MASTEK SWING ANALYSISThanks for stopping by.

All analysis here is done strictly from an investor’s perspective — focusing on risk, return, valuation, and potential upside.

The notes cover key details. I’ve backed every thesis with my own analysis — no fluff, just what matters to investors.

If you find the idea useful

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

121.80 INR

3.76 B INR

34.53 B INR

15.26 M

About MASTEK LTD

Sector

Industry

CEO

Umang Nahata

Website

Headquarters

Mumbai

Founded

1982

ISIN

INE759A01021

FIGI

BBG000BHX627

Mastek Ltd. is an enterprise digital and cloud transformation partner, which engages in the provision of digital experience and engineering, cloud implementations, data, automation and artificial intelligence (AI), and cloud managed services. The firm caters customers in industries such as healthcare and life sciences, retail and consumer, manufacturing, financial services, and public sector across countries including the United Kingdom, United States of America, Europe, the Middle East, and Asia Pacific. It operates through the following geographical segments: UK and Europe Operations, North America Operations, Middle East, and Others. The company was founded by Ashank Datta Desai, Ketan Bansilal Mehta, Radhakrishnan Sundar, and Venkatraman Ram Sudhakar on May 14, 1982 and is headquartered in Mumbai, India.

Related stocks

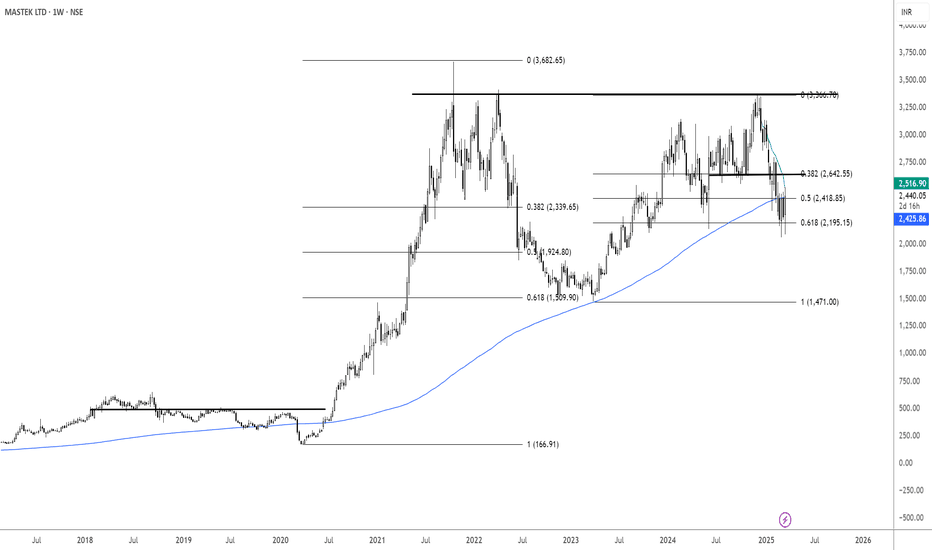

MASTEK MID-TERM ANALYSISMASTEK is looking positive on charts , and once it crosses and sustains above 2691, then it can go up to 3475-3661. And on the downside, if it slips further, then the important support range on the downside would be 2315-2128. And levels for short covering on the downside to look for would be 1924.

Mastek: Monthly Rounding Bottom Breakout Opportunity!🚀 Mastek: Monthly Rounding Bottom Breakout Opportunity! 🚀

Current Market Price: 3257

Stop Loss: 2480

Target: 5160

Mastek is nearing a major monthly rounding bottom breakout above the 3320 closing level. A confirmed monthly close above this level could signal a strong upward trend, offering a promi

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of MASTEK is 2,452.60 INR — it has decreased by −2.22% in the past 24 hours. Watch MASTEK LTD. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BSE exchange MASTEK LTD. stocks are traded under the ticker MASTEK.

MASTEK stock has risen by 0.10% compared to the previous week, the month change is a 4.55% rise, over the last year MASTEK LTD. has showed a −8.83% decrease.

We've gathered analysts' opinions on MASTEK LTD. future price: according to them, MASTEK price has a max estimate of 3,030.00 INR and a min estimate of 2,497.00 INR. Watch MASTEK chart and read a more detailed MASTEK LTD. stock forecast: see what analysts think of MASTEK LTD. and suggest that you do with its stocks.

MASTEK reached its all-time high on Oct 19, 2021 with the price of 3,666.00 INR, and its all-time low was 104.70 INR and was reached on Feb 17, 2016. View more price dynamics on MASTEK chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

MASTEK stock is 3.32% volatile and has beta coefficient of 1.27. Track MASTEK LTD. stock price on the chart and check out the list of the most volatile stocks — is MASTEK LTD. there?

Today MASTEK LTD. has the market capitalization of 77.62 B, it has decreased by −2.80% over the last week.

Yes, you can track MASTEK LTD. financials in yearly and quarterly reports right on TradingView.

MASTEK LTD. is going to release the next earnings report on Jul 16, 2025. Keep track of upcoming events with our Earnings Calendar.

MASTEK net income for the last quarter is 810.70 M INR, while the quarter before that showed 947.10 M INR of net income which accounts for −14.40% change. Track more MASTEK LTD. financial stats to get the full picture.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. MASTEK LTD. EBITDA is 4.93 B INR, and current EBITDA margin is 14.25%. See more stats in MASTEK LTD. financial statements.

Like other stocks, MASTEK shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade MASTEK LTD. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So MASTEK LTD. technincal analysis shows the buy rating today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating MASTEK LTD. stock shows the buy signal. See more of MASTEK LTD. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.