Key facts today

LKP Research recommends a 'BUY' for State Bank of India (SBI) with a target price of ₹908, highlighting strong loan growth, improved profits, and solid asset quality.

State Bank of India (SBI) reported 12% year-on-year credit growth, exceeding the average, fueled by retail and MSME sectors. Corporate credit growth slowed due to Rs 120 billion pre-payments.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

89.00 INR

775.61 B INR

6.58 T INR

3.98 B

About STATE BANK OF INDIA

Sector

Industry

CEO

Rana Ashutosh Kumar Singh

Website

Headquarters

Mumbai

Founded

1921

ISIN

INE062A01020

FIGI

BBG000GQ5829

State Bank of India provides a range of products and services to personal, commercial enterprises, large corporates, public bodies and institutional customers. Its segments include Treasury, which includes the entire investment portfolio and trading in foreign exchange contracts and derivative contracts; Corporate/Wholesale Banking, which comprises the lending activities of Corporate Accounts Group, Mid Corporate Accounts Group and Stressed Assets Management Group; Retail Banking, which comprises branches in National Banking Group, which primarily includes Personal Banking activities, including lending activities to corporate customers having banking relations with branches in the National Banking Group, and Other Banking Business, which includes the operations of all the Non-Banking Subsidiaries/Joint Ventures other than SBI Life Insurance Co. Ltd. and SBI General Insurance Co. Ltd. Its geographical segments include Domestic Operations and Foreign Operations.

