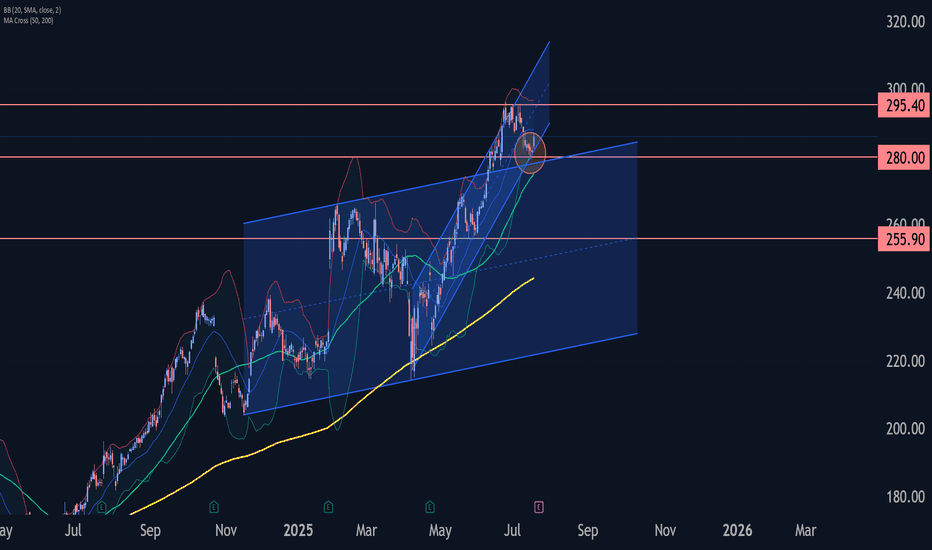

IBM Wave Analysis – 18 July 2025

- IBM reversed from support zone

- Likely to rise to resistance 295.40

IBM recently reversed up from the support zone between the support level 280.00, upper trendline of the recently broken weekly up channel from 2024 and the support trendline of the more recent up channel from April.

This suppo

Key facts today

IBM is set to announce its quarterly earnings report on Wednesday, July 23, coinciding with a week of earnings releases from other major tech companies, including Alphabet and Tesla.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

5.240 CHF

5.47 B CHF

56.99 B CHF

928.41 M

About International Business Machines Corporation

Sector

Industry

CEO

Arvind Krishna

Website

Headquarters

Armonk

Founded

1911

FIGI

BBG006M6Y279

International Business Machines Corporation (IBM) is a technology company. The Company operates through five segments: Cognitive Solutions, Global Business Services (GBS), Technology Services & Cloud Platforms, Systems and Global Financing. The Cognitive Solutions segment delivers a spectrum of capabilities, from descriptive, predictive and prescriptive analytics to cognitive systems. Cognitive Solutions includes Watson, a cognitive computing platform that has the ability to interact in natural language, process big data, and learn from interactions with people and computers. The GBS segment provides clients with consulting, application management services and global process services. The Technology Services & Cloud Platforms segment provides information technology infrastructure services. The Systems segment provides clients with infrastructure technologies. The Global Financing segment includes client financing, commercial financing, and remanufacturing and remarketing.

Related stocks

IBM eyes on $282.88: Golden Genesis fib a Key Support to uptrendIBM has been in a strong uptrend but looking top-ish.

It has pulled back to a Golden Genesis fib at $282.88

Look for a bounce but perhaps after a couple orbits.

.

See "Related Publications" for previous charts like this BOTTOM CALL:

Hit the BOOST and FOLLOW for more such PRECISE and TIMELY chart

IBM: SHA-ttering ExpectationsAs we move through 2024, NYSE:IBM continues to demonstrate its strength as a technology powerhouse, particularly in cloud computing, AI, and cybersecurity. With a legacy rooted in innovation, IBM's deep history in encryption technologies and its forward-looking strategies make it a compelling buy

Surprising ups and downs in global indicesJune brought contrasting moves across global stock markets: while the U.S. and Asia posted gains, Europe struggled under pressure. Rising tensions between Iran and Israel, political instability in the EU, and shifting rate expectations fueled volatility. In search of stability, investors turned to U

IBM: Still BullishAfter the increases over the recent weeks, we still place IBM within the magenta wave (3) and expect a bit more bullish headroom in the short term. However, in our medium-term alternative scenario, we would see a larger pullback with the green wave alt. . Such a detour is considered 30% likely and

IBM – Long Trade Setup📈

🔍 Pattern: Bullish pennant breakout

📍 Entry: Around $281.88 (breakout confirmation)

🎯 Target: $287.52 (green resistance zone)

🛑 Stop-loss: Below $278.50 (support area)

✅ Why this trade?

