7.95 INR

558.95 M INR

10.79 B INR

20.70 M

About INDO AMINES LTD

Sector

Industry

CEO

Vijay Bhalchandra Palkar

Website

Headquarters

Thane

Founded

1979

ISIN

INE760F01028

FIGI

BBG000BVVGH0

Indo Amines Ltd. operates as a holding company, which engages in the manufacture of chemicals. The company specializes in fine chemicals, specialty chemicals, performance chemicals. Its products serve end-users across various sectors, including agrochemicals, pharmaceuticals, polymers, paints, pigments, printing inks, rubber chemicals, additives, surfactants, dyes, flavors and fragrances, and home and personal care applications. Indo Amines was founded in 1979 and is headquartered in Thane, India.

Related stocks

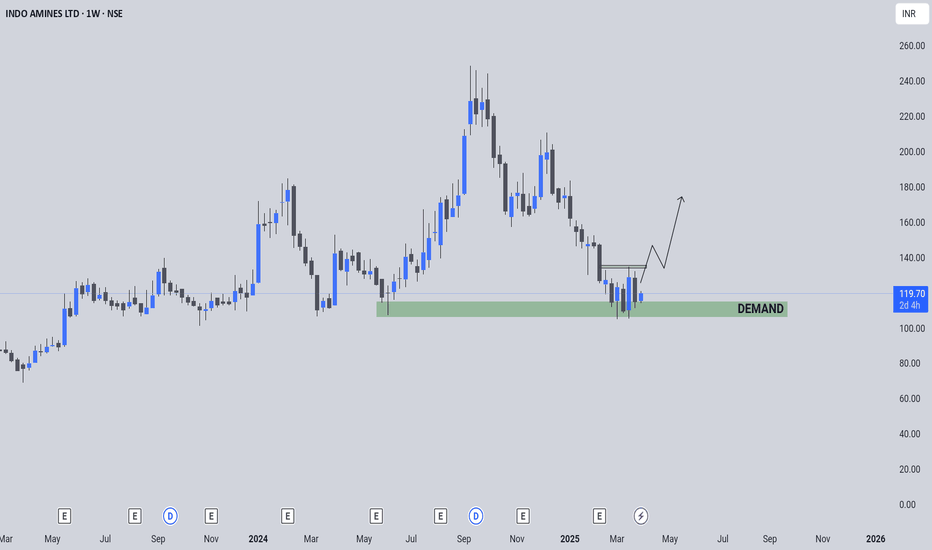

INDOAMIN CMP 185160 Level was a super strong support for this stock.After make a strong rally from Jan 2024 to Sep 2024 This stock corrected around 30% Now it Respecting its support level.After retest this area if it try to bounce back then it will be an best apportunity for a best Swing trade Setup.Add this to you

Indo Amines - Diwali PickMarket Cap - ₹ 1,343 Cr.

Current Price - ₹ 190

High / Low - ₹ 248 / 100

Stock P/E - 26.9

ROCE - 16.6 %

ROE - 16.7 %

Sales growth -3.72 %

Profit growth -12.1 %

Debt to equity - 0.82

Industry PE - 39.2

OPM- 8.84 %

Pledged percentage - 0.00 %

Debt - ₹ 217 Cr.

Down from 52w high - 23.5 %

QoQ Profits - 1

Darvas Box Strategy - Breakout StockDisclaimer: I am Not SEBI Registered adviser, please take advise from your financial adviser before investing in any stocks. Idea here shared is for education purpose only.

Stock has given break out. Keep this stock in watch list.

Buy above the High and do not forget to keep stop loss best suitable

INDOAMIN Showing Volume Strength near ALL TIME HIGH Zone NSE:INDOAMIN

Strengths:

Established market position: IAL was promoted by Mr Vijay B Palkar in 1979, as Techno Chemical Industries, and converted to IAL in 1992. Over the years, the promoters have developed strong expertise in the chemical industry. The company now manufactures oleo, special

Technical Analysis of INDOAMIN (Bullish)Technical Analysis of INDOAMIN based on Price Action - Based on the technical analysis of the chart, the current price of INDO AMINES LTD is 161.55 INR.

Technical Analysis:

RSI (14): The Relative Strength Index (RSI) is currently at 45.46, which suggests that the stock is oversold. This could

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of INDOAMIN is 139.45 INR — it hasn't changed in the past 24 hours. Watch INDO AMINES LTD. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BSE exchange INDO AMINES LTD. stocks are traded under the ticker INDOAMIN.

INDOAMIN stock has fallen by −4.71% compared to the previous week, the month change is a −17.47% fall, over the last year INDO AMINES LTD. has showed a −3.26% decrease.

INDOAMIN reached its all-time high on Sep 9, 2024 with the price of 247.90 INR, and its all-time low was 0.50 INR and was reached on Mar 3, 2004. View more price dynamics on INDOAMIN chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

INDOAMIN stock is 3.36% volatile and has beta coefficient of 2.26. Track INDO AMINES LTD. stock price on the chart and check out the list of the most volatile stocks — is INDO AMINES LTD. there?

Today INDO AMINES LTD. has the market capitalization of 10.06 B, it has decreased by −2.73% over the last week.

Yes, you can track INDO AMINES LTD. financials in yearly and quarterly reports right on TradingView.

INDOAMIN net income for the last quarter is 118.51 M INR, while the quarter before that showed 113.13 M INR of net income which accounts for 4.76% change. Track more INDO AMINES LTD. financial stats to get the full picture.

Yes, INDOAMIN dividends are paid annually. The last dividend per share was 0.50 INR. As of today, Dividend Yield (TTM)% is 0.36%. Tracking INDO AMINES LTD. dividends might help you take more informed decisions.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. INDO AMINES LTD. EBITDA is 1.01 B INR, and current EBITDA margin is 9.37%. See more stats in INDO AMINES LTD. financial statements.

Like other stocks, INDOAMIN shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade INDO AMINES LTD. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So INDO AMINES LTD. technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating INDO AMINES LTD. stock shows the neutral signal. See more of INDO AMINES LTD. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.