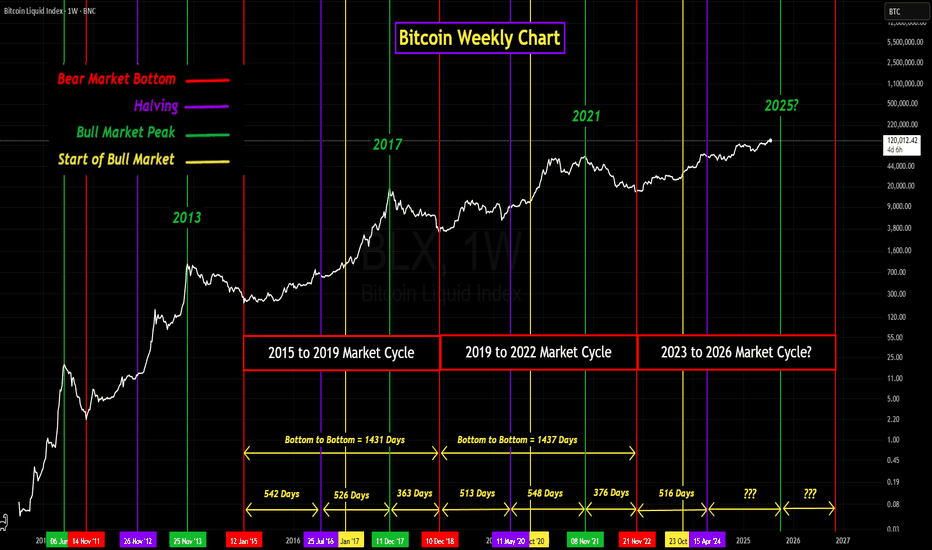

GROK's Analysis of Bitcoin's 4-Year Market CyclesIn the past I have published my own analysis of Bitcoin's 4-year market cycles, (cycles 2 and 3).

My purpose for analyzing the market cycles was to determine how similar in elapsed times the last two market cycles were to each other. Not only in the length of the overall market cycle but also betwee

Key data points

Previous close

—

Open

—

Day's range

—

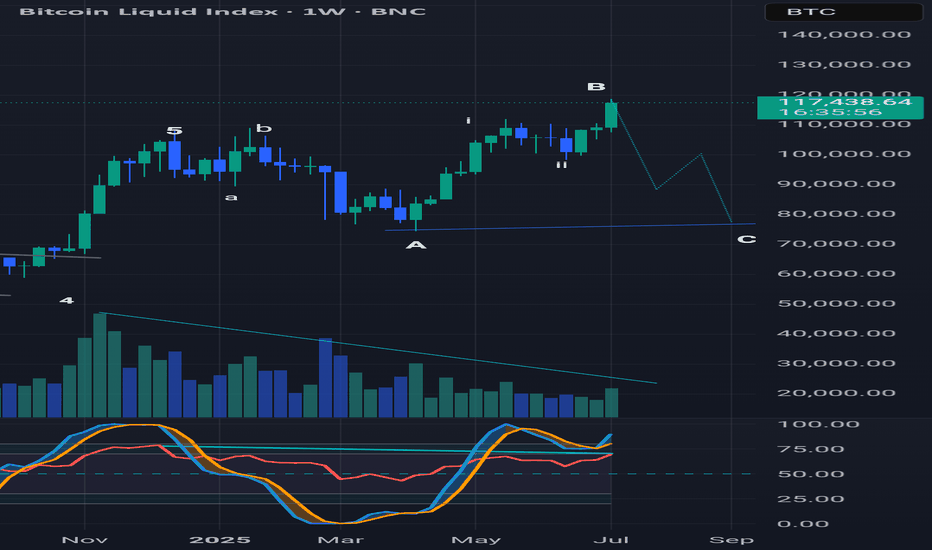

Running flat? Weekly chart wave analysisA running flat is where the B wave exceeds the starting point of wave A and the subsequent drop of wave C does not exceed the wave A low. Also note the declining volume and bearish divergence with the RSI on the weekly (and monthly) chart suggesting this move up is losing momentum.

