The Power of Confluence: Building Trade Setups Using 3 Indicator🔵 INTRODUCTION

Many traders fall into the trap of relying on a single indicator to make trading decisions. While one tool might work occasionally, it often leads to inconsistent results. The key to consistency lies in confluence — the strategic combination of multiple indicators that confirm each other.

In this article, you'll learn how to build high-probability trade setups by combining three essential components: trend , momentum , and volume .

🔵 WHY CONFLUENCE MATTERS

Confluence refers to multiple signals pointing in the same direction. When different indicators agree, your trade idea becomes much stronger. It helps reduce noise, avoid false signals, and increase confidence in your entries.

Think of it like crossing a busy road: you wait for the green light, check both sides, and make sure no cars are coming. The more confirmations you have, the safer your move.

🔵 WHAT IS CONFLUENCE IN TRADING?

Confluence means agreement. In trading, it’s when different methods, indicators, or tools all point toward the same outcome.

Think of it like this:

One green light? Maybe.

Two green lights? Worth watching.

Three green lights? That’s a trade worth considering.

Imagine you're planning a road trip. You check the weather forecast (trend), Google Maps traffic (momentum), and ask a local for advice (volume). If all three say “go,” you’re more confident in your decision. Trading works the same way — using multiple tools to validate a setup reduces risk and removes guesswork.

Important: Confluence is NOT about cramming 10 indicators onto your chart. It’s about using a few that each offer different types of information — and only acting when they align.

🔵 THE 3-STEP CONFLUENCE SETUP

1️⃣ Identify the Trend (Using EMAs)

Before entering any trade, you need to know the market direction. You can use:

Moving Averages (e.g., 21 EMA and 50 EMA crossover)

Structure-based analysis (e.g., higher highs = uptrend)

Trade only in the direction of the prevailing trend.

2️⃣ Check Momentum (Using RSI, MACD, or Stochastic)

Momentum tells you whether the market supports the current trend or if it's weakening.

RSI above 50 → Bullish momentum

MACD histogram rising → Acceleration

Stochastic crossing above 20 or 80 → Momentum shifts

Avoid entering when momentum is fading or diverging from price.

3️⃣ Confirm with Volume (To Validate Participation)

Volume reveals the strength behind the move. A breakout or trend continuation is more reliable when it's backed by volume.

Look for:

Volume spikes at breakout points

Increasing volume in the direction of the trend

Volume confirmation after pullbacks or retests

No volume = no conviction. Watch how the market "votes" with actual participation.

🔵 EXAMPLE TRADE SETUP

Let’s say you spot a bullish trend with 21 EMA above 50 EMA. RSI is above 50 and rising. A pullback forms, and volume picks up as price starts to push higher again.

That’s trend + momentum + volume lining up = a confluence-based opportunity.

🔵 BONUS: HOW TO ENHANCE CONFLUENCE

Add price action patterns (flags, wedges, breakouts)

Use support/resistance zones for cleaner entries

Combine with higher timeframe confirmation

Wait for retests after breakouts instead of chasing

Confluence doesn't mean complexity — it means clarity.

🔵 CONCLUSION

The best traders don’t guess. They wait for the market to align. By combining trend, momentum, and volume, you filter out weak setups and focus only on the highest-probability trades.

Start testing confluence-based setups in your strategy. You’ll likely find more consistency, fewer fakeouts, and greater confidence in your execution.

Do you trade with confluence? What’s your favorite trio of indicators? Let’s talk in the comments.

Tradingplans

The Market Rewards the PatientLast week was probably one of the slowest weeks I’ve ever had. I found two setups, but neither one truly materialized. They just didn’t meet all the conditions in my plan. It was tough. I won’t pretend it wasn’t tempting to drop my rules and chase other strategies just so I could be in the market.

But deep down, I knew exactly what I wanted. I want to be consistent . I want to trade like a professional . So I held back. All week, I watched and waited. No trades taken. It was boring, honestly . But that boredom protected my capital.

Instead of forcing trades, I spent the entire weekend backtesting , drilling into my strategy even more. I wanted to be sure that when my moment came, I’d recognize it without hesitation.

Then this week started. I didn’t know if it would be any different, but I trusted my process and stayed ready. Eventually, one clean setup appeared. I shared it here on TradingView. I managed my risk properly , took half my usual size at just 0.5%, and let the trade run. It almost hit my stop, but I didn’t touch it. It was simple: either TP or SL .

And this time, it hit TP. A clean 1:4.

This was a powerful lesson. Following my plan didn’t just lead to a winning trade. It protected my capital all of last week when the market wasn’t offering quality setups. That patience and discipline paid off.

That’s how you build consistency. That’s how you survive long enough to catch the trades that truly matter.

TESLA Always Pay YOURSELF! Tsla Stock were you PAID? GOLD Lesson

⭐️I want to go into depth regarding the this topic but it is a long one with PROS & CONS for doing and not doing it.

Every trader must choose what's best for them but you will SEE when I finally get to the write up that MANY OF THE PROS are NOT FINANCIAL but PSYCHOLOGICAL❗️

Another of 🟢SeekingPips🟢 KEY RULES!

⚠️ Always Pay YOURSELF.⚠️

I know some of you chose to HOLD ONTO EVERYTHING and place your STOP at the base of the WEEKLY CANDLE we entered on or the week priors base.

If you did that and it was in your plan GREAT but... if it was NOT that is a TRADING MISTAKE and You need to UPDATE YOUR JOURNAL NOW.

You need to note EVERYTHING. What you wanted to see before your exit, explain why not taking anything was justified to you, were there EARLY exit signals that you did not act on. EVERYTHING.

🟢SeekingPips🟢 ALWAYS SAYS THE BEST TRADING BOOK YOU WILL EVER READ WILL BE YOUR COMPLETE & HONEST TRADING JOURNAL ⚠️

📉When you read it in black amd white you will have YOUR OWN RECORD of your BEST trades and TRADING TRIUMPHS and your WORST TRADES and TRADING ERRORS.📈

✅️ KEEPING an UPTO DATE JOURNAL is STEP ONE.

STUDYING IT IS JUST AS IMPORTANT👍

⭐️🌟⭐️🌟⭐️A sneak peek of the LESSON after will be HOW & WHEN TO ENTER WHEN THE OPEN BAR IS GOING THE OPPOSITE WAY OF YOUR IDEA.👌

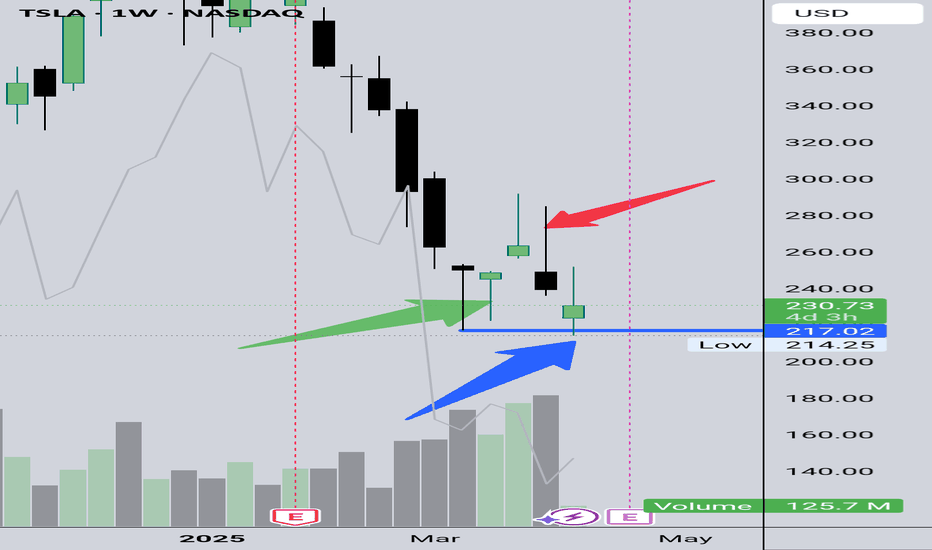

🚥Looking at the TESLA CHART ABOVE you will see that we were interested in being a BUYER when the weekly bar was BEARISH (GREEN ARROW) and we started to consider TAKE PROFITS and EXITS when the (RED ARROW) Weekly bar was still BULLISH.🚥

DOGS Main Trend. Tactics of Working on Risky Crypto 03 2025Logarithm. Time frame 3 days. Tactics of working on super-risky cryptocurrencies of low liquidity, which are always sold (without loading the glass), by the creators of “nothing”. In order to increase sales, of course, when they rationally reverse the trend and make pumps at a large % and marketing positive news "have time to buy". On such assets with such liquidity, “killed faith” (at the moment), and control of the emission in “one hand” it is not difficult. Something like in BabyDOGE.

