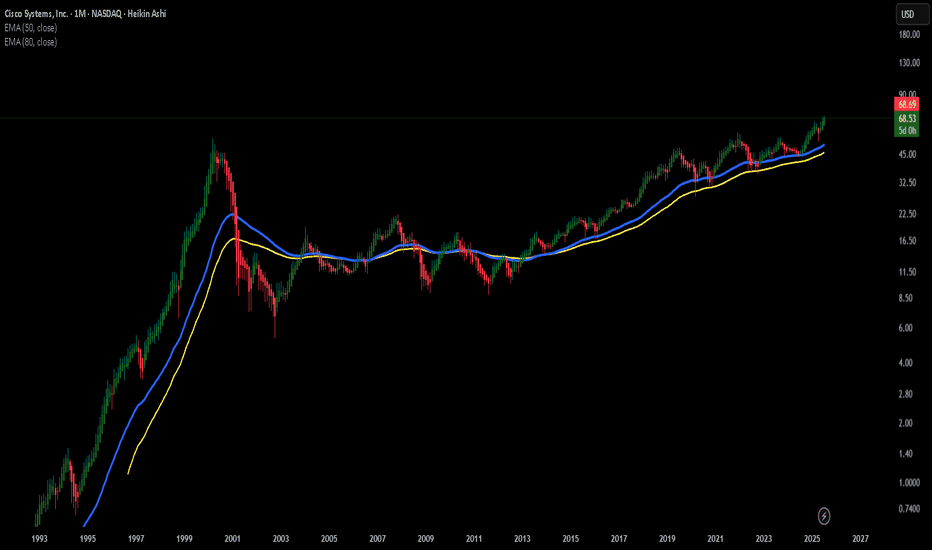

CSCO – Cisco’s Not Done Dancing Yet!

When I look at CSCO, I get the feeling that this old-school tech legend still has some rhythm left in its step. It’s like that uncle at the family wedding who’s been around the block but somehow still manages to pull off a surprisingly smooth move on the dance floor.

It may not be the flashiest st

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

2,338 CLP

9.76 T CLP

50.90 T CLP

3.95 B

About Cisco Systems, Inc.

Sector

Industry

CEO

Charles H. Robbins

Website

Headquarters

San Jose

Founded

1984

FIGI

BBG00YFSCBX3

Cisco Systems, Inc. engages in the design, manufacture, and sale of Internet Protocol-based networking products and services related to the communications and information technology industry. The firm operates through the following geographical segments: the Americas, EMEA, and APJC. Its products include the following categories: Secure, Agile Networks, Internet for the Future, Collaboration, End-to-End Security, Optimized Application Experiences, and Other Products. The company was founded by Sandra Lerner and Leonard Bosack in 1984 and is headquartered in San Jose, CA.

Related stocks

3 Reasons Why Cisco Stock Is Ready to Rocket (Bonus Strategy)3 Reasons Why Cisco Stock Is Ready to Rocket (Bonus Strategy Inside)

Cisco is flashing bullish signs from candlesticks to volume. Here's why a breakout could be imminent — with a bonus momentum strategy revealed.

---

Cisco Systems ( NASDAQ:CSCO ) is showing signs of a potential breakout — and sav

CSCO Long CallsCisco's uptrend exceeded previous highs and heading toward 127% extension from the 4/9 Tariff lows.

Prices are currently consolidating between $68 and $70 with a volume level.

I am buying in the lower 1/2 - 1/4 of the range with an expectation of a move back to the $70 level and beyond.

August 15

CSCOThe CSCO stock is very promising for investors, with excellent indicators. It has formed a symmetrical triangle on the weekly chart, which has been strongly broken out of after a significant accumulation phase at $55.95. Currently, we are at a resistance zone where we expect a correction. There are

Cybersecurity Strength Makes It a Stable Long-Term Bet Targets:

- T1 = $68.31

- T2 = $72.05

Stop Levels:

- S1 = $64.34

- S2 = $59.69

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups

Cisco Is Pushing a Generational HighCisco Systems has climbed as AI investment helps power growth, and some traders may think the move will continue.

