AVAX | USDHello!

This is my outlook for AVAX.

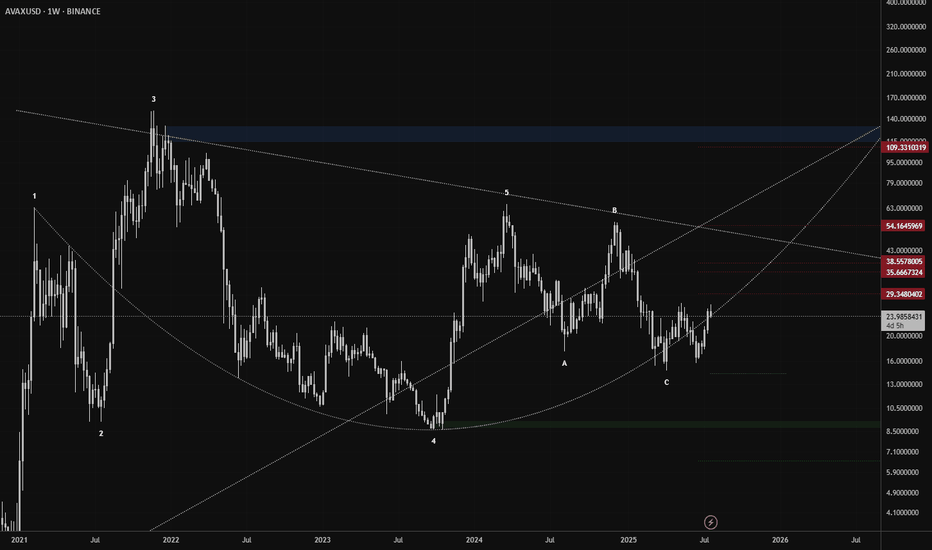

Weekly or monthly candle closures above the red price levels could lead us to higher levels.

I hope it can reach the $109 level by the end of the year.

I expect the market to enter a deep correction phase starting from the $54–58 range and ending around the $28–32 levels.

I believe this correction phase might occur around September or October.

AVAXUSD trade ideas

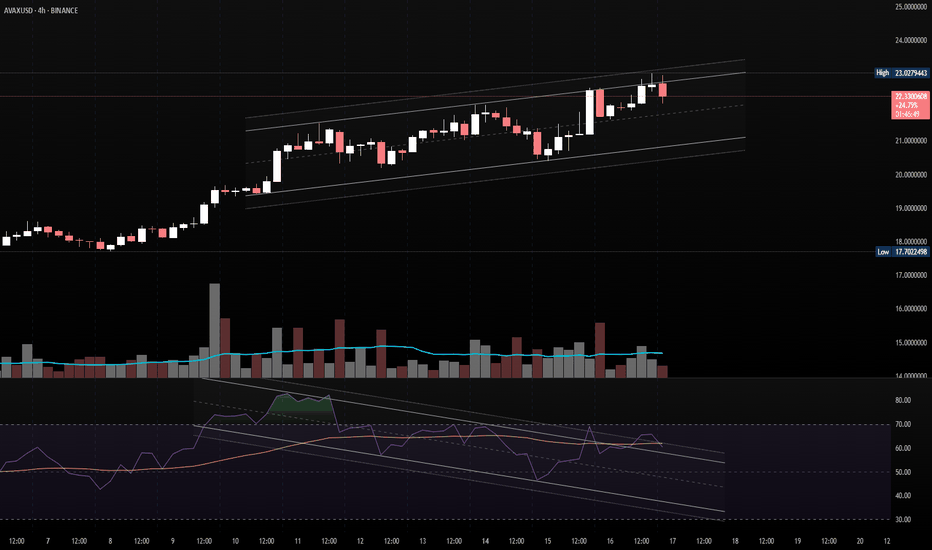

AVAX Just Broke Out — Now Comes the Real TestAvalanche ripped through key resistance around $20.50, tapping into fresh highs before pulling back. Price is now hovering just above the breakout zone, which has now flipped into potential support. This is the classic retest scenario — either bulls hold the line and reload for a move toward $25–$27, or we fall back into the range.

Stoch RSI is mid-range, giving room for either direction. But the structure is clean: breakout → retest → decision. If $20 holds, it’s game on. If it fails, look toward $18.00 again.