On such assets you should always remember:

1️⃣ allocate a certain amount for work in general on such assets from the deposit as a whole.

2️⃣ distribute money (potential reversal and decline zones) from this allocated amount to each similar asset in advance.

3️⃣ diversify similar assets themselves (5-10 cryptocurrencies), understanding that sooner or later they will scam. The scam of one of them should not be reflected significantly on the balance of the pump/dump group of low liquidity. It is impossible to guess everything that does not depend on you, and it is not necessary. Your miscalculations (what does not depend on you) are smoothed out by your initial trading plan and risk control, that is, money management (money management).

4️⃣ Set adequate goals. Part of the position locally trade 40-80% (not necessary, but this sometimes reduces the risk).

5️⃣ Work with trigger orders and lower them if they did not work and the price falls.

6️⃣ Remember that in consolidation and cut zones in assets of such liquidity, stops are always knocked out, so the size of the stop does not really matter. It will be knocked out, especially before the reversal.

7️⃣ Before the reversal of the secondary trend, as a rule, they first do a “hamster pump” by a conditionally significant %, when everyone is "tired of waiting". They absorb all sales. Then the main pumping without passengers by a very large % takes place to form a distribution zone. As a rule, it will be lower than the pump highs, that is, in the zone when they are not afraid to buy, but believe that after a large pump, the highs will be overcome significantly.

8️⃣ Remember that assets of such liquidity decrease after listings or highs by:

a) active hype, bull market -50-70%

b) secondary trend without extraordinary events -90-93%

c) cycle change -96-98% or scam, if it is a 1-2 cycle project (there is no point in supporting the legend, how it is easier to make a candy wrapper from scratch without believing holders with coins).

9️⃣In the capitulation zone, there can be several of them depending on the trend of the market as a whole and rationality, the asset is of no interest to anyone. Everyone gets the impression that everything is a scam. That is, on the contrary, you need to collect the asset, observing money management, that is, your initial distribution of money and the risk that you agreed with in advance. As a rule, in such zones people "give up" and abandon their earlier vision.

🔟 After the entire position is set (pre-planned, according to your money management), stop and do not get stuck in the market and news noise. Wait for your first goals.

Remember, people always buy expensive, and refuse to buy cheap ("it's a scam", they try to "catch the bottom"), when "the Internet is not buzzing". This all happens because there is no vision, and as a consequence, no tactics of work and risk control . Many want to guess the “bottom”, or “maximums”, and refuse to sell when they are reached. The first and second are not conditionally available, on assets of such liquidity and emission control. But, there are probabilities that you can operate and earn on this, without getting stuck in the market noise. And also in the opinions of the majority (inclination to the dominant opinion and rejection of your plan and risk control), from which you must fence yourself off.

Most people, immersed in market noise and the opinions of others , choose for themselves the price movement, which is beneficial to them at the moment , and to which they are inclined, but do not provide themselves with the tactics of work. This is a key mistake, and the main manipulation that the conditional manipulator achieves, who, by the way, is sometimes not on the asset, to form an opinion and, as a consequence, the actions of the majority.

Because, in essence, most people do not have the tactics of work. Where the news FUD (inclination to the dominant opinion), “market noise” (cutting zones and collecting liquidity), the opinion of the majority, is directed, that is what they are inclined to.

When the price goes in the other direction, it is disappointment.

If these are futures — liquidation of the position. Zeroing out due to greed.

If this is spot — "proud random holders" , without the ability to average the position (no money), to reduce the average price of the position set as a whole, and as a result increase the % of profit in the future.

A trading plan and risk control are the basis, not guessing the price movement. If you do not have the first “two whales” of trading in your arsenal, then you have nothing. It doesn't matter how much you guess the potential movement, as the outcome of such practice is always the same, and it is not comforting.

How Your Brain Tricks You Into Making Bad Trading Decisions!!!Hello everyone! Hope you’re doing well. Today, we’re diving into a crucial topic—how your brain can work against you in trading if it’s not trained properly. Many traders think they’re making logical decisions, but subconscious biases and emotions often take control.

Our brain operates in two modes: intuitive thinking (fast, emotional, automatic) and deliberative thinking (slow, logical, analytical). In trading, intuition can lead to impulsive mistakes—chasing price moves, hesitating on good setups, or exiting too early out of fear.

To improve, traders must shift from intuition to deliberation by following structured plans, back testing strategies, and practicing emotional discipline. In this discussion, we’ll explore how to overcome these mental biases and make smarter trading decisions. Let’s get started!

Most traders face common mistakes—exiting winners too early, letting profits turn into losses, holding onto bad trades, or making impulsive decisions. Why? Because our brain isn’t wired for trading. In everyday life, instincts help us, but in trading, they often lead to fear, greed, and denial.

Your Brain Operates in Two Modes

Just like in daily life, where we sometimes act on reflex and other times think things through carefully, our trading mind also operates in two distinct modes: intuitive thinking and deliberative thinking. Intuitive thinking is fast, automatic, and effortless. It helps us make quick decisions, like braking suddenly when a car stops in front of us. However, in trading, this rapid decision-making often leads to impulsive actions driven by emotions like fear and greed. This is why many traders enter or exit trades without a solid plan, reacting to market movements instead of following a strategy.

On the other hand, deliberative thinking is slow, effortful, and analytical. This is the part of the brain that carefully weighs options, follows rules, and makes logical decisions—like when solving a complex math problem or planning a trading strategy.

Our intuitive brain is designed to make quick and automatic decisions with minimal effort. This is the part of the brain that helps us react instantly to situations—like catching a falling object or braking suddenly while driving. It relies on patterns, emotions, and past experiences to make snap judgments. In everyday life, this ability is incredibly useful, saving us time and energy. However, when it comes to trading, this fast-thinking system can often lead us into trouble.

For example, a trader might see the market rising rapidly and instinctively think, “This can’t go any higher! I should short it now.” This reaction feels obvious in the moment, but it lacks deeper analysis. The market could continue rising, trapping the trader in a losing position. Because intuitive thinking is based on gut feelings rather than structured reasoning, it often leads to impulsive and emotionally driven trading decisions. In the next slides, we’ll explore how to counterbalance this instinct with deliberative thinking—the slow, logical approach that leads to better trading decisions.

Unlike intuitive thinking, which reacts quickly and emotionally, deliberative thinking is slow, effortful, and analytical. It requires conscious thought, logical reasoning, and careful consideration before making a decision. This is the part of the brain that helps traders analyze probabilities, assess risks, and make well-informed choices rather than acting on impulse. While it takes more time and effort, it leads to better trading outcomes because decisions are based on data and strategy rather than emotions.

For example, instead of immediately reacting to a fast-moving market, a deliberative trader might pause and think, “Let me check the higher time frame before deciding.” This approach helps traders avoid unnecessary risks and false signals by ensuring that every trade is well-planned. The most successful traders operate primarily in this mode, following a structured process that includes technical analysis, risk management, and reviewing past trades. In the next slides, we’ll discuss how to train our brains to rely more on deliberative thinking and reduce emotional reactions in trading.

Take a moment to answer these two questions:

A bat and a ball cost ₹150 in total. The bat costs ₹120 more than the ball. How much does the ball cost?

If 5 machines take 5 minutes to make 5 widgets, how long would 100 machines take to make 100 widgets?

At first glance, your brain might immediately jump to an answer. If you thought ₹30 for the first question or 100 minutes for the second, you’re relying on intuitive thinking. These answers feel right but are actually incorrect. The correct answers are ₹15 for the ball (since the bat costs ₹135) and 5 minutes for the second question (since each machine’s rate of production stays the same).

