UAMY Breakout Setup: Strong Earnings, High Volume, and Sector TaUnited States Antimony Corporation UAMY is the only significant U.S.-based producer of antimony, a critical mineral used in flame retardants, batteries, semiconductors, and military applications. The company controls mining, refining, and sales, positioning itself to benefit from growing domestic de

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.01 USD

−1.73 M USD

14.94 M USD

97.47 M

About United States Antimony Corporation

Sector

Industry

CEO

Gary C. Evans

Website

Headquarters

Dallas

Founded

1968

FIGI

BBG000F3M1Q1

United States Antimony Corp. engages in the extraction, processing and sale of antimony, zeolite, silver, and gold products. It operates through the following segments: United States Antimony Operations, Mexican Antimony Operations, Precious Metals Recovery, and United States Zeolite Operations. The company was founded by John C. Lawrence in June 1968 and is headquartered in Thompson Falls, MT.

Related stocks

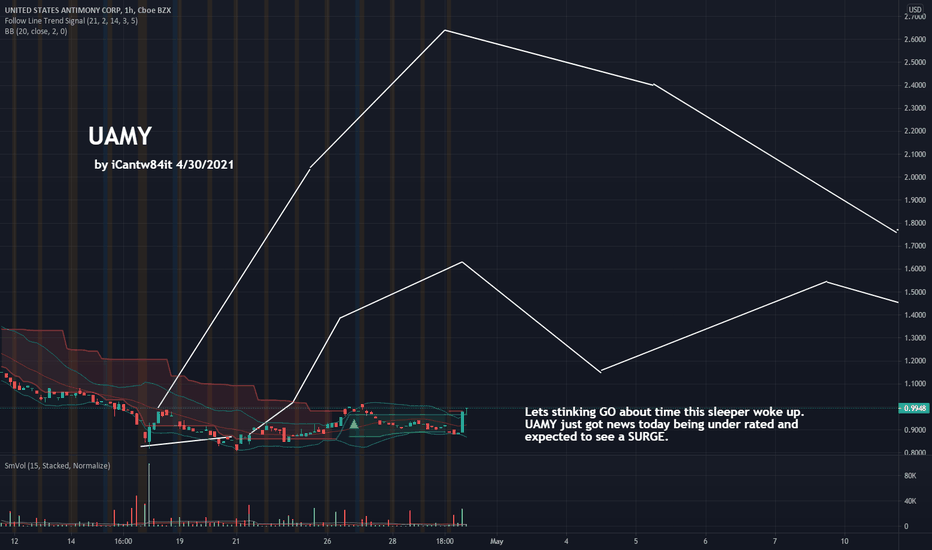

UAMY Ready for Another Run UpI believe UAMY is ready for another run up now. According to SimplyWall.St, UAMY earnings are forecast to grow 158.07% per year and has had a very volitile past months compared to the US market. SimplyWall.St is a website I just discovered yesterday and I am glad to share it with everyone. It has a

United States Antimony (UAMY) Stock AnalysisCompany Overview:

- United States Antimony Corporation (UAMY) is a company focused on the mining, production, and sales of antimony and related products. They operate in various mining and processing activities, extracting antimony and producing antimony oxide, which is crucial for a wide range of

UAMY - Beautiful Setup with Key Changes in ManagementNew CEO is Mr. Evans Evans has served for 24 years as a Director of Novavax Inc., a NASDAQ listed (“NVAX”) clinical-stage vaccine biotechnology company (Covid-19 Vaccine) with a market capitalization in excess of $15 Billion, and previously served as Chairman, CEO and Lead Director.

Gary Evans has

UAMY Liquidity GrabI only like this for a small position. There is a pretty low probability that it will drop to this point, but they arent currently mining silver and could see a sell off happen because of global depression before reaching new ATH after they start silver production. Its very possible this bounces at

$UAMY Reversal Rare earth metal needs for batteries - ammunition production.

They are only American-licensed antimoney smelter

After breakdown - good consolidation between 0.36 - 0.45 range.

Seems ready to breakout.

Volume is creeping up slowly with one day last week showing 3 x the average volume.

Recent ins

UAMY - Huge accumulation - Potential for Huge BreakoutUAMY - Huge price accumulation - Potential for Huge Breakout

- If the larger descending trend line breaks we could see a very sharp increase in price - I would look for an entry upon confirmation of breakout - set alerts

- Look out for down side risk if the bottom support breaks first

- Very good

UAMY - Fundamental catalysts and bullish chartBullish Thesis for UAMY:

1. UAMY share price has historically followed the raw price of Antimony. The last period that it traded in a similar price per metric ton was 2011-2012, in which the shares price traded in the $2-4 range on average. In 2021, the share price only briefly exceeded the $2 mark

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of UAMY is 2.99 USD — it has increased by 2.26% in the past 24 hours. Watch United States Antimony Corporation stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on AMEX exchange United States Antimony Corporation stocks are traded under the ticker UAMY.

UAMY stock has risen by 25.93% compared to the previous week, the month change is a −6.21% fall, over the last year United States Antimony Corporation has showed a 931.03% increase.

We've gathered analysts' opinions on United States Antimony Corporation future price: according to them, UAMY price has a max estimate of 5.25 USD and a min estimate of 4.50 USD. Watch UAMY chart and read a more detailed United States Antimony Corporation stock forecast: see what analysts think of United States Antimony Corporation and suggest that you do with its stocks.

UAMY reached its all-time high on Nov 26, 1980 with the price of 10.50 USD, and its all-time low was 0.06 USD and was reached on Apr 27, 1999. View more price dynamics on UAMY chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

UAMY stock is 15.96% volatile and has beta coefficient of 2.07. Track United States Antimony Corporation stock price on the chart and check out the list of the most volatile stocks — is United States Antimony Corporation there?

Today United States Antimony Corporation has the market capitalization of 323.95 M, it has increased by 5.16% over the last week.

Yes, you can track United States Antimony Corporation financials in yearly and quarterly reports right on TradingView.

United States Antimony Corporation is going to release the next earnings report on Aug 20, 2025. Keep track of upcoming events with our Earnings Calendar.

United States Antimony Corporation revenue for the last quarter amounts to 7.00 M USD, despite the estimated figure of 8.31 M USD. In the next quarter, revenue is expected to reach 9.81 M USD.

UAMY net income for the last quarter is 546.52 K USD, while the quarter before that showed −1.08 M USD of net income which accounts for 150.71% change. Track more United States Antimony Corporation financial stats to get the full picture.

No, UAMY doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 15, 2025, the company has 62 employees. See our rating of the largest employees — is United States Antimony Corporation on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. United States Antimony Corporation EBITDA is −635.11 K USD, and current EBITDA margin is −8.17%. See more stats in United States Antimony Corporation financial statements.

Like other stocks, UAMY shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade United States Antimony Corporation stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So United States Antimony Corporation technincal analysis shows the strong buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating United States Antimony Corporation stock shows the strong buy signal. See more of United States Antimony Corporation technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.