The chart’s telling a story — now we see how it ends.

AVAXUSD - Possible Correction from Channel ResistanceStructure: Ascending Channel

Indicators: RSI Overbought, Bearish Divergence Forming

📌 Confirmation:

Look for:

A strong bearish candle or

RSI breaking below 60

Volume divergence

Bias: Short-term bearish correction, bullish structure intact as long as price holds the channel.

AVAX Bull Run Loading!AVAX is showing signs of a strong bullish setup on the weekly chart, forming a double bottom pattern right at the lower support trendline of a long-term symmetrical triangle. This technical formation often indicates a potential trend reversal when confirmed with breakout and volume support.

Key Points:

-Double Bottom Support around $12–$14 with bullish momentum.

-Symmetrical Triangle structure compressing price for breakout.

-Breakout Zone near $27, a close above this level may trigger strong upside.

-Upside Target: Short-term Target- $45; Long Term Target - $125

Invalidation: A Break below $15 support could negate the setup.

Cheers

Hexa

CRYPTOCAP:AVAX BINANCE:AVAXUSDT

AVAX wait for entryAVAX has been consolidating within the $15–$26 range for the past four months.

Price is currently revisiting the range lows, which also align with the weekly trendline—creating a strong confluence zone.

A bounce is anticipated from this area.

Wait for a confirmed long setup as outlined in the chart.

Disclaimer:

This analysis is based on my personnal views and is not a financial advice. Risk is under your control.

$AVAX will go to at least $40 this year-Almost oversold

-Positive RSI divergence

-at significant multi-year support

-retail sentiment: dead

-undervalued relative to Bitcoin

-in a continued crypto bull market (which I expect in 2025), AVAX will rise too, my first PT is $40 (hitting the descending resistance) with the potential to go much higher

AVAXUSD – Rally Fizzled, Eyes LowerAVAX broke out impulsively to $18.60 but failed to sustain above $18.00 and quickly unwound. Price has now rounded off into a lower range near $17.30. A small recovery bounce is underway, but it lacks strong volume. The key level is $17.75 — reclaim that, and we could see a move back to $18.00. Until then, rallies are likely to be faded.

Watch the break on the 4 hour for AVAXThe AVAX 4 hour shows RSI is still coming down, but there is a chance it will revert prior to coming down for another double bottom or retest. Waiting for a confirmation by breaking the down trend would be good, but a break of the downtrend followed by a retest would be better for entry. If you want to be more aggressive and you do have confidence that AVAX will break the trend, you could place an entry below the current price for a 3 to 1 or 4 to 1 risk reward ratio.

This is simple analysis based on trends, simple support and resistance leves, confirming with RSI and MACD.

AVAXUSD – From Grind Down to Lift OffAvalanche finally snapped out of its tight chop after breaking through $16.20 resistance. Price had been grinding lower for hours until a sudden pivot created a V-shape recovery, pushing through lower highs and flipping intraday structure bullish. AVAX is now testing the $16.85–$17 zone – a minor supply area. If bulls hold $16.40 on the next dip, expect continuation toward $17.20+.

AVAX - Any Daily Chart Opinions?📉 Trend Overview

- AVAX has been in a clear downtrend since mid-May,

- steadily declining from ~$27 to the current ~$18.

- Multiple lower highs and lower lows are evident, confirming bearish market structure.

🔍 Price Action

- Price is currently testing a key support zone around $17.50–$18,

- near previous consolidation zones (seen in April and February).

- Candle body sizes are shrinking, indicating momentum loss from sellers.

📊 Volume

- Volume is declining slightly, even during the downtrend, which may suggest selling exhaustion.

- No major bullish spike yet — so no confirmation of accumulation.

🧮 WaveTrend Oscillator (WT_CROSS)

WT Oscillator is:

- In deep oversold territory (below -50).

- Close to printing a green dot or crossing up, signaling a potential bullish reversal.

- The crossover isn’t completed yet — but worth watching in the next few days.

⚠️ Key Levels

- Immediate Support: ~$17.80 to $14.60 (historic demand zone).

- Resistance to Watch: ~$20.50 (first test zone), then ~$22.60.

