$ADA lookin' goodBottom Line Up Front (B.L.U.F)

CRYPTOCAP:ADA looking strong

If you have followed my thesis, we are still on track and on time

Beware of the FUD, FUD always presents itself when haters are hating. Recently there have been articles slamming the lack of pump as ADA price has not "skyrocketed" after IOG being awarded 70M from treasuries to conduct system upgrades. This is plain non sense, it takes time to correctly liquidate the tokens ( which is underway ) and to complete the upgrades ) this is pure manipulation by authors and publishers

There have been glitches if the Glacier program: as expected, most glitches and frustrations are due to cold wallet manufactures NOT upgrading their software to allow for the larger sizes of data required for the Glacier, this is not a native problem but isolated issues with cold wallet products who have not done their duties to support their customers.

Cardano has never played into the Manipulators game and has always acted transparently and fair, that makes a bit of an uphill battle as the masters of the market prefer guaranteed positions for quick and huge gains. follow the narratives and see the MOTIVES.

The positives

if you are a y o r o i user they had by far the most seamless integration ALL IN WALLET, compliments to Cardano for that, which displays the quality reliability and ease of use native to Cardano.

Cardano CRYPTOCAP:ADA holders will receive CRYPTOCAP:ADA and $NIGHT for staking ( once the Midnight Network is live and the thaw has happened.

ETF approval nears.

Fundamentals are strong, Nothing significant to report (NSTR) there.

I am sitting back and enjoying the ride.

all of this is my opinion, NFA, DYOR, let me know what you think?

see you at the top, Liminal OUT

ADAUSD trade ideas

ADAUSD Bullish energy build up support at 7,370The ADAUSD remains in a bullish trend, with recent price action showing signs of a corrective sideways consolidation within the broader uptrend.

Support Zone: 7,370 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 7,370 would confirm ongoing upside momentum, with potential targets at:

8,340 – initial resistance

8,550 – psychological and structural level

8,685 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 7,370 would weaken the bullish outlook and suggest deeper downside risk toward:

7,120 – minor support

6,753 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the ADAUSD holds above 7,370. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Cardano ADA Buying Opportunity📈 CRYPTO:ADAUSD has completed a 3-swing pullback against the June low and entered the extreme buy zone at $0.72–$0.64. While marginal new lows are still possible, this area aligns with Fibonacci confluence, making it a prime zone for a bullish reversal or at least a 3-wave bounce next week.

$ADA weekly chart UpdateOver the past week the market remains volatile as it seeks clarity.

Top ten and others are range bound however CRYPTOCAP:ADA has completed a very nice breakout and retest of the descending triangle pattern started in DEC 2024 and holds support at .702 above the 50 Week MA and Bull market support bands.

CRYPTOCAP:ADA has recently performed a golden cross and the 100 week MA @ .578 is also set to cross the 200 week MA @.616

Developments are ongoing to the chain:

-Glacier drop details to be release in Aug. using Zero knowledge proof (ZKP) midnight achieves much needed blockchain privacy and interoperability with multiple chains creating a hub effect favouring Cardano.

-70M from Cardano treasury allocated to IOG in order to polish various developments which will continue to push Cardano to the leading edge of the Crypto space.

-Polymarket predicts 83% chance of Cardano ETF approval in 2025.

-BTC OS and ZKP link CRYPTOCAP:BTC and CRYPTOCAP:ADA ecosystems with safest non bridge method to move CRYPTOCAP:BTC into a multichain environment which massively supports CRYPTOCAP:ADA

-73,000,000. dollars of institutional inflows ranking CRYPTOCAP:ADA as the sixth largest attractor of institutional funding.

-Strong community support and conviction

There is a bearish case which would call for the cancellation of the altcoin season and would mean Santa also doesn't come this year. I assess this as due to the continued dominance of CRYPTOCAP:BTC forcing alt season hopes to stay rangebound for extended periods as crypto is adopted into the financial systems.

however part of my thesis includes being contrarian, to a degree. The crypto market is clearly manipulated and I watch for the weaponization of FUD , as recently experienced over the last week with political tension and tariff's causing mass liquidations. these FEAR spikes are TO ME indicators of deliberate attempts to shake out any retail interests.

Conclusion, I remain bullish, i repeat, I remain bullish. you don't have to and I encourage everyone to create their own thesis from all the available contributors ideas. I remain bullish as all the data I see is still in line with the upward trend. and remember NOBODY "KNOWS" what's coming so...