This exercise shows how intuitive thinking can mislead us when dealing with numbers and logic-based problems. The same happens in trading—snap decisions based on gut feelings often lead to costly mistakes. To improve as traders, we need to slow down, double-check our reasoning, and shift into deliberative thinking. In the next slides, we’ll explore how to strengthen this skill and apply it to trading decisions.

Did Your Intuition Trick You?

Let’s review the answers:

Answer 1: The ball costs ₹15, not ₹30! If the ball were ₹30, the bat would be ₹150 (₹120 more), making the total ₹180, which is incorrect. The correct way to solve it is by setting up an equation:

Let the ball cost x.

The bat costs x + 120.

So, x + (x + 120) = 150 → 2x + 120 = 150 → 2x = 30 → x = 15.

Answer 2: The correct answer is 5 minutes, not 100 minutes! Since 5 machines take 5 minutes to make 5 widgets, each machine produces 1 widget in 5 minutes. If we increase the number of machines to 100, each still takes 5 minutes to produce a widget, so 100 machines will still take 5 minutes to make 100 widgets.

Most people get these answers wrong because their intuitive brain jumps to conclusions without thinking through the logic. This is exactly how traders make impulsive mistakes—by relying on gut feelings instead of slowing down to analyze the situation properly. The key lesson here is that we must train ourselves to pause, question our first reaction, and shift into deliberative thinking when making trading decisions.

Why is Intuitive Thinking Dangerous in Trading?

Intuitive thinking is great for quick decisions in everyday life, like catching a falling object or reacting to danger. However, in trading, this fast-thinking system becomes a problem because it takes shortcuts, ignores probabilities, and acts on emotions rather than logic. When traders rely on intuition, they often react impulsively to price movements, overestimate their ability to predict the market, and make decisions based on fear or greed rather than strategy.

For example, a trader might see a market rapidly rising and instinctively think, “This can’t go any higher—I should short it!” without checking key levels or trends. Or, after a few losses, they may feel the urge to take revenge trades, hoping to recover quickly. These emotional reactions lead to poor risk management and inconsistent results. To succeed in trading, we must recognize these intuitive traps and learn to replace them with a structured, logical approach.

Let’s look at some common mistakes traders make due to intuitive thinking:

Shorting just because the market has risen too much: A trader might see a sharp price increase and feel like it’s too high to continue, instinctively thinking, “This can’t go any higher; it’s due for a drop.” However, the market doesn’t always follow logical patterns, and this emotional reaction can lead to premature trades that result in losses.

Buying just because the market is falling: Similarly, traders may feel compelled to buy when the market falls too much, thinking, “It’s too low to go any further.” This belief, without proper analysis, can lead to buying into a downtrend or even catching a falling knife, resulting in significant losses.

Taking tips from social media without analysis: Many traders fall into the trap of acting on market tips or rumors they see on social media or trading forums. These decisions are often made without proper research, relying purely on gut feelings or herd mentality.

If you've ever taken a trade just because it "felt right" without fully analyzing the situation, chances are your intuitive brain was in control. These emotional decisions are natural, but they often lead to costly mistakes. The key to improving your trading is learning to slow down, analyze the situation carefully, and avoid rushing into trades based on impulse.

Why Deliberative Thinking Matters

Deliberative thinking is the key to becoming a successful trader because it encourages us to assess probabilities, reduce impulsive trades, and ensure well-thought-out decisions. Instead of acting on gut feelings, traders who use deliberative thinking take the time to analyze market conditions, trends, and risks. By calculating probabilities, reviewing different scenarios, and sticking to a solid trading plan, they can make more rational decisions that are grounded in logic, not emotions.

This slow, methodical approach may seem counterintuitive in a fast-paced market, but it’s what separates successful traders from those who constantly chase the market. The best traders don’t act on impulse; they analyze, think critically, and then trade. This approach leads to consistency in trading, as decisions are based on a systematic process rather than emotional reactions. By training your brain to operate in this way, you’ll improve your decision-making and reduce the likelihood of impulsive, emotional mistakes.

Let’s look at a real-world example of how intuitive thinking can trap traders:

The market rallies from 26,800 to 28,800, and as the price starts to pull back, lower lows form on the hourly chart. Many traders, relying on the short-term price action, decide to short the market, thinking the rally is over. However, when you zoom out and check the daily chart, you notice that there’s no clear reversal signal—it's still showing an overall uptrend.

Despite this, many traders act impulsively based on what they see on the smaller time frames, only to watch the market rally another 500 points, trapping those who shorted the market.

This is exactly how intuitive traders get trapped—by making decisions based on the lower time frames without considering the bigger picture. Deliberative thinking would involve checking higher time frames, assessing the trend, and waiting for a proper confirmation before entering a trade. By training yourself to think this way, you’ll avoid getting caught in market traps like this one.

One of the best strategies for avoiding impulsive mistakes is to always check daily or weekly charts before taking a trade. While it’s tempting to act on short-term movements, smart traders zoom out to get a clearer picture of the market's overall trend. By analyzing higher time frames, you can see if the market is truly reversing or if it's simply a temporary pullback within a larger trend.

It’s important to look for confirmation of trends before acting. If the higher time frames show an uptrend, but the lower time frames show a temporary dip, it may be wise to wait for confirmation before making a trade. Don’t rush based on short-term movements; give yourself time to assess the bigger picture and make decisions based on a well-thought-out analysis rather than emotional reactions.

Remember, successful traders understand that the higher time frame offers critical insights into market direction. By incorporating this approach, you’ll make more informed, consistent trading decisions and avoid getting trapped by short-term fluctuations.

Shifting from intuitive to deliberative trading takes practice, but with consistent effort, you can train your mind to make better decisions. Here’s how you can start:

Review past trades – Were they intuitive or deliberate? Reflecting on your previous trades helps you identify whether your decisions were based on impulse or careful analysis. Understanding the reasoning behind your past trades can help you improve future ones.

Ask ‘Why?’ before every trade: Before entering any position, take a moment to ask yourself, “Why am I taking this trade?” This forces you to think critically and ensures that your decision is based on analysis rather than emotions.

Use probabilities, not gut feelings: Deliberative thinking is based on probability, so focus on statistical analysis and historical patterns rather than relying on your gut. This might include checking your risk-to-reward ratio or waiting for confirmation signals from multiple indicators.

Follow a structured trading plan: A solid trading plan with clearly defined rules and guidelines will help you make logical, consistent decisions. When you follow a plan, you’re less likely to make emotional, impulsive trades.

By implementing these steps, you’ll gradually train your mind to operate more deliberately, leading to more disciplined and profitable trading. Remember, trading is a skill that improves with practice, so take the time to develop your deliberative thinking.

A great historical example of intuitive thinking gone wrong is the Dot-Com Bubble of the late 1990s. During this time, many companies added “.com” to their names, capitalizing on the internet boom. Investors rushed in blindly, often buying shares of these companies based purely on the excitement of the market and the fear of missing out (FOMO).

However, many of these companies had no real business model or clear path to profitability. Investors, driven by emotional excitement and herd mentality, ignored the fundamentals—such as profitability, cash flow, and market demand. As a result, the market eventually collapsed, wiping out traders who didn’t take the time to analyze the companies' real value and business models.

This is a perfect example of intuitive investors acting on emotions and hype without real analysis—and losing big. To avoid this trap, it’s important to apply deliberative thinking, focusing on thorough research, fundamental analysis, and careful assessment of market conditions. This case study shows the importance of not jumping into investments based on emotional impulses but making decisions grounded in solid analysis.

To become a successful trader, you must shift from relying on intuitive thinking to embracing deliberative thinking. Here’s how you can start making that transition:

Avoid easy, obvious trades: If a trade feels too easy or too obvious, it’s often a trap. The market is complex, and quick decisions based on gut feelings usually lead to impulsive mistakes. Take the time to think through your trades, even if they seem like a “sure thing.”

Develop patience and discipline: Patience is key in trading. Instead of reacting immediately to market moves, wait for the right setups and confirmations. Discipline ensures you follow your plan and don’t get swept up in the moment.

