Key facts today

Abbott Laboratories faces over 500 lawsuits regarding its cow milk-based formulas, including Similac, for allegedly failing to warn about the risk of necrotizing enterocolitis in premature infants.

Abbott Laboratories is set to release its quarterly financial results later this week, coinciding with earnings reports from major companies including Johnson & Johnson and PepsiCo.

1.80 USD

11.86 B USD

37.26 B USD

About Abbott Laboratories

Sector

Industry

CEO

Robert B. Ford

Website

Headquarters

Abbott Park

Founded

1888

ISIN

ARDEUT110608

FIGI

BBG000HDMQX4

Abbott Laboratories engages in the discovery, development, manufacture, and sale of healthcare products. It operates through the following segments: Established Pharmaceutical Products, Diagnostic Products, Nutritional Products, and Medical Devices. The Established Pharmaceutical Products segment refers to the line of branded generic pharmaceuticals manufactured worldwide and marketed and sold outside the United States in emerging markets. The Diagnostic Products segment markets diagnostic systems and tests for blood banks, hospitals, commercial laboratories, clinics, physicians' offices, retailers, government agencies, and alternate care testing sites. The Nutritional Products segment caters to the worldwide sales of pediatric and adult nutritional products. The Medical Devices segment includes a broad line of rhythm management, electrophysiology, heart failure, vascular and structural heart devices for the treatment of cardiovascular diseases, and diabetes care and continuous glucose monitoring products, as well as neuromodulation devices for the management of chronic pain and movement disorders. The company was founded by Wallace Calvin Abbott in 1888 and is headquartered in Abbott Park, IL.

No news here

Looks like there's nothing to report right now

ABT on WatchLooking for a break above $137 and then a retest before entering.

Why:

Rounded bottom/saucer

Increased volume on green days

Shakeout on June 9th

Reacting well to previous support and resistance lines

NLong

ABT Trade Setup: Breakout Play with 10.6% Upside🏥 Abbott Labs (ABT) Trade Alert

Positioning in this healthcare giant as it breaks out from consolidation - here's the strategic play:

📌 Trade Levels

▶ Entry: $133.12 (confirmed above SMA 50)

🎯 Target: $147.21 (+10.6%)

🛑 Stop Loss: $126.00 (-5.3% risk)

⚖️ Risk/Reward: 1:2

Why ABT Now?

✅ Fundamental

NLong

ABT – Clean Technical Setup with Strong Risk/Reward📈 Ticker: NYSE:ABT (Abbott Laboratories)

🕒 Timeframe: Daily

💡 Strategy: Ichimoku + MACD + Risk/Reward Setup

Abbott ( NYSE:ABT ) is showing a compelling long opportunity after a pullback to the Tenkan-sen (conversion line) within the Ichimoku Cloud structure. Price action remains bullish as it res

NLong

Measured Move Target At 110Pretty simple analysis here:

touch of the bottom Keltner channel

potential weekly anti forming bearish

daily and weekly price action seem to deserve a second leg with the big surprise bear moves.

ABT long at 126.75 -- bad new is good news (for me)ABT got some bad news today when a Missouri judge ruled there would be a retrlal regarding a court case involving ABT's baby formula, and the stock, which was already down 3 days in a row, got thumped. While I don't dismiss long term risk from that news, I'm not in this for the long haul. I will l

NLong

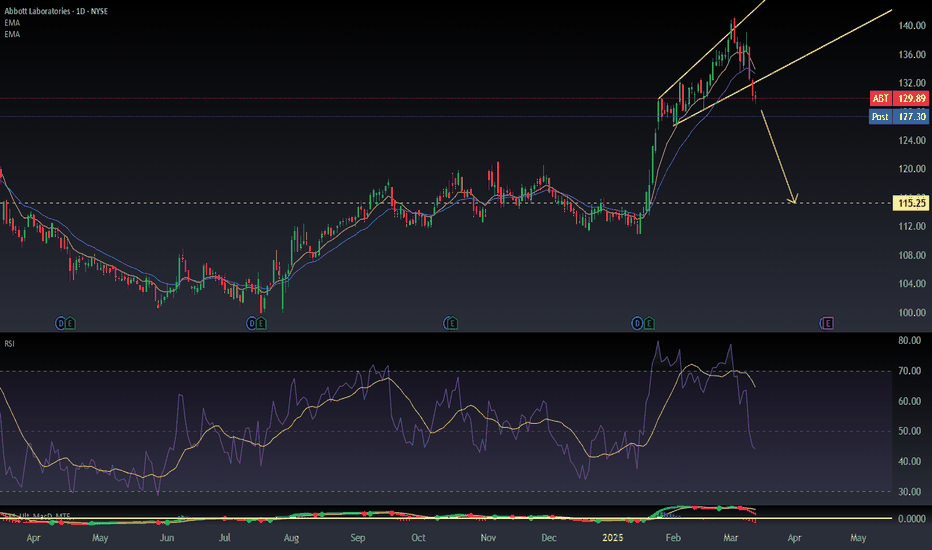

$ABT : Reversal Pattern Just Dropped – Is $115 the NextAlright, let’s check out ABT on the daily chart. The stock enjoyed a steady climb since Jan 2025, riding a clear uptrend line, and now just nailed a technical reversal pattern, and it seems like it’s aiming for a target around $115 per share in the short term (1-3 months).

NShort

Abbott Hitting its Top. ABTRSX Divergence and crosses on volatility and stochastic indicators below. A strong change in flavor of candlesticks now, despite no cross of MIDAS. This one has been climbing for quite a bit, and now it might be time for a correction if just a temporary one.

NShort

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US2824BH2

ABBOTT LABS 16/46Yield to maturity

5.68%

Maturity date

Nov 30, 2046

ABT4466215

Abbott Laboratories 4.75% 15-APR-2043Yield to maturity

5.52%

Maturity date

Apr 15, 2043

ABT.HB

Abbott Laboratories 5.3% 27-MAY-2040Yield to maturity

5.25%

Maturity date

May 27, 2040

ABLC

ABBOTT LABS 16/36Yield to maturity

5.07%

Maturity date

Nov 30, 2036

ABT.GX

Abbott Laboratories 6.0% 01-APR-2039Yield to maturity

4.94%

Maturity date

Apr 1, 2039

ABT4466374

Abbott Laboratories 3.875% 15-SEP-2025Yield to maturity

4.87%

Maturity date

Sep 15, 2025

ABT.GW

Abbott Laboratories 6.15% 30-NOV-2037Yield to maturity

4.85%

Maturity date

Nov 30, 2037

US2824BQ2

ABBOTT LAB 20/30Yield to maturity

4.60%

Maturity date

Jun 30, 2030

US2824BF6

ABBOTT LABS 16/26Yield to maturity

4.23%

Maturity date

Nov 30, 2026

See all ABTD bonds

Curated watchlists where ABTD is featured.