Related stocks

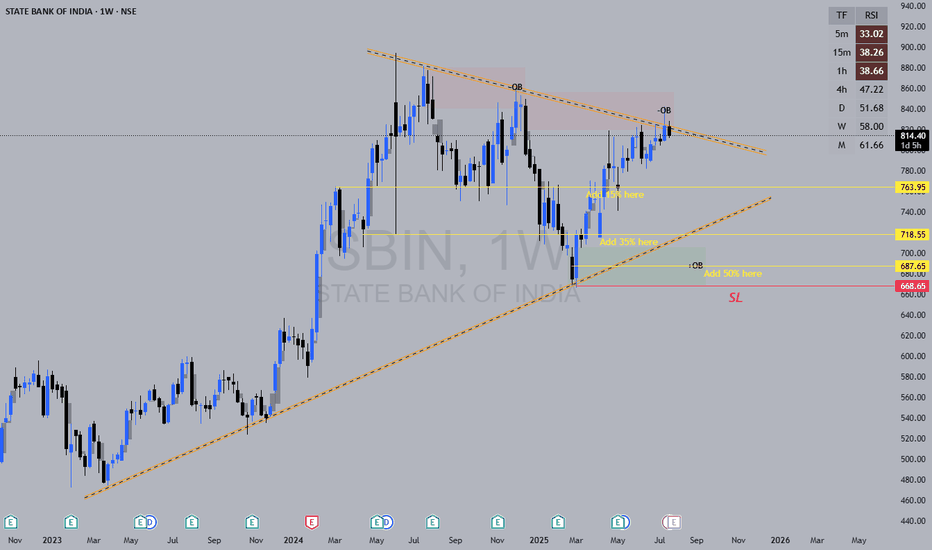

SBIN✅ Updated Trade Plan Summary

✅ Updated Trade Plan Summary

Metric Previous Value Updated Value

Entry 800 800

Stop Loss (SL) 757 775

Risk 43 25

Target 1256 1256

Reward 456 456

Risk-Reward (RR) 10.6 18.2

🔍 Implications of the Change

🔽 Risk reduced from 43 to 25 points

✅ RR improved significantly fro

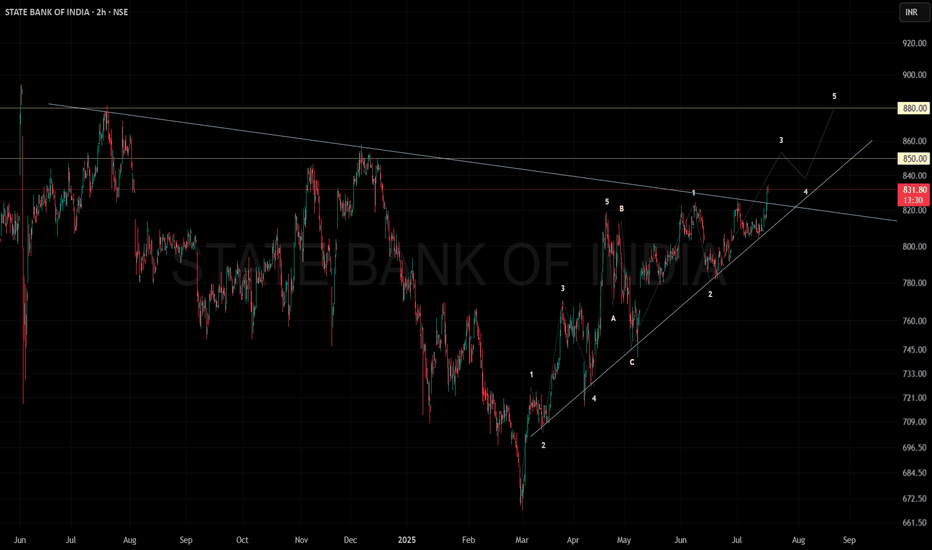

SBIN🧠 Technical Logics Highlighted

Qtrly BUFL Zone is respected – strong confirmation of demand at 765–705.

Weekly ASZ previously formed at 793, reinforcing buyer interest.

Engulfing Pattern with DMIP & SOE confirms buying strength.

Current price trades above Gann Level (766) – a technical sign of st

Importance of ATR(Average True Range)So idea here is to calculate risk.

understanding fear in the market ATR is an indication of volatility , not direction.

A smaller ATR range means low volatility.. tentatively market is consolidating.

A larger ATR range means the market is dealing with uncertainty so volatility has increased.

