BCHUSD getting ready for gainsHello traders,

this is a monthly chart - to keep things really simple.

For the last 2 years BCH price has been "climbing stairs". These "stairs" are based on important levels dating 6 years back (green lines). Price action from Q2 of 2021 up until now has been creating a 'cup and handle' pattern. Handle has beatifully reversed from support level, RSI has found support at 50 level (also important level).

This seems a good entry point to me, with target price for profit taking at 1000-1100 USD. Trade is invalidated, if price dips below 265 USD (one step lower).

It will take some time for this to play out - remember, it is a monthly chart.

This is not a financial advice, trade at your own risk.

BCHUSD trade ideas

TA on BCHUSD - 2025.05.14This is a quick technical analysis piece on Bitcoin Cash ( MARKETSCOM:BCHUSD ).

Let's dig in!

CRYPTO:BCHUSD

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

Wajani Investments: BCHUSDPair has formed invest neck and shoulder (same formation as XRP). A bullish wedge is also indicated on the chart. In addition, the market tested a very strong resistance become support level or zone. All these indicators point to a bullish move.

NB: Always check your entries and make necessary adjustments.

Let me know your thoughts.

Please let me your thoughts. In addition, I'm trying to build followers so if you like my ideas, don't forget to like and follow for more updates.

Thank you.

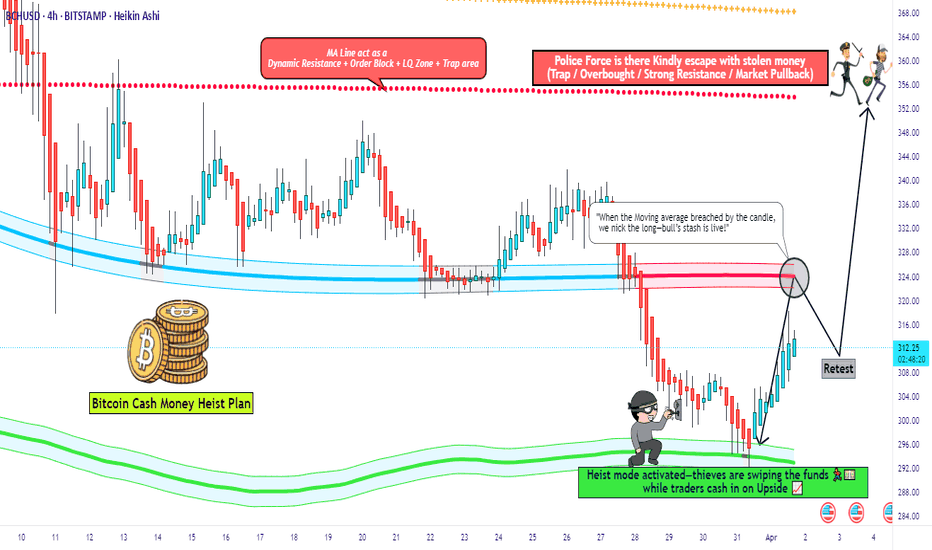

BCH/USD "Bitcoin Cash vs U.S.Dollar" Crypto Heist (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the BCH/USD "Bitcoin Cash vs U.S.Dollar" Crypto market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red MA Level. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout then make your move at (328.00) - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) after the MA breakout Place buy limit orders within a 15 or 30 minute timeframe most NEAREST or SWING low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📌Thief SL placed at the nearest/swing low or high level Using the 4H timeframe (304.00) Day trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 355.00 (or) Escape Before the Target

LTC/USD "Litecoin vs U.S.Dollar" Crypto Market Heist Plan (Day / Scalping Trade) is currently experiencing a bullishness,., driven by several key factors.👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, On Chain Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

BCH/USD "BitcoinCash vs US Dollar" Crypto Heist (Scalping / Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the BCH/USD "BitcoinCash vs U.S.Dollar" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk MA Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (320) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 1H timeframe (280) Scalping/Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 360 (or) Escape Before the Target

💰💵💸BCH/USD "BitcoinCash vs U.S.Dollar" Crypto Market Heist Plan (Day / Scalping Trade) is currently experiencing a bullishness,., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, On Chain Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Bitcoin Cash: Resistance Rejection Confirms Further DownsideBitcoin Cash (BCH/USD) remains under strong bearish pressure after failing to break above the key resistance at $369.40. This confirms continued downside potential, with $291.20 designated as the next major support and official profit target. Read on for key insights and updated targets.

