Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

28.75 INR

362.26 B INR

6.63 T INR

3.87 B

About OIL AND NATURAL GAS CORP.

Sector

Industry

CEO

Arun Kumar Singh

Website

Headquarters

New Delhi

Founded

1956

ISIN

INE213A01029

FIGI

BBG000BF0BK6

Oil and Natural Gas Corporation Limited is a global energy holding company. The Company is engaged in the exploration, development and production of crude oil and natural gas. The Company's segments include Exploration & Production (E&P), and Refining. The Company's geographical segments include operations in two categories: In India, which includes Onshore and Offshore, and Outside India. The Company's business spread include various areas, such as oil field services, transportation of the oil and natural gas, and production of value-added products, such as Liquefied Petroleum Gas (LPG), Naphtha, Refining, Petrochemicals, Power, unconventional and alternate sources of energy. The Company's subsidiaries include ONGC Videsh Limited (OVL), Mangalore Refinery and Petrochemicals Limited (MRPL) and ONGC Mangalore Petrochemicals Limited. The Company's oil and gas reserves are located internationally at Russia, Colombia, Vietnam, Brazil and Venezuela.

Related stocks

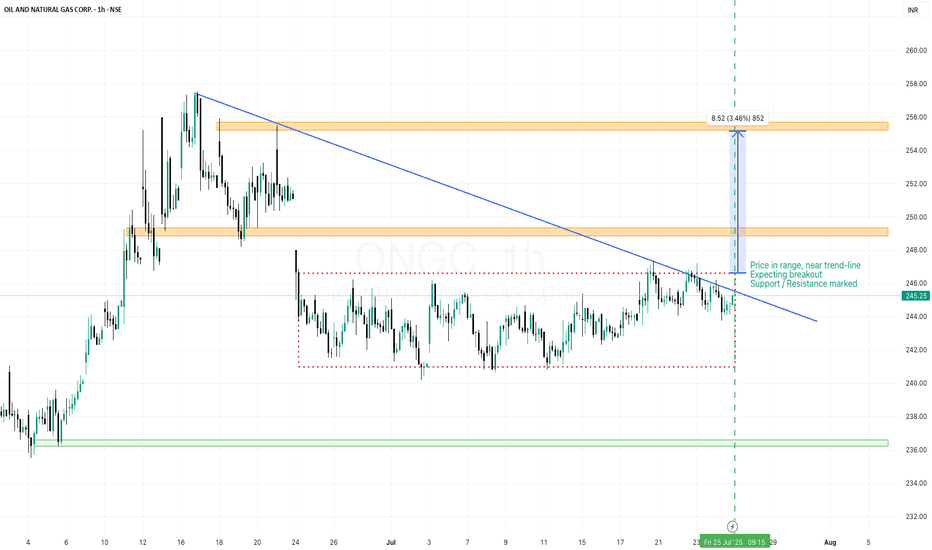

ONGC Swing Outlook Swing Trade Outlook – ONGC (Updated View)

📌 Key Levels and Observations

🔲 Major Resistance Zone:

The green zone (~₹252–₹258) has been a critical resistance area since October 2023.

Price has tested this zone multiple times but failed to close above it decisively—forming a long-term horizontal resis

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

RPIN4933146

Oil and Natural Gas Corporation Limited 3.375% 05-DEC-2029Yield to maturity

4.78%

Maturity date

Dec 5, 2029

O

RPIN4398733

ONGC Videsh Vankorneft Pte. Ltd. 3.75% 27-JUL-2026Yield to maturity

4.76%

Maturity date

Jul 27, 2026

See all ONGC bonds

Curated watchlists where ONGC is featured.

Indian stocks: Racing ahead

46 No. of Symbols

Upstream oil: Liquid gold extractors

34 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of ONGC is 240.10 INR — it has decreased by −0.04% in the past 24 hours. Watch OIL AND NATURAL GAS CORPORATIO stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BSE exchange OIL AND NATURAL GAS CORPORATIO stocks are traded under the ticker ONGC.

ONGC stock has fallen by −2.38% compared to the previous week, the month change is a −1.84% fall, over the last year OIL AND NATURAL GAS CORPORATIO has showed a −28.75% decrease.

We've gathered analysts' opinions on OIL AND NATURAL GAS CORPORATIO future price: according to them, ONGC price has a max estimate of 360.00 INR and a min estimate of 205.00 INR. Watch ONGC chart and read a more detailed OIL AND NATURAL GAS CORPORATIO stock forecast: see what analysts think of OIL AND NATURAL GAS CORPORATIO and suggest that you do with its stocks.

ONGC reached its all-time high on Aug 1, 2024 with the price of 344.60 INR, and its all-time low was 51.80 INR and was reached on Mar 13, 2020. View more price dynamics on ONGC chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

ONGC stock is 1.58% volatile and has beta coefficient of 1.08. Track OIL AND NATURAL GAS CORPORATIO stock price on the chart and check out the list of the most volatile stocks — is OIL AND NATURAL GAS CORPORATIO there?

Today OIL AND NATURAL GAS CORPORATIO has the market capitalization of 3.02 T, it has increased by 0.85% over the last week.

Yes, you can track OIL AND NATURAL GAS CORPORATIO financials in yearly and quarterly reports right on TradingView.

OIL AND NATURAL GAS CORPORATIO is going to release the next earnings report on Aug 8, 2025. Keep track of upcoming events with our Earnings Calendar.

ONGC earnings for the last quarter are 5.10 INR per share, whereas the estimation was 7.30 INR resulting in a −30.13% surprise. The estimated earnings for the next quarter are 6.73 INR per share. See more details about OIL AND NATURAL GAS CORPORATIO earnings.

OIL AND NATURAL GAS CORPORATIO revenue for the last quarter amounts to 1.71 T INR, despite the estimated figure of 521.29 B INR. In the next quarter, revenue is expected to reach 311.24 B INR.

ONGC net income for the last quarter is 73.23 B INR, while the quarter before that showed 86.22 B INR of net income which accounts for −15.07% change. Track more OIL AND NATURAL GAS CORPORATIO financial stats to get the full picture.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. OIL AND NATURAL GAS CORPORATIO EBITDA is 990.25 B INR, and current EBITDA margin is 14.90%. See more stats in OIL AND NATURAL GAS CORPORATIO financial statements.

Like other stocks, ONGC shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade OIL AND NATURAL GAS CORPORATIO stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So OIL AND NATURAL GAS CORPORATIO technincal analysis shows the strong sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating OIL AND NATURAL GAS CORPORATIO stock shows the buy signal. See more of OIL AND NATURAL GAS CORPORATIO technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.