Strong uptrend with clean pullback

Breakout from consolidation (pennant)

Solid volume and momentum follow-th

IBM: Strategic AI and Hybrid Cloud Expansion Signals Bullish Ups

Current Price: $277.22

Direction: LONG

Targets:

- T1 = $285.00

- T2 = $293.50

Stop Levels:

- S1 = $270.50

- S2 = $265.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to

IBM Strong uptrend and may see target at 302NYSE:IBM uptrend remain strong and we have been holding on to it since our last report sharing

Price action shows a clear uptick above the 123.6% Fibonacci extension level and with that, we see a strong potential bullish upside as there is not strong bearish reversal at 123.6%.

Hence, we are

IBM Approaching Channel Resistance – Bear Call Spread Setup?IBM has rallied strongly within a clear ascending channel since late 2023, pushing recently into all-time highs and testing the upper boundary of the structure. This level has acted as resistance multiple times in the past — and we may now be approaching another potential rejection zone.

🔍 Key Tech

IBM Wave Analysis – 11 June 2025

- IBM broke key resistance level 270.00

- Likely to rise to the resistance level 290.00

IBM broke above the key resistance level 270.00 (which stopped the previous impulse wave (1) in the middle of May).

The breakout the resistance level 270.00 accelerated the minor impulse wave 3 of the interme

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

IBM4983326

International Business Machines Corporation 2.95% 15-MAY-2050Yield to maturity

7.19%

Maturity date

May 15, 2050

IBM5354862

International Business Machines Corporation 3.43% 09-FEB-2052Yield to maturity

6.98%

Maturity date

Feb 9, 2052

IBM5449458

International Business Machines Corporation 4.9% 27-JUL-2052Yield to maturity

6.15%

Maturity date

Jul 27, 2052

I

IBM5744047

IBM International Capital Pte. Ltd. 5.3% 05-FEB-2054Yield to maturity

6.15%

Maturity date

Feb 5, 2054

IBM5534365

International Business Machines Corporation 5.1% 06-FEB-2053Yield to maturity

6.12%

Maturity date

Feb 6, 2053

IBM.GX

International Business Machines Corporation 7.0% 30-OCT-2045Yield to maturity

6.03%

Maturity date

Oct 30, 2045

See all IBM bonds

Curated watchlists where IBM is featured.

Frequently Asked Questions

The current price of IBM is 226.191 CHF — it has increased by 0.50% in the past 24 hours. Watch INTL BUSINESS MCHN stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BX exchange INTL BUSINESS MCHN stocks are traded under the ticker IBM.

IBM stock has fallen by −2.46% compared to the previous week, the month change is a −3.38% fall, over the last year INTL BUSINESS MCHN has showed a 37.79% increase.

We've gathered analysts' opinions on INTL BUSINESS MCHN future price: according to them, IBM price has a max estimate of 280.49 CHF and a min estimate of 152.27 CHF. Watch IBM chart and read a more detailed INTL BUSINESS MCHN stock forecast: see what analysts think of INTL BUSINESS MCHN and suggest that you do with its stocks.

IBM stock is 0.50% volatile and has beta coefficient of 0.71. Track INTL BUSINESS MCHN stock price on the chart and check out the list of the most volatile stocks — is INTL BUSINESS MCHN there?

Today INTL BUSINESS MCHN has the market capitalization of 214.00 B, it has decreased by −1.58% over the last week.

Yes, you can track INTL BUSINESS MCHN financials in yearly and quarterly reports right on TradingView.

INTL BUSINESS MCHN is going to release the next earnings report on Jul 23, 2025. Keep track of upcoming events with our Earnings Calendar.

IBM earnings for the last quarter are 1.42 CHF per share, whereas the estimation was 1.26 CHF resulting in a 12.35% surprise. The estimated earnings for the next quarter are 2.10 CHF per share. See more details about INTL BUSINESS MCHN earnings.

INTL BUSINESS MCHN revenue for the last quarter amounts to 12.87 B CHF, despite the estimated figure of 12.74 B CHF. In the next quarter, revenue is expected to reach 13.17 B CHF.

IBM net income for the last quarter is 933.93 M CHF, while the quarter before that showed 2.65 B CHF of net income which accounts for −64.71% change. Track more INTL BUSINESS MCHN financial stats to get the full picture.

Yes, IBM dividends are paid quarterly. The last dividend per share was 1.40 CHF. As of today, Dividend Yield (TTM)% is 2.34%. Tracking INTL BUSINESS MCHN dividends might help you take more informed decisions.

INTL BUSINESS MCHN dividend yield was 3.03% in 2024, and payout ratio reached 103.78%. The year before the numbers were 4.05% and 81.49% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 19, 2025, the company has 293.4 K employees. See our rating of the largest employees — is INTL BUSINESS MCHN on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. INTL BUSINESS MCHN EBITDA is 14.03 B CHF, and current EBITDA margin is 24.48%. See more stats in INTL BUSINESS MCHN financial statements.

Like other stocks, IBM shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade INTL BUSINESS MCHN stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So INTL BUSINESS MCHN technincal analysis shows the neutral today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating INTL BUSINESS MCHN stock shows the buy signal. See more of INTL BUSINESS MCHN technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.