Bitcoin Cash (BCH) continues to struggle with bearish momentum, as its failure to break above $369.40 reinforces the ongoing downtrend. This resistance rejection serves as a key signal that sellers remain in control, preventing any significant bullish recovery. The inability to reclaim this level suggests that further downside movement is highly probable in the near term.

As of today , Bitcoin Cash (BCH/USD) is trading at $366.5, confirming sustained selling pressure. The next major support zone is $291.20, a level that has historically provided strong demand. This now serves as our official profit target for this newly updated bearish outlook.

Bitcoin Cash Market Dynamics

Bitcoin Cash, a fork of Bitcoin, was designed to offer faster and lower-cost transactions. However, despite its technological advantages, market sentiment and broader macroeconomic conditions continue to weigh on BCH’s price. The recent inability to clear resistance aligns with a broader risk-off environment, reinforcing further bearish sentiment.

Fundamental Catalysts

Major Resistance Rejection: The failure to surpass $369.40 confirms strong selling pressure and a continuation of the bearish trend.

Continued Bear Cycle: BCH remains under sustained downside pressure, with $291.20 now in focus as the next key support.

Market Sentiment Weakens: Investors remain cautious as BCH struggles to reclaim lost ground, fueling further selling momentum.

Key Price Levels

Previous Resistance (Unbroken): $369.40

Next Major Support: $291.20

Bearish Profit Target: $291.20

Looking ahead, Bitcoin Cash’s failure to reclaim resistance levels suggests that selling momentum will likely persist. As long as $369.40 remains intact as a ceiling, the bearish outlook remains in effect. The upcoming test at $291.20 will determine whether further declines are in store or if buyers attempt to stabilize the price at this critical support level. Traders should monitor price action closely for confirmation of continued downside movement.

BCH/USD "Bitcoin Cash vs U.S Dollar" Crypto Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

⚔Dear Money Makers & Thieves, 🤑 💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the BCH/USD "Bitcoin Cash vs U.S Dollar" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (320) then make your move - Bearish profits await!" however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or Swing high or low level should be in retest.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: Thief SL placed at (360) swing Trade Basis Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 270 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

BCH/USD "Bitcoin Cash vs U.S Dollar" Crypto Market is currently experiencing a Neutral trend to Bearish., driven by several key factors.

📰🗞️Read the Fundamental, Macro Economics, COT Report, Seasonal Factors, Intermarket Analysis, Sentimental Outlook, Future trend predict.

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Elliott Wave Projection for BCH: Bearish Continuation Ahead?This chart illustrates an Elliott Wave analysis of BCH Perpetual Futures on Binance, indicating a potential downward move. The price structure suggests that BCH has completed a corrective wave and is now resuming its downtrend. The prominent red arrow highlights a projected wave (5) continuation towards the $250-$260 range. If the structure holds, this could align with broader market trends and trader sentiment.

Key observations:

A completed corrective pattern with sub-waves labeled (A), (B), (C)

Wave (3) marked as a prior significant low

Expected wave (5) target aligning with trend channel support

Traders should watch for confirmation signals before positioning, as price action around support levels may influence the next move.

Follow this account for more elliott wave analysis of charts

Elliott Waves Breakdown of $BCH Bearish ModeAnalyzing Bitcoin Cash ( BINANCE:BCHUSD.P BCH) on the 1D timeframe using Elliott Wave theory, we observe a potential bearish continuation forming.

🔹 Wave Count & Structure

The primary structure suggests a Wave 4 correction has completed, leading to a possible Wave 5 decline.

A descending triangle formation has been broken, with an (A)-(B)-(C)-(D)-(E) wave structure confirming the pattern.

A sub-wave 1-2-3-4-5 impulse appears to be developing for the next downward move.

🔹 Key Levels

Entry Zone: The price has rejected from resistance around $350.

Target Zone: Bears could push price toward the $286 - $281 demand zone, with an extended target near $260 if selling pressure persists.

Invalidation Level: A break above $350+ would negate this bearish setup.

🔹 Market Context

Bitcoin's movement could influence BCH direction.

Confirmation needed with volume & candlestick structure before a strong move.

🚨 Bearish Bias – Watching for a potential breakdown continuation with proper risk management. Let me know your thoughts in the comments! 🔥💬

#Crypto #BCH #ElliottWave #Trading #BitcoinCash #Bearish #ChartAnalysis

Elliott Wave Analysis of Bitcoin Cash $BCHUSDT-PAnalyzing Bitcoin Cash (BCH) on the 1H timeframe using Elliott Wave theory, we observe a potential bearish continuation forming.

🔹 Wave Count & Structure

The primary structure suggests a Wave 4 correction has completed, leading to a possible Wave 5 decline.