Learn to think in probabilities: Trading is about probabilities, not certainty. Start thinking in terms of risk and reward, and assess the likelihood of different outcomes before entering a trade. This shift in mindset will help you make more rational, logical decisions.

Be skeptical of ‘obvious’ trade setups: If a trade seems too perfect or too easy, it’s worth questioning. Often, the most obvious setups are the ones that lead to losses. Always do your due diligence and question your assumptions before pulling the trigger.

By making these changes, you’ll develop a trading mindset that focuses on thoughtful analysis, patience, and probability, rather than emotional, impulsive decisions. The goal is to think deeper, be more strategic, and avoid rushing into trades based on intuition.

Now that we’ve covered the key principles, it’s time to take action.

Start by reviewing your past trades. This is crucial for identifying whether your decisions were based on intuition or deliberate thinking. By reflecting on your trades, you can spot patterns and areas where you may have made impulsive decisions.

Next, identify your intuitive mistakes. Think about trades where you acted quickly or without full analysis. Were you influenced by emotions like fear or greed? Understanding these mistakes helps you avoid repeating them in the future.

Finally, commit to making deliberate decisions going forward. Before you place your next trade, take a step back. Analyze the market, assess probabilities, and follow your trading plan. This shift to a more thoughtful, disciplined approach is what will help you become a more consistent and successful trader.

Your next trade is an opportunity to put these principles into practice. Let’s focus on making smarter, more deliberate decisions from here on out!

123 Quick Learn Trading Tips #3: Better turn up the heat123 Quick Learn Trading Tips #3: Better turn up the heat 🔥

Ever wonder why some traders seem to have all the luck? 🤔 They're not just lucky; they've built an iceberg of hard work, discipline, and even failures beneath the surface of their "success." Don't just chase the tip – build your own solid foundation.

Here's what that iceberg looks like in trading:

Hard work: 📚 Studying markets, developing strategies, and always practicing. No shortcuts here! 🚫

Patience: ⏳ Giving up short-term gains for long-term strategies. Don't rush. Good traders wait for the best opportunities.

Risks: 🎲 Take smart trades, not reckless ones. Be brave, but not foolish.

Discipline: 🎯 Follow your trading plan. Don't let your feelings make you change it. Trust what you learned before. Trust your strategy.

Failures: 🤕 Everyone loses money sometimes. Learn from your losses. It's important to get back up and keep going.

Doubts: 😟 Managing emotions and fear is crucial. It's normal to have doubts.

Changes: 🔄 The market always changes. You need to change your strategies too. Be ready to adapt.

Helpful habits: 📈 Consistent analysis and risk management are your bread and butter. Stick to good routines.

Want to build a success iceberg? 🧊

Better turn up the heat 🔥

– it's going to be a long, cold journey beneath the surface.

👨💼 Navid Jafarian

So, stop scrolling through my TESLA pics 🚗 and get back to analyzing those charts! 📊 Your iceberg isn't going to build itself. 😉

TradeCityPro Academy | Risk Management👋 Welcome to TradeCityPro Channel!

Let’s continue with another training session after the first part, which was about Capital Management, and dive into the important topic of Risk Management.

🕵️♂️ Risk Management as a Profession

One of the heaviest responsibilities, riskiest roles, and most demanding efforts in studying or working in a company lies in the field of Risk Management.

The job of risk management exists in various fields, including banking, insurance, investment, and consulting. People working in this field are responsible for identifying financial, operational, or project-related risks and designing strategies to reduce or manage them.

The income of a risk manager varies depending on the country, industry, level of experience, and scope of the project. In developed countries, risk managers in financial industries can earn high incomes. On average, in the United States, the annual income of a risk manager ranges between $80,000 and $150,000.

💰 Risk Management in Financial Markets

Risk management is one of the most important skills and concepts in the world of finance, business, and even daily life. It helps you identify, assess, and control potential risks to avoid unexpected losses.

💡 What is Risk Management?

Risk management is the process of identifying and assessing potential threats and then taking actions to reduce or eliminate their negative impacts. This process helps you make more informed decisions and protect your capital or resources from unnecessary risks.

In financial markets, risk management means identifying, evaluating, and controlling risks related to investments to prevent major losses. This includes setting a Stop Loss, diversifying your investment portfolio, using leverage responsibly, and sticking to your trading strategy. The primary goal is to preserve capital and optimize profits by managing potential risks.

💵 Why Should We Manage Risk?

Before diving into the explanations, let’s illustrate the concept of risk management with a life example: Do you give the same kind of gift to your parents or partner as you would to a distant relative or a friend you recently met? Of course not! Everyone holds a different level of importance in your life.

Now let’s examine this in financial markets. It’s better to have different risk management strategies for your setups and strategies based on market conditions. Categorize them into different groups using your Excel data and setups.

As a side note, in this training, when we talk about risk, we mean the amount of capital you will lose after entering a position and hitting your stop loss not just the amount of capital involved in the position.

Additionally, if you don’t have a written trading plan, strategies, or if you don’t document your positions in Excel or any other platform, this will not be beneficial for you and may result in future losses.

💼 Implementing Risk Management in Trading

We need to categorize our trades based on market conditions, daily circumstances, chart setups, strategies, win rate, written trading plans, and our trade entry checklist.

Here’s how I categorize trades: Very Risky - Risky - Normal - Confident

1️⃣ Very Risky

For this category, it’s better to have a separate account purely for testing, FOMO, or experiments. These trades have very few confirmations (1–2). Trade with less than 0.1%–0.25% of your main capital in this category.

2️⃣ Risky

These trades are opened in your main account because they generally meet some confirmations but lack key ones. For instance, you anticipate a resistance breakout and go long before confirmation. These trades usually have a small stop loss, leading to higher risk-to-reward ratios. Use 0.25%–0.5% of your capital for these trades.

3️⃣ Normal

These trades have most confirmations but might miss a few. For example, out of 10 items on your checklist, 6–7 are confirmed. These form the majority of trades. Be cautious about the win rate of this category, as it should be higher than your overall average. Use 0.5%–0.75% of your capital here.

4️⃣ Confident

These trades have all major confirmations, and your strategy’s triggers are activated. Additionally, 8–9 out of 10 items on your trade entry checklist are confirmed. These are your most confident trades. Use 0.75%–1% of your capital for these trades.

⚠️ Daily Risk Management

Don’t use your entire daily risk limit at once. For example, if your daily risk is 1.5%, keep some risk in reserve in case your first trade hits its stop loss. This allows you to recover and even profit later in the day.

Focus on normal trades. These should form the majority of your trades since they maintain a healthy win rate. Risky trades might lower your win rate, while confident trades occur less frequently and won’t significantly impact your overall win rate.

📝 Building Risk Management and Consistency

Risk management based on your checklists and spreadsheets can take around 6–8 months to develop, starting after learning technical analysis. In the beginning, allocate 0.5% risk per trade while documenting your trades.

This will prevent unnecessary self-blame for stop-loss hits in risky trades and help you trade confidently with a solid plan.

❤️ Friendly Note

If you don’t follow these principles, trading might become an on-and-off journey, leading to frustration and eventual market exit. In the end, your money will go to traders who adhere to these rules.

If you’ve read this far, congratulations! Unlike misleading social media ads, this guide offers genuine, practical insights. Be proud of your effort and focus on applying these principles. Let’s progress together and elevate our lives through financial markets. 😊

FOMO and Hope for a Price Reversal: Two Psychological Traps❓ Have you ever entered a trade out of fear of missing out (FOMO) or held on to a losing position, hoping the market would turn in your favor?

Psychological mistakes are a huge factor in whether a trader succeeds or fails. One of the most common and damaging mistakes is FOMO (Fear of Missing Out), followed by holding onto trades because of an unrealistic hope that the market will reverse despite all evidence pointing to the opposite. These behaviors are far too common, even among experienced traders. Understanding and avoiding them is essential to improve your trading results. 🧵

💡In this article, we’ll break down the psychological mistakes every trader faces, how to identify them, and practical strategies to prevent them from affecting your trades.