The Evolution of BitcoinNot Financial Advice

Born in 2009, bitcoin was a proof of concept out of an esoteric online forum.

It was intended as a secure, swift, P2P solution to transact on a global stage without global scrutiny nor supervision.

Sure it worked, but would it last?

Then Proof of Work, PoW , showed it's e

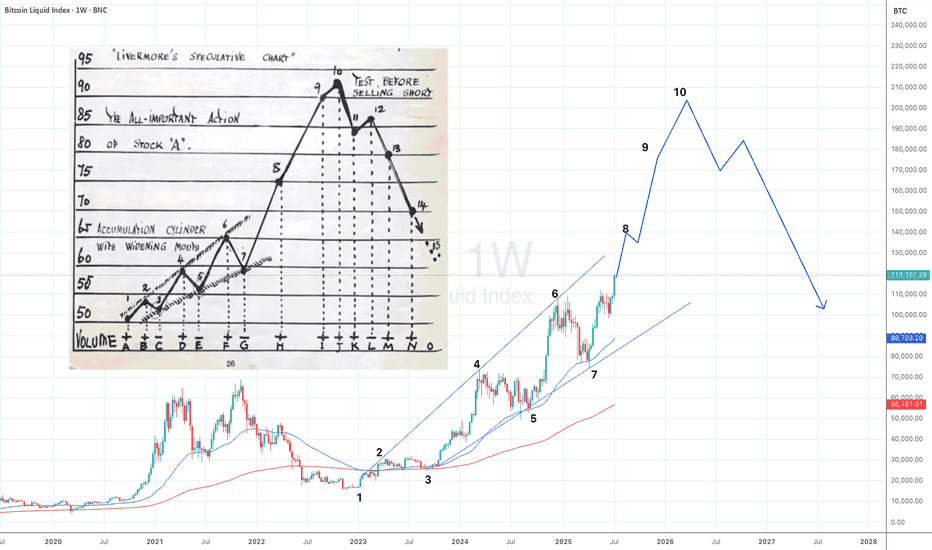

Livermore’s Speculative Blueprint: Are We Near the Final Act?Livermore’s Speculative Blueprint: Are We Near the Final Act?

Bitcoin’s price action since 2022 eerily mirrors Jesse Livermore’s legendary “Speculative Chart,” a timeless model of market psychology and price behavior. The attached overlay illustrates how BTC has respected nearly every phase—accumul

The Final Parabola: What History Says About Bitcoin’s July MovesIf you’ve been following here for a while, you know we’ve been nearly pinpoint in calling all the moves for Bitcoin. The altcoin market, not so much, but check out previous TAs to catch up on my perspective.

The two wave counts you see on the main chart have been in place for many months, I believe

BTC reached the local peak? 👀#Bitcoin distance from BMS

Below is the oscillator, which shows how far the price has moved away from the bull market support. Mostly when we are in the 2-3 year of the cycle, the mark on the oscillator 40 acts as resistance, which indicates a mid-cycle peak.

Can it be different this time?🤔

Let'

BIG BEAUTIFUL BILL - Markets are Ready to PUMP Again! At the 4th of July, the Independence Day, the "One Big Beautiful Bill Act" was signed into law by President Trump. In this idea I want to take a closer look at some points of this law and explain why I consider it VERY bullish for most of financial markets, and especially for crypto.

Here are

Hash rate capitulationThe hash rate capitulation (HRC) indicator used in the Bitcoin Bottom Indictor (BBI) has fired. The HRC indicator measures the rate of change of the hash rate. Steadily increasing hash rate is a sign of health of the bitcoin network. This indicator uses moving averages (20- and 100-day) of the hash

Bitcoin Log Regression 👀#Bitcoin Log Regression 👀

The orange line, as in the previous cycle, offers strong resistance.

💡I think CRYPTOCAP:BTC will stay at the current mark for another month. After that, we go to the correction, most likely it will not be a deep correction, but rather a consolidation.

This is indicated

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.