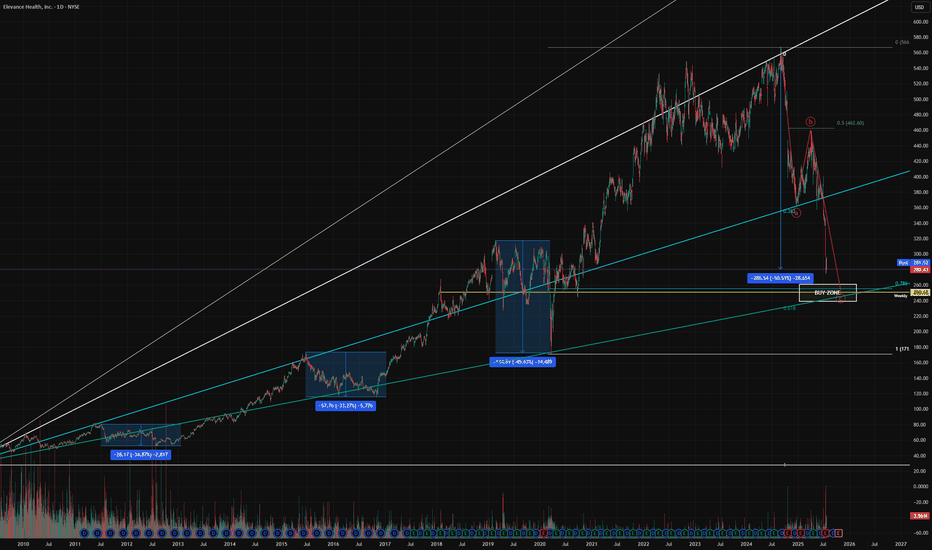

Elevance is losing the long term trendlineLosing such a large trendline is always a bad signal for a company.

The price can easily fall from 15 to 25% in the upcoming weeks or months, take care with this stock unless you are shorting.

This is especially significant while we are seeing Indexs, BTC and more doing new all time highs.

A SL

12,111.896

0.027 BRL

32.24 B BRL

953.17 B BRL

About Elevance Health, Inc.

Sector

Industry

CEO

Gail Koziara Boudreaux

Website

Headquarters

Indianapolis

Founded

1944

ISIN

BRE1LVBDR002

FIGI

BBG00R4Z5100

Elevance Health, Inc. operates as a health company, which engages in improving lives and communities, and making healthcare simpler. It operates through the following segments: Health Benefits, CarelonRx, Carelon Services, and Corporate and Other. The Health Benefits segment offers a comprehensive suite of health plans and services to different customers. The CarelonRx segment markets and offers pharmacy services to affiliated health plan customers, as well as to external customers. The Carelon Services segment integrates physical, behavioral, pharmacy, and social services with the aim of delivering whole health affordably by offering a broad array of healthcare related services. The Corporate & Other segment includes businesses that do not individually meet the quantitative threshold for an operating segment. The company was founded in 1944 and is headquartered in Indianapolis, IN.

Related stocks

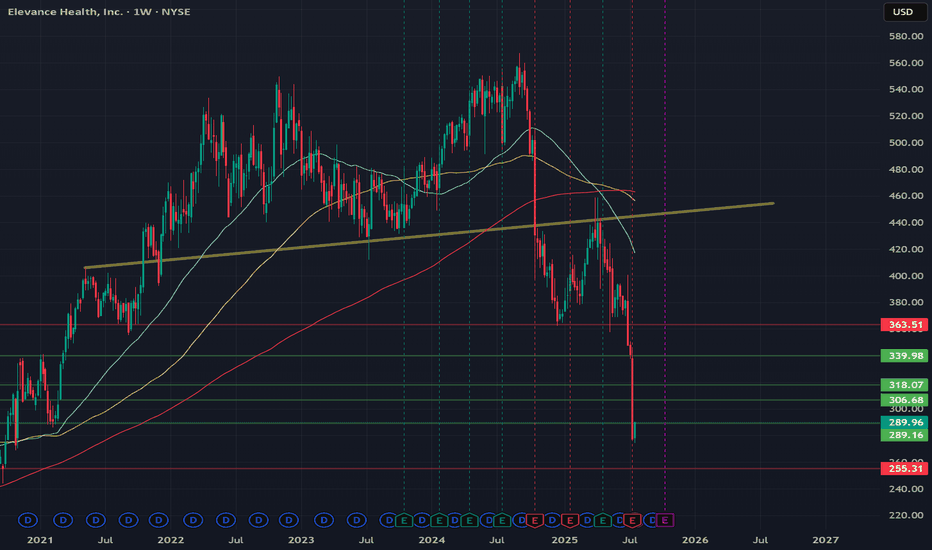

Support Levels approaching$250 could potentially be a good opportunity to pick up Elevance. We are moving towards that level and I will be patient here as the downtrend is strong. The stock is representing deep value here and insiders agree as the CEO is been acquiring shares.

