Key facts today

Shares of Freeport-McMoRan Inc. (FCX) experienced a slight decline amid a broader downturn in copper mining stocks, attributed to a decrease in copper prices.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.71 B CHF

22.83 B CHF

1.43 B

About Freeport-McMoRan, Inc.

Sector

Industry

CEO

Kathleen L. Quirk

Website

Headquarters

Phoenix

Founded

1987

FIGI

BBG006TLQ063

Freeport-McMoRan, Inc. engages in the mining of copper, gold, and molybdenum. It operates through the following segments: North America Copper Mines, South America Operations, Indonesia Operations, Molybdenum Mines, Rod and Refining, Atlantic Copper Smelting and Refining, and Corporate and Other. The North America Copper Mines segment operates open-pit copper mines in Morenci, Bagdad, Safford, Sierrita, Miami in Arizona and Chino, and Tyrone in New Mexico. The South America Operations segment includes Cerro Verde in Peru and El Abra in Chile. The Indonesia Operations segment handles the operations of the Grasberg minerals district that produce copper concentrate containing significant quantities of gold and silver. The Molybdenum Mines segment includes the Henderson underground mine and Climax open pit mine, both in Colorado. The Rod and Refining segment consists of copper conversion facilities located in North America and includes a refinery and rod mills. The Atlantic Copper Smelting and Refining segment smelts and refines copper concentrate and markets refined copper and precious metals in slimes. The Corporate and Other segment offers other mining and eliminations, oil and gas operations, and other corporate and elimination items. The company was founded by James R. Moffett on November 10, 1987, and is headquartered in Phoenix, AZ.

Related stocks

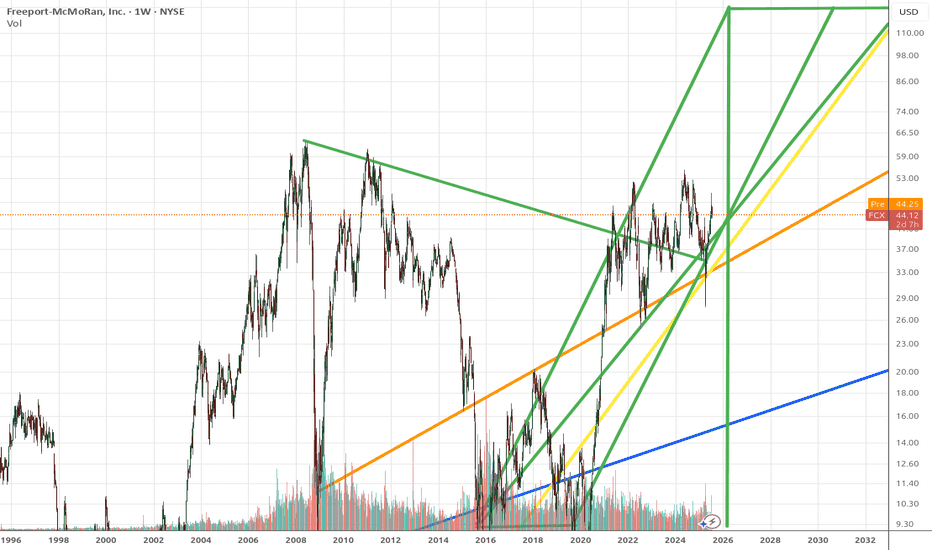

FCX)| Long | Metal Demand Surge | (June 16, 2025)Freeport‑McMoRan (FCX) | Long | Inverse Head & Shoulders + Metal Demand Surge | (June 16, 2025)

1️⃣ Short Insight Summary:

FCX appears to be forming an inverse Head & Shoulders pattern, signaling a potential bullish reversal. Strong fundamentals and rising metal demand align with this technical set

FCX - We had a great month, can we continue with the uptrend?FCX

Looking for a potential buy!

🔍 Technical Context:

FCX had a tremendous up-beat with 24% increase in the stock just in march!

MACD Bullish Crossover: A clear bullish cross on the MACD confirmed upward momentum.

