The Return Of The 3 Step Rocket Booster StrategyOne thing you can know about me is i desire to learn how to

drive a car.I still dont know how to drive car.

Sometimes i feel safe being driven

on public roads.

But the freedom that comes from owning your own car,

i still dont know how that feels like.

Whats better to do it yourself, or have other

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

43.78 USD

14.28 B USD

126.83 B USD

305.15 M

About Goldman Sachs Group, Inc. (The)

Sector

Industry

CEO

David Michael Solomon

Website

Headquarters

New York

Founded

1869

FIGI

BBG009STMZL1

The Goldman Sachs Group, Inc. engages in the provision of financial services. It operates through the following business segments: Global Banking and Markets, Asset and Wealth Management, and Platform Solutions. The Global Banking and Markets segment includes investment banking, global investments, and equity and debt investments. The Asset and Wealth Management segment relates to the direct-to-consumer banking business which includes lending, deposit-taking, and investing. The Platform Solutions segment includes consumer platforms such as partnerships offering credit cards and point-of-sale financing, and transaction banking. The company was founded by Marcus Goldman in 1869 and is headquartered in New York, NY.

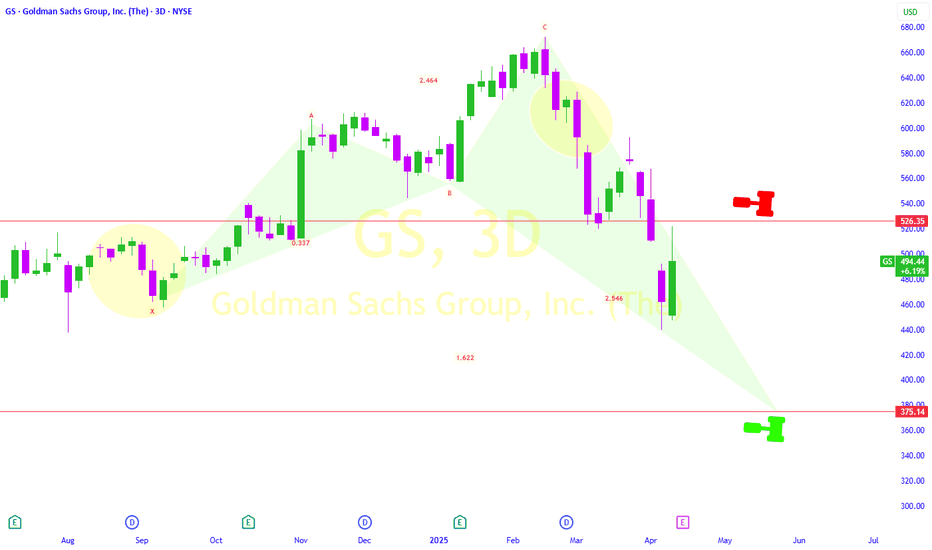

Goldman Sachs (GS): Long Position Opportunity Amid Stabilizing V

-Key Insights: Goldman Sachs (GS) stands to benefit from stabilizing market

volatility, as reflected by the declining VIX. While macroeconomic uncertainties

and earnings season pressures persist, GS has room for recovery with strong

potential upside driven by resilience in financial services and li

4/14/25 - $gs - A buy4/14/25 :: VROCKSTAR :: NYSE:GS

A buy

- 1.5x book w/ mid teens ROEs.

- 11x PE

- great result

- financials will do well in this environment

- not a tariff punching bag

- all the financial services should supplement IPO/ IB issues in the ST

- trying to keep cash high

- but you could get 3% yield on

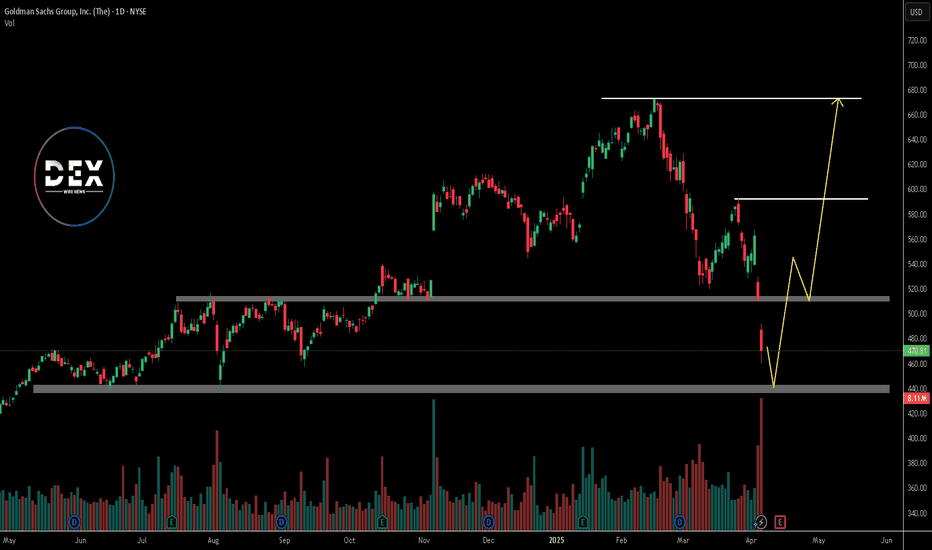

Just In: The Goldman Sachs Group, Inc. (GS) Set for Breakout The Goldman Sachs Group, Inc. (GS) shares is set for a breakout today as the firm smashes Q1 Estimates leading to a 2.45% surge in Monday's premarket trading.

