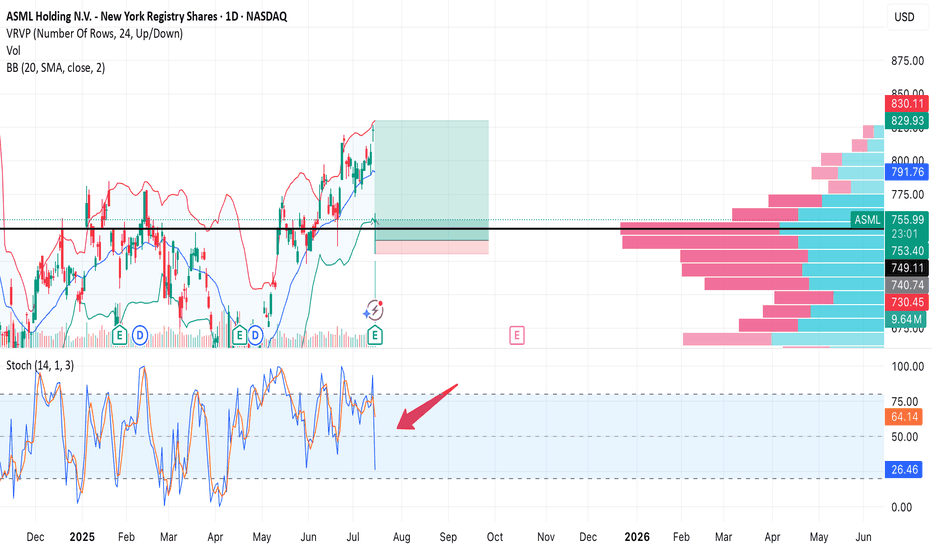

ASML, retrace for entry?ASML is currently having slight pull back, retesting the SMA 200 Weekly which were bought up with quite a volume.

Having broken out of 1 year resistance trendline consolidation (March 2024-March 2025) falling wedge/bull flag formation

If we are actually forming a trend reversal to the upside, this

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

489.90 MXN

170.76 B MXN

637.40 B MXN

393.06 M

About ASML HOLDING

Sector

Industry

CEO

Christophe D. Fouquet

Website

Headquarters

Veldhoven

Founded

1994

FIGI

BBG010JBQFR2

ASML Holding NV engages in the development, production, marketing, sales, upgrading and servicing of advanced semiconductor equipment systems. It includes lithography, metrology and inspection systems. The company was founded on April 1, 1984 and is headquartered in Veldhoven, the Netherlands.

Related stocks

ASML monopolist, a +181% | 2Y oppertunityASML is the monopoly Extreme ultra violet machinery company. There is no one close to it's technology or there is no one investing enough to R&D a thing like it. The whole AI datacenter and cloud chip growth depends on EUV machinery of ASML developed in 2013 (>10y of PhD level R&D deveopment). The f

ASML — Strong earnings, sharp drop on profit-taking. Second chanAfter a strong quarterly report, NASDAQ:ASML stock initially surged, but then dropped -7.6% in a single session. Most likely due to profit-taking and a broader tech sector correction. Still, the key $754 support held, and the uptrend remains intact.

Trade Setup:

• Buy Zone: $754–760 (on retest)

ASML monopolist, AI expanding +181% | 2Y oppertunity ASML is the monopoly Extreme ultra violet machinery company. There is no one close to it's technology or there is no one investing enough to R&D a thing like it. The whole AI datacenter and cloud chip growth depends on EUV machinery of ASML developed in 2013 (>10y of PhD level R&D deveopment). The f

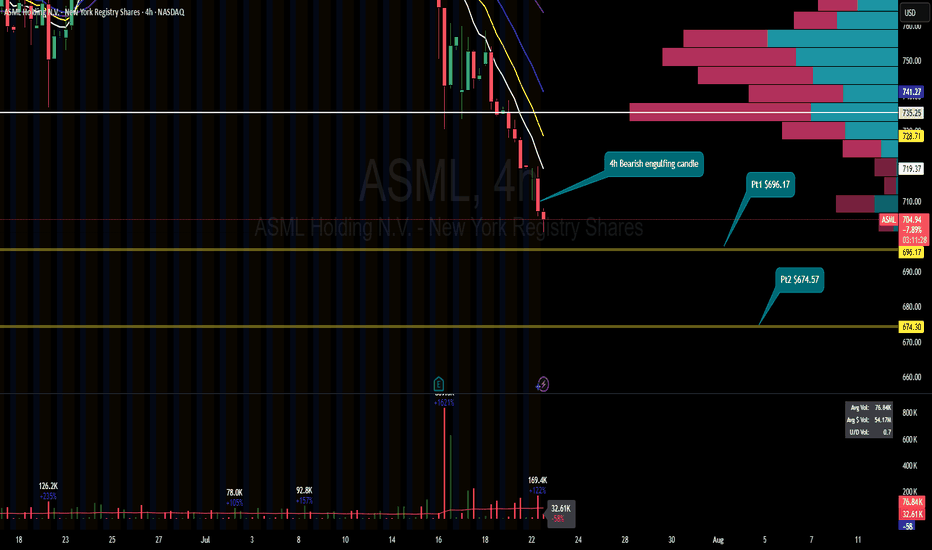

ASML - Resuming its bearish trendASML NASDAQ:ASML saw a strong bearish continuation after the stock has broken below its rising wedge formation. Ichimoku has shown a clear three bearish death cross right after yesterday's gap down below the kumo.