The first pattern on today’s chart is the February 13 peak of $66.50. It was the highest level since September 2000, when the dotcom bubble was deflating. The networking giant come with

What Fuels Cisco's Quiet AI Domination?Cisco Systems, a long-standing titan in networking infrastructure, is experiencing a significant resurgence, largely driven by a pragmatic and highly effective approach to artificial intelligence. Unlike many enterprises chasing broad AI initiatives, Cisco focuses on solving "boring" yet critical cu

Cisco’s Charts Are Painting a Conflicting PictureCisco Systems NASDAQ:CSCO lost some ground in recent days even as the tech giant kicked off its Cisco Live 2025 event this week in San Diego, and the stock’s charts are flashing some conflicting signals. Let’s take a look.

Cisco’s Fundamental Analysis

CSCO’s three-day Cisco Live event began Mo

Cisco Wave Analysis – 11 June 2025

- Cisco reversed from the key resistance level 65.60

- Likely to fall to support level 62.20

Cisco recently reversed down from the key resistance level 65.60 (which has been reversing the price from the start of February).

The downward reversal from the resistance level 65.60 created the daily J

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where CSCOCL is featured.

Frequently Asked Questions

The current price of CSCOCL is 48,038 CLP — it hasn't changed in the past 24 hours. Watch CISCO SYSTEMS INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BCS exchange CISCO SYSTEMS INC stocks are traded under the ticker CSCOCL.

We've gathered analysts' opinions on CISCO SYSTEMS INC future price: according to them, CSCOCL price has a max estimate of 76,023.39 CLP and a min estimate of 62,378.17 CLP. Watch CSCOCL chart and read a more detailed CISCO SYSTEMS INC stock forecast: see what analysts think of CISCO SYSTEMS INC and suggest that you do with its stocks.

CSCOCL reached its all-time high on Jul 10, 2025 with the price of 66,084 CLP, and its all-time low was 37,118 CLP and was reached on Oct 11, 2022. View more price dynamics on CSCOCL chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

CSCOCL stock is 34.04% volatile and has beta coefficient of 1.04. Track CISCO SYSTEMS INC stock price on the chart and check out the list of the most volatile stocks — is CISCO SYSTEMS INC there?

Today CISCO SYSTEMS INC has the market capitalization of 259.53 T, it has increased by 1.57% over the last week.

Yes, you can track CISCO SYSTEMS INC financials in yearly and quarterly reports right on TradingView.

CISCO SYSTEMS INC is going to release the next earnings report on Aug 13, 2025. Keep track of upcoming events with our Earnings Calendar.

CSCOCL earnings for the last quarter are 914.29 CLP per share, whereas the estimation was 873.43 CLP resulting in a 4.68% surprise. The estimated earnings for the next quarter are 953.76 CLP per share. See more details about CISCO SYSTEMS INC earnings.

CISCO SYSTEMS INC revenue for the last quarter amounts to 13.48 T CLP, despite the estimated figure of 13.38 T CLP. In the next quarter, revenue is expected to reach 14.28 T CLP.

CSCOCL net income for the last quarter is 2.37 T CLP, while the quarter before that showed 2.39 T CLP of net income which accounts for −0.92% change. Track more CISCO SYSTEMS INC financial stats to get the full picture.

Yes, CSCOCL dividends are paid quarterly. The last dividend per share was 382.82 CLP. As of today, Dividend Yield (TTM)% is 2.41%. Tracking CISCO SYSTEMS INC dividends might help you take more informed decisions.

CISCO SYSTEMS INC dividend yield was 3.30% in 2024, and payout ratio reached 62.19%. The year before the numbers were 2.96% and 50.12% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 3, 2025, the company has 90.4 K employees. See our rating of the largest employees — is CISCO SYSTEMS INC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. CISCO SYSTEMS INC EBITDA is 14.38 T CLP, and current EBITDA margin is 28.64%. See more stats in CISCO SYSTEMS INC financial statements.

Like other stocks, CSCOCL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade CISCO SYSTEMS INC stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So CISCO SYSTEMS INC technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating CISCO SYSTEMS INC stock shows the buy signal. See more of CISCO SYSTEMS INC technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.