RSI Strength: The RSI remains in bullish territory, signaling further upside poten

Freeport McMoran - Run with copper...1. Trend Analysis

Overall Trend: The stock has been in a downtrend since mid-2023 but is showing signs of a potential reversal.

Recent Price Action: The stock recently bounced from a support level around $35.59 - $37.43, indicating a possible trend reversal.

Moving Averages: The stock is trading ne

Opening (IRA): FCX July 18th 25/March 21st 39 Long Call Diagonal... for an 11.02 debit.

Comments: Taking a directional shot post-earnings on weakness, buying the back month 90 delta call and selling the front month 30 delta that pays for all of the extrinsic in the long, resulting in a break even that is slightly below where the underlying is currently trading

FCX Freeport-McMoRan Options Ahead of EarningsAnalyzing the options chain and the chart patterns of FCX Freeport-McMoRan prior to the earnings report this week,

I would consider purchasing the 40usd strike price Calls with

an expiration date of 2025-2-21,

for a premium of approximately $1.94.

If these options prove to be profitable prior to the

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where FPMB is featured.

Frequently Asked Questions

The current price of FPMB is 35.798 CHF — it has decreased by −1.05% in the past 24 hours. Watch FREEPORT-MCMORAN stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BX exchange FREEPORT-MCMORAN stocks are traded under the ticker FPMB.

FPMB stock has fallen by −0.98% compared to the previous week, the month change is a 6.63% rise, over the last year FREEPORT-MCMORAN has showed a −11.21% decrease.

We've gathered analysts' opinions on FREEPORT-MCMORAN future price: according to them, FPMB price has a max estimate of 45.44 CHF and a min estimate of 36.67 CHF. Watch FPMB chart and read a more detailed FREEPORT-MCMORAN stock forecast: see what analysts think of FREEPORT-MCMORAN and suggest that you do with its stocks.

FPMB reached its all-time high on May 28, 2024 with the price of 48.328 CHF, and its all-time low was 25.939 CHF and was reached on Apr 4, 2025. View more price dynamics on FPMB chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

FPMB stock is 1.06% volatile and has beta coefficient of 1.72. Track FREEPORT-MCMORAN stock price on the chart and check out the list of the most volatile stocks — is FREEPORT-MCMORAN there?

Today FREEPORT-MCMORAN has the market capitalization of 51.39 B, it has decreased by −6.52% over the last week.

Yes, you can track FREEPORT-MCMORAN financials in yearly and quarterly reports right on TradingView.

FREEPORT-MCMORAN is going to release the next earnings report on Oct 16, 2025. Keep track of upcoming events with our Earnings Calendar.

FPMB earnings for the last quarter are 0.43 CHF per share, whereas the estimation was 0.36 CHF resulting in a 20.08% surprise. The estimated earnings for the next quarter are 0.40 CHF per share. See more details about FREEPORT-MCMORAN earnings.

FREEPORT-MCMORAN revenue for the last quarter amounts to 6.02 B CHF, despite the estimated figure of 5.70 B CHF. In the next quarter, revenue is expected to reach 5.65 B CHF.

FPMB net income for the last quarter is 612.50 M CHF, while the quarter before that showed 306.29 M CHF of net income which accounts for 99.97% change. Track more FREEPORT-MCMORAN financial stats to get the full picture.

FREEPORT-MCMORAN dividend yield was 1.58% in 2024, and payout ratio reached 46.04%. The year before the numbers were 1.41% and 47.00% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 26, 2025, the company has 28.5 K employees. See our rating of the largest employees — is FREEPORT-MCMORAN on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. FREEPORT-MCMORAN EBITDA is 7.14 B CHF, and current EBITDA margin is 34.96%. See more stats in FREEPORT-MCMORAN financial statements.

Like other stocks, FPMB shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade FREEPORT-MCMORAN stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So FREEPORT-MCMORAN technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating FREEPORT-MCMORAN stock shows the sell signal. See more of FREEPORT-MCMORAN technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.