The Psychological Side of Trading 🧠

In trading, emotions can be our worst enemy. Here are two common psychological traps that many traders fall into:

🔮 FOMO (Fear of Missing Out):

What It Is: FOMO is when you enter a trade impulsively, simply because you see others making profits or you fear missing the "big move."

Why It Happens: The market seems to be moving in one direction, and you don't want to miss out on potential profits. This often happens when you're watching others on social media or in trading groups.

Impact: This leads to impulsive decisions, often entering trades late in the trend or at inappropriate levels.

Tip: To combat FOMO, stick to your pre-defined trading plan and only take trades based on your specific criteria. Remember, there will always be new opportunities.

🔎 Unrealistic Hope in Price Reversals:

What It Is: This is when you hold onto a losing position, hoping that the market will reverse in your favor, despite clear signs to the contrary.

Why It Happens: It’s often rooted in the belief that “the market can’t keep going against me,” or the hope that the trend will change.

Impact: This often results in larger losses because the trader doesn't cut their losses early and ends up holding onto a position until it’s too late.

Tip: When you see signs that the market is continuing against you, cut your losses quickly. Trading is about being patient and disciplined, not about hoping for a reversal.

🛠 Strategies and Tools for Managing Emotions 📈

Trading is all about control—control over risk, strategy, and most importantly, over your emotions. Here are some tools and strategies to keep your psychology in check:

1. Position Sizing & Risk Management

Position Sizing: One of the most effective ways to reduce emotional stress and maintain control over your trades is by managing your position size. A general rule of thumb is to risk 1-2% of your total account balance on each trade. However, this percentage can vary based on your risk tolerance, experience, and self-awareness. As you gain more experience and better understand your risk profile, you may adjust this amount accordingly, but always ensure you're comfortable with the risk you're taking.

2. Stick to Your Strategy

Trading Plan: Make sure you have a solid trading plan and stick to it. Your plan should include:

Entry signals

Exit signals

Risk management rules (e.g., stop-loss, take-profit levels)

Don't Chase the Market: If you missed the breakout, don’t chase it. There will always be new opportunities, and chasing the market often leads to poor entry points and higher risks.

3. Psychological Self-Awareness

Track Your Emotions: Keep a trading journal to track not only your trades but also your emotional state. Understanding your psychological triggers (e.g., fear, greed) can help you avoid emotional mistakes.

Set Realistic Expectations: Remember, trading is a marathon, not a sprint. Accept that you will have losses, and focus on your long-term profitability rather than on every single trade.

Successfully navigating trading isn’t just about technical indicators or chart patterns—it’s also about controlling your emotions. FOMO and holding on to unrealistic hopes can seriously damage your trading performance. The key is to develop a strong psychological mindset: stick to your strategy, manage your risk, and always make decisions based on data, not emotions.

💌Now, it’s your turn!

Which psychological mistakes have you encountered in your trading journey? Share your experiences in the comments below and let’s learn from each other!

I’m Skeptic , here to simplify trading and help you achieve mastery step by step. Let’s keep growing together! 🤍

Trading Without a Plan: The Rollercoaster I Couldn’t Get OffWhen I started trading, I thought I didn’t need a plan. I’d jump into trades, figuring I’d make it work as I went along. For a while, I got lucky. But soon, luck ran out.

The Day I Realized I Needed a Plan

It hit me after a week of back-to-back losses. Every win I’d made was wiped out, and I didn’t understand why. I wasn’t following any rules—I was just hoping each trade would work out. And when it didn’t, I felt completely lost.

What Trading Without a Plan Did to Me

-My results were inconsistent: Some days were great, but most weren’t.

-I had no risk management: I’d risk too much on one trade and too little on another.

-I felt out of control: Without a plan, I was relying on gut feelings, and they failed me.

How I Fixed It

I decided to start over. I created a simple plan, back-tested it, and promised to stick to it. I set rules for how much I’d risk and reminded myself that small, consistent wins would add up over time.

What I Learned

-A plan gives you control and consistency.

-Risk management is key—it protects your account when trades don’t go your way.

-Trading without a plan isn’t trading. It’s gambling.

If you’re struggling with inconsistency or a lack of direction, send me a DM—I’ve been there and can help. I also have a webinar this Sunday to help you build a strategy and stay consistent.

Kris/ Mindbloome Exchange

Trade What You See

XRP SeekingPips reminds himself STICK TO THE PLAN, XRP LONG ONLY

I would consider the following as a GOLD STAR LESSON TO BE SAVED.

Yesterday created a great reminder opportunity that you must have a PLAN & RULES.

Even SeekingPips is human and therefore sometimes will deviate from the plan.

The GOLD SECRET is to realise the error and get back on track as soon as possible.

I was very clear on the chart share on 01/01/2025 that I only wanted to accumulate XRP

Here is the copy of that paragraph :

"ℹ️ However whilst price remains above 2.10 USD I do not want to take the short side of XRP."

By the next chart share the next day 02/01/25 it was clear to me where price was and that I was seeing a clear BULL FLAG on the DAILY CHART.

✅️ With that information I had a plan❕️✅️

ℹ️So what's the lesson you ask?❔️

⭐️Well Seeking Pips didn't stick to the plan.

Price was still well above 2.10 but shared a short chart idea.

This is why a TRADE JOURNAL is a GREAT idea.

In real time you may not see or notice any TRADING ERRORS but by having a journal it's in black and white and you can spot any problems early.✅️

⚠️So what were the KEY POINTS from yesterday?

🟢 Based on the D1 timeframe chart there was no valid reason according to my PLAN to conditioner any short positions.

🟢 Even based on the intra day timeframes that I use my RED LINE on my chart share at 2.3268 was never traded below.

🟢 Too zoomed in to price on lower timeframes. Seeking Pips considered the intra day timeframes and price action over what the Daily and Weekly charts were indicating.

🟢 Quantity over quality, wanting to be active and share some content, even given the fact that the DAY, WEEK and EVEN YEAR had just started.

🟢 NOT GIVING the IDEA time to play out. Barely two hours earlier I had already decided that my bias was to the long side.

There was no trigger to invalid that bias.

⭐️THE LESSON⭐️

Trading is not all about Lambos and penthouses. Yes that can be a final goal if you want it to be BUT to get to that point you really do have to iron out all of the ugly stuff first...

If this post helps even one peron on their trading journey it has done it's job.👌

PLEASE LIKE AND SHARE THIS POST IF YOU FOUND IT USEFUL. 👍

Choppy Market: Patience and Key Levels to WatchThis chart highlights a low-probability trading environment with corrective structures and low volatility. Key focus areas:

Upside Breakout: Watch for impulsive moves above the 30M trendline and 4H LQZ for short-term bullish setups.

Downside Correction: A steeper drop into the 15M or 1H LQZ may provide higher-probability long opportunities.

Stay Patient: Avoid trading inside the choppy range; wait for clear reactions at liquidity zones or strong breakouts with momentum.

Stop Losses: Protecting Your Trades and Building Consistency

Stop losses are a critical tool for any trader aiming to manage risk and protect capital. A stop loss is a preset level at which a trade will automatically close to prevent further losses if the price moves against you. This approach is one of the most effective ways to protect your account, and understanding how to set and use stop losses correctly can help you trade more confidently.

In this article, I will discuss why stop losses are essential, the types of stop losses available, and how they link to other core strategies like position sizing and maintaining consistency.

Why Every Trader Needs a Stop Loss

The primary role of a stop loss is to limit potential losses on a trade. By setting a stop loss level, you define your risk before entering the trade, which helps ensure that no single trade can damage your account significantly. This practice is fundamental to disciplined trading, where managing risk is just as important as aiming for profits. When you use stop losses, you’re able to protect your account without relying on emotions or making quick decisions based on fear or market volatility .

Using stop losses also promotes consistency, as it allows traders to follow their strategy and avoid unexpected, large losses. Knowing your risk upfront means you can execute your trades with a clear plan, focusing on opportunities rather than worrying about sudden market moves. This consistency is key to achieving long-term success in trading 🚀.

The Types of Stop Losses Every Trader Should Know

There are different types of stop losses, each suited to particular trading strategies and market conditions. Here are some of the most common types and how they work:

Fixed Dollar or Percentage Stop Loss

This is the simplest type, where you set a specific dollar amount or percentage of your capital as the maximum loss.

