Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

91.75 MXN

70.40 B MXN

238.38 B MXN

81.44 M

About Southern Copper Corporation

Sector

Industry

CEO

Oscar González Rocha

Website

Headquarters

Phoenix

Founded

1952

FIGI

BBG000PP0611

Southern Copper Corp. engages in the development, production, and exploration of copper, molybdenum, zinc, and silver. It operates through the following segments: Peruvian Operations, Mexican Open-Pit Operations, and Mexican Underground Mining Operations. The Peruvian Operations segment focuses on the Toquepala and Cuajone mine complexes and the smelting and refining plants, industrial railroad, and port facilities that service both mines. The Mexican Open-Pit Operations segment comprises the La Caridad and Buenavista mine complexes, the smelting, and refining plants and support facilities, which service both mines. The Mexican Underground Mining Operations segment is involved in the operation of five underground mines, a coal mine, and several industrial processing facilities. The company was founded on December 12, 1952 and is headquartered in Phoenix, AZ.

Related stocks

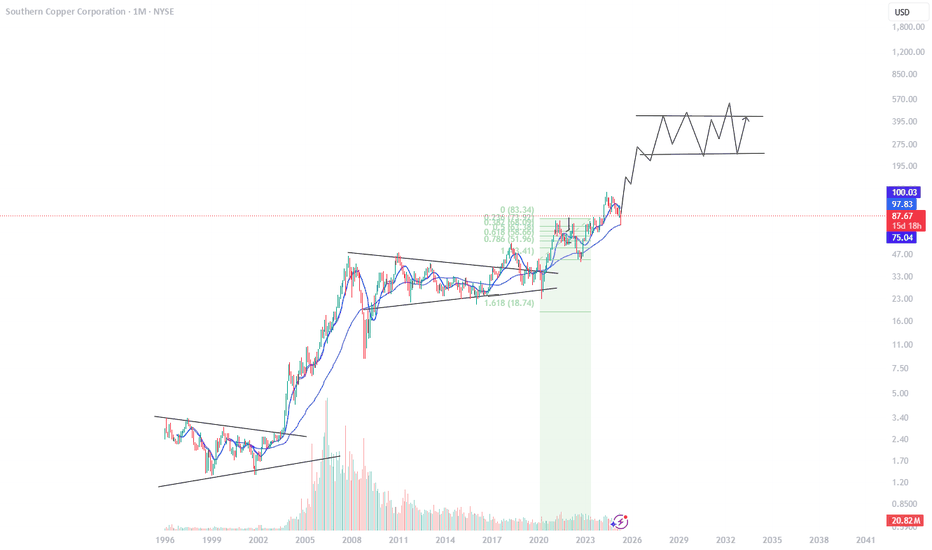

SCCO watch $87.05 above 83.65 below: Key fibs to determine trendSCCO may have bottomed but not yet flying.

Currently fighting Genesis fib above at $87.05

Likely dips need to hold Golden Covid at $83.65

Of course we have the Copper > Econ > China thing,

No way to know effects but the fibs say "look here".

=============================================

Copper Equities Breaking Down, Is tthe economy?Copper is very close to losing criyical support.

If this daily chart trendline breaks, there is a big move down into the next support.

Copper Equity stocks are already teing us aa likely breakdown in the commodity is coming.

Is this base metal signaling weaker economic demand & growth?

SCCO bulls struggle at current highs.SOUTHERN COPPER CORPORATION - 30d expiry - We look to Sell at 77.48 (stop at 81.21)

We are trading at overbought extremes.

Posted a Double Top formation.

Bespoke resistance is located at 78.70.

Resistance could prove difficult to breakdown.

