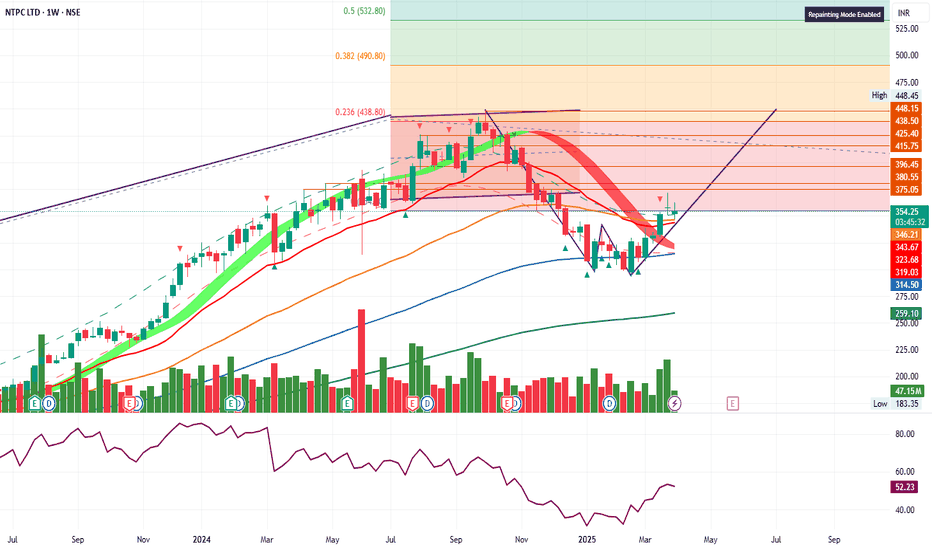

NTPC📈 Trade Setup: BUY at 338

Parameter Value

Entry Price 338

Stop Loss (SL) 323

Risk 15

Target 494

Reward 156

Risk:Reward (RR) 10.4

Last High 448

Last Low 292

✅ Trade Interpretation

Entry Zone (338) is exactly at Weekly & Daily Demand.

SL (323) is just below this demand zone – protects from fake brea

Key facts today

NTPC Ltd. has launched commercial operations for Unit 3 (660 MW) of the Barh Super Thermal Power Project, raising its total capacity to 60,978 MW standalone and 82,080 MW group.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

24.15 INR

234.22 B INR

1.88 T INR

4.72 B

About NTPC LTD

Sector

Industry

CEO

Gurdeep Singh

Website

Headquarters

New Delhi

Founded

1975

ISIN

INE733E01010

FIGI

BBG000BMWKT7

NTPC Ltd. engages in the generation of electric power in coal based thermal power plant. It operates through the Generation of Energy and Others segments. The Generation of Energy segment involves the generation and sale of bulk power to State Power utilities. The Others segment includes provision of consultancy, project management and supervision, energy trading, oil and gas exploration, and coal mining. The company was founded on November 7, 1975 and is headquartered in New Delhi, India.

Related stocks

NTPC Swing and short positional viewsWe can see in H1 chart, after 80% Fibonacci retracement taking, chart has formed H1 CHoCH (change of character). So, it ensure bullish market view started. After hitting H1 OB(order block) market has formed internal CHoCH (i-Ch) which reinforces bullish view. So, at this moment aggressive trader ta

NTPC One can make an entry in NTPC after breakout from cup and handle pattern.

If you find this helpful and want more FREE forecasts in TradingView, Hit the 'BOOST' button

Drop some feedback in the comments below! (e.g., What did you find most useful?

How can we improve?)

Your support is appreciated!

NTCP NTPC

*W* in the making on Weekly TF.

Price Breakout Need to be Watched.

Respective Resistance levels are the Target - Multiple.

*Trail SL with Upside*

*Book Profit as per Risk Appetite*

RSI: In Bullish Zone.

Strong Vol. Consolidation. Continued Traction.

Positive Energy Outlook too in favour.

*

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of NTPC is 339.30 INR — it has increased by 0.64% in the past 24 hours. Watch NTPC LTD. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BSE exchange NTPC LTD. stocks are traded under the ticker NTPC.

NTPC stock has risen by 2.90% compared to the previous week, the month change is a 0.10% rise, over the last year NTPC LTD. has showed a −7.03% decrease.

We've gathered analysts' opinions on NTPC LTD. future price: according to them, NTPC price has a max estimate of 490.00 INR and a min estimate of 320.00 INR. Watch NTPC chart and read a more detailed NTPC LTD. stock forecast: see what analysts think of NTPC LTD. and suggest that you do with its stocks.

NTPC reached its all-time high on Sep 30, 2024 with the price of 448.30 INR, and its all-time low was 60.00 INR and was reached on Nov 22, 2004. View more price dynamics on NTPC chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

NTPC stock is 1.27% volatile and has beta coefficient of 1.12. Track NTPC LTD. stock price on the chart and check out the list of the most volatile stocks — is NTPC LTD. there?

Today NTPC LTD. has the market capitalization of 3.21 T, it has decreased by −0.68% over the last week.

Yes, you can track NTPC LTD. financials in yearly and quarterly reports right on TradingView.

NTPC LTD. is going to release the next earnings report on Jul 28, 2025. Keep track of upcoming events with our Earnings Calendar.

NTPC earnings for the last quarter are 6.90 INR per share, whereas the estimation was 6.18 INR resulting in a 11.61% surprise. The estimated earnings for the next quarter are 5.20 INR per share. See more details about NTPC LTD. earnings.

NTPC LTD. revenue for the last quarter amounts to 471.58 B INR, despite the estimated figure of 475.18 B INR. In the next quarter, revenue is expected to reach 482.53 B INR.

NTPC net income for the last quarter is 76.11 B INR, while the quarter before that showed 50.63 B INR of net income which accounts for 50.34% change. Track more NTPC LTD. financial stats to get the full picture.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. NTPC LTD. EBITDA is 540.93 B INR, and current EBITDA margin is 28.77%. See more stats in NTPC LTD. financial statements.

Like other stocks, NTPC shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade NTPC LTD. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So NTPC LTD. technincal analysis shows the buy rating today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating NTPC LTD. stock shows the buy signal. See more of NTPC LTD. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.