The stock has dropped 50% since it's recent hi

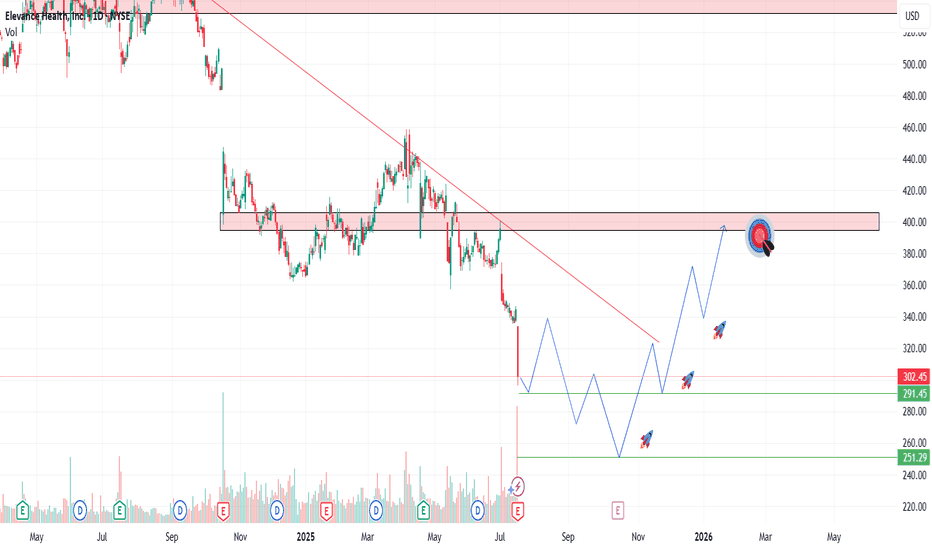

Elevance Health | ELV | Long at $286.00What are seeing in the healthcare and health insurance provider industry right now is destruction before a once-in-a-lifetime boom. The baby boomer generation is between 60 and 79 right now and the amount of healthcare service that will be needed to serve that population is staggering. Institutions

ELV (Elevance Health) – Catching the Knife or Catching Value?Elevance (ELV) just took a 12% hit after Q2 earnings missed estimates and full-year guidance was cut significantly. But here's the thing—the selloff may be overdone. The stock now trades at a forward P/E of ~10, well below industry peers, and is approaching multi-year support levels.

📥 Entry Plan

ELV Swing Trade Setup - May 2025Fundamentally undervalued with a strong balance sheet, consistent earnings beats, and a low P/E ratio. Recent drop (~33% from 52-week highs) appears overdone relative to earnings strength likely due to short-term Medicaid cost concerns, not long-term deterioration.

📊 Position Type:

✅ Swing Trade t

$ELV Earnings Preview: Oversold Potential + Key Metrics AheadEarnings Estimates: Analysts forecast an EPS of $3.82 for the upcoming quarter, indicating a 32% year-over-year decline. Revenue is projected at $44.67 billion, a 5.2% increase from the same period last year.

Oversold Potential: With an oversold score of 59%, NYSE:ELV appears attractive for a

Elevance - Short interest declining, buy the dip?The shorts have done extremely well here, dragging the price down by over 34%. ELV has been under severe pressure due to a miss on EPS on their last earnings report. However, they did beat on revenue (by $1.58B) but that did not stop holders exiting their positions.

Unless you're living under a she

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

ANTM4983288

Elevance Health, Inc. 3.125% 15-MAY-2050Yield to maturity

7.31%

Maturity date

May 15, 2050

US36752AS2

ELEVANCE HE. 21/51Yield to maturity

7.12%

Maturity date

Mar 15, 2051

ANTM4880736

Elevance Health, Inc. 3.7% 15-SEP-2049Yield to maturity

6.95%

Maturity date

Sep 15, 2049

AE1J

ELEVANCE HE. 17/47Yield to maturity

6.62%

Maturity date

Dec 1, 2047

ANTM4606236

Anthem, Inc. /Old/ 4.55% 01-MAR-2048Yield to maturity

6.60%

Maturity date

Mar 1, 2048

ANTM4153492

Elevance Health, Inc. 4.85% 15-AUG-2054Yield to maturity

6.58%

Maturity date

Aug 15, 2054

ANTM5405192

Elevance Health, Inc. 4.55% 15-MAY-2052Yield to maturity

6.55%

Maturity date

May 15, 2052

ANTM4153493

Elevance Health, Inc. 4.65% 15-AUG-2044Yield to maturity

6.34%

Maturity date

Aug 15, 2044

ELVH5534305

Elevance Health, Inc. 5.125% 15-FEB-2053Yield to maturity

6.33%

Maturity date

Feb 15, 2053

ANTM3851462

Elevance Health, Inc. 4.625% 15-MAY-2042Yield to maturity

6.30%

Maturity date

May 15, 2042

ANTM3899002

Elevance Health, Inc. 4.65% 15-JAN-2043Yield to maturity

6.27%

Maturity date

Jan 15, 2043

See all E1LV34 bonds