Early optimism is likely to lead to gains although ex

Southern Copper top?Southern Copper Corporation has been on a tear the past 2 weeks since the China reopening news. Eventually within another week or so, copper will hit its top resistance level. Here's a SCCO 1 week chart and HG1! comparison using my TTCATR(beta) indicator set to 9 with my commodity channel index comp

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

M

MNRMF4887148

Minera Mexico, S.A. de C.V. 4.5% 26-JAN-2050Yield to maturity

7.13%

Maturity date

Jan 26, 2050

M

MNRMF5999370

Minera Mexico, S.A. de C.V. 5.625% 12-FEB-2032Yield to maturity

5.42%

Maturity date

Feb 12, 2032

G

GMBX3686196

Grupo Minero Mexico SA de CV 9.25% 01-APR-2028Yield to maturity

5.15%

Maturity date

Apr 1, 2028

M

MNRMF5999369

Minera Mexico, S.A. de C.V. 5.625% 12-FEB-2032Yield to maturity

—

Maturity date

Feb 12, 2032

See all SCCO bonds

Curated watchlists where SCCO is featured.

Frequently Asked Questions

The current price of SCCO is 1,738.23 MXN — it hasn't changed in the past 24 hours. Watch SOUTHERN COPPER CORPORATION stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BMV exchange SOUTHERN COPPER CORPORATION stocks are traded under the ticker SCCO.

We've gathered analysts' opinions on SOUTHERN COPPER CORPORATION future price: according to them, SCCO price has a max estimate of 2,475.39 MXN and a min estimate of 1,332.90 MXN. Watch SCCO chart and read a more detailed SOUTHERN COPPER CORPORATION stock forecast: see what analysts think of SOUTHERN COPPER CORPORATION and suggest that you do with its stocks.

SCCO reached its all-time high on Oct 21, 2024 with the price of 2,219.67 MXN, and its all-time low was 309.39 MXN and was reached on Dec 5, 2013. View more price dynamics on SCCO chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

SCCO stock is 0.00% volatile and has beta coefficient of 1.21. Track SOUTHERN COPPER CORPORATION stock price on the chart and check out the list of the most volatile stocks — is SOUTHERN COPPER CORPORATION there?

Today SOUTHERN COPPER CORPORATION has the market capitalization of 1.43 T, it has increased by 3.71% over the last week.

Yes, you can track SOUTHERN COPPER CORPORATION financials in yearly and quarterly reports right on TradingView.

SOUTHERN COPPER CORPORATION is going to release the next earnings report on Jul 23, 2025. Keep track of upcoming events with our Earnings Calendar.

SCCO earnings for the last quarter are 24.14 MXN per share, whereas the estimation was 23.16 MXN resulting in a 4.25% surprise. The estimated earnings for the next quarter are 20.57 MXN per share. See more details about SOUTHERN COPPER CORPORATION earnings.

SOUTHERN COPPER CORPORATION revenue for the last quarter amounts to 63.96 B MXN, despite the estimated figure of 60.71 B MXN. In the next quarter, revenue is expected to reach 55.40 B MXN.

SCCO net income for the last quarter is 19.38 B MXN, while the quarter before that showed 16.55 B MXN of net income which accounts for 17.08% change. Track more SOUTHERN COPPER CORPORATION financial stats to get the full picture.

Yes, SCCO dividends are paid quarterly. The last dividend per share was 13.72 MXN. As of today, Dividend Yield (TTM)% is 2.83%. Tracking SOUTHERN COPPER CORPORATION dividends might help you take more informed decisions.

SOUTHERN COPPER CORPORATION dividend yield was 2.27% in 2024, and payout ratio reached 47.87%. The year before the numbers were 4.65% and 127.51% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jun 22, 2025, the company has 16.13 K employees. See our rating of the largest employees — is SOUTHERN COPPER CORPORATION on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. SOUTHERN COPPER CORPORATION EBITDA is 138.52 B MXN, and current EBITDA margin is 55.98%. See more stats in SOUTHERN COPPER CORPORATION financial statements.

Like other stocks, SCCO shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade SOUTHERN COPPER CORPORATION stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So SOUTHERN COPPER CORPORATION technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating SOUTHERN COPPER CORPORATION stock shows the neutral signal. See more of SOUTHERN COPPER CORPORATION technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.