Example: If you’re willing to lose $100 on a trade, you place a stop loss that will close your position if the loss reaches $100.

Technical Stop Loss

A technical stop loss is set using chart levels, like support or resistance, which reflect natural points where prices may bounce or reverse.

Example: If a stock has support at $48 and you buy it at $50, you might set your stop loss just below $48. This way, if the price breaks the support level, the trade closes to prevent further loss.

Trailing Stop Loss

A trailing stop loss adjusts upward as the price moves in your favor, locking in profits if the stock reverses.

Example: If you buy a stock at $50 with a $1 trailing stop, and the price rises to $55, your stop automatically moves to $54. If the price then drops to $54, the trade closes, protecting your $4 profit.

Volatility-Based Stop Loss

This type of stop loss takes into account the stock’s usual price swings, setting the stop far enough away to avoid being triggered by minor fluctuations.

Example: If the ATR (Average True Range) of a stock is $2, you might set your stop $3 below your entry point to account for normal market movements.

Time-Based Stop Loss

A time-based stop loss closes the position after a set period, which is particularly useful for day traders who avoid holding trades overnight.

Example: A day trader might exit all trades by 4 p.m., regardless of the price movement, to avoid the risks of holding overnight positions.

How Stop Loss and Position Sizing Work Together

Stop losses and position sizing are deeply connected. Position sizing is the amount of capital you commit to each trade, and it’s based on your risk tolerance and the distance to your stop loss level. For instance, if you have a $10,000 account and want to risk only 1% per trade (or $100), you’ll need to calculate how many shares you can buy based on the distance to your stop loss.

Let’s say your stop loss is $5 away from your entry price. To stick to your $100 risk limit, you would only buy 20 shares ($100/$5 stop distance). By setting your position size relative to your stop loss, you control how much of your capital is at risk. This approach keeps your losses small enough that no single trade can impact your overall capital significantly, allowing you to trade consistently and confidently.

How Stop Losses Contribute to Consistent Trading

Stop losses are essential for maintaining consistency in trading. They allow you to avoid big losses that can drain your capital and help keep emotions in check, allowing you to trade with a clear mind. Using stop losses also helps you keep your risk-to-reward ratio in balance, so even if some trades go against you, the overall profits from successful trades will outweigh these losses.

This discipline keeps you aligned with your strategy and limits impulsive actions, which are often harmful to trading success. In this way, stop losses help establish a consistent, repeatable process that strengthens your trading foundation and increases your chances of long-term success.

I know very well the frustration of seeing my stop losses being hit, but believe me, the worst feeling is getting stuck with a large loss for weeks, months, or even years. Sometimes, stocks never recover.

Trading Forex Without a Strategy? These Are the ConsequencesForex trading involves buying and selling currencies to profit from fluctuations in their exchange rates. As one of the world’s most liquid and fast-paced markets, it offers vast opportunities but also significant risks. The dynamic nature of forex trading makes it essential for traders to have a well-defined strategy to navigate market complexities effectively.

The importance of having a trading strategy cannot be overstated. It provides a structured plan that outlines how to enter and exit trades, manage risk, and achieve trading goals. Without a clear strategy, traders often find themselves making impulsive or emotional decisions, leading to inconsistent results and increased losses.

In this article, we'll explore the consequences of trading forex without a strategy, highlight the risks associated with this approach, and discuss why a solid strategy is crucial for consistent success.

⭐️ Read the entire article as I'll include tips and strategies to help you get started.

What Is a Forex Trading Strategy?

A forex trading strategy is a structured plan that guides traders in making informed decisions. It defines specific rules and criteria for entering and exiting trades, managing risk, and achieving trading goals. By following a well-defined strategy, traders maintain consistency and discipline, which are essential for long-term success.

An effective strategy typically includes:

1- Entry and Exit Rules: Criteria based on technical indicators, chart patterns, or fundamental factors to determine when to buy or sell.

2- Risk Management: Guidelines for setting Stop Loss orders, position sizing, and risk-reward ratios to protect capital and minimize losses.

3- Goals and Objectives: Specific profit targets and trading frequency to ensure traders have measurable and achievable benchmarks.

Risks of Trading Without a Strategy

Trading forex without a clear strategy can have significant consequences:

⭐️ BONUS 1

Emotional Decision-Making

Without a strategy, traders are more likely to make impulsive decisions driven by emotions rather than rational analysis.

For instance, during a sudden market dip, a trader may panic and sell, only to miss a subsequent rebound that a strategy would have anticipated.

Inconsistent Performance

A lack of structured guidelines results in inconsistent results and unpredictable performance.

Research shows that traders without a strategy often experience higher rates of failure and lower returns compared to those who follow a disciplined approach.

Increased Risk of Losses

Without predefined risk management rules, traders may incur substantial losses if the market moves unfavorably.

The absence of protective measures, such as Stop Loss orders, exposes traders to severe financial setbacks, especially in volatile market conditions.

⭐️ BONUS 2

Consequences of Not Having a Trading Strategy

1- Lack of Direction

Trading without a plan can result in impulsive or arbitrary decisions, leading to confusion and missed opportunities. This disorganized approach makes it difficult to measure progress or achieve goals.

2- Inability to Adapt to Changing Market Conditions

Traders without a strategy may struggle to respond effectively to sudden shifts in trends or volatility. This can lead to missed trades or significant losses due to a lack of preparation for emerging opportunities or risks.

3- Difficulty in Measuring Performance

Without clear benchmarks, traders cannot accurately track or evaluate their performance.

This lack of metrics makes it challenging to refine strategies or identify areas for improvement.

4- Benefits of Having a Well-Defined Trading Strategy

Consistency and Discipline. A solid strategy enforces rules for entry, exit, and risk management, reducing the likelihood of erratic behavior.

Successful traders often attribute their achievements to adhering to well-developed strategies.

5- Improved Risk Management

Strategies include guidelines for setting Stop Loss orders and managing position sizes, minimizing potential losses.

Traders with effective risk management practices tend to experience fewer large losses and achieve better returns.

⭐️ BONUS 3

6- Clear Goals and Objectives

A well-defined strategy outlines specific trading goals, providing a roadmap for success.

Setting measurable objectives helps traders track progress and make informed adjustments to improve performance.

How to Develop an Effective Forex Trading Strategy

1-Assess Your Trading Goals

Define what you want to achieve—whether it's generating income, growing capital, or improving skills. Set clear, realistic objectives that align with your experience and market conditions.

2- Choose a Trading Style

Select a style that suits your personality and time commitment. Options include:

Day Trading: Involves multiple trades within a day, focusing on short-term price movements.

Swing Trading: Involves holding positions for several days to weeks to capitalize on market swings.

Scalping: Seeks small profits from numerous trades, focusing on quick entries and exits.

Position Trading: Focuses on long-term trends, holding positions for weeks, months, or longer.

3-Backtest and Refine Your Strategy

Test your strategy using historical data to evaluate its performance under different market conditions.

Refine the strategy by adjusting parameters based on results, increasing its effectiveness and adaptability.

4-Utilize Tools and Resources

Leverage trading platforms like TradingView, known for their advanced charting tools and indicators.

Use educational resources like webinars, online courses, and forums to enhance your knowledge and skills.

⭐️ BONUS 4

In Conclusion...

A well-defined trading strategy is crucial for success in the forex market. It provides a clear framework for making informed decisions, setting precise entry and exit points, managing risk, and maintaining consistency. Without a strategy, traders risk falling prey to emotional decision-making, inconsistent results, and significant losses.

Implementing a solid strategy ensures that every trade is driven by analysis and predetermined rules, enhancing your ability to navigate market fluctuations with confidence. By setting clear goals, refining your approach, and leveraging available tools, you can build a reliable and profitable trading practice.

Take the first step today: assess your trading goals, choose a suitable style, backtest your strategy, and utilize resources to create a comprehensive trading plan that aligns with your objectives. With the right strategy, you’ll be better equipped to handle the challenges of the forex market and achieve long-term success.