yo

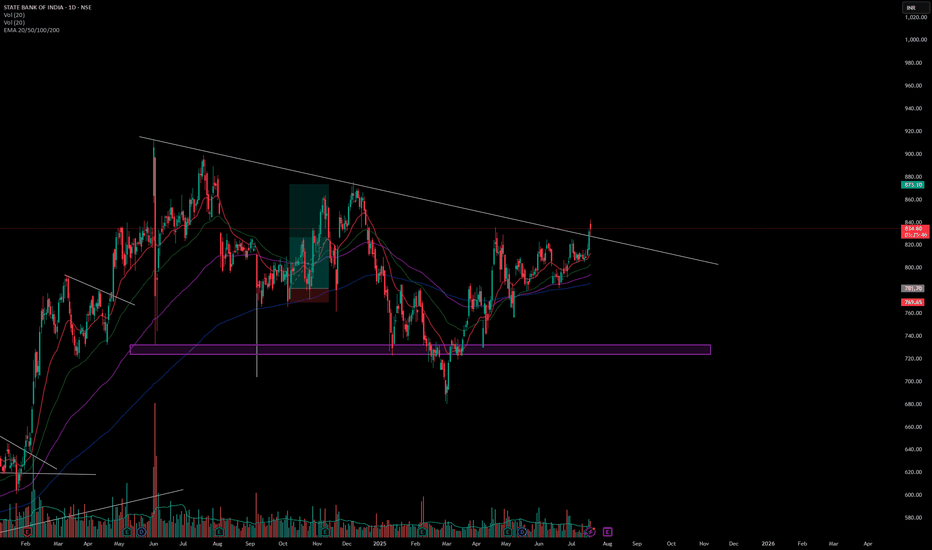

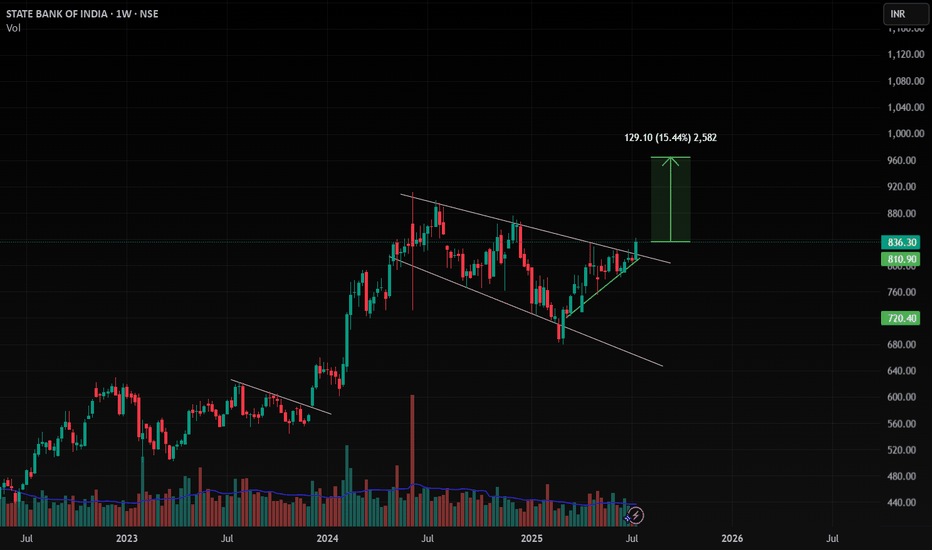

SBI - My Pick - No Financial Advice - VCP PatternAfter a recent upside rally SBI has retraced approx 8.5% from the resistance zone of 825-830, theafter second compression of 5% occurred. Thus I see sucessive Volatility contraction. Recent Golden Cross over clubbed with VCP is indication of good buying opportunity. Short to mid-term momentum is bul

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

S

SBIN5412137

State Bank of India (London Branch) 2.49% 26-JAN-2027Yield to maturity

4.93%

Maturity date

Jan 26, 2027

S

SBIN5114735

State Bank of India (London Branch) 1.8% 13-JUL-2026Yield to maturity

4.67%

Maturity date

Jul 13, 2026

S

SBIN5693776

State Bank of India (London Branch) 4.875% 05-MAY-2028Yield to maturity

4.61%

Maturity date

May 5, 2028

See all SBIN bonds

Curated watchlists where SBIN is featured.

Indian stocks: Racing ahead

46 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of SBIN is 823.55 INR — it has increased by 2.45% in the past 24 hours. Watch STATE BANK OF INDIA stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BSE exchange STATE BANK OF INDIA stocks are traded under the ticker SBIN.

SBIN stock has risen by 3.69% compared to the previous week, the month change is a 2.02% rise, over the last year STATE BANK OF INDIA has showed a 0.53% increase.

We've gathered analysts' opinions on STATE BANK OF INDIA future price: according to them, SBIN price has a max estimate of 1,100.00 INR and a min estimate of 720.00 INR. Watch SBIN chart and read a more detailed STATE BANK OF INDIA stock forecast: see what analysts think of STATE BANK OF INDIA and suggest that you do with its stocks.

SBIN reached its all-time high on Jun 3, 2024 with the price of 912.10 INR, and its all-time low was 13.20 INR and was reached on Sep 21, 2001. View more price dynamics on SBIN chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

SBIN stock is 0.58% volatile and has beta coefficient of 0.94. Track STATE BANK OF INDIA stock price on the chart and check out the list of the most volatile stocks — is STATE BANK OF INDIA there?

Today STATE BANK OF INDIA has the market capitalization of 7.61 T, it has increased by 1.42% over the last week.

Yes, you can track STATE BANK OF INDIA financials in yearly and quarterly reports right on TradingView.

STATE BANK OF INDIA is going to release the next earnings report on Nov 3, 2025. Keep track of upcoming events with our Earnings Calendar.

SBIN earnings for the last quarter are 21.47 INR per share, whereas the estimation was 18.31 INR resulting in a 17.23% surprise. The estimated earnings for the next quarter are 14.46 INR per share. See more details about STATE BANK OF INDIA earnings.

STATE BANK OF INDIA revenue for the last quarter amounts to 584.18 B INR, despite the estimated figure of 566.80 B INR. In the next quarter, revenue is expected to reach 556.02 B INR.

SBIN net income for the last quarter is 212.01 B INR, while the quarter before that showed 196.00 B INR of net income which accounts for 8.17% change. Track more STATE BANK OF INDIA financial stats to get the full picture.

Yes, SBIN dividends are paid annually. The last dividend per share was 15.90 INR. As of today, Dividend Yield (TTM)% is 1.93%. Tracking STATE BANK OF INDIA dividends might help you take more informed decisions.

STATE BANK OF INDIA dividend yield was 2.06% in 2024, and payout ratio reached 18.30%. The year before the numbers were 1.82% and 18.23% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 12, 2025, the company has 236.23 K employees. See our rating of the largest employees — is STATE BANK OF INDIA on this list?

Like other stocks, SBIN shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade STATE BANK OF INDIA stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So STATE BANK OF INDIA technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating STATE BANK OF INDIA stock shows the buy signal. See more of STATE BANK OF INDIA technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.