Bearish divergence is in on the 23-period ROC.

Long-term MACD has performed a be

ASMLASML Holding

ASML closed at $671.6 on July 7, 2025.

Market Capitalization:

ASML's market cap is approximately $302–$314 billion as of early July 2025, making it one of the world’s 30 most valuable companies.

Key Financials and Outlook

Next Earnings Release:

Scheduled for July 16, 2025. The consens

ASML ASML is trading around $659.4per share The stock has a market capitalization of approximately $312 billion

Company Overview

ASML is a global leader in advanced semiconductor equipment, specializing in lithography systems essential for chip manufacturing, including extreme ultraviolet (EUV) and dee

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

XS247368710

ASML HOLDING 22/32Yield to maturity

2.85%

Maturity date

May 17, 2032

XS201003237

ASML HOLDING 20/30Yield to maturity

2.69%

Maturity date

Feb 25, 2030

XS216621972

ASML HOLDING 20/29Yield to maturity

2.66%

Maturity date

May 7, 2029

XS263141695

ASML HOLDING 23/25Yield to maturity

2.63%

Maturity date

Dec 6, 2025

XS152755619

ASML HOLDING N.V. 16/27Yield to maturity

2.35%

Maturity date

May 28, 2027

XS140578096

ASML HOLDING N.V. 16/26Yield to maturity

2.23%

Maturity date

Jul 7, 2026

See all ASML1/N bonds

Curated watchlists where ASML1/N is featured.

Frequently Asked Questions

The current price of ASML1/N is 13,020.00 MXN — it has decreased by −0.53% in the past 24 hours. Watch ASML HOLDING N.V stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BIVA exchange ASML HOLDING N.V stocks are traded under the ticker ASML1/N.

ASML1/N stock has fallen by −3.22% compared to the previous week, the month change is a −12.22% fall, over the last year ASML HOLDING N.V has showed a −25.26% decrease.

We've gathered analysts' opinions on ASML HOLDING N.V future price: according to them, ASML1/N price has a max estimate of 18,228.18 MXN and a min estimate of 12,844.73 MXN. Watch ASML1/N chart and read a more detailed ASML HOLDING N.V stock forecast: see what analysts think of ASML HOLDING N.V and suggest that you do with its stocks.

ASML1/N stock is 0.61% volatile and has beta coefficient of 1.22. Track ASML HOLDING N.V stock price on the chart and check out the list of the most volatile stocks — is ASML HOLDING N.V there?

Yes, you can track ASML HOLDING N.V financials in yearly and quarterly reports right on TradingView.

ASML HOLDING N.V is going to release the next earnings report on Oct 15, 2025. Keep track of upcoming events with our Earnings Calendar.

ASML1/N earnings for the last quarter are 128.34 MXN per share, whereas the estimation was 114.40 MXN resulting in a 12.19% surprise. The estimated earnings for the next quarter are 120.33 MXN per share. See more details about ASML HOLDING N.V earnings.

ASML HOLDING N.V revenue for the last quarter amounts to 167.32 B MXN, despite the estimated figure of 164.57 B MXN. In the next quarter, revenue is expected to reach 171.66 B MXN.

ASML1/N net income for the last quarter is 48.73 B MXN, while the quarter before that showed 50.78 B MXN of net income which accounts for −4.03% change. Track more ASML HOLDING N.V financial stats to get the full picture.

Yes, ASML1/N dividends are paid quarterly. The last dividend per share was 29.48 MXN. As of today, Dividend Yield (TTM)% is 0.88%. Tracking ASML HOLDING N.V dividends might help you take more informed decisions.

ASML HOLDING N.V dividend yield was 0.85% in 2024, and payout ratio reached 28.35%. The year before the numbers were 0.74% and 25.88% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 2, 2025, the company has 44.03 K employees. See our rating of the largest employees — is ASML HOLDING N.V on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. ASML HOLDING N.V EBITDA is 248.05 B MXN, and current EBITDA margin is 35.42%. See more stats in ASML HOLDING N.V financial statements.

Like other stocks, ASML1/N shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade ASML HOLDING N.V stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So ASML HOLDING N.V technincal analysis shows the strong sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating ASML HOLDING N.V stock shows the sell signal. See more of ASML HOLDING N.V technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.