IF YOU SAY YOU NEVER HAD A CHANCE YOU NEVER TOOK A CHANCE.

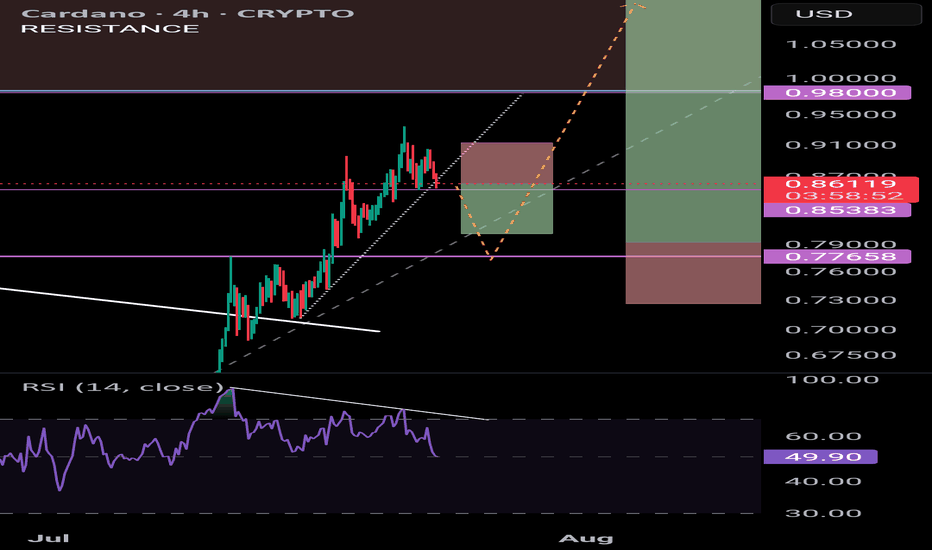

Cardano (ADA/USD) – Bullish Breakout SetupTrend:

ADA is trading above the 50 EMA and 200 EMA on the 4H and Daily charts.

Higher lows since the $0.75 zone show consistent buying pressure.

Pattern:

Breakout from falling wedge confirmed on strong volume.

Current price consolidating above key resistance at $0.80, now acting as support.

Key Levels:

Support: $0.794 – $0.800 (strong demand zone)

Resistance: $0.87, $1.05, $1.21

Breakout Trigger: $0.816 – $0.820 (4H close)

Indicators:

RSI holding above 55–60, showing bullish momentum without being overbought.

MACD histogram printing higher highs, bullish cross active.

Volume expansion on up-moves, contraction on pullbacks.

Trade Plan:

Entry (Breakout): $0.816 – $0.820 on confirmed 15m/1H close with volume

Stop-loss: $0.794 (below demand zone)

TP1: $0.90

TP2: $1.05

TP3: $1.21 (≈ 50% gain from entry)

Bias: Bullish unless price closes below $0.794 on 4H chart.

📈 ADA is showing strong momentum; buyers are defending support aggressively. A clean breakout above $0.820 could ignite a sharp rally toward $1.00+.

We are moving - Cardano weekly update August 6 - 12thCardano appears to have completed a clean Wave 2 correction and is now forming the first 1-2 setup within a larger impulsive move to the upside. From an Elliott Wave perspective, this suggests we are at the very beginning of a broader bullish development. Structurally, the chart aligns across multiple degrees of trend: we are currently within Cycle Wave 3, Primary Wave 1, and Intermediate Wave 3 — a highly favourable configuration for strong upside momentum.

The recent retracement reached the 0.5 Fibonacci level, where price reacted strongly and formed a well-defined bullish order block. This confluence between Fibonacci support and structural demand reinforces the idea that the local bottom is likely in place. The move off the lows also began with a clear five-wave advance, indicating that an impulsive structure is developing.

While an alternative scenario is shown on the chart — suggesting a possible deeper correction — this is considered low probability. The main reason this alternative exists is the relatively short time duration of the Wave 2 correction, which might appear shallow compared to expectations. However, given the structural symmetry, the clear order block, and the impulsive reaction from support, the primary bullish scenario remains heavily favoured.

Additional confluence comes from sentiment and derivatives data. Funding rates are still in negative territory but are turning upward, signalling a potential shift in market positioning toward longs. At the same time, open interest is increasing — an encouraging sign of growing participation and conviction in the current move.

