Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

95.45 INR

3.02 B INR

25.74 B INR

19.62 M

About LG BALAKRISHNAN & BROS

Sector

Industry

CEO

Palanichamy Prabakaran

Website

Headquarters

Coimbatore

Founded

1937

ISIN

INE337A01034

FIGI

BBG000F71DV3

L.G. Balakrishnan and Bros Ltd. engages in the manufacture and trade of automotive parts and equipment. It operates through the segments Transmission and Metal Forming. The Transmission segment produces chains, sprockets, tensioners, belts and brake shoes. The Metal Forming segment includes fine blanking, machined components, and wire drawing products. The company was founded by L.R.G. Naidu in 1937 and is headquartered in Coimbatore, India.

Related stocks

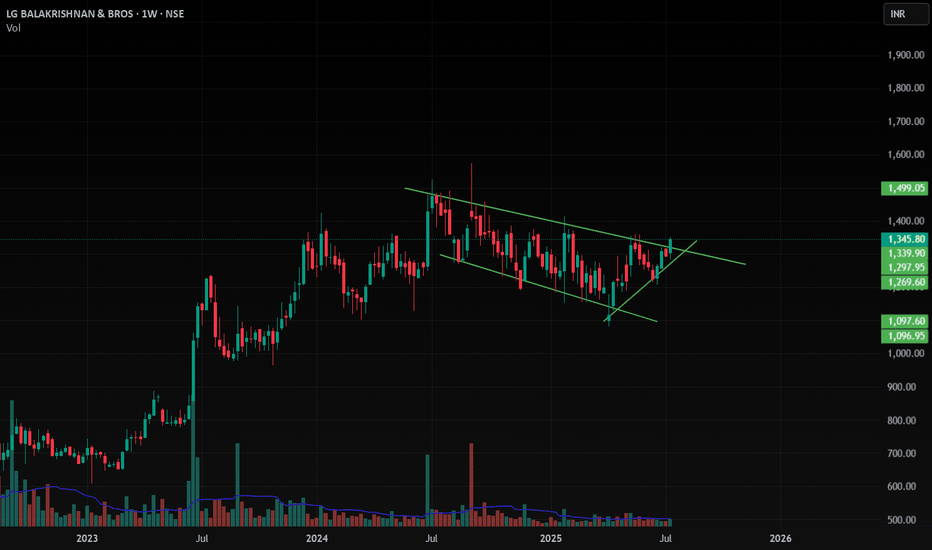

LG Balakrishnan & Bros looking upwards L.G. Balakrishnan and Bros Ltd. engages in the manufacture and trade of automotive parts and equipment. It operates through the segments Transmission and Metal Forming. The Transmission segment produces chains, sprockets, tensioners, belts and brake shoes. The Metal Forming segment includes fine bla

Resistance BreakoutPlease look into the chart for a detailed understanding.

Consider these for short-term & swing trades with 2% profit.

For BTST trades consider booking

target for 1% - 2%

For long-term trades look out for resistance drawn above closing.

Please consider these ideas for educational purpose

8 Stocks for the weekNotes

#MOL Retraced to 9EMA with lower volume

#Jamna Retraced to top of box with lower volume

#Cummins Broke the box and is a buy as per last week

#Meto - Waiting to break the box

# LG Bala - Good setup. Box. Dobule bottom. Present target 736. Close open 736 another 150 Rs possible

# CoalIndia

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of LGBBROSLTD is 1,295.00 INR — it has decreased by −0.32% in the past 24 hours. Watch L.G.BALAKRISHNAN & BROS.LTD. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BSE exchange L.G.BALAKRISHNAN & BROS.LTD. stocks are traded under the ticker LGBBROSLTD.

LGBBROSLTD stock has fallen by −0.30% compared to the previous week, the month change is a 3.03% rise, over the last year L.G.BALAKRISHNAN & BROS.LTD. has showed a −8.08% decrease.

We've gathered analysts' opinions on L.G.BALAKRISHNAN & BROS.LTD. future price: according to them, LGBBROSLTD price has a max estimate of 1,840.00 INR and a min estimate of 1,840.00 INR. Watch LGBBROSLTD chart and read a more detailed L.G.BALAKRISHNAN & BROS.LTD. stock forecast: see what analysts think of L.G.BALAKRISHNAN & BROS.LTD. and suggest that you do with its stocks.

LGBBROSLTD reached its all-time high on Sep 2, 2024 with the price of 1,575.00 INR, and its all-time low was 3.60 INR and was reached on Oct 27, 2008. View more price dynamics on LGBBROSLTD chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

LGBBROSLTD stock is 0.71% volatile and has beta coefficient of 1.07. Track L.G.BALAKRISHNAN & BROS.LTD. stock price on the chart and check out the list of the most volatile stocks — is L.G.BALAKRISHNAN & BROS.LTD. there?

Today L.G.BALAKRISHNAN & BROS.LTD. has the market capitalization of 41.30 B, it has increased by 2.86% over the last week.

Yes, you can track L.G.BALAKRISHNAN & BROS.LTD. financials in yearly and quarterly reports right on TradingView.

L.G.BALAKRISHNAN & BROS.LTD. is going to release the next earnings report on Jul 31, 2025. Keep track of upcoming events with our Earnings Calendar.

LGBBROSLTD net income for the last quarter is 840.37 M INR, while the quarter before that showed 752.99 M INR of net income which accounts for 11.60% change. Track more L.G.BALAKRISHNAN & BROS.LTD. financial stats to get the full picture.

Yes, LGBBROSLTD dividends are paid annually. The last dividend per share was 18.00 INR. As of today, Dividend Yield (TTM)% is 1.39%. Tracking L.G.BALAKRISHNAN & BROS.LTD. dividends might help you take more informed decisions.

L.G.BALAKRISHNAN & BROS.LTD. dividend yield was 1.69% in 2024, and payout ratio reached 20.95%. The year before the numbers were 1.42% and 20.82% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 27, 2025, the company has 12.64 K employees. See our rating of the largest employees — is L.G.BALAKRISHNAN & BROS.LTD. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. L.G.BALAKRISHNAN & BROS.LTD. EBITDA is 4.15 B INR, and current EBITDA margin is 16.32%. See more stats in L.G.BALAKRISHNAN & BROS.LTD. financial statements.

Like other stocks, LGBBROSLTD shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade L.G.BALAKRISHNAN & BROS.LTD. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So L.G.BALAKRISHNAN & BROS.LTD. technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating L.G.BALAKRISHNAN & BROS.LTD. stock shows the buy signal. See more of L.G.BALAKRISHNAN & BROS.LTD. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.