

hidden divergence.

Let us now analyze them.

The classic divergence

The simplest and clearest signal, which hints at a future trend reversal. If price makes a lower low and the oscillator makes a higher low, we have a traditional bullish divergence. In other words, if the oscillator is up and the price is down, that is a hint of a reversal of the price in the direction of the oscillator.

The opposite situation is also true. The trend is going upward and the price is updating the maximums and if the oscillator is not then it’s a divergence.

The optimal use of divergence is on the maximum and minimum values of the price. This is the easiest way to find the reversal zone. The oscillator directly indicates that the momentum is changing and although the price keeps updating levels, it will not last.

We have considered the conventional divergence, now let's look at its evil cousin, the hidden divergence. It is not so secret that it is just a divergence hidden within the trend.

Hidden divergence

A divergence does not always indicate a trend reversal. Sometimes it is, on the contrary, a clear indication that the trend will continue. Remember, you should be friends with the trend, so any signal that the trend will continue is a good signal.

Hidden divergence is quite simple. The price updates the upper low and the oscillator updates the lower low. It is easy to see. When the price has updated the maximum, check if the oscillator has done the same. If it doesn't and goes in the opposite direction, it's a divergence.

And there is the hidden bearish divergence. The price updates lower highs on a downward move and the oscillator, on the other hand, it is trending upwards and updating the higher highs. If the general trend is downward, it is an indication that this trend will continue and quite possibly double its efforts.

How Use Divergences Properly?