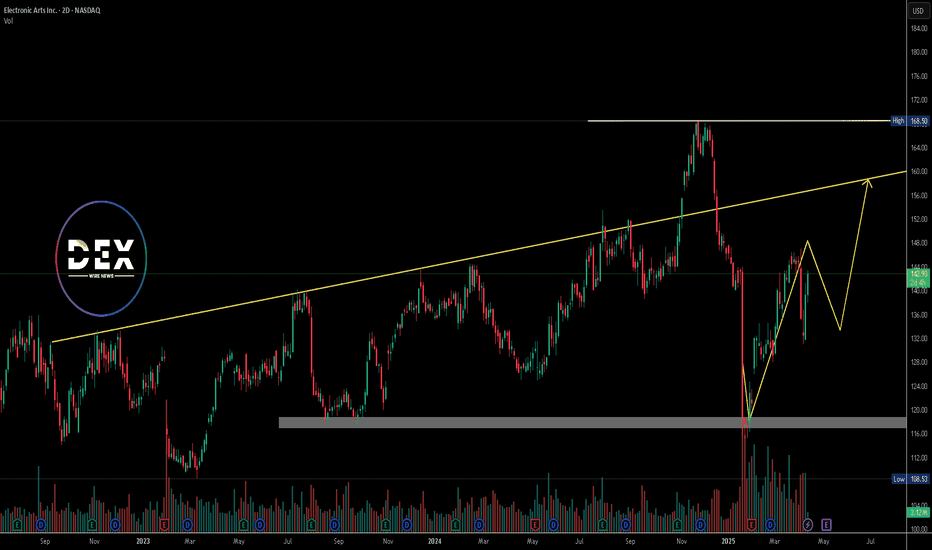

Electronic Arts Inc. (EA) – Inverse Head & Shoulders Breakout📈 Long Setup

🔍 Description:

Electronic Arts Inc. (NASDAQ: EA) has broken out above the neckline of an Inverse Head & Shoulders pattern — a bullish reversal signal. Price action confirms breakout strength, with a surge in volume accompanying the move. Bullish continuation is expected if the br

300 ARS

1.09 T ARS

7.22 T ARS

About Electronic Arts Inc.

Sector

Industry

CEO

Andrew P. Wilson

Website

Headquarters

Redwood City

Founded

1982

ISIN

ARBCOM4603Y4

FIGI

BBG017SL2KC6

Electronic Arts, Inc. engages in the development, marketing, publication, and distribution of games, content, and services for game consoles, PCs, mobile phones, and tablets. The company develops and publishes games and services across various genres, such as sports, first-person shooter, action, role-playing, and simulation primarily under the Battlefield, The Sims, Apex Legends, Anthem, Need for Speed, and Plants v. Zombies brands, and license games, including FIFA, Madden NFL, and Star Wars brands. The firm also provides advertising services and licenses its games to third parties to distribute and host its games. It markets and sells its games and services through digital distribution channels, as well as through retail channels, such as mass-market retailers, electronics specialty stores, and game software specialty stores. The company was founded by William M. Hawkins III and William Gordon in 1982 and is headquartered in Redwood City, CA.

Related stocks

Electronic Arts: Heading LowerElectronic Arts has dropped roughly 13% since our last update, continuing the expected decline within ongoing wave (3). This move is likely to break below support at $114.60 and gradually push the stock downward to the anticipated low. Our alternative scenario suggests the correction may already be

When the game is a quick flip, EA long at 149.27 for the winAs mentioned in the text box, this setup has done very well in the last 12 months with EA. But in addition to that historical performance, the uptrend since January is still intact, and the recent April pre-breakout highs are now acting as support.

The idea here is a quick flip, though I may or ma

Electronic Arts: Jump!Recently, EA has made a strong upward jump, coming very close to the significant resistance at $169.82. However, the price quickly fell again, providing us with sufficient confirmation to consider the magenta wave (2) as completed. The current wave (3) should extend below the support at $114.60, and

Electronic Arts: A Leader in the Gaming IndustryElectronic Arts (EA) is a renowned game developer and publisher that's been around since 1982. Founded by William M. Hawkins III and William Gordon, the company has grown to become a major player in the gaming industry.

**What does EA do?**

* Develops and publishes games across various genres, inc

Electronic Arts Inc. Stock Sees Momentum Ahead of Earnings Electronic Arts Inc. (NASDAQ: NASDAQ:EA ) is gaining attention as the gaming industry shows signs of recovery. The stock closed at $142.93 on April 11, 2025, reflecting a gain of $3.54( 2.54%) for the day. Its next earnings report is scheduled for May 6, 2025.

The gaming industry grew rapidly durin

A Market Teetering on the Edge: Is EA Poised for a Rebound?With NASDAQ-EA trading at $118.70, down nearly 30% from its all-time high of $168.50 just 63 days ago, the market presents a mix of caution and intrigue. RSI levels languish deep in oversold territory, with daily RSI14 at an eye-popping 12.19—signaling potential exhaustion in bearish momentum. Add t

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

ERTS5129009

Electronic Arts Inc. 2.95% 15-FEB-2051Yield to maturity

7.12%

Maturity date

Feb 15, 2051

ERTB

EL. ARTS 16/26Yield to maturity

5.10%

Maturity date

Mar 1, 2026

ERTS5129008

Electronic Arts Inc. 1.85% 15-FEB-2031Yield to maturity

4.99%

Maturity date

Feb 15, 2031

See all EA bonds

Curated watchlists where EA is featured.