Key facts today

Exxon Mobil is set to launch the largest low-carbon hydrogen project in Texas, pending a final investment decision based on future hydrogen demand clarity, according to CEO Darren Woods.

Exxon Mobil has returned to Trinidad and Tobago after 20 years, securing deepwater exploration blocks with a potential $21.7 billion investment, pending reserve discoveries.

ExxonMobil ended its ethylene supply deal with TotalEnergies after the latter shut down a steam cracker in Antwerp. ExxonMobil has found new ethylene sources for its LDPE sites in Belgium.

725 ARS

30.84 T ARS

311.25 T ARS

About Exxon Mobil

Sector

Industry

CEO

Darren W. Woods

Website

Headquarters

Spring

Founded

1882

ISIN

ARDEUT110152

FIGI

BBG000DYN1T1

Exxon Mobil Corp engages in the exploration, development, and distribution of oil, gas, and petroleum products. It operates through the following segments: Upstream, Downstream and Chemical. The Upstream segment produces crude oil and natural gas. The Downstream segment manufactures and trades petroleum products. The Chemical segment offers petrochemicals. The company was founded by John D. Rockefeller in 1882 and is headquartered in Irving, TX.

No news here

Looks like there's nothing to report right now

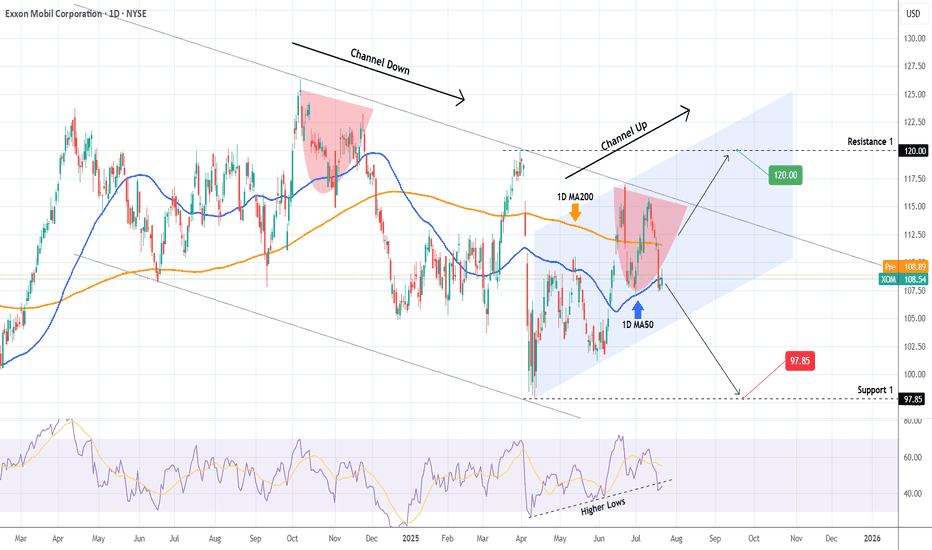

EXXON MOBIL Critical crossroads.Exxon Mobil (XOM) has been trading within a Channel Down since the June 17 2024 Low and just recently on the July 11 2025 High, it made a Lower High pattern similar to November 22 2024.

As long as the price trades below the 1D MA200 (orange trend-line), we expect to start the new Bearish Leg and te

Top-Down Analysis in Action – Live Trade: Where I Enter and WhyIn this video, I walk you through my full trading process – starting with a clean top-down analysis.

I begin on the daily chart to spot key market structure and levels, then zoom in to the 1-hour chart for confirmation, and finally execute my trade on the 5-minute chart.