✅ Bullish Signs

- Oversold oscillator with near crossover = possible bounce setup.

- Strong historical support zone — price may stabilize here if buyers step in.

- Heikin Ashi candles showing small-bodied red candles = possible trend weakening.

🚨 Bearish Risks

- No bullish divergence or confirmation yet — WT signal not fully formed.

- If support around ~$17.50 fails, next stop could be $14.50–$15.00 area.

- Still in macro downtrend — any bounce could just be a lower high retracement.

📌 Conclusion

AVAX is showing early signs of bottoming out, but not confirmed yet.

If you're a short-term trader, watch for:

- WT bullish crossover

- Bullish candle confirmation (e.g. engulfing or hammer)

- Volume spike on green days

For investors: cautiously accumulate only if price respects this support and macro sentiment improves.

--

Disclosures:

This analysis is for informational purposes only and is not financial advice. It does not constitute a recommendation to buy, sell, or trade any securities, cryptocurrencies, or stocks. Trading involves significant risk, and you should consult with a qualified financial advisor before making any investment decisions. Past performance is not indicative of future results.

AVAXUSD – Grinding Down, Rebound DeniedAvalanche has continued its downward trajectory, posting consistent lower highs and lower lows. After a brief attempt to recover during the late session of June 17, price failed to hold above $18.80 and resumed the bearish grind. The decline is steady rather than sharp, indicating controlled selling pressure rather than panic. If $18.30 fails to hold, watch for retests near $18 or even lower. For bulls, a clear reclaim above $18.75 is needed to invalidate this short-term downtrend.

Avalanche Slides into Bearish Drift After Double TopAvalanche (AVAX) initially rallied strongly but formed a double top near $22.80 before entering a persistent downtrend. The pair is now trending below $21.10 with lower highs and lower lows, suggesting weakening momentum and a bearish breakout risk.

AVAX: Low in Sight?AVAX continued its expected decline into the magenta Target Zone between $24.42 and $13.31, before reversing course over the weekend with a modest bounce. While it's possible that this marked the low of the wave ii correction, we're not ruling out the potential for another dip within the zone. For now, the setup remains open-ended. Once orange wave ii has been confirmed as complete, we expect a strong rally to follow in wave iii, likely driving the price beyond resistance at $49.95.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

Long Trade Analysis – AVAX/USD (30M Chart)!📈

✅ Setup Overview

Chart: Avalanche (AVAX) / USD, 30-minute timeframe (Coinbase)

Pattern: Descending trendline breakout

Trade Type: Long (Buy)

📌 Key Levels

Entry: ~$20.77 (at trendline breakout + above yellow zone)

Stop Loss: ~$20.34 (recent low/support zone)

Target 1: ~$21.23 (first resistance zone)

Target 2: ~$21.91 (major green resistance)

📊 Trade Justification

Trendline breakout confirmed with candle close above resistance

Bounce from a strong support zone at ~$20.34

High reward-to-risk ratio (2:1+), targeting resistance levels

📢 Suggested Caption for Sharing:

✅ AVAX/USD Long Setup (30M)

Trendline breakout with strong support holding!

🔹 Entry: 20.77 | SL: 20.34 | TP1: 21.23 | TP2: 21.91

Let’s ride the momentum!

#AVAX #CryptoTrading #LongSetup #Breakout #TradingView

Avax headed for 100%+ gainsAVAX Linear regression trend for 2-day chart just turned in a buy signal. Price is in the lower 25% Bollinger Band range, indicating a low risk entry. I am targeting the 3-year pivot point at $54 I will set a trailing stop at that point for $10 below the highest price and let it run out from there... I do expect it to run a bit further to $60 to $70 and maybe even $100 in a wild bull run.

AVAX Dual Scenario Analysis: Breakout or Further Drop?In the analysis of the AVAX 1H chart, if the highlighted candle gets strongly engulfed by a solid red candle, we could expect a continuation of the Avalanche downtrend. On the other hand, if the blue line is broken to the upside, it could present a good long opportunity.

Keep in mind that in both scenarios, the blue box serves as our stop-loss reference. In the bullish case, the bottom of the box will be our stop-loss level, while in the bearish case, the blue line will act as our stop-loss.