The liquidity heatmap currently shows significant clusters both above and below the current price, making the liquidity picture overall neutral. However, this also implies potential for strong directional movement should one side be taken out decisively. Overall, the technical and sentiment-based evidence points to a structurally sound bullish setup with limited downside risk, so long as the current low remains protected.

ADA/USD – Blocked by the BridgeCardano pushed into local resistance at 0.7300–0.7350, which previously acted as key support and now flips to potential rejection. The price remains below the 200 SMA, putting it under bearish pressure despite the latest rally. RSI sits above 56, indicating bullish momentum—but without a structural reclaim above 0.7350, continuation is uncertain. This is a classic range rejection setup unless bulls break and close above that key level.

🟢 LONG bias only above 0.7350 – reclaim the range.

🔴 Otherwise, watch for bearish rejection and lower support at 0.7160.

📊 Keywords: #CryptoTrading #ADAUSD #SmartMoneyZones #RSISetup #ChartBreakdown #ReclaimOrReject

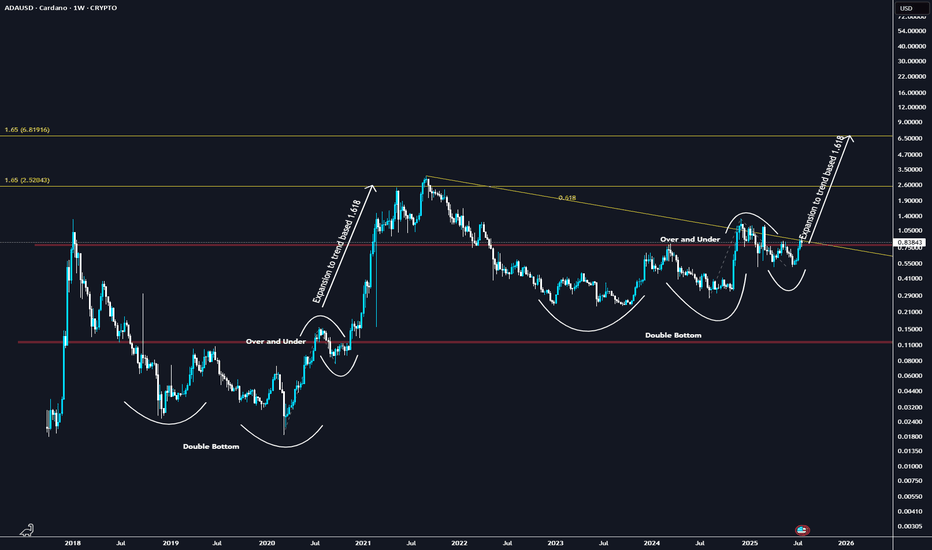

$ADA about to popCRYPTOCAP:ADA currently sits at strong support. and is technically repeating the exact pattern from previous Bull Runs, this does not guarantee repetition but I extrapolate the phrase, the trend is your friend and feel it applies macro scale.

ETF soon

Crypto laws passed

Leios inbound

Glacier drop inbound

CRYPTOCAP:BTC DEFi Inbound

Interoperability expanding

QE inbound

And CRYPTOCAP:ADA IMO is one of the easiest UI and is also among the most cost effective Blockchains to use on a daily basis.

This Chart is a thesis and I like Crayons.

Panic sets in. but its all goodThe crypto market has experienced a strong panic driven correction as the FED refuses to cut rates and inflation is on the rise while wages are slowly in decline.

CRYPTOCAP:ADA continues to provide thrills and chills

Is it time to dump? and cry into your empty wallet?

IMO NO, CRYPTOCAP:BTC has recently taken out liquidity below the $117,000.00 price point which is a normal move, if you are over leveraged it can feel horrible but I assess as a normal correction.

CRYPTOCAP:ADA price remains in the range in which it has formed .93 - .71 the possibility that CRYPTOCAP:ADA can dip deeper to .65 is possible but unlikely. This correction provides a cooling off of MACD and RSI on higher timeframes and the chart still remains BULLISH.

Remember be greedy when others are fearful.

A man who says he never had a chance never took a chance!