Uptrend or Fadeout? Learn the Key to Catching Market Breakouts1. Recognizing Market Structures: Uptrends and Downtrends

Higher Highs (HH) and Higher Lows (HL):

These are signs the market is in an uptrend—prices keep moving up, forming new highs (peaks) and lows (dips) that are higher than the previous ones.

Think of it like climbing stairs: each step higher shows the market’s strength.

Lower Highs (LH) and Lower Lows (LL):

When prices stop climbing and start forming lower peaks and lower dips, it signals that the market might be slowing down or reversing into a downtrend.

In the chart:

The first part shows a bullish (upward) move with Higher Highs and Higher Lows.

Later, the market shifts to lower highs, signaling a potential slowdown or shift toward a downward move.

2. What Is the LQZ (Liquidity Zone)?

Liquidity Zone (LQZ): This is a key price area where a lot of trading activity happens—like a hotspot where buyers and sellers clash.

When price reaches such a zone, it either breaks through and keeps moving in that direction (bullish continuation) or bounces back down (rejection).

Think of it like a soccer goal line: if the ball crosses the line, the team scores a goal (bullish move); if it’s blocked, the ball goes the other way (bearish move).

In the chart:

The LQZ is highlighted as the key level to watch. A clean breakout (with more than just a quick spike or wick) signals that buyers are strong enough to push the market higher.

If the price gets rejected at this zone, the sellers regain control, and the market might move down.

3. Scenarios: What Happens Next?

The chart offers two possible outcomes based on how price behaves near the LQZ.

Bullish Scenario:

If the price breaks above the LQZ and stays there, it’s likely to continue upward towards:

Target 1: 2,661.38

Target 2: 2,673.60

These are the next levels where buyers might take profits or where new sellers could appear.

Bearish Scenario:

If the price gets rejected at the LQZ and drops lower, it could move towards:

Bearish Target 1: 2,569.49

Bearish Target 2: 2,546.25

This suggests the sellers have taken control, pushing the market down.

4. How to Know When to Enter a Trade?

The chart highlights the importance of waiting for confirmation before jumping into a trade. Here’s a simple trade plan:

For a Buy (Long) Trade:

Wait until the price breaks above the LQZ and stays above it.

Enter on the first pullback (dip) after the breakout—this is often called a flag or retest.

For a Sell (Short) Trade:

If the price gets rejected at the LQZ, wait for a clear downward movement.

Enter after the first lower high forms, confirming that the sellers are in control.

Why wait for confirmation?

Jumping in too early might cause you to get caught in a false breakout or fake move. Think of it like waiting to see which team scores first before betting on the game.

5. Avoid Emotional Trading and Manage Risk

This chart reflects a key lesson: trading is a game of patience and probabilities.

If the trade doesn't go as expected, it’s important to step back and wait for the next opportunity.

Don’t chase trades just because you fear missing out (FOMO). You might enter too soon and hit your stop loss unnecessarily.

Risk Management Tip:

Use stop losses to protect your account from big losses.

Avoid placing multiple risky trades on the same pair just because you’re impatient. It’s better to wait for high-probability setups.

6. Summary: A Simple Trading Plan

Watch the LQZ level:

If the price breaks above, look to buy on the next dip.

If the price gets rejected, look to sell when it starts forming lower highs.

Set Clear Targets:

For bullish trades, aim for Target 1 and 2 above.

For bearish trades, aim for Bearish Targets 1 and 2 below.

Don’t Rush:

Wait for clear confirmation before entering.

Follow your trading plan and avoid emotional decisions.

Unlock Trading Success with These Proven Chart PatternsTechnical Analysis of the Trade:

The chart you provided highlights several patterns and levels, which I'll break down into different components for a clear analysis:

1. Market Structure:

Ascending Channel:

The price is moving within an upward-sloping channel, indicating that the market is in a bullish structure. An ascending channel like this represents a controlled trend higher with occasional corrections, providing potential buying opportunities on pullbacks to the lower boundary of the channel.

Trade Implication: As long as price remains within this channel, the overall bias is bullish. A break below the channel, however, would signal a shift in momentum, suggesting a potential sell-off.

2. Bull Flags:

Bull Flag 1 (Lower on the chart):

This flag formed after a strong upward move, followed by a tight consolidation, which is a classic bullish continuation pattern. The breakout from this flag has already occurred, leading to a further upward push.

Bull Flag 2 (Upper on the chart):

Similar to the previous one, this bull flag formed after another sharp move up, indicating a potential continuation. The price is currently in the process of consolidating in this flag, which makes this an area of interest for a potential entry on a breakout.

Trade Implication : Both flags suggest that the market is in a bullish phase. You could consider entering on a breakout above the upper bull flag, aiming for continuation to the upside.

3. Support/Resistance Zones:

1-Hour Liquidity Zones (LQZ):

The chart shows two 1-hour liquidity zones:

Upper LQZ (Around 2660): Price is consolidating just below this area. This zone could act as short-term resistance but would be a strong area for a breakout and continuation move higher.

Lower LQZ (Around 2640): Should the price reject from the upper bull flag, this area is the next potential support zone where price could find liquidity and buyers might step back in.

4-Hour Liquidity Zone (Around 2622): This lower level is a major support area. If price retraces significantly, this could be a high-probability area for a reversal or continuation of the overall bullish trend.

Trade Implication: If the price breaks above the 1-hour LQZ (Upper), it could trigger a bullish continuation. If rejected, you might look for a retracement back to the lower LQZ or even the 4-hour LQZ for a potential buying opportunity.

4. Pattern Confirmation & Confluences:

Multi-Touch Confirmation:

The price has interacted with significant levels multiple times (ascending channel, bull flags, and liquidity zones), strengthening the idea that these levels are respected by the market. This gives added confidence in the patterns you are trading off of, such as bull flags and support levels.

Trinity Rule:

Before entering a trade, ensure you have at least three confluences. In this case, potential confluences include:

Price staying within the ascending channel.

Bull flag formation at the current level.

Proximity to key liquidity zones.

With these three factors, you can confidently look for a continuation to the upside.

5. Price Action Signals:

Correction vs. Impulse:

If the market continues to move upwards impulsively, it supports the bullish continuation thesis. However, if it begins to correct, expect a pullback towards the lower boundaries of the liquidity zones or the lower boundary of the ascending channel.

Trade Implication: If you see a sharp impulse (breakout of the upper bull flag), it could be a signal to enter long positions, while a slow corrective move might indicate waiting for a better entry lower.

6. Risk Management:

Stop Placement:

Place your stop loss below the lower boundary of the second bull flag or below the most recent swing low. For a safer trade, consider setting the stop just below the lower 1-hour LQZ (2640), where price may likely find support.

Trade Implication: This gives the trade room to breathe while protecting against a deeper pullback.

Take Profit:

Based on the bullish pattern, your first take profit should be just above the upper 1-hour LQZ around 2660, with the next take profit near the next liquidity zone or potential resistance levels further up.

7. Probable Scenarios:

Bullish Scenario: If price breaks above the upper 1-hour LQZ and the current bull flag, it could rally towards the next significant resistance level (around 2670-2680).

Bearish Scenario : If price rejects from the upper bull flag and falls below the lower 1-hour LQZ, it could retrace to the 4-hour LQZ around 2620. This area would then offer a high-probability long entry.

Summary of the Trade:

Bias: Bullish (based on the ascending channel, bull flags, and liquidity zones).

Entry Strategy:

Enter on a breakout above the upper bull flag, with the price moving above 2660.

Alternatively, if the price retraces, enter near the 2640 (lower 1-hour LQZ) or 2622 (4-hour LQZ).

Stop Loss: Below the lower 1-hour LQZ (2640) or the recent swing low within the bull flag consolidation.

Take Profit: Around 2670-2680 (based on the next potential resistance and liquidity zones).

Lesson 6: Staying Emotionally Aware in TradingWelcome to Lesson 6 of the Hercules Trading Psychology Course—Staying Emotionally Aware in Trading. Building on the essential traits of Patience, Initiative, and Discipline covered in previous lessons, today we explore the critical role of Emotional Awareness in achieving long-term trading success across all financial markets, including stocks, commodities, cryptocurrencies, and forex.

