BAIDU 63.6% cash & short term inv., P/E 8.7,possible rotation TABaidu largest search engine in china but way less monopoly in china, there is also bing.

Baidu invests heavily in AI and autonomous driving by apollo go.

China economy is in deleveraging and seems to start growing again.

China devlation problems comapnies sitting on cash.

Baidu advertisment income w

5.79 BRL

17.36 B BRL

99.72 B BRL

About Baidu, Inc.

Sector

Industry

CEO

Yan Hong Li

Website

Headquarters

Beijing

Founded

2000

ISIN

BRBIDUBDR002

FIGI

BBG00Q8HYC93

Baidu, Inc. engages in the provision of internet search and online marketing solutions. The firm’s products and services include Baidu App, Baidu Search, Baidu Feed, Haokan, Quanmin, Baidu Post Bar, Baidu Knows, Baidu Encyclopedia, Baidu Input Method Editor or Baidu IME, Baidu AI Cloud and Overseas Products. It operates through the following segments: Baidu Core and iQIYI. The Baidu Core segment provides search-based, feed-based, and other online marketing services. The iQiyi segment is an online entertainment service provider, which offers original, professionally produced and partner-generated content on its platform. The company was founded by Yanhong Li and Xu Yong on January 18, 2000 and is headquartered in Beijing, China.

Related stocks

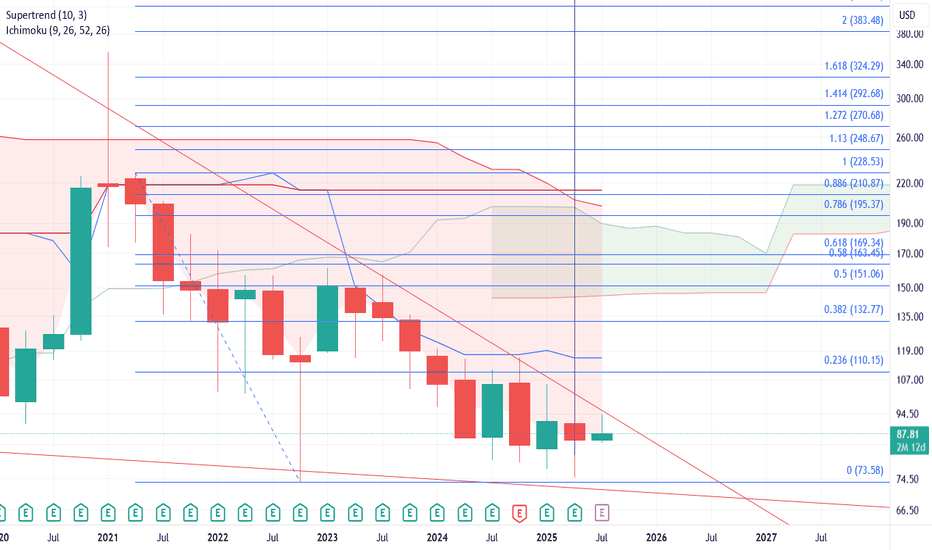

BIDU 1D: triangle breakoutBIDU 1D: triangle breakout + real-world AI deployment boosts bulls

Baidu (BIDU) breaks out of a triangle within a falling channel on the daily chart, with solid volume, reclaim of the 50MA, and approach to the 200MA. $90.09 flips into support. Targets stretch to $105.47 / $113.68 / $124.06 (Fibo l

Baidu Accelerates Robotaxi Expansion and Opens the European DoorBy Ion Jauregui – Analyst at ActivTrades

Baidu (NASDAQ: BIDU), the Chinese tech giant, is doubling down on autonomous vehicles through Apollo Go, its robotaxi platform. According to industry sources, the company is planning to expand into Europe, with Switzerland and Turkey as its first potentia

BIDU close watchAs of the latest update, here’s a snapshot of Baidu Inc. (BIDU) stock:

Current Price: $86.86 (as of May 11, 2025, 10:26 AM EDT)

After-Hours Price: $87.29

Day Range: $86.68 – $87.75

52-Week Range: $74.71 – $116.25

Market Cap: $29.86 billion

P/E Ratio: 9.66

Dividend Yield: 0% 1

Analyst Outlook:

Conse

$bidu smash or crashNASDAQ:BIDU continues to get bought up at this demand zone that has held for 12 years between $85-$73. One of the most beautiful charts Ive seen on an individual name in a long time. Not the most exciting name around but $70 cash per share on hand and a PE of 9 with as solid of a defined R/R as yo

Baidu Wave Analysis – 11 April 2025

- Baidu reversed from support zone

- Likely to rise to resistance level 90.00.

Baidu recently reversed from the support zone between the major long-term support level 78.60 (which has been reversing the price from the end of 2022) and the lower weekly Bollinger Band.

The upward reversal

Baidu | BIDU | Long at $82.50Baidu NASDAQ:BIDU - the Google of China. This one is being ignored by AI investors, and may be an opportunity. Maybe... nothing is certain (especially with the "risks" of Chinese investments).

P/E = 9x

Debt/Equity = 0.27x

Price/Sales = 1.55x

Price/Book = 0.80x

Price/Cash flow = 7.59x

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where BIDU34 is featured.