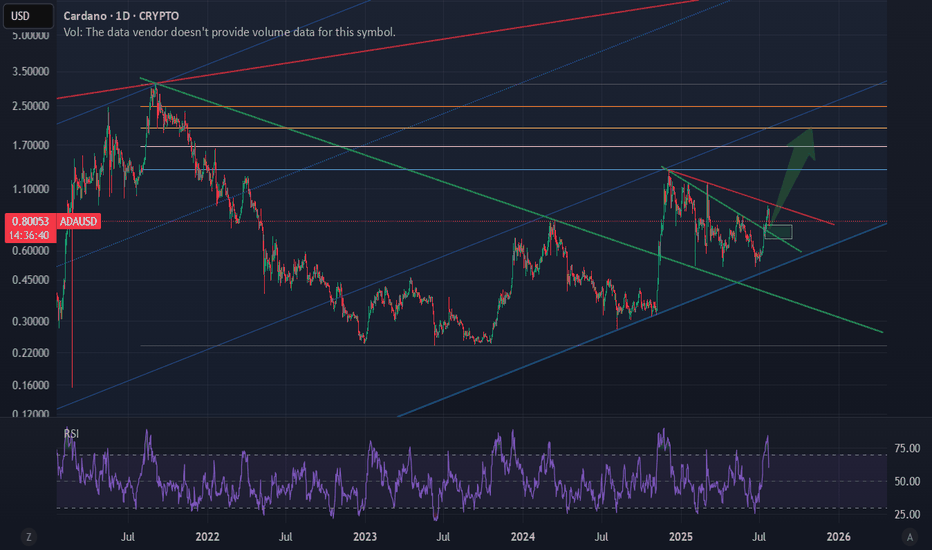

ADA, long term dubious speculationWARNING: This idea is highly dubious!

This is a logarithmic estimate of potential targets, in case Cardano moves in long logarithmic measures.

The real potential of this idea is strongly linked to the fundamentals evolution on time, i.e.: FED reducing the interest rate, for instance, but not only.

The plot features top and bottom limits drown by hand!, these are not perfect logarithmic measures, thus they certainly lacks of math accuracy. Beware.

There are zones in red and green, as transparent boxes, which depicts potential zones of buy and sell interest, of course, everything is in a log scale.

Everyone wish these kind of scenarios to be true. Only time and reality will show us the true face of it. In any case, in the total chaos of uncertainty that this market is, we try to make a sense of it.

Best of the lucks for everyone.

T.

DISCLAIMER: Do your own research! This idea is not a financial advice. All the information presented is highly speculative and cannot be taken as a reference in any circumstance.

$ADA Macro ThesisGD To all

I have cleaned up and thrown a few other correlated patterns on the Chart for my Macro thesis.

You will have to watch the metrics and on chain data as well as sentiment to verify as we move fwd.

This is Pattern recognition on a Log Chart:

BINANCE:ADAUSD

I have been using this thesis since 2019 and have been able to successfully ident general buy/sell points ( weighing against real world events and on chain data )

I hope it helps you and feel free to ask questions.

Told ya I like crayons

ADA 4H – 67% MACD Long Captured, But Is Trend Breaking?ADA just printed a textbook 67.03% move using the MACD Liquidity Tracker Strategy (Normal Mode). The system triggered long on bullish MACD crossover confluence with the 60/220 EMA trend filter — signaling the first real momentum shift after weeks of sideways action.

Price rallied from ~$0.56 to over $0.93, with the strategy holding the entire trend thanks to its filter logic: no early exits, no noise, just directional conviction. The exit fired only after MACD flipped bearish and price fell back below the trend EMAs.

Now, we’re watching the $0.72–$0.74 zone — a key support structure from early July. Momentum is weakening, pink candles are printing, and if bulls can’t reclaim the EMAs soon, a deeper pullback toward $0.68–$0.70 is likely.

📊 Backtest Snapshot:

– MACD: 25 / 60 / 220

– Trend Filter: 60 EMA + 220 EMA

– Strategy Mode: Normal

– Timeframe: 4H

Short Breakdown of Cardano (ADAUSDT) weekly/daily technicalsLooked over this for a friend. Rowland I would love your feedback in the comments 🫡

I will see my biggest expectation is for this to make it's way into the weekly imbalance range below the weekly Mother Candle we are existing within. The entire crypto market seems to want to revisit some key lows to correct some inefficiently delivered rally ranges (meaning too many pending orders left behind due to price not coming back to grab them, happens when HUGE money places--attempts to place/fill--bulk orders).

We are getting what I think is a temporary bullish correction due to taking of profits at key lows. It is my belief/observation that after correcting the newly minted bearish range (grabbing pending shorts above daily highs--turtle soup I think they call it), we will be able to drive down into the bullish imbalance weekly candle's range.