Reports Overview

Goldman Sachs delivered a strong first-quarter performance, beating Wall Street expectations on both earnings and revenue,

"Trip of Sache Sellers Crab" is still ongoing.Alright folks, let's talk Goldman Sachs.

They're dropping their earnings report tomorrow, which means Wall Street's gonna be buzzing like a caffeinated hive. Are we ready for a bullish breakout? A bearish beatdown? Honestly, your guess is as good as mine.I’m about as fundamentally clueless as a go

Goldman Sachs Raises Recession Odds to 35% Amid Tariff Fears Goldman Sachs (NYSE: GS) has lowered its S&P 500 year-end target again. The firm now sees the index ending at 5,700 points, down from its earlier forecast of 6,200. This revision comes just days before President Trump’s new round of tariffs is set to begin. The updated target implies only a 2% gain

Goldman Sachs Earnings Tomorrow – Ready for a Bullish Breakout?Goldman Sachs (NYSE: GS) is shaping up for a potential bullish move ahead of its earnings report tomorrow (January 15) before the market opens. With the stock bouncing off key support levels and positive momentum indicators, a strong earnings surprise could trigger further upside toward my targets.

Goldman Sachs Wave Analysis – 25 March 2025

- Goldman Sachs continues daily uptrend

- Likely to rise to resistance level 600.00

Goldman Sachs continues to rise inside the B-wave of the medium-term ABC correction (4) from the end of February.

The active wave B started earlier from the support zone between the support levels 520.00

Goldman Sachs - Too Cheap to Ignore?NYSE:GS and the general financial services sector as a whole has faced extreme trauma over this past month. However, one that particularly stands out is the "bad guy" of the industry who has taken the equivalent to a roundhouse kick to the face, and the chart shows it. But does this mean that someo

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where GS is featured.

Related stocks

Frequently Asked Questions

The current price of GS is 595.45 USD — it hasn't changed in the past 24 hours. Watch GOLDMAN SACHS GROUP INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BVL exchange GOLDMAN SACHS GROUP INC stocks are traded under the ticker GS.

GS stock has fallen by −1.66% compared to the previous week, the month change is a 1.55% rise, over the last year GOLDMAN SACHS GROUP INC has showed a 45.05% increase.

We've gathered analysts' opinions on GOLDMAN SACHS GROUP INC future price: according to them, GS price has a max estimate of 720.00 USD and a min estimate of 500.00 USD. Watch GS chart and read a more detailed GOLDMAN SACHS GROUP INC stock forecast: see what analysts think of GOLDMAN SACHS GROUP INC and suggest that you do with its stocks.

GS stock is 0.00% volatile and has beta coefficient of 1.41. Track GOLDMAN SACHS GROUP INC stock price on the chart and check out the list of the most volatile stocks — is GOLDMAN SACHS GROUP INC there?

Today GOLDMAN SACHS GROUP INC has the market capitalization of 188.40 B, it has increased by 1.06% over the last week.

Yes, you can track GOLDMAN SACHS GROUP INC financials in yearly and quarterly reports right on TradingView.

GOLDMAN SACHS GROUP INC is going to release the next earnings report on Jul 16, 2025. Keep track of upcoming events with our Earnings Calendar.

GS earnings for the last quarter are 14.12 USD per share, whereas the estimation was 12.32 USD resulting in a 14.64% surprise. The estimated earnings for the next quarter are 9.77 USD per share. See more details about GOLDMAN SACHS GROUP INC earnings.

GOLDMAN SACHS GROUP INC revenue for the last quarter amounts to 15.06 B USD, despite the estimated figure of 14.77 B USD. In the next quarter, revenue is expected to reach 13.50 B USD.

GS net income for the last quarter is 4.74 B USD, while the quarter before that showed 4.11 B USD of net income which accounts for 15.25% change. Track more GOLDMAN SACHS GROUP INC financial stats to get the full picture.

Yes, GS dividends are paid quarterly. The last dividend per share was 3.00 USD. As of today, Dividend Yield (TTM)% is 1.95%. Tracking GOLDMAN SACHS GROUP INC dividends might help you take more informed decisions.

GOLDMAN SACHS GROUP INC dividend yield was 2.01% in 2024, and payout ratio reached 28.37%. The year before the numbers were 2.72% and 45.92% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jun 7, 2025, the company has 46.5 K employees. See our rating of the largest employees — is GOLDMAN SACHS GROUP INC on this list?

Like other stocks, GS shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade GOLDMAN SACHS GROUP INC stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So GOLDMAN SACHS GROUP INC technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating GOLDMAN SACHS GROUP INC stock shows the buy signal. See more of GOLDMAN SACHS GROUP INC technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.