How Can You Stay Emotionally Aware in Trading?

Listening to advice and consuming educational content can significantly boost your confidence and help you achieve impressive monthly returns. However, there’s a catch: experiencing high returns can lead to emotional blindness, much like speeding in a fast car without recognizing the potential for a crash.

Once you encounter this emotional wall, the decisions you make next are pivotal for your trading future. That’s why maintaining emotional awareness is crucial. Understanding that there are both right and wrong ways to win in trading, especially during periods of success, is essential for sustainable profitability.

This lesson breaks down the importance of emotional awareness, covering both the big picture and the intricate details, while emphasizing the fundamental role of money management in any trading strategy.

Why Should You Care About Trading Psychology?

Risk management is undeniably important, and many traders are becoming more adept at it. While focusing on finding the best trade entries is essential, many overlook another key player: Trading Psychology. This aspect can profoundly influence your trading results. Despite the growing emphasis on risk management, not enough traders are tuning into the psychological components of trading.

This gap highlights just how crucial trading psychology is. When traders believe they have everything under control, they might ignore the emotional rollercoaster that trading can bring, undermining their success.

What Are Key Strategies for Trading Success?

To excel in trading, one golden rule is to avoid unnecessary interference and resist the urge to act as if you know more than your trading system. Stick to these three principles, and you might find success in the long run, even amidst the emotional ups and downs that come with trading.

Emotions play a significant role in our lives—from music to relationships—but in trading, it’s vital to keep them in check. It’s perfectly normal to feel emotions, but letting them dictate your trading decisions can be detrimental. Professional traders know how to stay calm under pressure, maintaining a clear and objective mindset.

New traders often experience a rush of emotions during winning streaks, leading to common mistakes. Understanding these pitfalls is essential for maintaining a disciplined approach during both profitable and challenging times.

How to Set Realistic Trading Expectations

Managing your trading success requires balancing consistent returns with emotional control, which can be a rollercoaster ride. Achieving milestones is exciting, but it’s not just about securing wins; it’s about venturing into new territory with realistic expectations.

A common trap is believing that your wins are guaranteed—thinking you can achieve a steady 15% profit every month without setbacks. This mindset can lead to overconfidence, making it difficult to sustain long-term success.

It’s crucial to set realistic earning goals and understand that trading involves ups and downs. Anyone claiming otherwise might be misleading you. Prepare for challenges instead of assuming trading will always be smooth sailing.

How Should You Approach Risk and Returns in Trading?

It’s important to remember that if you’re not hitting that 9% monthly return and only achieving 1.5%, it doesn’t mean you’ve failed. Instead, it’s a classic case of regression to the mean. A steady 1.5% monthly return is actually impressive and can pave the way to becoming a professional trader over time, even if some high performers overlook this perspective.

Avoid the temptation to increase your risk just because you think you’re on a winning streak. Such actions can lead to unsustainable returns and significant losses. Look to seasoned investors who stay calm and play the long game, consistently achieving impressive annual returns by focusing on disciplined strategies.

When markets take a downturn, refocus on these core concepts to avoid emotional trading and strengthen your grasp on risk management.

Why Is Trading Experience So Crucial?

Jumping into trading without real experience sets you up for significant struggles. While making a profit feels great, the reality of trading can hit hard sooner or later. When things go sideways, it’s an opportunity to pause and reflect—did you stick to your rules or make impulsive decisions? These mistakes can lead to overtrading, making it essential to review and learn from setbacks.

Learning from these challenges allows you to bounce back and tackle the market with renewed strength. Grasping the bigger picture and applying those lessons is key, especially when practicing on demo accounts.

How Can Emotions Affect Your Trading?

Trading can be an emotional rollercoaster! Many traders find themselves spiraling into different emotional states that can significantly impact their decision-making. To manage these emotions effectively, consider three simple actions:

Stay Regret-Free:

Avoid feeling regret over successful trades. Instead, focus on the strategy and the process that led to those wins. This mindset helps maintain a clear perspective by the end of the trading year.

Avoid Emotional Trading:

While it’s natural to feel emotions, don’t let them take control of your trading decisions. Keeping emotions in check allows for more rational and objective trading choices.

Learn from Mistakes:

Acknowledge that mistakes are part of the trading journey. Use them as learning opportunities to improve your trading strategies and emotional control.

By adopting these practices, you can enhance your trading performance and maintain a balanced mindset.

How Does Trading Psychology Impact Your Success?

Many traders feel disappointed when their performance drops from high returns to moderate ones. Instead of celebrating their wins, they focus on what they missed, which can lead to a negative mindset and hinder future performance.

It’s essential to stay flexible and not become fixated on specific performance metrics, especially in volatile markets. Regret can interfere with your trading game, so sticking to a reliable trading system is crucial. Always monitor your risks and be strategic about when to take profits to prevent unexpected losses.

How to Move Past Trading Regrets

Regret is a common emotion among traders, especially when reflecting on missed opportunities, such as exiting trades too early. Straying from your trading system invites losses over time, as these systems are designed to be effective when followed consistently.

Relying on emotions for trading decisions often leads to chaos, particularly for those who can’t adhere to their rules. It’s tempting to increase risks during seemingly easy trades, but this is a result of hindsight bias complicating decision-making.

Instead, focus on three key principles to simplify trading and achieve long-term success without overcomplicating the process.

Why Staying Focused in Trading Matters

Reaching your trading goals is the ultimate objective, but many traders encounter obstacles due to emotional fluctuations. Choosing the right trading path is vital, as the decisions you make are crucial, especially when emotions run high after a win.

This lesson delves into not just technical analysis but the entire spectrum of trading, highlighting the essential aspects of trading psychology and money management. For beginners, it’s important to absorb these foundational insights to build a solid trading career.

Staying committed to your trading system and continuously improving your strategies ensures sustainable success and minimizes the risks associated with emotional trading decisions.

Conclusion: Embrace Emotional Awareness for Trading Success

Emotional Awareness is more than just recognizing your emotions—it’s about managing them effectively to enhance your trading performance. By staying emotionally aware, you empower yourself to navigate the complexities of all financial markets with confidence and resilience.

In Lesson 6, we’ve explored the importance of staying emotionally aware, the impact of emotions on trading decisions, and strategies to maintain emotional control. These elements are essential for building a strong foundation and achieving consistent profitability across all financial markets, whether you’re a swing trader or a day trader.

Action Steps:

Reflect on Your Emotions:

Assess how your emotions influence your trading decisions. Identify triggers that lead to impulsive actions and work on managing them.

Develop a Comprehensive Trading Plan:

Create a detailed trading plan that outlines your strategies, risk management techniques, and criteria for entering and exiting trades. Ensure that this plan emphasizes emotional control and disciplined execution.

Implement Robust Risk Management:

Protect your capital by setting appropriate stop-loss orders, limiting trade sizes, and diversifying your portfolio across different financial instruments.

Maintain a Trading Journal:

Document every trade to gain insights into your trading behavior and identify patterns that need improvement. Reflect on your trades to reinforce emotional awareness and disciplined strategies.

Practice Emotional Control Techniques:

Incorporate mindfulness practices, meditation, or journaling into your daily routine to manage stress and maintain emotional equilibrium.

Engage with the Trading Community:

Join forums, attend webinars, or participate in trading groups to share experiences and gain support from fellow emotionally aware traders.

Trust in Your System:

Have confidence in your trading system. Understand that managing emotions is a continuous process that contributes to long-term profitability.

Ready to take the next step?

Continue your journey by enrolling in Lesson 7: Emotional Awareness continuation, where we will develop even further this subject so that you’ll learn how to enhance your trading performance across all financial markets.

Lesson 4: Handling Losing Streaks – Embrace DisciplineWelcome to Lesson 4 of the Hercules Trading Psychology Course—Handling Losing Streaks: Embrace Discipline for Long-Term Success. Building on the essential traits of Initiative and Discipline covered in previous lessons, today we address a critical aspect of trading psychology: how to handle losing streaks. Whether you’re involved in forex, stocks, commodities, or cryptocurrencies, understanding and managing losing streaks with discipline is vital for achieving sustained profitability across all financial markets.

Understanding Losing Streaks