Let's see how we go! 😈

Up to $1 - ADA weekly update August 13 - 19thWe are currently at the end of Primary Wave 1, specifically completing Intermediate Wave 5. This will be followed by Primary Wave 2.

The liquidity heatmap indicates a growing concentration of liquidity below the current price, which, similar to the Polkadot setup, is likely to be targeted during the formation of Wave 2. My target for Intermediate Wave 5 is the 1.618 Fibonacci extension, as this level coincides with a significant cluster of resting orders and the psychologically important $1.00 mark.

Funding rates remain steadily positive, and open interest has continued to rise, signaling a stable uptrend. This also suggests that market participants are moderately willing to take on risk, while excessive euphoria is not yet present.

In summary, I am targeting the $1.00 level for Intermediate Wave 5 and will be looking for short entry opportunities from that area to position for Primary Wave 2.

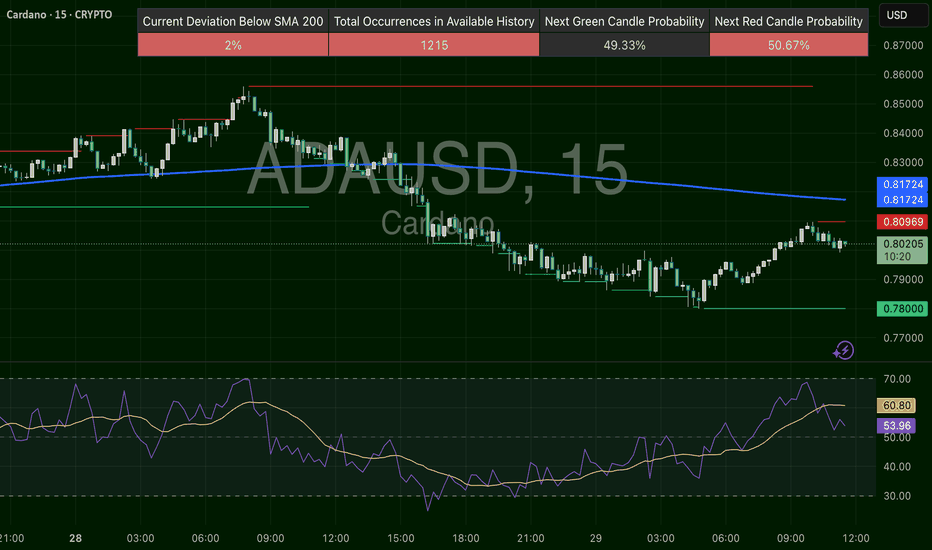

ADAUSD – Recovery, But Below The LineADA broke below the 200 SMA yesterday, selling off from $0.83 into $0.78 before forming a strong reversal pattern. It's now pushing back toward $0.81 resistance, but volume and RSI are showing signs of slowing. A reclaim of $0.8100 could trigger another leg toward $0.8170+. Until then, it’s a fading rally inside a bear structure.

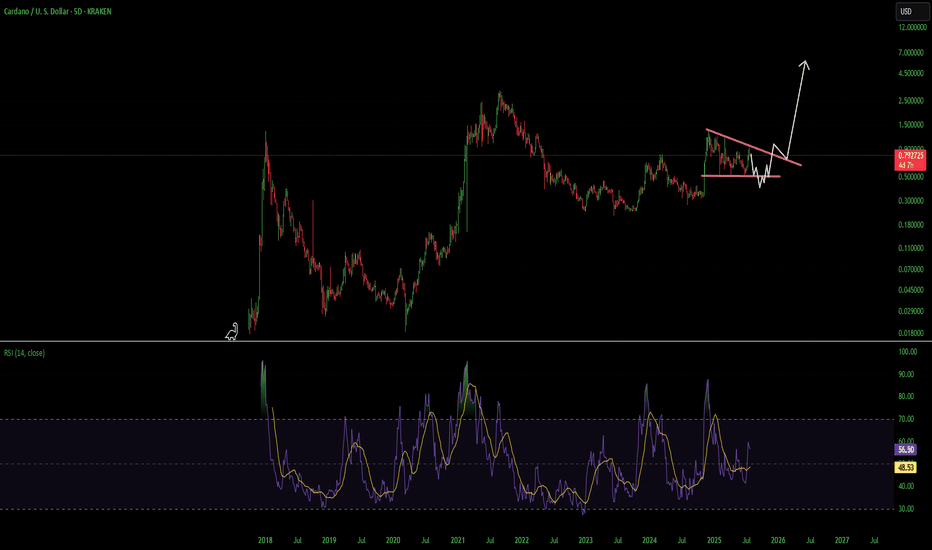

ATH for ADA soonChart says it all, ADA looks prime to run, could reach as high as $6.80

1. Technological Upgrades and Hard ForksThe Plomin Hard Fork in Q1 2025 enhanced governance, while upcoming features like Leios for scalability, BTC DeFi interoperability, L2s, and partnerchains boost efficiency and adoption, positioning Cardano as a leader in secure, sustainable blockchain tech.