A descending triangle formation has been broken, with an (A)-(B)-(C)-(D)-(E) wave structure confirming the pattern.

A sub-wave 1-2-3-4-5 impulse appears to be developing for the next downward move.

🔹 Key Levels

Entry Zone: The price has rejected from resistance around $350.

Target Zone: Bears could push price toward the $286 - $281 demand zone, with an extended target near $260 if selling pressure persists.

Invalidation Level: A break above $350+ would negate this bearish setup.

🔹 Market Context

Bitcoin's movement could influence BCH direction.

Confirmation needed with volume & candlestick structure before a strong move.

🚨 Bearish Bias – Watching for a potential breakdown continuation with proper risk management. Let me know your thoughts in the comments! 🔥💬

#Crypto #BCH #ElliottWave #Trading #BitcoinCash #Bearish #ChartAnalysis

Follow us for more Chart Analysis

BCH/USD "Bitcoin Cash vs U.S Dollar" Crypto Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the BCH/USD "Bitcoin Cash vs U.S Dollar" market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (380.00) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low or high level Using the 4H timeframe (330.00) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 500.00 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT Report, On Chain analysis, Sentimental Outlook etc....

BCH/USD "Bitcoin Cash vs U.S Dollar" market is currently experiencing a Bullish 🐃 trend,., driven by several key factors.

1. Fundamental Analysis

Fundamental analysis evaluates Bitcoin Cash's intrinsic value based on its technology, adoption, and market position. Here are the key factors:

Technology and Network Upgrades:

Bitcoin Cash (BCH), created from a 2017 Bitcoin hard fork, aims to be a peer-to-peer electronic cash system with faster transactions and lower fees. Recent network upgrades have enhanced scalability and security, making it more efficient for everyday use.

Adoption and Transaction Volume:

BCH boasts a large, active community and high transaction volumes, signaling robust adoption. Its design supports practical use cases, such as micropayments, which strengthens its utility.

Market Position:

Ranked 15th by market capitalization (approximately 7.13 billion USD), BCH holds a solid position among cryptocurrencies. Its established presence and community support contribute to its value.

Key Insight:

BCH’s fundamentals are strong, driven by technological improvements and growing adoption. However, it faces competition from newer cryptocurrencies and potential challenges in maintaining its niche compared to Bitcoin.

2. Macroeconomic Factors

Macroeconomic conditions influence BCH as a global asset. Here’s a breakdown:

Global Economic Growth:

The global economy is experiencing moderate growth, with GDP forecasted at 3.0% for 2025. This supports risk assets like cryptocurrencies but doesn’t strongly favor inflation hedges.

Inflation Rates:

Inflation is stable at around 3%, reducing the urgency for investors to seek cryptocurrencies as an inflation hedge, though it keeps them viable as alternative investments.

Interest Rates:

Interest rates remain steady, with central banks maintaining current policies. Stable rates provide a neutral environment for crypto investments, neither strongly encouraging nor discouraging capital flows.

Geopolitical Events:

No major geopolitical crises are currently affecting markets, limiting BCH’s appeal as a safe-haven asset in the short term.

Key Insight:

The macroeconomic backdrop is stable and neutral for BCH. While moderate growth supports risk assets, the absence of significant inflation or instability means BCH’s price is more tied to crypto-specific factors than macro drivers.

3. Global Market Analysis

This section compares BCH’s performance to other cryptocurrencies and traditional assets:

Market Capitalization:

BCH’s market cap is approximately 7.13 billion USD, placing it 15th among cryptocurrencies. This reflects its established status but also its distance from top-tier coins like Bitcoin and Ethereum.

Trading Volume:

A 24-hour trading volume of 618.85 million USD indicates strong liquidity and active trading, supporting price stability and market interest.

Correlation with Other Assets:

BCH exhibits a positive correlation with Bitcoin (BTC), which often sets the tone for altcoins. If BTC sustains bullish momentum, BCH is likely to follow, though with potentially higher volatility.

Performance Comparison:

Over the past year, BCH has risen 25.85%, outperforming many traditional assets like fiat currencies and commodities, reinforcing its appeal as a growth asset.

Key Insight:

BCH’s solid market position and correlation with BTC suggest potential upside, especially if the broader crypto market trends upward. Its liquidity supports active trading, though it remains a secondary player compared to top coins.

4. Commitment of Traders (COT) Data

COT data reveals the positions of large traders and institutions:

Speculative Positions:

Large traders are net long on BCH, reflecting bullish sentiment and confidence in future price increases.

Commercial Traders:

Commercial traders are net short, indicating a cautious or bearish stance, possibly due to hedging against price declines.