You’ll see:

✔️ How I define

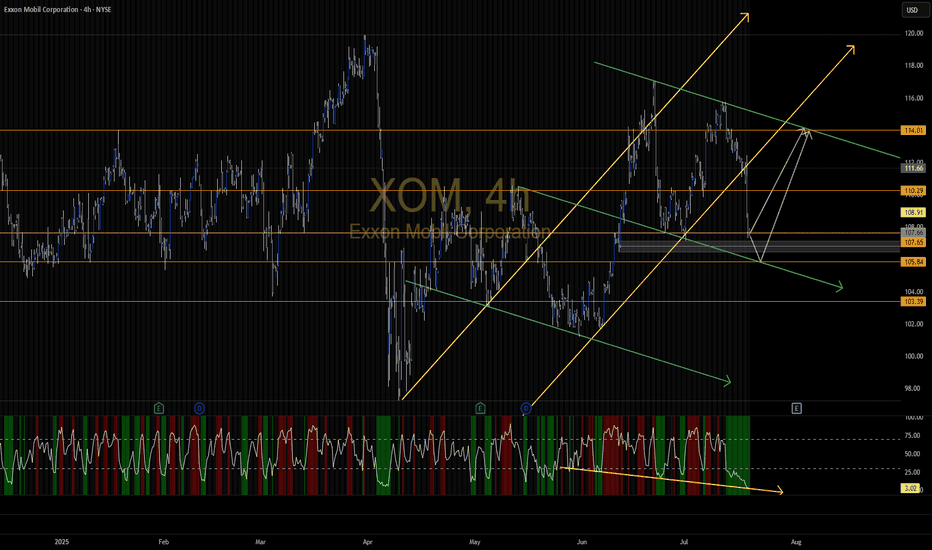

XOM daily setup to $117XOM gave us a 50% retracement on the daily (I use 24 hour chart since it includes after hours), swept a key level, and bouncing off bullish FVG.

We break and hold $110.94 and we're in business.

Targeting $117.05. I have July 18 $110 calls.

NLong

Exxon Mobil Corporation (XOM) – BUY IDEA📌 We’re watching a strong bullish structure in XOM. After a sharp open, price retraces to fill the GAP and respects the key Low zone 🟧, signaling institutional interest.

🟢 Entry aligns with downside liquidity sweep followed by bullish momentum. This trade has confluence between previous liquidity,

NLong

Energy giants surge: Top 5 stocks to watchJune 2025 was marked by heightened volatility across the global energy sector . Amid fluctuating oil prices, geopolitical uncertainty, and ongoing industry transformation, major oil and gas companies delivered mixed results. Let’s break down the key drivers behind the moves in Shell, TotalEnergies,

NLong

XOM - Bullish Trade ideaXOM Trade Idea... 🎯 Entry Plan:

Base Entry Zone (accumulation):

ENTRY OPTION 1: $110.60–$111.50 → Retest 12-moving average

ENTRY OPTION 2 momentum trigger: Bullish reversal candle on 2H or 1H + reclaim of $113.00 (this means let price break above $113 after you get a fresh inverse Arc or Level 3

NLong

Quick View: $XOM

EMA21 crossed above EMA50 and pulled back.

Watching for a #TopSwing Setup

Area of $111as key resistance.

Support → $103 and $100

NLong

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

XOM4871940

Exxon Mobil Corporation 3.095% 16-AUG-2049Yield to maturity

6.62%

Maturity date

Aug 16, 2049

XOM4976375

Exxon Mobil Corporation 3.452% 15-APR-2051Yield to maturity

6.43%

Maturity date

Apr 15, 2051

US30231GAN2

EXXON MOBIL CORP. 15/45Yield to maturity

6.13%

Maturity date

Mar 6, 2045

XONE

EXXON MOBIL 20/50Yield to maturity

6.07%

Maturity date

Mar 19, 2050

XONJ

EXXON MOBIL CORP. 16/46Yield to maturity

6.01%

Maturity date

Mar 1, 2046

XOM4871939

Exxon Mobil Corporation 2.995% 16-AUG-2039Yield to maturity

5.74%

Maturity date

Aug 16, 2039

XONC

EXXON MOBIL 20/40Yield to maturity

5.55%

Maturity date

Mar 19, 2040

See all XOM bonds

Curated watchlists where XOM is featured.

Big Oil: Integrated energy companies

10 No. of Symbols

Oil stocks: Liquid black gold

6 No. of Symbols

See all sparks