2. Spot ETF Speculation and Institutional InterestGrayscale's pending ADA ETF filing with Nasdaq, plus inclusion in their Large Cap ETF, could unlock massive demand. Analysts see this as a game-changer, similar to Bitcoin/ETH ETFs, potentially driving prices to $5+ by year-end.

3. Ecosystem Expansion and IntegrationsNew tools like the EMURGO global Cardano card for ADA payments, Blockchain.com DeFi wallet integration (37M users), and Tokeo Wallet's XRP bridge enhance real-world utility. DeFi TVL and on-chain activity (unique addresses +4.79%, active wallets +12%) are surging.

4. Whale Activity and On-Chain MomentumWhales are accumulating amid spikes in network volume and no downtimes/hacks. Features like privacy via Midnight Network and Charles Hoskinson's White House advisory role add credibility, fueling a "silent surge."

5. Technical Breakouts and Market CorrelationADA has formed bullish patterns like a golden cross, double-bottom, and breakout from descending channels, correlating with Bitcoin's rally. RSI at 76 signals strong momentum, with targets at $0.82–$1.18 short-term and up to $2.80+ long-term.

6. Airdrops and Community HypeUpcoming events like the Glacier airdrop and NIGHT airdrop are creating buzz, alongside Cardano's unmatched decentralization and energy efficiency, potentially sparking a 383% rally as in past cycles.

ADA Cardano Decsending Triangle Use Caution HereCardano had a heck of a move but i think its going to erase most if not all of it before it goes on its next leg up. A break over the overhead resistance line and finding support above would invalidate this. Not financial advice just my opinion. Thank you

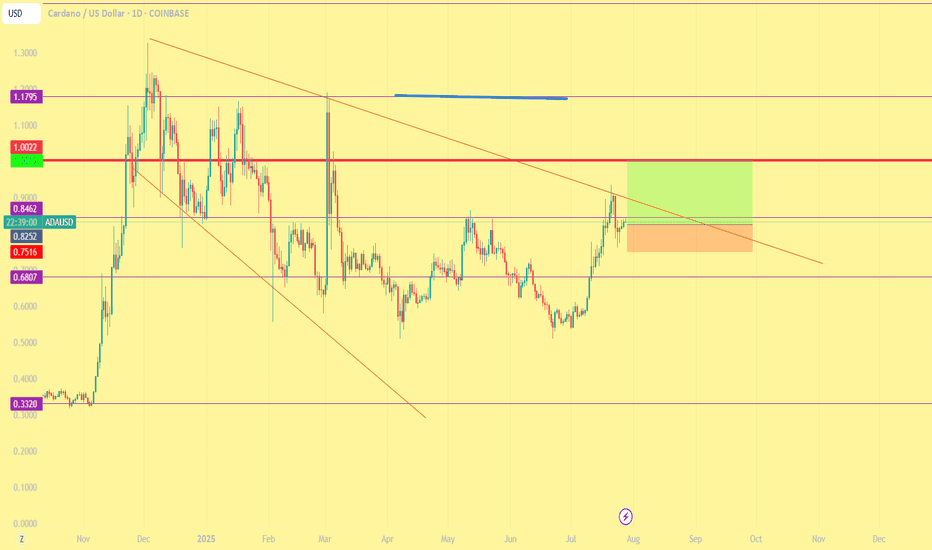

ADA - pull back then blast offIf ADA breaks below 0.85 I believe the next level of support will be @ 0.78 - this price level acted as resistance and was the Weekly high on 3 x occassions. Thus it is assumed that resistance will flip into support.

Bearish div. Suggests a move down as well as a break in the uptrend.

Entry @ 0.79

TP 1: 1.13

TP2: 1.43

TP3: 2.00

You could take a small short position now and profit in the event that price does start to retrace to 0.78 (ish)