Market Sentiment Implications:

The split between speculative bullishness and commercial caution suggests mixed sentiment. Speculators anticipate growth, while commercial shorts may reflect risk management.

Key Insight:

The net long speculative positions lean bullish, but the net short commercial stance introduces uncertainty. This divergence could signal choppy price action ahead.

5. On-Chain Analysis

On-chain data reflects BCH’s blockchain activity and holder behavior:

Active Addresses:

The number of active addresses is rising, indicating growing network usage and interest from users.

Transaction Counts:

Transaction counts are increasing, reinforcing adoption and utility as a payment system.

Holder Distribution:

A balanced mix of long-term holders and short-term traders suggests stability. Long-term holders provide a price floor, while short-term activity adds liquidity.

Key Levels:

On-chain metrics identify support at 334.08 USD and resistance at 395.00 USD, critical for predicting price movements.

Key Insight:

Positive on-chain trends, like rising activity and balanced ownership, indicate a healthy network. This supports price stability and potential growth if adoption continues.

6. Market Sentiment Analysis

Market sentiment gauges the mood of traders and investors:

Social Media Sentiment:

Sentiment on Internet is slightly positive, with a score of 0.721360266209. Discussions highlight both bullish (breakout to 395.00 USD) and bearish (drop to 334.08 USD) scenarios.

Fear & Greed Index:

At 15 (Extreme Fear), the index suggests widespread caution or panic, potentially signaling a contrarian buying opportunity if sentiment shifts.

Trading Patterns:

Mixed trading activity reflects uncertainty, with some traders shorting BCH and others accumulating at current levels.

Key Insight:

Sentiment is mixed but leans slightly positive on social media, contrasted by extreme fear in broader markets. This could indicate an oversold condition ripe for a reversal.

7. Positioning

Positioning shows how traders are aligned in the market:

Trader Positioning:

Traders are net short on BCH, suggesting a bearish short-term outlook and potential downward pressure.

Institutional Interest:

Institutional investors are increasing exposure via ETFs, signaling long-term confidence in BCH’s value.

Market Impact:

Short-term bearish positioning contrasts with long-term institutional bullishness, creating a tug-of-war dynamic.

Key Insight:

The bearish trader stance may cap upside in the near term, but growing institutional interest could provide a foundation for recovery or growth.

8. Next Trend Move

Technical analysis predicts the next likely price movement:

Current Trend:

BCH is in a downtrend, testing support at 334.08 USD. Resistance looms at 395.00 USD.

Key Levels:

Support: 334.08 USD – A break below could lead to further declines toward 325.00 USD.

Resistance: 395.00 USD – A breakout above could trigger a bullish reversal targeting 500.00 USD.

Triggers:

A surge in volume or positive news could push BCH above resistance, while sustained selling pressure might breach support.

Key Insight:

The next move hinges on support at 334.08 USD. Holding this level keeps bullish hopes alive; breaking it confirms bearish momentum.

9. Other Data

Additional factors influencing BCH/USD:

Partnerships:

A new partnership with a major payment processor could boost adoption, enhancing BCH’s real-world utility and long-term value.

Regulatory Risks:

Rumors of a potential regulatory crackdown on cryptocurrencies introduce uncertainty, potentially pressuring prices if confirmed.

Technological Developments:

Ongoing network improvements strengthen BCH’s fundamentals, though they must translate to broader adoption to impact price significantly.

Key Insight:

Positive developments like partnerships are bullish catalysts, but regulatory risks pose a wildcard that could overshadow gains.

10. Overall Summary Outlook

Overview:

On March 5, 2025, BCH/USD at 360.00 USD presents a cautiously bullish outlook. Strong fundamentals, rising on-chain activity, and institutional interest support long-term potential. However, bearish trader positioning, mixed sentiment, and regulatory uncertainty introduce short-term risks. The market is at a pivotal point, with price action near key levels determining the next direction.

Future Prediction

Trend: Cautiously Bullish (Long-Term), Short-Term Uncertainty

Scenarios:

Bullish Case: If BCH holds above 334.08 USD and breaks 390.00 USD, it could rally to 500.00 USD, fueled by adoption and institutional buying.

Bearish Case: A drop below 334.08 USD might push prices to 240.00 USD or lower, driven by regulatory fears and bearish positioning.

Conclusion:

The long-term trend leans bullish due to robust fundamentals and growth potential. However, short-term risks warrant caution. Traders should monitor support/resistance levels and sentiment shifts closely.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

BCH/USD "Bitcoin Cash vs U.S Dollar" Crypto Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the BCH/USD "Bitcoin Cash vs U.S Dollar" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (270.00) then make your move - Bearish profits await!"

however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest. I Highly recommended you to put alert in your chart.

Stop Loss 🛑: Thief SL placed at (310.00) swing Trade Basis Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 210.00 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental, Positioning, Overall Outlook:

╰┈➤BCH/USD "Bitcoin Cash vs U.S Dollar" Crypto Market is currently experiencing a bearish trend,., driven by several key factors.

🔴Fundamental Analysis

BCH Price Drivers: The current BCH price is influenced by the overall cryptocurrency market sentiment, adoption rates, and regulatory environment.

Ripple's Partnerships: BCH's partnerships with financial institutions and businesses are a key driver of the price.

Competition: The competition from other cryptocurrencies, such as BTC and ETH, is a significant factor in determining the BCH price.

🔵Macro Economics

Global Economy: The global economic environment, including inflation rates, interest rates, and GDP growth, can impact the BCH price.

Cryptocurrency Market: The overall cryptocurrency market capitalization and trading volume can influence the BCH price.

Regulatory Environment: Changes in regulations and laws governing cryptocurrencies can significantly impact the BCH price.

⚪COT Data

Commitment of Traders: The COT data shows that large speculators are net short BCH, indicating a bearish sentiment.

Open Interest: The open interest in BCH futures is decreasing, indicating a declining interest in the market.

🟠On-Chain Analysis

Transaction Volume: The transaction volume on the BCH blockchain is decreasing, indicating slowing adoption.

Hash Rate: The hash rate of the BCH blockchain is stable, indicating a secure network.

Block Size: The block size of the BCH blockchain is decreasing, indicating slowing demand for transactions.

🟢Market Sentimental Analysis

Bearish Sentiment: The market sentiment is currently bearish, with many investors expecting the BCH price to continue its downward trend.

Risk Aversion: The market is experiencing high risk aversion, with investors seeking safe-haven assets such as BTC and USD.

🟡Positioning

Short Positions: Many investors are holding short positions in BCH, expecting the price to continue its downward trend.

Long Positions: Some investors are holding long positions in BCH, expecting a potential bounce or reversal.

🟤Next Trend Move

Bearish Trend: The current trend is bearish, with the BCH price expected to continue its downward trend driven by slowing adoption and regulatory uncertainty.

Support Levels: The next support levels are seen at 210

🟣Overall Summary Outlook

Bearish Outlook: The overall outlook for BCH is bearish, driven by slowing adoption, regulatory uncertainty, and competition from other cryptocurrencies.

Volatility: The market is expected to remain volatile, with investors closely watching regulatory developments, adoption rates, and market sentiment.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Bitcoin Cash shows signs of resilienceBitcoin Cash MARKETSCOM:BCHUSD is currently resisting to go for lower lows. Instead, the crypto is forming higher lows. If this remains like this, there might see some buying interest coming through. Let's dig in.

CRYPTO:BCHUSD

Let us know what you think in the comments below.

Thank you.

74.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

BITCOIN CASH Stock Chart Fibonacci Analysis 022025Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 349/61.80%

Chart time frame: B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: B

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

BCHUSD - Falling Wedge Recovery at the middle of the falling wedge

This recovery allowing price to break out and retest the initial price high (horizontal dotted line)

I consider the vertical dotted line the middle of the overall larger pattern

Retest of previous high during this bull run

Daily chart

Bitcoin Cash Faces Pressure: Will $300 Hold or Break ?

Downtrend Confirmation: The price recently broke below the mid-Bollinger Band (20-day SMA), signaling bearish momentum.

Lower Bollinger Band Touch: The price recently reached the lower band, suggesting oversold conditions or a continuation of the downtrend.

Volume Spike in Down Move: Increased volume during the price drop indicates strong selling pressure.

Support Around $300: The price has recently bounced from near $300, a psychological and historical support level.

Resistance Near $380-$400: The mid-Bollinger Band and previous price rejections suggest resistance in this range.

Bullish Reversal: If BCH can reclaim the mid-Bollinger Band ($380 area) and hold, it may trigger a move toward the upper band ($480+).

Further Downside: A failure to hold $300 may open the door for further declines toward $280 or lower.

Consolidation Phase: If BCH stabilizes between $300-$380, sideways movement may occur before a new breakout.

BCH , sleeping giant Slowly stabilising on the support and getting ready for the throw, I bet the move will be harsh and fast , in the chart I appointed three tps to show safe places to unload but will try to chase the move and update in the path , the fact is I feel we bottomed out and next will be non stop gains for this lovely dinosaur.